Wondering what typically high inflation is a sign of a healthy economy? Welcome to a world where typically, high inflation is a sign of robust economic conditions. Confused? Well, that’s perfectly alright. Just think of it like a movie that’s yet to come in cinemas. But once it’s here, the plot unfolds rapidly.

Understanding the ‘Typically High Inflation is a Sign of’ Concept

Let’s kick things off by unraveling this seemingly complex concept of high inflation. Think of inflation as the rate at which the general level of prices for goods and services is rising.

Now, when this inflation is consistently high, it’s usually because of increasing costs of raw materials or labor. Think of it as an episode of the nanny cast, where the expenses to meet basic needs keep rising!

Unpacking the Myths: What Does High Inflation Indicate?

Despite common misconceptions, high inflation often mirrors the rise in aggregate demand due to a healthy economy. More demand, more value! So, typically, high inflation is a sign of increased output. Surprise, surprise!

Recognizing the Indicators of High Inflation

You’ll see indicators of high inflation pulsating through the economy like a heartbeat. From increased interest rates, a fall in purchasing power, a decrease in fixed rate bank loans, to even falling production. The signs are all around us, if we know where to look.

The Main Cause of Inflation: Behind the Scenes

Let’s delve into the backstage mechanics of inflation. Often, it’s an increase in the costs of raw materials and labor sparking this off. Other times, it’s a result of high wage demands due to expected inflation or perhaps even loose fiscal and monetary policies. Inflation is a multifaceted beast that needs careful tracking.

High Inflation Indicating a Struggling Economy: The Uncommon Phenomenon

Now comes the plot twist. Remember the 1970s when high inflation was due to a decrease in aggregate supply, presenting a struggling economy? It was like a choppy sea, creating significant cost and consequences on the economy.

Exploring the Other Side of the Coin: ‘Typically, Low Inflation is a Sign of’

A small amount of inflation, on the other hand, can rev up the engine room of economic growth. The Federal Reserve even targets a 2% inflation rate, in fear of the negative effects of deflation. After all, too much of anything can be harmful, even inflation.

Is High Inflation a Sign of a Bad Economy? The Impact of Inflation

Here’s the harsh reality. High inflation often bruises the economy by reducing purchasing power and real income. It’s like taking a pay cut without any prior notice. The distortion of purchasing power for recipients and payers of fixed interests is acute.

But we are far from doomed! Curious if and will inflation go down? Let’s dive into inflation checks.

How Do You Know When Inflation is High? Inflation Checks explained

Inflation checks, my friends, are like your trusted guard dog. They warn you when inflation is high and help you plan and adapt accordingly.

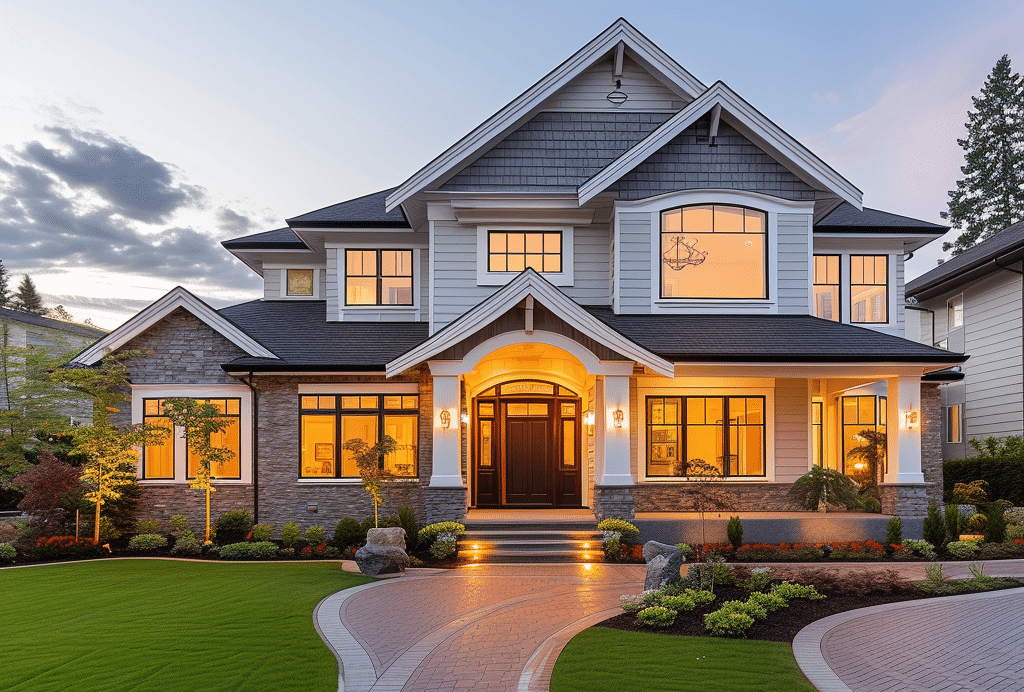

High Inflation: Sign of 5 Shocking Real Estate Upswings

Are you ready for the grand reveal? High inflation has been historically linked to an increase in property values, a shift towards purchase of properties as inflation hedges, and unexpected rental rates increment. Additionally, it has led to a boom in real estate investment trusts as well as a surge in home construction costs.

Wrapping It Up: Demystifying the ‘Typically, High Inflation is a Sign of’ Concept and its Impact on Real Estate

There you have it, folks! The big picture of high inflation and its surprising sway over real estate. Despite all its challenges, remember that periods of high inflation are part of an economic cycle and it’s not all doom and gloom. It’s all about seeing the hidden opportunity beneath the chaos!

While the ride can be bumpy, understanding the concept of inflation and preparing for it can help you sail smoothly. Embrace the waves of change, my friends, and remember: Knowledge is power, especially in the realm of real estate and mortgages. Until our next adventure!