Navigating the labyrinth of loan management can feel like an uphill struggle, but it’s the guiding light of experts like RightPath Servicing that can illuminate the path forward. A distinguished player on the mortgage field, RightPath Servicing, a segment under the Nationstar Mortgage / Mr. Cooper umbrella, has been simplifying the complexities of loan servicing and administration.

With a dedication to excellence and a unique flair for innovation in loan management, RightPath Servicing isn’t your run-of-the-mill financial institution; it is a name synonymous with reliability and trust. The organization understands that when it comes to the question of home loans or refinancing options, the stakes are as high as the skyscrapers that line our cityscapes. Let’s delve into what sets RightPath Servicing apart and how it has cemented its reputation as a beacon for borrowers.

Exploring the Excellence of RightPath Servicing in Loan Management

RightPath Servicing isn’t just in the business of managing loans—it’s in the business of forging futures and fostering dreams. As part of the bigger picture alongside Mr. Cooper, it is all about throwing the traditional, sometimes impersonal, loan servicing methods out the window and bringing on board a more tailored experience for the customers.

Unique methodologies that set RightPath Servicing apart in loan management

What’s the secret sauce, you ask? Here’s the lowdown:

Their innovative methods haven’t just raised the bar; they’ve launched it into stratosphere.

The Pillars of RightPath Servicing’s Reputation as a Top Loan Expert

To be a top dog in the world of loan servicing, you’ve got to have a few aces up your sleeve. RightPath’s aces? Service, technology, and acute financial know-how.

In-depth understanding of RightPath Servicing’s customer service approach

Their approach to customer service isn’t rocket science—it’s all heart. They listen, they understand, and then they get cracking on the best route for each individual.

Analysis of the technology and tools employed by Rightpath Servicing

Technology? Think cutting edge. Everything’s designed to make the ride smoother, from the loan depot Login to managing those monthly payments.

Key financial expertise and loan optimization strategies of Rightpath

Heart meets smarts with financial strategies that turn mountains of doubts into molehills. If you thought recast mortgage was a spell from a fantasy novel, Rightpath’s experts will turn you into a believer.

| Feature | Details |

|---|---|

| Name of Servicing Organization | RightPath Servicing |

| Parent Company | Nationstar Mortgage LLC, doing business as Mr. Cooper |

| Ownership Relation | RightPath Servicing and Mr. Cooper are owned by the same entity |

| Services Offered | Loan servicing after funds disbursement, which includes payment processing, account management, customer service, escrow account management, collection of missed payments, and handling loan payoffs. |

| Servicing Fee | Typically an annual rate of 0.25% to 0.5% of the remaining mortgage balance, paid monthly |

| Relationship to Origination | RightPath Servicing takes over post-disbursal of funds, distinct from the mortgage origination process undertaken by lenders and originators. |

| Mortgage Servicing Rights (MSR) | RightPath may acquire MSRs, representing the right to service mortgages from the original lenders. |

| Compensation for Origination | Not directly involved in origination; compensation is through the servicing fee for ongoing loan management. |

| Date of Ownership Announcement | September 19, 2022 |

| Key Functions of Loan Servicing | Payment collection, loan administration, escrow management, customer service, default management. |

| Enhancement of Customer Experience | Not explicitly stated, but typically focuses on efficient loan management and responsive customer service. |

| Regulatory Compliance | Ensures adherence to federal, state, and local regulations regarding mortgage servicing. |

| Impact on Borrowers | Aims to provide seamless management of mortgage loans post-origination, potentially impacting the borrower’s experience positively through streamlined loan servicing. |

RightPath Servicing and Client Relationships: Beyond the Transaction

This industry juggernaut is about more than just numbers. They know that money talks, sure, but it’s the personal connection that sings.

Detailed exploration of RightPath Servicing’s approach to building lasting client relationships

It’s like finding a new best friend. They’re in it for the long haul, through thick and thin.

Case studies of RightPath Servicing’s success stories with client engagement

When folks start waxing lyrical about their experience with RightPath Servicing, you know something’s up. It’s success stories galore, each as heartwarming as an Oscar-winning tearjerker.

