Understanding Todays Mortgage Rates 30 Year Fixed Loans

Today’s mortgage rates 30-year fixed are like a delicate dance between economic forces and consumer expectations. With the buzz that rates are expected to take a dip, it’s like the market’s putting on its dancing shoes for a surprising number. But what leads to this rhythmic shift? Connect the dots, and you’ll find the Federal Reserve orchestrating the tempo with its policies, as inflation rates jive in the backdrop, setting the pace. Furthermore, the secondary mortgage market, with its complex twirls, has traders and investors placing their bets on mortgage-backed securities, a move that can tip the scales of supply and demand, thus influencing the tune of interest rates.

Given this intricate ballet, understanding the interplay of these forces is akin to appreciating an Artsakh performance – it’s about wrapping your head around the narrative behind the motions to truly grasp the essence. If you’re in the market for a house or looking to refinance, the potential dip in 30-year fixed mortgage rates gives you a reason to pay attention – after all, timing is everything.

Historical Context of 30-Year Fixed Rates and Today’s Shift

Peering into the rearview mirror, the historic 30-year fixed rates have their own saga, punctuated by peaks and valleys that tell tales of inflation scares and policy pivots. Remember when Mission Impossible 2 hit the theaters? Back then, rates were indeed on an impossible mission of their own, defying gravity and predictions alike.

Though the current climate seems far removed from those heady days, the plot may feel somewhat familiar. Comparing notes with yesteryears, experts whisper of a decrease akin to a gentle autumn leaf, floating down to grace us with lower rates. This predicted dip isn’t just a fluke; it echoes the patterns of a prequel we’ve seen before, starring the usual suspects of economic cooling and subdued inflation.

| Category | Details |

| Today’s Average Rate* | *This will be a daily updated value based on the current market rates. |

| Rate Comparison (Major Lenders)** | **This section would list several major lenders and their offered rates for a 30-year fixed mortgage for comparison purposes. |

| Predicted Rate Changes | Expected to decline by at least 0.5 percentage point through mid-2024. |

| Influencing Factors | Economic weakening, inflation slowdown, anticipated Fed rate cuts. |

| Short-Term Outlook | Gradual decline as economic conditions shift. |

| Long-Term Outlook (Through End of 2024) | Projected to fall to low-6% range. |

| Forecast into Early 2025 | Possibly dipping into high-5% territory. |

| Forecast Sources | Fannie Mae, Mortgage Bankers Association, National Association of Realtors. |

Key Factors Prompting Today’s Mortgage Rate Decrease

Why the sneak peek at a mortgage rate decrease? See, it’s the cocktail of current events – a bit of government bond yield changes here, a splash of housing market dynamics there – that’s brewing this cocktail of a dip. The ingredients? A dash of:

– A slowing U.S. economy, which could make borrowing a tab cheaper.

– Inflation that’s easing up, like a partygoer easing into the night’s end.

– And, the Federal Reserve potentially rolling back interest rates.

These factors stir up the mortgage market like Iggy Azalea shaking up the OnlyFans world. For potential homeowners and refinancers, the mix could serve up opportunities that had seemed like punchlines in a Pootie Tang comedy.

Impact of Today’s Mortgage Rates on the Housing Market

Here comes the ripple effect. Today’s mortgage rates on 30-year fixed loans can flutter through the housing market like butterflies in your garden, making everyone sit up and take notice. A dip in rates translates to:

– More buying power for home seekers. It’s like suddenly finding a sale at your favorite store.

– A refinance rush, as current homeowners scramble to lock in the savings, sort of a financial makeover for their monthly budgets.

– An impact on the wider economy, maybe not front-page news but certainly the talk of the town in real estate circles.

What this dip represents is akin to a clearance sale for homebuyers, where even a fraction of a percentage point off can save you a bundle over the life of the loan.

Comparison of Major Lenders’ 30-Year Fixed Rates Today

Each financial institution dances to the beat of its own drum. Chase might whisper sweet lower rates into the ears of borrowers, while Bank of America could play coy, waiting for others to make the first move. Wells Fargo, meanwhile, could pull a maverick stunt, edgily tweaking its rates to capture the market’s pulse.

