Retirement ought to be your victory lap — a time to bask in the glory of your hard-earned chill-out sessions. You’ve punched that timecard for the last time, and now, it’s all about sipping lemonade on the porch and maybe even catching up on some new scary Movies in 2024. But hold your horses and your remote! Before you switch from earning to spending, let’s talk turkey about what a good monthly retirement income looks like.

Understanding What a Good Monthly Retirement Income Entails

The Key Elements That Define Financial Comfort Post-Retirement

Ever wondered, “What is a good monthly retirement income?” It’s the million-dollar question, with no one-size-fits-all answer. A good monthly retirement income is your financial security blanket — the dough you need to live comfortably without punching the clock.

What does comfort mean to you? Is it keeping the lights on and the fridge stocked, with a little extra for the grandkid’s birthday treats? Or does it mean jet-setting to exotic locales without a financial care in the world? Here’s the skinny: it’s not just about having a wad of cash; it’s about ensuring your golden years are actually golden.

Retirement Is a Full time Job And You’re the Boss! (gift book)

$14.59

Retirement Is a Full-time Job And You’re the Boss! is a delightful gift book designed to celebrate the new chapter in the life of any retiree. With its humorous approach, it captures the joys and newfound freedoms that come with leaving the workforce. Through an engaging mix of witty quotations, insightful reflections, and light-hearted jokes, the book serves as a daily reminder that retirement is not an end but a beginning, offering endless possibilities for leisure and adventure.

This attractively bound book is portable and easy to read, making it the perfect companion for the newly-retired individual who is ready to embrace their liberty on-the-go. Its pages are filled with inspiring prompts and space for personal notes, allowing readers to contemplate and jot down their own ideas for making the most of their retirement years. Illustrations and themed activities are scattered throughout the book, adding a playful touch designed to spark the imagination and encourage the pursuit of new hobbies.

Retirement Is a Full-time Job And You’re the Boss! is an ideal gift for anyone embarking on the journey of retirement, be it a family member, a friend, or a colleague. With its upbeat tone and positive outlook, it’s a celebration of the retiree’s career journey and the exciting new era ahead. This book serves not just as a keepsake but as a token of enthusiasm and support for the retiree’s future endeavors, making every page a tribute to their achievements and the adventures that await.

Preparing for Tomorrow: How Much Money Should I Have Saved by 30?

Early Savings Goals and Milestones to Ensure a Secure Retirement

By the ripe age of 30, how much green should you have stashed away? Kicking off your career, the goal is to save at least a year’s worth of salary. If you’re pulling in $50k a year, aim to have that much in your retirement piggy bank.

Now, friend, that nest egg won’t hatch by itself. It’s all about being a savvy saver and making smart choices — like that avocado toast might look tempting, but your future self might thank you for opting for a good old PB&J instead.

| Factor | Details | Example Calculation | Notes |

|---|---|---|---|

| Desired Monthly Retirement Income | This is based on the premise that a retiree will need approximately 80% of their pre-retirement annual income to maintain their lifestyle. | $120,000 annual pre-retirement income x 80% = $96,000/12 = $8,000 per month | This principle assumes retirees will have fewer expenses, such as no commuting costs, lower taxes, or a paid-off mortgage. |

| Projected Social Security Benefits | The average retired worker’s Social Security benefit. For a couple, it would be doubled. | Average retiree benefit: $1,800 x 2 = $3,600 per month as a couple | This will vary greatly based on work history and the age at which benefits are claimed. |

| Required Supplemental Income | This is the additional monthly income needed in addition to Social Security to meet the desired retirement income goal. | $8,000 desired – $3,600 from Social Security = $4,400 needed from other sources | This could come from pensions, savings, investments, retirement accounts, or part-time work. |

| Average Social Security Benefits Variation for Retirees | Average monthly benefit payment specifically for retirees, which is generally higher than the overall average. | Average retiree check: $1,705.79 (individual) | Couples may receive benefits that are higher or lower than twice this figure based on individual work records. |

| Additional Retirement Income Strategies | Methods to boost retirement income to achieve higher monthly targets, such as $10,000 per month. | Savings, investment returns, downsizing home, annuities, etc. | Pre-retirement planning and investment can greatly increase the feasibility of attaining a higher income goal. |

Crafting Your Retirement Blueprint: Income in Retirement

Strategically Diversifying Income Streams for a Resilient Retirement Portfolio

To build a rock-solid retirement, it’s time to get your ducks in a row and diversify. Think of it as a buffet of income streams — some social security here, a side of pension there, and a sprinkle of investments for good measure.

