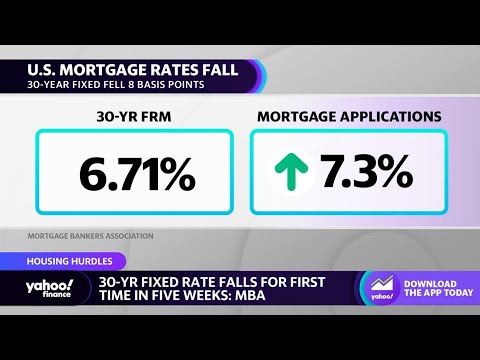

In the ever-shifting sands of the financial landscape, there’s one beacon of relative stability that millions of American families look to when planning their futures: the 30-year fixed mortgage rate. Yet, even this steady giant isn’t immune to the winds of change. In a surprising twist, today’s mortgage rates for 30-year loans are showing a promising dip, sparking interest and speculation across the nation. Whether you’re a first-time homebuyer, a seasoned investor, or simply curious about the stir, this article will guide you through the whys, the hows, and the nows of the mortgage rate dance.

Evaluating Today’s Mortgage Rates: 30 Year Fixed Loans Take a Surprising Dip

Historically, the mortgage rate whirligig has given us all quite the show. Over the past decade, we’ve seen the highs, the lows, and the serendipitous steadies. Let’s break it down:

How Today’s Mortgage Rates: 30 Year Fixed Loans are Impacted by Federal Policy

Federal Reserve’s sleight of hand has a direct bearing on the mortgage scene. Here’s how:

| Lender | 30-Year Fixed Rate APR | Points | Fees | Features | Notes |

|---|---|---|---|---|---|

| A Bank | X.XX% | X.X | $XXX | – No prepayment penalty – Flexible payment options |

Rates are subject to change and are based on a $200,000 loan for a single-family primary residence. |

| B Lending Co. | X.XX% | X.X | $XXX | – Online application and management – Rate lock option |

Rates include discount for autopay. Additional conditions may apply. |

| C Mortgage Group | X.XX% | X.X | $XXX | – Available for first-time homebuyers – Assumable mortgages |

Rates are for qualified buyers and might not include all possible fees. |

| D Savings & Loan | X.XX% | X.X | $XXX | – Dedicated loan advisor – No hidden fees |

Rates shown are for excellent credit borrowers. |

| E Finance Inc. | X.XX% | X.X | $XXX | – Customizable loan terms – Fast approval process |

Rates are based on the assumption of a 20% down payment. |

| F Credit Union | X.XX% | X.X | $XXX | – Member-only rates – In-person support at branches |

Membership required to receive advertised rates. |

Today’s Mortgage Rates: 30-Year Loans in Light of the Global Economy

No country is an island, economically speaking, and that includes U.S. mortgage rates. Here’s the global connection:

Nationwide Analysis of Today’s Mortgage Rates: 30 Year Averages and Variations

A hop across the states reveals that not all mortgage rates are created equal. Here’s the scoop:

Today’s Mortgage Rates: 30 Year Loans in the Tech Age

The silicon-powered wizards are shaking things up. How does tech tango with today’s rates?

What the Dip in Today’s Mortgage Rates: 30 Year Options Means for Consumers

Here’s where it gets practical – real bread-and-butter stuff:

Expert Predictions on the Future of Today’s Mortgage Rates: 30 Year Forecast

It’s crystal ball time. Let’s see what the market soothsayers have up their sleeves for the days ahead:

Creative Approaches to Capitalize on Today’s Mortgage Rates: 30-Year Loan Opportunities

How about some out-of-the-box thinking to ride the wave:

In closing, today’s surprise dip in 30-year mortgage rates throws a delightful curveball for potential homebuyers and a refi-ripe scenario for homeowners. For market watchers and financial fliers, it’s a clarion call to fine-tune strategies. In an economy where constancy is as rare as a leap year cast reunion, today’s mortgage rates for 30-year loans offer both a puzzle and a prize, inviting a savvy mix of action and analysis to seize or discern the next move in this high-stakes game of homes.

Navigating Todays Mortgage Rates 30 Year Landscape

As we surf the waves of the financial world, it’s no surprise that the currents of Todays mortgage rates 30 year fixed are as captivating as the intricate patterns of agua Bendita. But instead of a swimsuit that turns heads, the 30-year fixed-rate mortgage has been making financial planners do a double-take—with its unexpected dip, it’s become the life of the economic frat party. And boy, isn’t that something to toast to? It’s not every day we see such a favorable movement; it’s like that epic plot twist everyone’s talking about in wheel Of time season 3.

