Navigating the bewildering world of finances can be akin to steering through a labyrinth, but fear not! A beacon of hope shines in the form of repair credit services, designed to guide wayward credit reports back to the promised land of fiscal responsibility. However, like a plot twist in a Hollywood movie, the truth behind these services is not always what it seems. So, let’s buckle up and embark on an eye-opening journey that would make the likes of Suze Orman and Robert Kiyosaki nod in approval.

Navigating the Landscape of Repair Credit Services

You’re Approved! Never Get Turned Down For Credit Again. (Credit Repair Books )

$9.99

Are you tired of the constant rejections every time you apply for credit, leaving you feeling trapped and powerless? “You’re Approved! Never Get Turned Down For Credit Again” is a transformative credit repair guide designed to help you break free from the shackles of poor credit scores. With proven strategies and easy-to-follow steps, this book demystifies the complex credit system, enabling you to understand exactly what lenders look for and how to become an ideal candidate for approval. Whether you’re aiming for a credit card, a loan, or a mortgage, this indispensable resource lays down the blueprint for credit success.

Within the pages of “You’re Approved! Never Get Turned Down For Credit Again,” you will discover the insider secrets to not only repairing your credit but also enhancing it to levels you never thought possible. Our expert authors distill the knowledge gained from years of industry experience into actionable advice that can help you erase negative marks and build a positive credit history. You’ll learn how to negotiate with creditors, remove inaccuracies from your credit reports, and develop financial habits that will keep you on the path to pristine credit.

Tackle the future of your finances with newfound confidence and the powerful knowledge contained in “You’re Approved! Never Get Turned Down For Credit Again.” This book holds the key to unlocking a world where you no longer fear loan applications but instead look forward to the opportunities your excellent credit score will bring. Start turning those denials into approvals and experience the financial freedom you deserve with this essential guide by your side, trailblazing your journey to an impeccable credit score.

The Emergence of Credit Fixers: A Historical Perspective

Once upon a time, the credit fixers were nothing but a blip in the financial realm. The growth of credit fixing companies resembles the classic American dream story—rags to riches, or more aptly, from bad credit to A-credit. Legislative evolution, such as the Fair Credit Reporting Act, cleared the runway for this industry to take off. Key players like Lexington Law and Sky Blue Credit Repair emerged, evolving from small-time operations to grand-scale enterprises, empowering folks to scrub away the financial stains from their credit reports.

Understanding the Intricacies of Credit Fixing Companies

The Strategies and Techniques Used by Professional Credit Fixers

Credit repair experts are like the master jewelers of the financial services world, buffing and polishing your credit report until it shines. They deploy a variety of methods, but the most common tactic is to dispute all negative items, regardless of their accuracy. It’s kind of like throwing spaghetti at the wall and seeing what sticks. And let’s be real, the effectiveness of disputing valid claims is about as promising as the chances of arnold Schwarzenegger young winning another Mr. Olympia title.

The Economic Impact of Credit Repairs Near Me: Local vs. National Services

When we peek at the benefits of “credit repairs near me,” it’s clear that local credit repair services are like the neighborhood superheroes. They understand your local economic environment, making their approach as tailor-fit as a Burt Jenner racing suit. On the other hand, nationwide firms can leverage their larger scale to potentially swing harder punches with credit bureaus, but may lack the personalized touch.

Unveiling the Myriad of Services Offered by Credit Report Repair Services

From Disputes to Debt Negotiation: The A-Z of Credit Report Repair Services

Credit report repair services are like a Swiss Army knife when it comes to rebuilding your financial reputation. Firms such as Experian, Equifax, and TransUnion provide a wide array of services that aim to polish your credit report:

These services directly impact credit scores, potentially leading to that financial freedom you’ve been dreaming of.