The role of trust in RightPath Servicing’s client interactions

Trust is not just a five-letter word here—it’s the foundation of every relationship. And it’s solid as a rock.

RightPath Servicing’s Innovations in Loan Servicing and Administration

Innovation isn’t just a buzzword as is Sacred pepper; it’s the map that RightPath follows to uncharted success.

Examination of the latest innovations introduced by RightPath Servicing

Constantly pushing boundaries, they’ve embraced tech and trends that are reshaping the loan landscape one pixel at a time.

How Rightpath’s innovative practices have shaped the loan servicing industry

Call them trailblazers or pioneers; either way, RightPath Servicing has left its indelible mark on the industry.

Data-driven look at the efficiency improvements due to RightPath’s innovations

When numbers talk, they sing praises of efficiency. After all, in this era of data, that’s what seals the deal.

The Educational Role of Rightpath Servicing in Empowering Borrowers

RightPath Servicing arms its borrowers not just with loans, but with knowledge. Because knowing is owning.

Insight into RightPath Servicing’s educational resources for borrowers

With resources that shine a light on the sometimes dim corners of the financial world, clients are never left in the dark.

Analysis of how RightPath Servicing’s education initiatives contribute to borrower success

Every borrower walks away with a nugget of wisdom that could be the very thing tipping the scales in their favor.

Comparing RightPath’s measures against industry benchmarks for financial literacy

Stack them against the rest, and it’s clear: RightPath Servicing’s initiatives are head, shoulders, and tophat above the rest.

Navigating Market Challenges: RightPath’s Approach to Risk Management

Risk is a dancing partner in the mortgage tango, but RightPath Servicing knows all the moves.

Detailed analysis of RightPath Servicing’s risk management strategies

A stitch in time saves nine, and RightPath’s foresight has been saving more than pennies.

An examination of how RightPath Servicing navigates through market volatility

When the market gets rocky, RightPath Servicing is the steady hand at the helm.

Case examples of RightPath’s proactive measures during economic downturns

The proof is in the pudding, or in this case, the stability and strength RightPath Servicing has shown when the going gets tough.

The Future Outlook of RightPath Servicing in the Loan Industry

Peering into the crystal ball, the future for RightPath Servicing is as bright as a supernova.

Discussion on the future trajectory of RightPath Servicing and its services

Buckle up because RightPath Servicing is about to kick it into hyperdrive, and the industry is all eyes.

Predictions on how RightPath Servicing will continue to evolve in the face of changing loan landscapes

Change is the only constant, and RightPath Servicing is poised like a surfer ready to catch the next big wave.

The potential impact of regulatory changes on RightPath Servicing’s operations

Regulations shuffle the cards, but RightPath Servicing has the aces to trump any hand.

Reflecting on the Comprehensive Journey with RightPath Servicing

As we stitch up the seams on this tapestry of insights, it’s clear that the journey with RightPath Servicing is more than just about reaching the destination—it’s about thriving along the way.

Summative reflections on the key points discussed about RightPath Servicing

A mosaic of innovation, service, and smarts, RightPath Servicing stands out as a lodestar in the loan industry.

The importance of choosing a top loan expert in today’s economic climate

In today’s economy, not all heroes wear capes—some come equipped with the best loan management strategies in town.

Final thoughts on how Rightpath Servicing continues to define excellence in loan servicing

RightPath Servicing continues to etch its name in the annals of loan servicing history, not just with ink, but with actions that echo across homeowners’ dreams.

As we look forward to more milestones, remember, when it comes to managing those crucial financial decisions, there’s nothing like having the right expert on your path. This isn’t just any journey—it’s the one aligned with Rightpath Servicing.

Is RightPath servicing the same as Mr Cooper?

Hold up, don’t confuse RightPath servicing with Mr. Cooper! While they both might manage loans, they’re as different as apples and oranges. Mr. Cooper is a big name in the biz, but RightPath might be servicing loans under their own brand or style.

