Washington State stands as an economic powerhouse, attracting individuals and businesses with its lush landscapes, cutting-edge tech industry, and a unique tax structure that differentiates it from many of its peers. As we embark on this deep dive into the Washington state tax rate, it’s important to remember that while taxes are as certain as a Seattle drizzle, they don’t have to dampen your financial spirit. Buckle up; it’s time for an educational journey through the ins and outs of Washington’s tax landscape—money matters made easier.

The Structure of Washington State Tax Rate

In Washington State, the tax system is akin to a complex tapestry, woven with threads of various taxes but missing one often hefty strand—the personal income tax. This omission is more than a mere peculiarity; it’s a defining characteristic of the Washington tax system that significantly influences the financial decisions of its residents.

Without a personal income tax, Washingtonians can breathe a sigh of relief come tax season, as their paychecks aren’t subject to state-level skimming. However, it’s worth noting, like a strategically placed tattoo might shift attention, the state recoups its coins elsewhere. Just as people seek out Tattoos on Pennis for specific reasons, Washington has its own design in place with high sales and property taxes.

Sales Tax: The Backbone of Washington Tax Rate

When it comes to sales tax—the bread and butter of Washington’s revenue intake—the state implements a 6.5% pinch on all retail sales. The intricate dance of taxes doesn’t end there, though. Cities and counties can layer on their own taxes, culminating in an average combined rate of 8.86 percent—comparable to perusing Everything everywhere all at once streaming options; it varies depending on your location.

Seattle shoppers, for instance, encounter a 10.25% sales tax rate, which is like opting for an Iphone 13 Pro unlocked—it’s noticeably pricier than its less embellished counterparts. These revenues provide vital funding for state and local services, touching everything from the concrete of infrastructure to the classrooms brimming with future leaders.

| Tax Type | Rate | Additional Information | Ranking/Index Position | Effective Date |

|---|---|---|---|---|

| State Sales Tax | 6.50% | Imposed on all retail sales within the state | State Business Tax Climate Index: 28th | As of Jan 1, 2024 |

| Maximum Local Sales Tax Rate | 4.10% | May be added to the state tax by cities, towns, counties, transit, and facilities districts | None specified | As of Jan 1, 2024 |

| Average Combined State and Local Sales Tax Rate | 8.86% | Includes the state rate plus average local rates | None specified | As of Jan 1, 2024 |

| Property Tax | Varies by jurisdiction | Property taxes are about average when compared to other states | None specified | As of Jan 1, 2024 |

| Personal Income Tax | None | No tax on income including Social Security, pensions, and retirement accounts | None specified | Permanent (as of last update) |

| Seattle Sales Tax Rate | 10.25% | Total of state, county, and city sales tax rates for Seattle, WA | None specified | As of Jan 1, 2024 |

Property Tax in Washington State: A Closer Look

Washington’s property tax paints a middle-of-the-road portrait, neither notably high nor remarkably low compared to other states. Rates are set at the county level and can provoke a varied range of responses akin to finding a petting zoo near me—some are delighted by the reasonable rates; others, not as much.

Take King County, for instance; property owners there navigate a higher-than-average tax rate, squeezing wallets but also funding key services. Pierce and Snohomish counties follow suit, each with their own tax quirks that reflect local needs and priorities.

Business Taxes in Washington State

For businesses, the B&O (Business and Occupation Tax) is the star of the Washington tax stage. Retailers may see rates different than those of service providers or manufacturers, a reminder that, like individuals, companies must choreograph their financial strategies carefully within the contours of tax law.

Entrepreneurs, take heart—Washington also extends olive branches in the form of small business tax incentives, acknowledging that fledgling operations are the apple Paltrow of the business world: bursting with potential but needing the right conditions to thrive.

Washington State Excise Taxes Explained

Washington also imposes excise taxes on specific goods like tobacco, alcohol, and motor fuel. These excise taxes can be viewed as minor characters in the state’s tax narrative, but their roles are far from insignificant, echoing neighboring states’ systems while funding transportation and public health initiatives.

The impact of excise taxes extends beyond government coffers, shaping consumer behavior and business decisions. It’s a fiscal impact you feel with every puff of a cigarette, sip of craft beer, or mile driven on Washington’s evergreen-lined highways.

Recent Changes to the Washington Tax Rate

The tax landscape is mutable, and recent changes reflect lawmakers’ ongoing quest to balance revenue needs with citizens’ well-being. Within the last two years, adjustments have been made—a legislative dance that offers a mix of tightening belts and loosening constraints.