The Direct Correlation Between Credit Restoration and Financial Freedom

You know those makeover shows where someone walks in looking drab and walks out looking fabulous? Credit restoration can be similar for your financial health. Success stories abound, with many seeing dramatic score improvements that translate to real-world perks like lower interest rates and better loan terms. The transformation can be as impressive as Sara Ramirez’s career shift from “Grey’s Anatomy” to Broadway and back.

| Attribute | Details |

|---|---|

| Service Name | Repair Credit Service |

| Service Description | A process intended to fix poor credit by disputing and removing inaccurate, negative information from credit reports. |

| Methods Employed | – Disputing negative items, whether accurate or not |

| – Filing disputes with credit bureaus on the client’s behalf | |

| Self-Service Cost | Free (cost of personal time and effort) |

| Professional Service Cost Range | $15 to $150 per month + Initial setup fee |

| Typical Setup Fee | Varies, can often exceed the monthly fee |

| Average Duration | Several months (no guaranteed outcome) |

| Effectiveness | Can’t remove accurate, timely, and verifiable negative marks |

| Alternative Self-Help Tips | – Pay balances on time |

| – Reduce debt | |

| Warning | Many services offer no benefit beyond what individuals can do themselves, and fees can be a waste of money. |

| Recent Price Data | Stewart indicates $15.00 – $150.00 monthly (as of Oct 5, 2023) |

| Last Update | Sep 22, 2023, for effectiveness; Dec 5, 2023, for self-help tip |

Repair Credit Service Vs. Repair Credit Services: What’s in a Name?

Choosing Between Singular and Plural: Who Can Help Me Fix My Credit?

Deciding between going solo with an individual consultant or signing up with a corporate repair service is like choosing between a personal trainer and a gym membership. The individual consultant, like Lexington Law, may offer that one-on-one attention to buff up your credit fitness, while a service like Sky Blue Credit Repair comes with the clout of a reputable organization, even if it means less personalization.

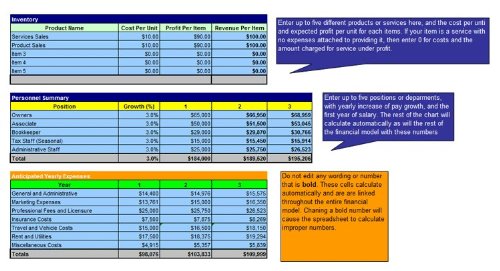

How to Start a Franchised Credit Repair Service Plus Business Plan

$29.95

The “How to Start a Franchised Credit Repair Service Plus Business Plan” package is an invaluable resource for entrepreneurs looking to enter the financial services industry with a focus on credit rehabilitation. Designed with precision for potential business owners, this product not only guides you through the nuances of starting a credit repair franchise but also provides you with a comprehensive, customizable business plan template. The guide covers essential topics such as regulatory compliance, marketing strategies, and operational procedures, all tailored to the unique challenges and opportunities of the credit repair sector. Every section is meticulously crafted to ensure you understand the competitive landscape and are prepared to make informed decisions about your fledgling enterprise.

With a keen emphasis on practicality, the business plan included in this package serves as a roadmap, detailing financial projections, target markets, and growth strategies. It’s structured to help you secure financing by meeting the expectations of lenders and investors who favor clear, strategic, and financially sound business propositions. The plan is easy to adapt to your specific franchise requirements, allowing you to set realistic goals and timelines, as well as to track your progress effectively. It sets the foundation for your operational blueprint, positioning you to build a credit repair service that is both resilient and profitable.

Supporting your journey beyond the startup phase, this product also includes access to ongoing professional advice to navigate the complexities of franchise operations. This continuous support ensures that as the market evolves, your business remains updated with industry best practices, adapting swiftly to legal and market changes. The “How to Start a Franchised Credit Repair Service Plus Business Plan” is more than a document; it’s a dynamic partner in your entrepreneurial venture, designed to offer clarity and confidence as you establish and grow your credit repair franchise. Whether you’re a seasoned entrepreneur or a novice in the world of franchising, this robust business tool unlocks the door to a future of financial success and client satisfaction.

Critically Examining Credit Restoration Success Rates

The True Effectiveness of Credit Restoration: Unveiling Success and Failure Rates

As for success rates, well, they’re about as predictable as guessing the next plot twist in an episode of your favorite show with an Hbo max student discount. The industry’s best keep mum, but here’s the bottom line: credit restoration firms cannot perform magic on accurate, timely, and verifiable negative marks. However, they sure can optimise your chances when inaccuracies are dragging your score down.