Don’t put all your eggs in one basket; mix it up! A dash of stocks, a dollop of bonds, and maybe some rental income to keep things interesting. It’s about playing it smart and safe, allowing your money to cha-cha through your retirement years.

Deciphering What Is a Good Monthly Retirement Income for Individuals

Estimating the Ideal Retirement Income Based on Personal Needs and Inflation

So, you’re flying solo and aiming to figure out your magic number for retirement income. Remember the 80% rule? If you’re used to living on a yearly salary of $60,000, after you retire, you’ll wanna aim for about $48,000 a year, which breaks down to $4,000 a month.

But don’t forget about that sneaky little thing called inflation — it’s like a raccoon rummaging through your retirement funds. Plan for it, and you won’t get caught with your financial pants down.

Year (Days) Retirement Count Down xBlack and White Tear Off Countdown Calendar Table and Desk Unit Perfect for Office, Event, Corporate and Door Gifts

$31.95

The “Year (Days) Retirement Count Down xBlack and White Tear Off Countdown Calendar” is the ideal countdown companion for anyone eagerly anticipating their retirement. This stylish, monochromatic calendar serves not only as a daily reminder of the approaching leisure days but also as a sleek addition to any office desk or home workspace. Each page tears off easily, marking the satisfying conclusion of another day closer to the ultimate relaxation milestone. With its compact table and desk unit design, it occupies minimal space while delivering maximum excitement.

Perfect for corporate environments or as a thoughtful gift for soon-to-be retirees, this countdown calendar acts as both a functional timekeeper and an encouraging statement piece. The high contrast black and white motif ensures clear visibility and complements any office aesthetic, blending seamlessly with personal or professional decor. It’s not just a practical tool; it’s a conversation starter and a daily morale booster, reminding future retirees of the well-earned break that lies ahead. Its presence transforms the countdown to retirement from an abstract concept into an engaging and tangible experience.

As a gift, the countdown calendar is a poignant token that expresses appreciation for years of dedication and hard work. It’s an ideal choice for door gifts at farewell parties or as a surprise present from colleagues or family members. Its universal appeal makes it suitable for all, regardless of personal tastes or office styles. As recipients tear off each passing day, they’re reminded of the support and well-wishes from those who gifted this sleek, symbolic calendar, heightening the anticipation for the new chapter in their lives that awaits.

Determining What Is a Good Monthly Retirement Income for a Couple

Adjusting Expectations and Strategies for Dual-Income Retirement Planning

If you’re cozying up with a better half, planning for two is the game. Dual-income retirees should aim for about $96,000 annually, based on the 80% principle. That’s a comfortable $8,000 every month, not too shabby for two lovebirds in the nest.

Sharing is caring, especially when it comes to retirement funds. Got a partner in crime? Then you’ve got a partner in planning — double the brainpower, double the fun!

Real-Life Benchmarks: Analyzing Current Retirement Income Standards

Integrating Data and Expert Forecasts to Frame a Contemporary Retirement Income Model

Let’s put down the pie-in-the-sky dreams for a sec and peek at the real world. These days, the average retired worker pockets about $1,800 monthly in Social Security. So, a couple with matching earnings history would reel in about $3,600 each month or $43,200 a year.

Yep, that’s a far cry from our $8,000 monthly dream. But hey, knowledge is power, and with a splash of planning, that power’s in your hands.

The Role of Social Security and Pensions in Your Retirement Income Strategy

Maximizing Government and Employer-Sponsored Benefits for a Financially Sound Retirement

Counting on Social Security and pensions is like having a trusty sidekick in your retirement saga. Did you know the average Social Security check is roundabout $1,705.79 per person? Not exactly chump change!