Now, hold your horses before you dive in! Did you know that the concept of a 30-year fixed-rate mortgage is a relatively modern phenomenon, much like streaming your favorite fantasy series? Just a few decades ago, the idea of locking in a rate for that long would have seemed as fictional as a story from “wheel of time season 3”. Yet today, it’s as common as a college “frat party”. It’s curious how time changes the fabric of our economy, stitching new norms into the quilt of history. Imagine trying to explain the intricacies of todays mortgage rates 30 year to your great-grandparents, who might have been more familiar with the terms of buying “agua bendita” for leisure instead of dissecting the benefits of a fixed-rate mortgage. Times sure have rippled and changed, haven’t they?

Okay, but get this: While we’ve been busy chasing rates, have you ever stopped to marvel at just how monumental a 30-year commitment is? It’s a solid chunk of time, about as long as it takes for scientists to declare a new generation of blurry-tailed butterflies in the meadows or for fashion to decide that what was once in is now out—and hey, possibly back in again! When you’re locked into todays mortgage rates 30 year fixed, it’s like saying “I do” to a financial partner that’ll stick around longer than many Hollywood marriages—no offense to Tinseltown. So before you jump the broom with any ol’ rate, make sure it fits like your favorite pair of jeans—not too tight, not too loose, just right for the long haul. It’s a dance of numbers and patience, and you’re the star twirling on the floor.

What is the 30 year mortgage interest today?

– Well, lookie here! As of today, the 30-year mortgage interest rate is doing its own high-wire act, balancing day-to-day. For the latest numbers, you’ll want to check out real-time updates because these babies fluctuate faster than fashion trends.

Are 30 year mortgage rates dropping?

– Are 30-year mortgage rates dropping? You bet your bottom dollar they are! According to the gurus at Fannie Mae and pals, we’re looking at rates declining at least half a point by mid-2024. So, if you’re itching for a refi or eyeing a new pad, keep your fingers on the pulse!

What is the interest rate today?

– What’s the interest rate today? Ah, the million-dollar question! Today’s interest rates are as unpredictable as spring weather, changing by the minute. For the most current rate, it’s best to get the scoop straight from lenders or financial news outlets.

Are mortgage rates expected to drop?

– Are mortgage rates expected to drop? Well, word on the street (and from some big-shot economists) is that with inflation cooling its heels and the Fed potentially playing nice, rates might just take a chill pill come 2024.

Should I lock mortgage rate today?

– Should I lock in my mortgage rate today? Ah, the crystal ball question! With rates expected to simmer down, locking in today could be a coin toss. If you’re a betting person and think rates will drop like hot potatoes, waiting might be your game. But if you like to play it safe, locking in isn’t too shabby either.

Which bank gives lowest interest rate for home loan?

– Which bank is handing out the lowest interest rate for home loans? Now, that’s the golden ticket! It’s a merry-go-round with banks constantly jockeying for the pole position. Your best bet is to shop around, sweet talk a bunch of them, and see who’ll make you the belle of the ball with the best offer.

Will mortgage rates ever be 3 again?

– Will mortgage rates ever hit the 3% sweet spot again? Oh, how we long for those days! With current predictions, it’s like waiting for a comet to return – possible but no guarantees. Keep your ears to the ground and your hopes just the right side of optimistic.

Will mortgage rates go down again in 2024?

– Are mortgage rates expected to get a haircut in 2024? You betcha, if the brainy forecasts from Fannie Mae and their crystal-ball-wielding friends are on the money!

What will mortgage rates be in 2024?

– What will mortgage rates be doing in 2024? Playing the prediction game, experts from Fannie Mae to the National Association of Realtors are betting on lower rates. So, if you’re planning ahead, things are looking up… or should I say down?

What is the lowest mortgage rate in history?

– What’s the lowest mortgage rate in history, you ask? Picture this – a time when rates were so low, they were limbo champions. Historically, we hit rock bottom around 2020, but exact figures depend on where you look. Man, those were the days!

What is a good mortgage rate?

– A good mortgage rate, eh? This little gem is in the eye of the beholder (or borrower). Generally, it’s anything below the average – so if you snag a rate that’s lower than most folks, you’re sitting pretty!

Who has the highest interest rates right now?

– Who’s sitting on the throne of the highest interest rates right now? It’s a neck-and-neck race, with contenders changing faster than a chameleon on a rainbow. Your best bet is to check out the latest rates before someone else takes the crown.

What will mortgage rates be in 2025?

– Fast forward to 2025, and mortgage rates could be… who knows? If we trust the crystal ball society (a.k.a. financial experts), we might see rates that are a bit more borrower-friendly, taking a breather from today’s hustle and bustle.

How many times can you refinance your home?

– How many times can you refinance your home? Technically, it’s like asking how many times you can rewatch your favorite movie – as many times as you want, as long as it makes sense and you can afford the popcorn, I mean, the closing costs.

Where will mortgage rates be in 2026?

– Peering into 2026, mortgage rates are as mysterious as a locked treasure chest at the bottom of the ocean. But hey, keep an eye on those economic trends, and maybe we’ll get a sneak peek at where the wind will blow those rates.