The Significance of Credit Repair Services in Modern Society

How Repair Credit Service Shapes Consumer Creditworthiness

Credit repair has become as essential as the morning cup of coffee for consumer financial health. It holds the keys to unlocking lower interest rates, easier loan approvals, and, dare we say, a less stressful financial horizon. Experts weigh in, declaring credit repair a vital cog in the economy’s wheel, helping consumers recover and spend confidently again.

Ethical Considerations and Industry Regulations

Repair Credit Services and the Question of Ethics

The credit repair sandbox is governed by rules to prevent the cats from running amok. The Credit Repair Organizations Act (CROA) sets the bar, ensuring companies play nice and don’t promise the moon when they can only deliver a balloon ride. Ethical practices are paramount, and while the allure of a quick fix is like candy for the financially desperate, reputable companies provide transparency and realistic expectations.

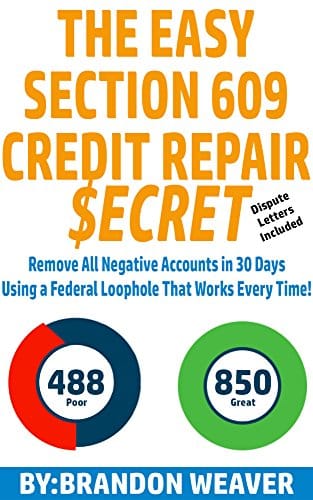

The Easy Section Credit Repair Secret Remove All Negative Accounts In Days Using A Federal Law Loophole That Works Every Time

$9.99

“The Easy Section Credit Repair Secret” is a ground-breaking digital guide that promises to revolutionize the way individuals approach their credit history. Within its pages lies a detailed, step-by-step method leveraging a little-known federal law loophole that purportedly allows users to remove negative accounts from their credit reports in a matter of days. This product is designed for those who are struggling with poor credit scores due to past financial missteps, offering a beacon of hope for faster credit recovery. With its bold claim of a ‘secret’ that works every time, the guide positions itself as an essential tool for anyone looking to improve their financial standing quickly and effectively.

Developed by financial experts well-versed in credit legislation, “The Easy Section Credit Repair Secret” sheds light on the intricacies of credit reporting and the laws that govern it. It empowers consumers by educating them on their rights under the Fair Credit Reporting Act and how to exercise those rights to their full advantage. This program not only aims to help remove negative items from credit reports but also to provide a deep understanding of the credit system, enabling users to maintain and protect their credit scores in the future. This comprehensive approach ensures that anyone can take control of their financial destiny, irrespective of their current credit situation.

The guide boasts a user-friendly format, ensuring it is accessible to people of all backgrounds and education levels. Customers of “The Easy Section Credit Repair Secret” are provided with templates, sample letters, and a step-by-step plan to communicate effectively with credit bureaus and creditors. These tools are designed to be easy to use and are tailored to fit the individual needs of each user. Furthermore, the product comes with the promise of fast results, enticing potential customers with the prospect of seeing significant improvements in their credit reports in a remarkably short time frame.

Conclusion: The Revelatory Landscape of Credit Repair

There you have it—credit repair laid bare. While there’s a silver lining in the cloud of bad credit, it’s clear that the industry sways between the truly helpful and the potentially wasteful. It’s not all roses, but for some, repair credit services sow the seeds of financial renewal.

As for the future, technology and regulation will likely intertwine, weaving a tighter net around this industry. For now, if you’re beating the war drums against bad credit, remember that knowledge is power. Equip yourself with the right strategies for rebuilding credit, consult the wizards if needed, but keep your eyes wide open all the way.

So there it goes, folks—prepare your credit score for a facelift, and remember, whether you choose to go DIY or hire the pros, your financial well-being remains, as always, in your hands. Now, go forth, and may your credit scores soar as high as your dreams!

The Inside Scoop on Repair Credit Service

Fixing the Score: It’s Not Just a Myth!

So, you’ve heard rumors that credit scores are as tough to tackle as an overcooked steak on a cheap dinner date. But hold your horses! The truth is, understanding How To fix Your credit score can be as straightforward as piecing together a jigsaw puzzle—it just takes the right pieces. I mean, you wouldn’t believe how much your score could jump with a few savvy moves. Imagine going from a not-so-great score to one that gets lenders lining up at your door!