Sure, it won’t buy you a yacht, but when paired with a nice plump pension, you’re looking at a more secure financial horizon. So don’t snooze on these benefits — make ’em work for you!

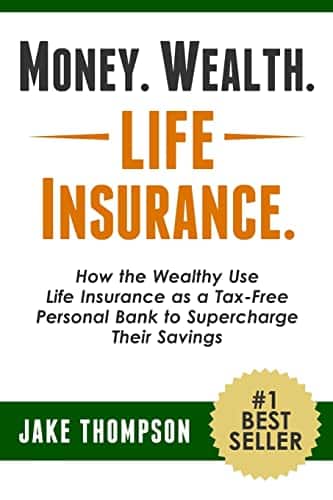

Money. Wealth. Life Insurance. How the Wealthy Use Life Insurance as a Tax Free Personal Bank to Supercharge Their Savings

$7.99

“Money. Wealth. Life Insurance.” offers a comprehensive guide into the strategically intelligent ways that the affluent manage their finances using life insurance as a powerful financial tool. This insightful book uncovers the often-overlooked benefits of using life insurance policies not just as a safety net but also as a dynamic vehicle for tax-free savings and wealth accumulation. It delves into the various methods by which life insurance can act as a personal bank, offering readers a clear understanding of how to leverage policies for loans, retirement planning, and estate management. The author expertly explains complex financial concepts in a reader-friendly manner, making the strategies accessible to anyone looking to enhance their financial savvy and secure their future.

Readers of “Money. Wealth. Life Insurance.” are introduced to the secrets of how life insurance can serve as a tax-efficient cornerstone in the careful planning of personal wealth strategy. Through a blend of real-life examples and technical advice, the book explains how the wealthy take advantage of the growth potential and the favorable tax treatment afforded within the life insurance realm to build substantial cash reserves. The book also emphasizes the importance of consulting with financial professionals to tailor a policy to an individual’s specific needs and goals, ensuring the optimization of the life insurance instrument in oneâs personal wealth management arsenal. It empowers individuals by highlighting the ways life insurance can protect wealth while offering a mechanism for cash accumulation free from market volatility.

The ultimate takeaway from “Money. Wealth. Life Insurance.” is its revelation of using life insurance as more than just a protective measure; it’s an active, strategic choice for bolstering oneâs financial position. The book stresses the role of life insurance in facilitating liquidity and financial stability, turning the death benefit-centric view on its head to spotlight life benefits. Readers will appreciate the sophisticated yet straightforward strategies outlined, providing them with the knowledge to implement life insurance savings as a part of their sophisticated wealth-building toolkit. “Money. Wealth. Life Insurance.” is an essential read for anyone from aspiring wealth-builders to seasoned investors looking to utilize life insurance to its full potential for achieving financial prosperity.

Investment Strategies to Boost Your Retirement Income

How Smart Investment Choices Now Can Translate to a Better Retirement Income Later

You don’t need to be the next Warren Buffett to get your investments to pay off. Start playing the long game — slow and steady wins the retirement race.

Looking for a hot tip? Consider embracing index funds — they’re like the chill tortoise that steadily marches toward the finish line. Add in some real estate action for a splash of flair, and bam, you’ve just upped your retirement ante!

Reducing Liabilities: The Impact of Debt on Retirement Income

Techniques for Debt Management to Optimize Your Monthly Retirement Income

Let’s talk dirty four-letter words — like “debt.” It’s a pesky little critter that can chew through your retirement funds like nobody’s business. Manage it right, and you’ll have more cash to flash when you finally kick up your feet.

Plan your swan song to debt well before you say adios to the 9-to-5 gig. A mortgage-free retirement is like sipping piña coladas on the beach — sweet, stress-free, and downright delightful.

Geographic Considerations for Your Retirement Income

How Location Can Affect the Value of a Good Monthly Retirement Income

Ever heard the phrase “location, location, location”? Well, it ain’t just for real estate moguls. Where you settle down can be a game-changer for your retirement finances.

