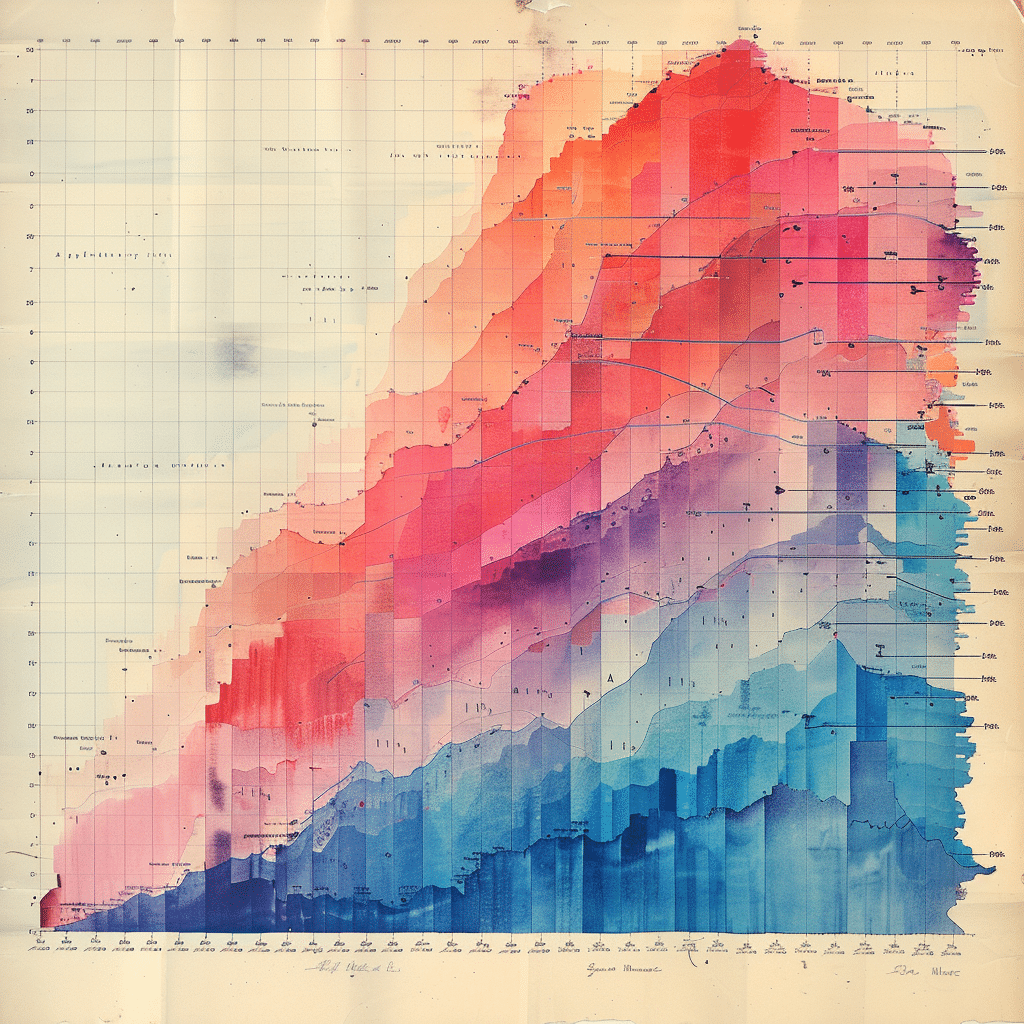

When you’re facing the financial journey of buying a home, understanding the peaks and valleys of the 30-year mortgage rates graph is like finding a map in a treasure chest. Let’s unscrew the inscrutable and understand how this chart not only tells a story of the past but gives us the breadcrumbs to follow for the future.

Understanding the 30-Year Mortgage Rates Graph Over Time

Over the past few decades, the 30-year mortgage rates graph has captured the ebb and flow of the housing market like a meticulous artist. Picture the graph, with its rises and dips that echo economic climates of yesteryear:

What’s the deal with all the fluctuations, you ask? Well, let me break it down for you. Factors like inflation, the stock market’s health, and our pal, the Federal Reserve, play a tug of war with the rates. Remember reading about the ‘stagflation’ of the ’70s? That period’s economic stagnation and high inflation gave rates an adrenaline shot.