Policy changes reflect not only economic theories but real-world implications. As analysts pore over the details and residents adapt to their new financial realities, the state watches with bated breath to see how these shifts will sculpt Washington’s economic future.

Tax Incentives and Exemptions: Reducing the Washington Tax Rate Burden

Seeking relief from the tax burden, Washingtonians can navigate a maze of incentives and exemptions. These financial reprieves are spread across various sectors, with emphases on clean energy and targeted industries. They’re the life rafts in a sea of taxes, and wise navigators will harness them to keep their financial ships afloat.

Case studies show that effective use of these incentives can make a palpable difference, echoing the old adage of a penny saved is a penny earned. For those aspiring to seize these opportunities, the journey begins with diligent research and proactive steps towards application.

Resident and Analyst Perspectives on Washington State Tax Rate

No examination of Washington’s unique financial terrain is complete without polling its navigators—the residents and experts who traverse it daily. Surveys suggest a mixture of appreciation for the income tax absence and frustration with the high sales and property taxes. It’s as varied as opinions on who is the greatest tech visionary of our time.

Tax scholars weigh in too, offering analyses that are as detailed as a breakdown of California income tax rates or as broad as a discussion of States With lowest Taxes. They scrutinize Washington’s system against its peers, looking for efficiencies and shortcomings, just as an economist might compare the tax leniencies of state tax in Texas with States With The Highest Taxes.

Conclusion: The Future of Taxation in Washington State

When it comes to taxes, Washington State stands out with its lack of personal income tax and genuine efforts to create a business-friendly environment. However, the state’s high sales and property taxes are a trade-off that every resident and business must weigh.