What does it mean for consumers? As you navigate these waters, remember, shopping around is key, as you might find a lender that’s slipped under the radar with even more competitive rates. Today’s mortgage rates 30-year fixed options are not a monolith, so comparison is your secret weapon in finding the best deal.

Expert Predictions on the Future of 30-Year Fixed Mortgage Rates

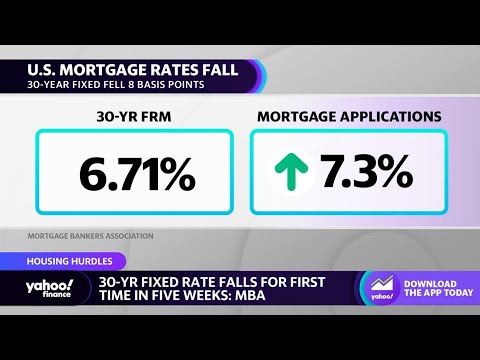

Forecasts from the likes of Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors are all chanting a similar mantra: 30-year fixed-rate mortgage rates could be on the descent, like a skier gracefully coming down a gentle slope. With predictions of a half a percentage point drop through mid-2024, it’s the kind of financial forecast that makes you actually want to check the weather – or in this case, the market trends.

By the end of 2024, expect to see rates cozying up in the low-6% range, potentially flirting with high-5% territory by early 2025. It’s not just reading the tea leaves; it’s about seeing the clouds part and a brighter horizon for borrowers.

Strategies for Homebuyers in Response to Today’s 30-Year Fixed Rate Trends

Alright, you see the dip coming; how do you dive in? It’s strategy time:

– Shine that credit score like it’s a prized trophy. Lenders love them, and a good one can unlock doors to great rates.

– Shop around like you’re hunting for that last Easter egg. Different lenders offer different rates, and the hunt can pay off.

– Time your move with the finesse of a chess grandmaster. The market can be a fickle friend, but with rates expected to nudge down, watching and waiting could be your winning move.

Innovative Wrap-Up: Navigating the Ebb and Flow of Fixed Mortgage Rates

Navigating today’s mortgage landscape calls for both the wisdom of a sage and the agility of a fox. The impending dip in today’s mortgage rates for 30-year fixed loans is your cue to stay sharp, gather intel, and be ready to leap when the iron – or in this case, the rate – is hot.

Stay tapped into resources like MortgageRater.com, and keep an eye on those market whispers, because being informed is the smartest play in your mortgage playbook. And remember, as the mortgage market ebbs and flows, your strategy should be as dynamic as the rates themselves. Because in this game, those who are swift to adapt can often catch the worm – or the rate – that others miss.

Keeping Up with Today’s Mortgage Rates 30-Year Fixed

Have you ever wondered how people keep tabs on today’s mortgage rates 30 year fixed? It’s fascinating to think that a simple number can hold so much significance, especially when you’re in the market for a new home. Now, you might be itching to know What Is The current 30 year fixed mortgage rate, and voila! With just a click, getting this crucial information is easier than finding a penny in your pocket.

But it isn’t just about the numbers. Imagine this: you’re chilling on the couch, thinking about your dream home, and you say, “Alexa, what are today’s mortgage rates 30 year?”, and presto, you’ve got the lowdown without lifting a finger. Meanwhile, in a completely different realm, singer Iggy Azalea might be handling her own numbers, like her latest venture into the exclusive world of content creation on OnlyFans. Who knew that queries like Iggy azalea Onlyfans would brush shoulders with mortgage rates in the weirdest of ways?

Hopping from celeb moves to financial maneuvers, sometimes life’s treasures are in the miles we accumulate. Likewise, understanding when to buy United Miles can be as critical as timing the market for the best mortgage rates. It’s a game of strategy and timing, where the smart ones win and saving a pretty penny is the trophy. Isn’t it peculiar how life’s different facets, ranging from mortgages to miles, intertwine?

Never a dull moment, eh? Who said mortgages were dry and cut-and-dried? As you can see, the world of today’s mortgage rates 30 year fixed is ever-evolving and full of surprises. Whether it’s a celebrity’s unexpected business moves or a smart travel hack that could save you loads, the charm of the unexpected is just around the corner.