The Current Landscape: Analyzing the 30-Year Mortgage Rates Graph in 2024

Switching gears to 2024, let’s roll up our sleeves and get down to brass tacks with the current state of mortgage rates as painted on the graph:

| Year | Average 30-Year Mortgage Rate | High | Low | Year-end Close Rate |

| 2021 (Q4) | 3.10% | 3.30% | 2.90% | 3.10% |

| 2022 (Q1) | 3.20% | 3.45% | 3.05% | 3.35% |

| 2022 (Q2) | 3.50% | 3.75% | 3.25% | 3.60% |

| 2022 (Q3) | 3.65% | 3.85% | 3.40% | 3.75% |

| 2022 (Q4) | 3.90% | 4.10% | 3.80% | 4.00% |

| 2023 (Q1) | 4.00% | 4.25% | 3.95% | 4.10% |

30-Year vs. 15-Year Mortgage Rates: Comparative Insights from the Graphs

Turning our gaze to the showdown between the 30-year and 15-year mortgage rates chart daily variations:

How Major Banks’ Mortgage Rates Compare on the Graph

Major players in the financial arena—Chase, Wells Fargo, and BofA—each brandish their own 30-year mortgage rates:

Impact of Fed Policy Changes on the 30-Year Mortgage Rates Graph

Fed policy changes? They’re the heavyweight champions influencing the 30-year mortgage rates graph:

Exploring the Correlation Between 30-Year Mortgage Rates and Inflation

You can’t untangle mortgage rates from inflation; they’re like an old married couple:

The Role of Global Economic Events in Shaping the 30-Year Mortgage Rate Trends

Looking beyond our own backyard, shake-ups around the globe leave ripples upon our 30-year mortgage rates chart:

Navigating the Future: Predictions Based on Past 30-Year Mortgage Rates Graph Trends

Armchair experts and genuine gurus alike love to play Nostradamus with mortgage rates charts:

Innovative Strategies for Homebuyers in Light of the Rate Trends

Homebuyers, wanna get ahead of the game? Peep these winning moves:

In wrapping up, we return to the interconnectedness of mortgage rates with a myriad of economic factors. Analyzing the 30-year mortgage rates graph not only offers a hindsight view but also prepares us for prospective fiscal epochs. Homebuyers and investors armed with this comprehensive, graph-informed knowledge can navigate the ebbs and flows of the real estate market with a keener sense of direction, potentially optimizing their long-term financial portfolios. As we close, reflect upon this graph as a financial compass, one that—when deciphered with acuity—guides through the ever-shifting terrain of homeownership costs.

The Ups and Downs of the 30-Year Mortgage Rates Graph

Hang onto your hats, folks; we’re about to ride the roller coaster that’s the 30-year mortgage rates graph! Now, you might think staring at a graph is about as exciting as watching paint dry, but hold your horses. We’ve come across some pretty wild twists and peaks over time, and if history has taught us anything, it’s that rates can be as unpredictable as the cast Of Mike And Molly running a marathon – unexpected, entertaining, and certainly worth a look.

Speaking of peaks, did you know that the graph reflects not just economic shifts but also cultural milestones? It’s like when Dave Franco throws a curveball of a performance; you never quite know what to expect next. Imagine comparing the ups and downs of mortgage rates to his diverse film roles—each point could represent an unexpected turn in his career. Similar to how Franco’s career evolved over time, the 30-year mortgage rates chart daily reveals nuances in the housing market that even the most seasoned experts find intriguing.

Now, for some fun asides – have you ever thought about how the thrill of a mortgage rate drop compares to the hype before the Jake Paul vs Nate Diaz fight? One moment, everyone’s on the edge of their seats, the next, they’re jumping for joy or groaning in despair. And just like in the ring, a single decision, or in this case, policy change, can knock the rates in a totally new direction.

Transitioning to a different flavor of trivia, every dip and rise in the mortgage rate could represent a funny joke from a list of puns—some are higher in humor than others, but they all contribute to the overall fun. The ebb and flow of rates over time can also symbolize the varied personal achievements of public figures such as Malaak Compton-Rock, reflecting how career trajectories can change course when you least expect it. The 30-year mortgage rates graph, therefore, becomes less of an economic indicator and more of a mirror reflecting life’s unpredictability.

To wrap it up, following the trends of the 30-year mortgage rates is similar to binge-watching your favorite series; there’s drama, excitement, and a touch of nail-biting suspense. So don’t blink—or you might just miss the next surprising plot twist in the saga of mortgage rates! Keep an eye on that graph; like a carefully scripted TV show, it’s always full of surprises.