Think about it — Nebraska ‘s income tax and property tax might look like pocket change compared to other states. So, do your homework, and you might just find your perfect retirement Shangri-La.

Envisioning the Future: Adaptations for Increasing Life Expectancies

Calculating Retirement Needs With Longer Lifespans in Mind

We’re living longer, folks — which is great for racking up more birthdays, but it also means your retirement funds need to stretch further. It’s like planning an all-nighter; you want enough snacks to last till dawn.

So, assume you’ll be hitting a grand old age — and plan accordingly. Better to have too much cheese in the fridge than to run out during the last episode binge of your favorite series.

Personalizing Your Retirement: Lifestyle Choices and Income Needs

Evaluating How Your Desired Retirement Lifestyle Influences Income Requirements

Dream of globetrotting or chilling in a rocking chair with your cat? Your retirement game plan should reflect your personal retirement #goals.

Plot out your ideal retirement — the hobbies, the adventures, the pace — and put a price tag on it. Then, pad it a bit, because let’s be honest, who doesn’t want a little extra cushion for spontaneous splurges?

The Shift from Savings to Spending: Managing Your Nest Egg

Effective Strategies for Withdrawing from Retirement Savings to Sustain Income Levels

Alright, you’ve saved a mountain of cash — now it’s time to spend it without blowing it. There’s an art to withdrawal, kinda like a financial tap-dance.

The 4% rule is your friend here — take out just 4% of your retirement pot each year, adjusted for inflation, and you should be golden. Manage it right, and you won’t have to sweat running out of dosh.

Navigating the Unexpected: Planning for Health Care and Emergencies

Integrating the Costs of Health and Contingency into Your Retirement Income Plan

Health care costs in your twilights can be like a bull in a china shop — unexpected and potentially costly. So, it’s time to build your own financial safety net.

Perhaps look into long-term care insurance or a health savings account (HSA). And always have an “uh-oh” stash of cash for those just-in-case moments when life throws you a curveball.

Unveiling New Perspectives on Retirement Living

Embracing Modern Concepts and Innovations to Enhance Retirement Income Sustainability

The world is changing, and so are retirement concepts. Nowadays, you might find retirees sharing digs to split costs or diving into the gig economy for some extra pocket money.

Get creative with your resources — maybe that fancy camera can snag you some cash on the side. The key? Be open to new ideas to keep those greenbacks flowing in.

A Vision for Retirement: Thriving Beyond the Numbers

Crafting a Retirement Journey That Couples Personal Fulfillment With Financial Stability

My friends, retirement is so much more than crunching numbers — it’s about living the lifescript you’ve been doodling in your mind all these years. Aim for a balance of personal joy and financial security to really rock those retirement years.

Whether you’re yearning for tranquility or adventures in far-flung places, now’s the time to weave the tapestry of your twilight years — rich in experiences, friendships, and yes, a steady stream of income to boot. After all, in the tree of life, your retirement is meant to be the cherry on top. Now go out there and pick it!

Fun Trivia & Interesting Facts: Hitting the Retirement Jackpot

Retirement may make you think of kicking back with a lemonade, but let’s shake up that image with some tantalizing tidbits that’ll have your financial gears turning. We’re diving in to answer the million-dollar question—or should we say, the “good monthly retirement income” question!

The Magic Retirement Number: Circus Act or Financial Fact?

Alright, truth bombs coming at ya! Ever wondered, “What’s a good monthly retirement income?” Spoiler alert: It’s like asking Stephen Campbell to pen a one-size-fits-all blockbuster. Spoiler alert: It’s like asking Stephen Campbell( to pen a one-size-fits-all blockbuster. Not happening, right? Just as Stephen tailors his scripts for his audience, your retirement income should be customized for your lifestyle—no rough drafts here!

The Young’uns Taking Notes

Now, if you’re a “spring chicken” reading up on this, you’re sharp as a tack! Getting your ducks in a row for retirement is like being a first-time homebuyer in Arizona. You need the right info to make savvy choices. Before you nail down those white picket fences, learn the ropes with guidance on being a first time home buyer in Arizona.( Getting your dream abode in the Grand Canyon State is one thing; planning for the retirement villa is another!