When the Stars Align: Credit Improvement and Hollywood?

Now, what if I told you that even Hollywood stars, like the iconic Ally Sheedy, have their financial advisers on speed dial? Okay, maybe that’s not front-page news, but it’s a juicy reminder that we all start somewhere, and even those who’ve graced the silver screen aren’t immune to a financial hiccup or two. It makes you wonder if any of them ever needed a “repair credit service” to give their finances a blockbuster overhaul. If it’s good enough for the stars, it’s certainly a script worth considering for your own fiscal feature!

The Plot Twist in Your Financial Saga

Just when you thought your credit tale was headed for a cliffhanger, enter “repair credit service” – the twist in the story you didn’t see coming. It’s like those unexpected turns in Sara Ramirez’s movies and TV shows that leave you glued to your seat. But instead of just providing an hour or two of entertainment, this plot twist can have a life-changing effect on your wallet. You can go from on-the-edge-of-your-seat tension to smooth sailing with a credit score that finally reflects your true financial narrative.

Breaking the Ice With Your Credit

Let’s chat for a sec. Talking about credit can be as awkward as bringing up politics at a family BBQ. But, you know what? It’s gotta be done. Repair credit services are like that cool cousin who knows how to break the ice and make everyone laugh. They waltz in and work their magic, turning those icy credit scores into something a bit warmer and friendlier. And who doesn’t love a little more warmth, right?

Don’t Bet the Farm…Or Maybe Do?

Alright, let’s wrap this up with a little daydream. Ever thought about betting the farm on a sure thing? Well, buckle up, because using a repair credit service could be the closest thing to a winning wager. Imagine the thrill as you watch those negatives disappear and your score climb faster than a squirrel up a tree!

So there you have it, folks! Five shocking, delightful tidbits about repair credit services that could make you rethink your whole financial game plan. Who knew credit could be so enthralling? Now if you’ll excuse me, I gotta go check my score – this whole chat has got me amped to get mine into shape!

Credit Repair Services Business Book Secrets to Start up, Finance, Market, How to Fix Credit & Make Massive Money Right Now!

$10.97

“Credit Repair Services Business Book Secrets to Start up, Finance, Market, How to Fix Credit & Make Massive Money Right Now!” is an indispensable guide for anyone looking to dive into the profitable world of credit repair. This comprehensive resource is packed with expert advice on how to successfully launch and finance a credit repair business. From insightful market analysis to practical strategies for attracting clients, this book provides a detailed roadmap to help you establish a strong foundation for your venture. Step by step, it breaks down complex financial concepts into understandable sections, ensuring you have the confidence to navigate the credit repair industry.

Within the pages of this informative book, readers will discover an array of secrets that can lead to considerable income in the credit repair sector. The author delves into cutting-edge marketing techniques tailored specifically for credit repair services, enabling entrepreneurs to reach their target audience effectively and turn leads into loyal customers. Additionally, readers will learn valuable methods for fixing credit, which are not only essential for helping clients but also crucial for maintaining the credibility and success of their own business. The book promises to equip readers with actionable strategies to make money right now, positioning them to take advantage of the growing demand for credit repair services.

Moreover, “Credit Repair Services Business Book Secrets” does more than just outline the operational aspects; it inspires with real-life success stories and case studies that illustrate the massive earning potential within this niche market. Aspiring business owners will appreciate the frank discussion on common pitfalls and how to avoid them, optimizing their chances for success. The author’s commitment to helping readers make substantial profits is evident throughout the book as it emphasizes the importance of customer satisfaction and long-term business planning. This is not just a how-to guideit’s a comprehensive mentorship in book format, promising financial freedom for those ready to commit to the journey of credit repair entrepreneurship.

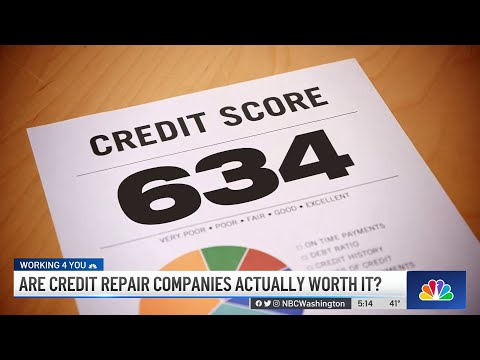

Is it worth paying someone to fix your credit?