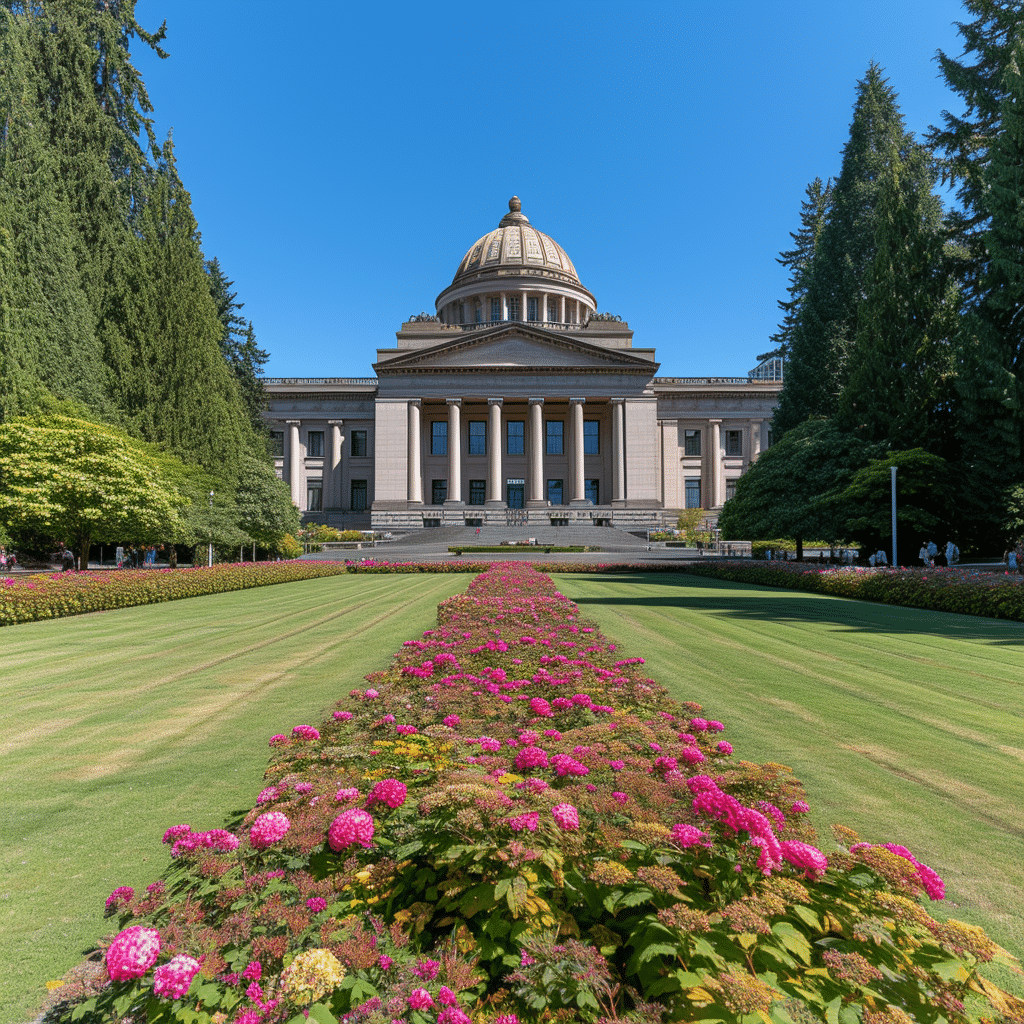

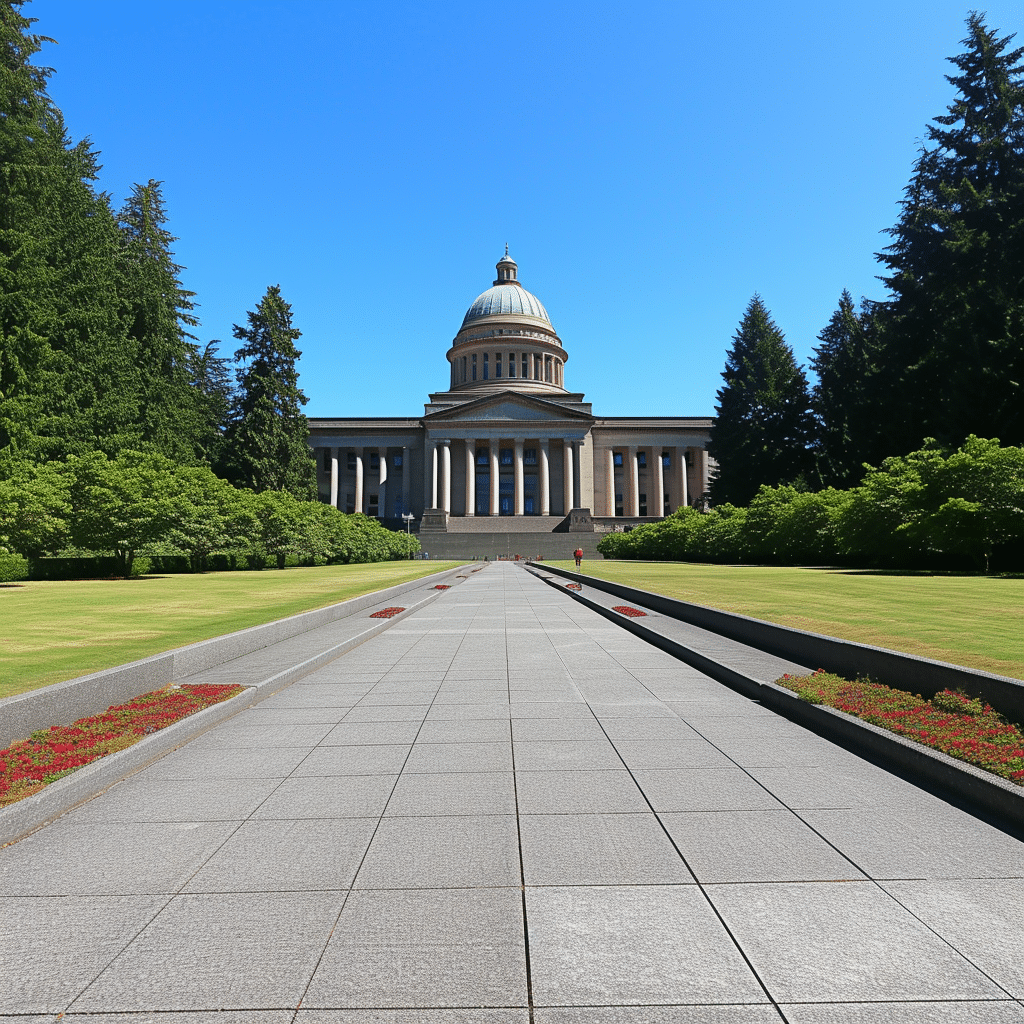

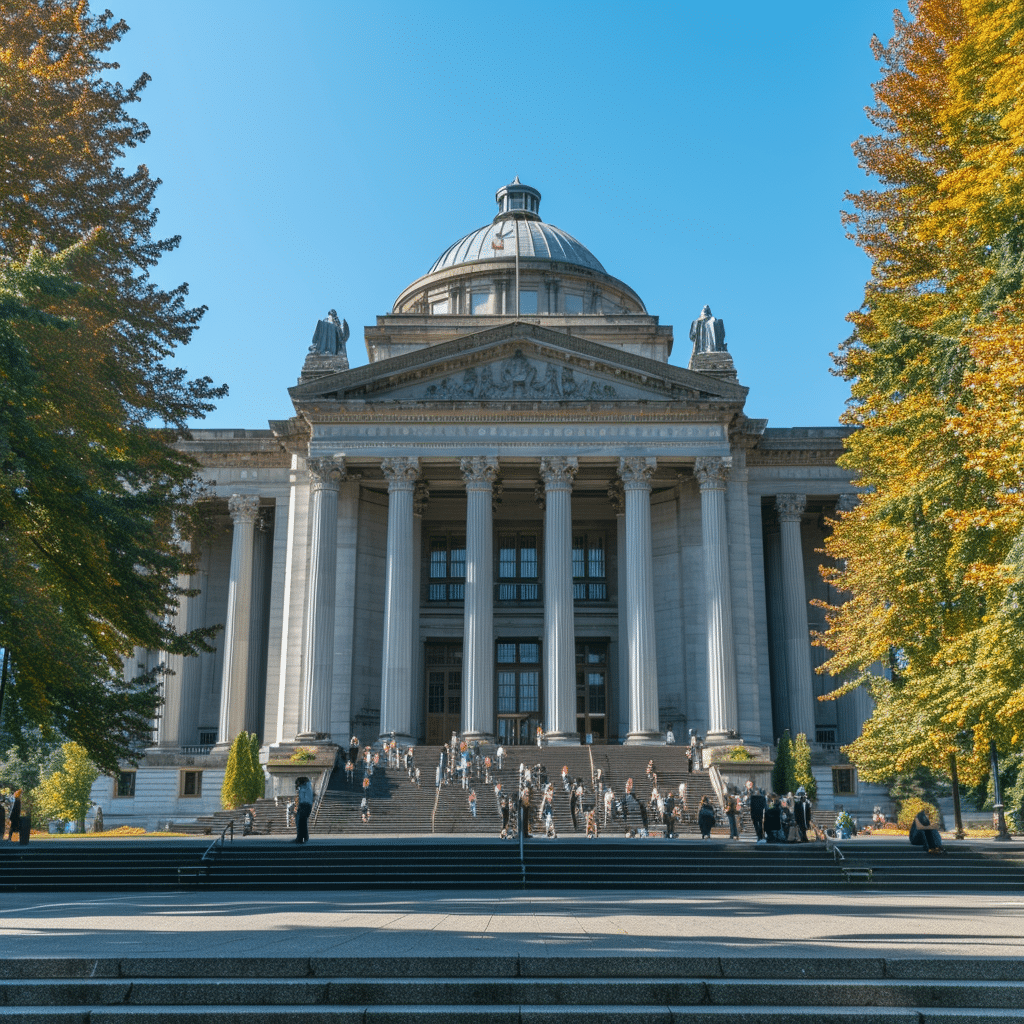

Looking ahead, potential tax reforms loom on the horizon like the promise of spring after a damp Pacific Northwest winter. Advocacy and opposition will play out in a public forum, as is the right and responsibility of the taxpaying populace. Our collective voice will echo in the halls of Olympia, shaping the fiscal policy that will, in turn, shape our state’s destiny.

In the end, just as a gardener tends to their blooms, so too must Washingtonians nurture their understanding of the state’s tax system. With knowledge as our tool and foresight as our compass, we can all navigate the taxing waters of financial stewardship in the Evergreen State.

Uncovering the Curiosities of Washington State Tax Rate

Ah, taxes – the two things certain in life: death and taxes, right? But let’s dish out some intriguing tidbits and fun facts about the Washington state tax rate that might just tickle your fancy. They say knowledge is power, and who knows, by the end of this, you might just become the new trivia champ at your next virtual hangout!

The Art of No Income Tax

Hold your horses, did you hear that right? Absolutely. Washington state dances to its own beat and doesn’t impose a personal income tax on its residents. Yep, you heard it! While some other states might be reaching into your paychecks, Washington says, “Not here, pal!” It’s one of only nine states with this claim to fame, making it a tantalizing option for those wishing to keep their earnings a tad closer to their hearts.