The Home Stretch: Demolishing Myths

Let’s knock down some misconceptions while we’re at it! Knowing when to save and how to spend in retirement can be as complex as figuring out How much it costs To demolish a house.( Costs can vary wildly, and the same goes for that nest egg. So before you take a sledgehammer to your current budget, do the math and don’t just swing wildly.

The Golden Years Game Plan

Well, butter my biscuit—did we cover some ground or what? From learning the ABCs of a first-time home purchase to razing retirement myths to the ground, we’ve blazed a trail straight to ‘know-how’ city. Remember, a good monthly retirement income isn’t about reaching a universal finish line; it’s carving out your personal path to a comfy chair by the beach or a cabin in the mountains—your retirement, your rules!

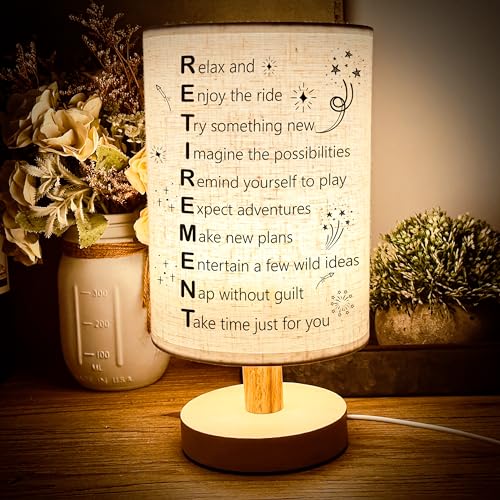

MAMAGIFTREE Best Retirement Gifts Boho Table Lamp Inspirational Blessings Lamp with Soft Linen Shade Retirement Gifts for Women Men Coworker Teacher Boss Mom Dad Best Friend’s Retirement.

$23.99

The MAMAGIFTREE Best Retirement Gifts Boho Table Lamp is the ideal token of appreciation for your coworker, boss, mom, dad, or best friend as they transition into their golden years. This unique and meticulously crafted lamp features a bohemian-inspired base that adds a touch of free-spirited elegance to any room. Paired with a calming soft linen shade, it offers a warm and inviting glow that sets a peaceful ambiance perfect for reading and relaxation in retirement.

Designed with inspiration in mind, the lamp comes engraved with heartfelt blessings, making it more than just a decorative item, but a constant reminder of the joy and peace that retirement can bring. It makes for a thoughtful retirement gift that conveys your best wishes and serves as a symbol of the retiree’s achievements and the exciting new chapter ahead. Its neutral color palette ensures that it blends harmoniously with any interior décor, making it a versatile addition to the retiree’s home.

Beyond its aesthetic appeal, the MAMAGIFTREE Boho Table Lamp is crafted for durability and ease of use, featuring a user-friendly switch and supporting standard E26 bulbs for hassle-free maintenance. This lamp is not only a functional piece for everyday use but also an inspirational centerpiece that celebrates the culmination of a career with grace and style. It stands as a touching tribute to the retireeâs hard work and dedication, making their retirement all the more special and memorable.

What is the average retirement monthly income?

Oh boy, the average retirement monthly income is a bit of a moving target, isn’t it? But here goes: it’s generally around $1,500 to $1,600 per month. That’s combining Social Security payments, pensions, investments, and savings. Remember, that’s just a ballpark figure and it swings wildly depending on your lifetime earnings and savings habits.

What is a good monthly income for a retired couple?

Looking for a good monthly income for a retired couple, are we? Well, most financial advisors suggest aiming for about 70-80% of your pre-retirement income. So, if they were used to living on a combined $5,000 a month while working, they should be shooting for about $3,500 to $4,000 in retirement to maintain their lifestyle.

How much monthly income do I need to retire comfortably?

How much green do you need each month to retire comfortably? Well, it’s not a one-size-fits-all answer. A general rule of thumb is around 70-80% of your final pre-retirement salary. So, if you’re making $100,000 a year before retiring, you’d be looking at needing about $5,800 to $6,667 per month. But hey, your mileage may vary!