Well, shelling out cash to fix your credit can be a smart move, especially if you’re scratching your head over the complex web of credit reports. Hiring a pro can not only save you a heap of stress but might also speed things up!

What is the best credit repair service?

When it comes to the crème de la crème of credit repair, look no further than Sky Blue Credit Repair or Credit Saint. They’ve nailed it with top-notch customer feedback and an impressive track record. Plus, they’re as transparent as grandma’s china!

Can I pay someone to fix my credit score?

Sure, you can pay someone to give your credit score a face-lift. It’s like hiring a personal trainer for your finances—they do the heavy lifting, while you eventually flex that higher credit score.

How much does it cost to repair your credit?

Fixing your credit doesn’t have to cost an arm and a leg – it’s not like buying a yacht! Expect to dish out anywhere from a few bucks to the mid-hundreds, depending on how tangled your credit web is.

What is pay to wipe your credit history?

Ah, pay to wipe your credit history, eh? Sounds like waving a magic wand, but hold your horses—it’s not really a thing. Legit errors can be scrubbed clean, but accurate blemishes? They’re stickier than gum on a shoe.

How do you fix badly damaged credit?

To fix badly damaged credit, you’ve gotta roll up your sleeves and get down to business. Start by catching up on overdue bills, trimming spending, and using a secured credit card responsibly. It’s a marathon, not a sprint!

What is the 609 loophole?

The 609 loophole is the financial world’s Loch Ness Monster—lots of buzz, but hard to find. It refers to a section of the Fair Credit Reporting Act that gives you the right to ask for verification of debts. It’s not a fix-all, but it can help clean up errors.

How to raise your credit score 200 points in 30 days?

Raising your credit score by 200 points in 30 days is like trying to climb Everest in shorts—it’s a stretch. Still, quick wins like paying down debt and disputing errors can pump up your score more modestly.

How do I clear my bad credit history?

Wiping the slate clean for your bad credit history isn’t a simple magic trick, but you can get the ball rolling by disputing errors and showing lenders you’ve turned over a new leaf by paying bills on time, every time.

Is National debt Relief legit?

National Debt Relief? Yup, they’re as legit as a librarian in glasses. They’ve got strong reviews and a track record of helping folks negotiate their debts down. Just make sure it’s the right fit for you!

Can I fix my credit score by myself?

Flying solo to fix your credit score? Absolutely! Start with pulling up your credit report, disputing any oopsies, and tightening up your budget belt. Just remember, patience is a virtue here.

How long does it take to repair bad credit?

Repairing bad credit is a bit like losing weight after the holidays—it takes time and effort. You’re usually looking at months, or maybe even a year or more, if your credit’s really taken a hit.

What is the fastest way to repair your credit?

For the fastest credit repair, get laser-focused: dispute credit report errors, whittle down high credit card balances, and keep those bill payments as punctual as a Swiss train.

How long does it take to repair a 400 credit score?

Starting from 400, eh? That’s a tough one, not gonna lie. But with some elbow grease and smart financial moves, you can see improvement in about 6 to 12 months. Remember, no pain, no gain!

Is credit repair hard?

Credit repair hard? Well, it ain’t exactly a walk in the park. But with focus, determination, and the right moves, it’s more DIY-friendly than you might think.

What is the fastest way to repair your credit?

Ah, back to the fast lane, are we? For quick credit repair, pinpoint the low-hanging fruit like paying down debt and zapping errors on your report. Think of it as a financial sprint.

Does 609 credit repair really work?

The 609 credit repair? Well, it’s like expecting a miracle cure — it works if there are mistakes to challenge, but don’t expect it to delete legit negative marks from your report.

What is the most reliable credit agency?

For the gold standard in credit agencies, folks often turn to FICO and its main competitor, VantageScore. They’re like the Beyoncé and Taylor Swift of credit scoring.

How fast can a credit repair company fix your credit?

As for the pace at which a credit repair company can jazz up your credit, think of them as a pit crew in racing. They’re quick—with the right tools and knowledge, they can help speed things up in about 3 to 6 months. No magic, just know-how!