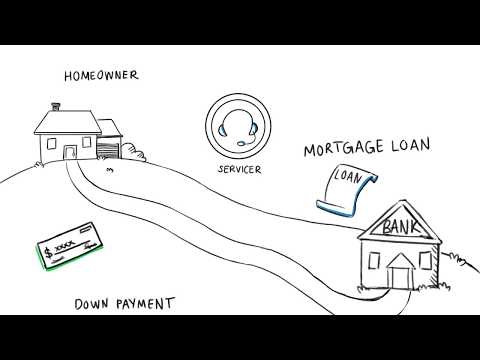

What is the difference between loan origination and loan servicing?

Alright, let’s break it down: loan origination is like the kickoff at your favorite football game – it’s where your loan journey begins, with the lender cooking up your loan. Loan servicing, on the other hand, is like a trusty coach guiding you through the season – they handle the day-to-day management of your loan after it’s been dished out.

How do loan servicers make money?

So, how do loan servicers rake in the cash? It’s pretty straightforward—they get a slice of the pie from your monthly payment. Think of it as a servicing fee for keeping the loan’s gears greased and running smoothly.

What is MSR in mortgage?

MSR in the mortgage world stands for Mortgage Servicing Rights. Just like having dibs on the last slice of pizza, MSR means a company has the right to service a mortgage and get paid for it.

Is RightPath servicing a debt collector?

Nope, RightPath Servicing isn’t necessarily coming after your piggy bank like a debt collector. They’re usually more about managing your loan payments, not chasing down old debts. But, if you’ve missed a beat on your mortgage, they might give you a nudge.

Is Mr. Cooper loan servicing legit?

You betcha, Mr. Cooper loan servicing is legit. They’ve been in the game for a hot minute and they’re a recognized name in handling home loans.

Does a loan servicer own your loan?

Alright, gather ’round: having a loan servicer doesn’t mean they own your loan. They’re just the middleman, making sure everything’s tickety-boo with your payments and paperwork.

Why was my loan transferred to Specialized Loan Servicing?

Ever wondered why your loan got transferred to Specialized Loan Servicing? Sometimes, it’s like a coach trading a player to a new team—it might be a strategic move for better management or a better fit for your loan’s needs.

Can you pick your loan servicer?

Choosing your loan servicer isn’t like picking your favorite ice cream flavor at the store. Usually, your lender decides who gets to manage your loan after it’s made, and you’ve gotta roll with it.

Who pays the loan servicing fee?

Who’s footing the bill for the loan servicing fee? Drumroll, please… it’s you! That fee is typically woven into your monthly mortgage payment.

What is the average servicing fee for a mortgage?

As for the average servicing fee for a mortgage, you’re looking at about 0.25% to 0.5% of the remaining loan balance per year. Not huge, but it adds up like loose change in a jar.

Who is the largest holder of mortgage servicing rights?

When it comes to the kingpin of mortgage servicing rights, Wells Fargo often sits on the throne. They’re a behemoth in the scene, holding tons of these rights.

What are the top mortgage servicing companies?

In the top-tier league of mortgage servicing companies, you’ve got some big players—think Wells Fargo, Chase, and Mr. Cooper going head-to-head for the championship title.

Why do banks sell mortgage servicing rights?

So, why do banks sell those valuable mortgage servicing rights? It’s all about the Benjamins. Banks can cash in now rather than waiting for fees to trickle in, plus it frees up their time and resources to focus on making new loans.

How does loan servicing work?

Loan servicing is like a backstage crew at a concert—they keep the show running from behind the curtains, handling your payments, taxes, and insurance, making sure the financial notes are always in tune.

What is another name for Mr. Cooper mortgage company?

Need another name for Mr. Cooper mortgage? They used to go by Nationstar Mortgage—like an artist changing their stage name, they rebranded to keep things fresh.

Who is Mr. Cooper affiliated with?

Wondering who Mr. Cooper’s pals are? They’re affiliated with big names in financial services, but they fly solo as an independent mortgage servicer and lender.

What is the new name for Mr. Cooper mortgage?

The new moniker for Mr. Cooper mortgage? No new names here—since shaking off the Nationstar Mortgage name, Mr. Cooper has been sticking to it.

Who is Mr. Cooper owned by?

And the grand reveal: Who owns Mr. Cooper? It’s publicly traded, baby, so it’s owned by shareholders who’ve bought a piece of the pie on the stock market. Talk about having a lot of parents!