Is $4000 a month enough to retire on?

Is $4,000 a month enough to retire on? Well, it’s not chump change, but whether it’s enough hinges on your lifestyle and location. It might be plenty in one place and barely scratch the surface in another. Plus, consider healthcare costs, travel plans, and any unforeseen expenses that could shake things up.

How much money do most people retire with?

How much money do most people retire with? Now, this is like guessing how many jellybeans are in the jar, but the median retirement savings pot is around $60,000 to $70,000. Keep in mind that’s just the middle ground. Some folks have way more stashed away, while others are getting by on less.

How much money does the average person retire with?

The average Joe or Jane typically retires with, well, not a king’s ransom — think more along the lines of $60,000 to $70,000 in personal savings. But that’s just an average, with some saving a lot more and, regrettably, some a lot less.

Can a retired couple live on $3,000 a month?

Can a retired couple live on $3,000 a month? Sure, they can, but it’ll be tight. It’s like doing the tango in a broom closet! They’ll need to be smart with their budget, and they might have to cut back on the frills, but it’s doable, especially in areas with a lower cost of living.

How much Social Security will I get if I make $60000 a year?

How much Social Security will I get if I make $60,000 a year? Grab your calculators, folks! It’s not straightforward, but typically you can expect to receive about 40% of your average pre-retirement yearly income. For a $60,000 salary, you’re probably looking at a benefit of about $24,000 a year or roughly $2,000 per month.

How much Social Security does the average person get?

The average Social Security check? It’s not winning the lottery, that’s for sure. Most folks see about $1,500 a month. Remember, this figure can vary based on your earnings and the age you start taking benefits.

How much do I need to retire if my house is paid off?

Retiring debt-free with a paid-off house is a game-changer! But you’ll still need to cover taxes, insurance, maintenance, and of course, life’s other little necessities and joys. Financial gurus often suggest having enough to cover at least 70-80% of your current income, but with no mortgage, you might feel comfortable with a bit less.

What is the $1000 a month rule for retirement?

The $1,000 a month rule for retirement sounds nifty, right? It’s a quick-and-dirty way to figure out your savings goal. Squirrel away enough so that for every $1,000 you want monthly in retirement, you’ve got $240,000 in the bank. So, for $3,000 a month, you’re looking at a cool $720,000 saved up.

What is the average 401k balance for a 65 year old?

Ah, the average 401k balance for a 65-year-old? It’s a mixed bag, but we’re talking somewhere around $255,000. Keep in mind, though, averages can be deceiving with high rollers skewing the numbers.

Is $6,000 a month a good pension?

Raking in $6,000 a month in retirement? That’s not too shabby! For most, it’s a pretty comfortable amount, well above the average retiree’s income. You could be living the dream, as long as you keep a lid on those extravagant impulses.

What percentage of retirees have $2 million dollars?

How many retirees are sitting on a $2 million nest egg? Not a boatload. Actually, only about 1-2% of retirees hit that mark. It’s like finding a four-leaf clover in a field of three-leafers.

How many people have $1000000 in savings?

Million-dollar savings aren’t the norm, that’s for sure. It’s estimated that only around 5-8% of folks have a seven-figure stash. So if you’ve got $1,000,000 in savings, you’re in a pretty exclusive club.

What is the average Social Security check at age 65?

The average Social Security check at age 65? You’re looking at about $1,543 a month. But that’s before Medicare premiums take their bite, so keep that in mind!

How much Social Security will I get if I make $60000 a year?

Social Security and a $60,000 salary, round two! You can expect about $2,000 each month, but your actual benefit might vary. The Social Security Administration’s calculators can give you a personalized estimate.

What is the average income for retirees over 65?

The over-65 crowd’s average income includes Social Security, pensions, investments, and savings, putting them at about $1,500 to $1,600 a month. But hey, some seniors are rolling in more dough, and others are getting by on less.

What is the average Social Security check at age 67?

At age 67, the typical Social Security payout is roughly $1,503 each month. Just a hop, skip, and a jump from what folks get at 65, thanks to cost-of-living adjustments and later retirement credits.