What is the interest rate on a 30 year fixed right now?

– Wanna know the current scoop on a 30-year fixed-rate mortgage? Well, rates can be as finicky as the weather, so it’s best to check today’s rates for the most up-to-date info. That said, the buzz around the financial watering hole is to expect those numbers to shift, so keep your eyes peeled.

Are 30 year mortgage rates dropping?

– You betcha, it looks like 30-year mortgage rates are on a bit of a downhill slide. Experts are whispering that we might see at least a half a percentage point drop by mid-2024. So, if you’re waiting for a sign, this might just be it!

Are mortgage rates expected to drop?

– If the crystal ball of financial gurus is anything to go by, yup, mortgage rates are poised to take a tumble. We’re talking a cool off to the low-6% range by the end of 2024, with a possible toe-dip into the high-5% pool come early 2025.

What is mortgage rates today?

– “What’s the deal with mortgage rates today?” I hear you ask. It’s a roller coaster, my friend! To get the latest digits, you’ve gotta check today’s rates—but just a heads up, they could be doing the limbo under those high rates we’ve been seeing.

Which bank gives lowest interest rate for home loan?

– On the hunt for the lowest interest rate for a home loan? Banks are more varied than flavors at an ice cream shop, but some are definitely sweeter deals. Do a little digging, compare those numbers, and you may just hit the jackpot with a bank that’s slicing rates like a hot knife through butter.

Should I lock mortgage rate today?

– To lock or not to lock—that is the question! With whispers of rates heading south, it might seem like a game of Red Light, Green Light. If your gut’s doing somersaults worrying about rates spiking, locking in might just be your ticket to a good night’s sleep.

Will mortgage rates ever be 3 again?

– Will mortgage rates ever hit that sweet 3% again? Well, that’s the million-dollar question, isn’t it? The road ahead is as unpredictable as a game of Monopoly, but let’s just say don’t bank on it for the immediate future—keep your eyes on the prize and maybe, just maybe, we’ll get lucky.

Will mortgage rates go down again in 2024?

– Hmm, will mortgage rates go down in 2024? Let’s peek into the crystal ball: the smart folks—from Fannie Mae to the National Association of Realtors—are lining up their ducks, predicting a little drop-see-doodle by mid-2024. Stay tuned, ’cause only time will tell!

What is the mortgage rate forecast for 2024?

– So, you’re curious about the mortgage rate forecast for 2024? Put on your future goggles because the forecast is looking chillier for rates, with a nice cool-down predicted. Remember, though, forecasts are like weather predictions—they’re not written in the stars!

How much does it cost to buy down interest rate?

– Ah, the cost of buying down that pesky interest rate. It’s a bit like haggling at a flea market—it can vary based on how many points you’re after and your lender’s price tag. Crunch some numbers and chat with your lender to see if it’s a wallet-friendly move for you.

What will mortgage rates be in 2025?

– Fast forward to 2025, and what do we see? Predictions suggest the ole’ 30-year fixed mortgage rate could be lounging in the high-5% zone. Don’t take it to the bank just yet, though; this financial tea is still brewing.

Where will mortgage rates be in 2026?

– Jumping ahead to 2026 is a bit like time-traveling without a DeLorean, but if the mortgage rate compass is pointing anywhere, experts reckon it could stay in the land of the low to mid-6%. But hey, don’t quote me on that—ask me again closer to 2026!

Why are mortgage rates so high?

– Why on earth are mortgage rates reaching for the sky? It’s a bit like a bad hair day stemming from a perfect storm: the economy’s on a roller-coaster ride, inflation’s doing the tango, and the Fed’s juggling interest rates. All that adds up to rates that are higher than a kite.

Are mortgage rates really high right now?

– “Are mortgage rates sky-high right now?” Well, they’re definitely not lounging on the ground, let’s put it that way. They’ve climbed the ladder in recent times, making us all feel a little faint. But don’t lose hope—what goes up must come down, right?

How high will mortgage rates go?

– Talking about how high mortgage rates will go is a bit like predicting the final score in a game that’s still in the first quarter. Some folks think rates might keep climbing, just like toddlers on furniture. But you know what? No one’s got a magic 8-ball, so let’s wait and see what the market does.