Sales Tax: The Balancing Act

Now, don’t get too carried away — Washington’s generosity with income tax has a catch. The state makes up for it with a sales tax that can really add up depending on where you make your purchases. Whether you’re snagging a latte in Seattle or a book in Spokane, you’ll notice that extra pinch when you reach into your wallet. The Evergreen State’s baseline sales tax rate( isn’t shy, and depending on the local add-ons, you could be looking at a decent chunk of change.

Business and Occupation Tax: A Different Angle

Instead of an income tax, Washington’s got something unique up its sleeve – the Business and Occupation (B&O) tax. This is the state’s way of saying, “Doing business here? Great! That’ll be x percent of your revenue, please.” Sure, it’s a different way of doing things, but businesses in Washington have learned to roll with the punches. If you’re curious about how this tax works and impacts various industries, dive into the meat and potatoes of the B&O tax here.(

Property Taxes: The Middle Ground

As for property taxes, Washington doesn’t hit the highest notes or the lowest lows — it’s more or less middle of the pack. So if you’re looking to set down roots and buy some real estate in the scenic Northwest, you might want to crunch some numbers or talk to a local expert to see where you stand. The rates can vary by county, so do a bit of homework before you sign on any dotted lines.

No Carbo-Loading on Car Taxes

Oh, and get this: if you’re thinking of buying a car in Washington, you might get a bit of sticker shock when it comes to the tax on vehicles. It’s not just the upfront sales tax; the state also takes a bite each year with car tab renewals based on the vehicle’s value. This just goes to show, Washington isn’t afraid to get creative when it comes to taxation, and your car is not immune!

A Sweet Deal for Candy Lovers

Here’s a quirky fact: Washington tried to tax candy differently from other food items back in 2010, but the sweet-toothed citizens said, “No way, José!” Through a public vote, they overturned the decision, ensuring candy aficionados could indulge without forking over extra dough at the checkout. Feel free to savor that victory( the next time you unwrap a chocolate bar in the shadow of Mount Rainier.

Tax Haven for Retirees

And finally, let me paint you a picture: you’re ready to clock out of the workforce for good and want to maximize your retirement savings. Washington might just roll out the red carpet for you. With no income tax on your 401(k) withdrawals and Social Security benefits, retirees can stretch their dollars further. If you’re looking for the deets on how Washington can be a tax haven for your golden years, check out the benefits here.(

Well, there you have it—some chucklesome insights into Washington state’s tax rate! Whether it’s the sales tax shuffle or the quirky B&O tax tango, one thing’s for sure: it’s never a dull day when dealing with taxes in the Pacific Northwest. So next time you hear someone grumbling about taxes, just toss a few of these fun facts their way, and watch their eyebrows shoot up in surprise. Who knew tax talk could be such a hoot?

What is Washington state income tax rate?

What is Washington state income tax rate?

Well, here’s some good news for folks in Washington state – there’s no personal income tax to worry about! That’s right, you can cash in that paycheck without the state taking a slice of your hard-earned money for income taxes, and isn’t that a breath of fresh air?

Is Washington a tax friendly state?

Is Washington a tax friendly state?

You bet! While Washington may say a big ‘no thanks’ to personal income tax, it does lean quite heavily on sales taxes, which are higher than a kite compared to many other states. But, hey, for retirees and anyone living off a pension, Washington rolls out the welcome mat by not taxin’ that income, placing it smack-dab in the middle of tax-friendly territory.

What is Washington state sales tax?

What is Washington state sales tax?

Hold onto your wallets, because Washington’s state sales tax is sitting pretty at 6.5%. But remember, local go-getters can tack on additional taxes, so you might end up forking over as much as 10.4% in some areas. Ouch!

What is Seattle’s tax rate?

What is Seattle’s tax rate?

Seattle is reaching for the stars with a combined sales tax rate of a whopping 10.25%. It’s a mix of Washington’s state sales tax at 6.5%, plus the local charges that really up the ante.

How much is 100k after taxes in Washington state?

How much is 100k after taxes in Washington state?

Well, chuckles, the Evergreen State won’t pinch a cent of your income thru state taxes. So that cool $100k is safe from state taxes, but the feds still want their cut. The final take-home pay? It depends on federal tariffs, deductions, and credits you’ve got up your sleeve.

Why Washington state has no income tax?

Why Washington state has no income tax?

Back in the day, Washingtonians simply decided income tax wasn’t their cup of tea, and that mentality sticks like glue. There’s even a state constitution snag that makes implementing a graduated income tax tougher than a two-dollar steak, so most folks are betting it won’t see the light of day.

Is it cheaper to live in California or Washington?

Is it cheaper to live in California or Washington?

Oh, boy, that’s a tough cookie. California’s known for its eye-watering house prices and higher overall cost of living, but Washington isn’t exactly bargain-bin either — especially with those sales taxes. Best to crunch the numbers and consider your lifestyle before making a beeline to either state.

Is it better to live in Oregon or Washington for taxes?

Is it better to live in Oregon or Washington for taxes?

Depends on how you make your dough! Oregon plays the taxing hardball with income, but gives sales taxes the boot. Washington flips the script – no income tax but reaches deep into your pockets at the checkout. Pick your poison or, um, tax preference!

Is Washington a high tax state?

Is Washington a high tax state?

Put it this way, Washington’s not skimping on taxes altogether; it just shifts gears from income tax to one of the highest sales taxes nationwide. And let’s not forget property taxes sit comfortably in the middle of the pack. So, “high tax” might depend on how much you shop ’til you drop or own primo property.

What is not taxed in Washington state?

What is not taxed in Washington state?

Got a hankering for some tax-free goodies? In Washington, groceries generally get a pass – because even tax collectors know you gotta eat – as well as prescription drugs, and hey, most of your personal income is safe from the state’s reach, too.

What is tax exempt in Washington state?

What is tax exempt in Washington state?

Washington may have a hearty sales tax appetite, but it takes a step back when it comes to necessities. You’re off the hook for sales tax on things like most food items, prescriptions, and certain healthcare services. Because sometimes, even taxmen show a little heart!

Which states have no income tax?

Which states have no income tax?

Looking to keep Uncle Sam’s fingers outta your paycheck? There are seven states, including Washington, where you can skip on the income tax dance: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming are waving a ‘no income tax’ banner, and two others, New Hampshire and Tennessee, join the party with no tax on earned wages.

Which state has the lowest taxes?

Which state has the lowest taxes?

States like Alaska and Wyoming usually take the crown for lowest taxes, thanks to no state income tax and their habit of rolling in dough from natural resources. But it’s not just about tax rates; it’s how the states gather their pennies, whether from your income, sales, or property.

Which city has the highest taxes in us?

Which city has the highest taxes in us?

Bridgeport, Connecticut, generally tops the charts like a pop star when it comes to high taxes, with a mega-mix of income, property, and sales taxes that could make your wallet weep. The takeaway? High taxes are often just part of the urban shuffle.

Is sales tax higher in California or Washington?

Is sales tax higher in California or Washington?

Quick math, guys: California’s got a high state sales tax, sure, but Washington usually outdoes it with local rates that could climb higher than a kite on a windy day. Before you go spending that paycheck, know that Washington can offer bigger sticker shocks at the checkout.

What is the tax rate in Washington state in 2023?

What is the tax rate in Washington state in 2023?

In coming to 2023, the Evergreen State is keeping its state sales tax rooted to 6.5%. But don’t forget, local areas can sprinkle their own sales taxes on top, so depending on where you’re at, the total can bloom up to around 10.4%.

How much federal tax should I pay on $75000?

How much federal tax should I pay on $75000?

Looks like this is where Uncle Sam gets a piece of your pie. If you’re raking in $75k a year, the federal tax bill depends on a whole jigsaw puzzle of factors like your deductions, filing status, and other yawn-inducing tax talk. Time to huddle with a tax calculator or a savvy accountant!

At what age do you stop paying property taxes in Washington state?

At what age do you stop paying property taxes in Washington state?

Hold your horses, because in Washington, there’s no magical age where property taxes hit the road. But if you’re 61 or older (or disabled), you might wave goodbye to some of those taxes thanks to exemptions based on income levels. Who said getting older didn’t have perks?

How much federal income tax do I pay on $200000?

How much federal income tax do I pay on $200000?

Alright, if you’re hauling in a cool $200k, the feds will want to chat. Your slice of federal tax depends on a mishmash of things—filing status, deductions, credits—it ain’t just about the price tag. Best bet? Get cozy with a tax pro who can help you sort your dimes.