Navigating the intricacies of a real estate transaction in 2024 can be akin to charting unknown waters. With the swipe of a pen, dreams can transform into reality, or sometimes, into waking nightmares. At the very heart of this complex voyage is the real estate purchase agreement—a document more binding than the legendary Gordian knot. Mortgagerater.com presents an insightful expedition through its unyielding threads, guiding you to seal the deal with confidence.

Navigating the Intricacies of the Purchase Agreement in Real Estate Transactions

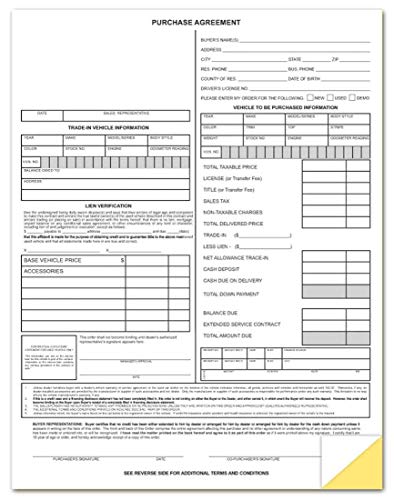

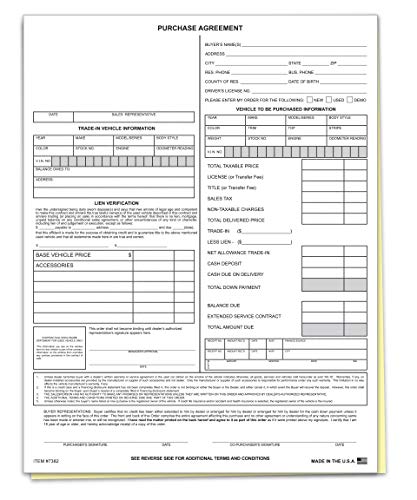

Vehicle Purchase Agreement Forms (Part) (per Pack)

$25.68

Vehicle Purchase Agreement Forms are an indispensable tool for both car dealerships and private sellers engaging in the sale or purchase of vehicles. Each pack contains multiple sets of professionally drafted documents designed to ensure all parties understand the terms of the vehicle transaction. The forms detail the vehicle’s make, model, VIN, warranty information, and any additional disclosures required to comply with local and state regulations. Moreover, these forms are updated regularly to ensure compliance with the latest legal requirements, providing peace of mind for buyers and sellers alike.

Crafted from high-quality paper, the forms are designed to be durable and easy to fill out, with clear sections for signatures and initials to cement the agreement. The forms come pre-packaged with step-by-step instructions, simplifying the process of completing each section accurately. Their intuitive layout means that even those with no legal background can navigate the complexities of vehicle transactions with confidence. Additionally, the pack format ensures you always have necessary forms on hand, making them a convenient resource for high-volume sellers and frequent buyers.

Investing in Vehicle Purchase Agreement Forms can help avoid potential legal disputes by clearly outlining the obligations and expectations of each party involved in a vehicle sale. These forms serve as a binding agreement, providing a comprehensive record of the sale which can be used as evidence should any disagreements arise post-purchase. Using these forms also demonstrates professionalism, boosting consumer trust and helping to build a reputable business presence or ensure a smooth private sale. The “per pack” offering allows for the purchase of quantities tailored to individual needs, from small-scale private sales to larger dealership operations.

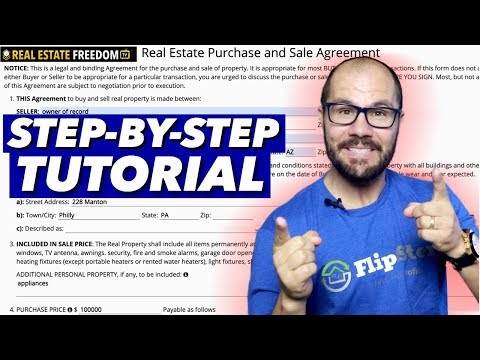

Explaining the Real Estate Purchase Agreement and Its Importance

Imagine a purchase agreement as the backstage pass to your future home—it gets you through the door, but you’ve got to know the terms by heart. This isn’t the Rockstar sign in kind of deal where the crowd parts; it’s the foundation of your investment, the script of your real estate drama.

The real estate purchase agreement, in these mercurial market conditions of 2024, is your talisman against the unpredictable. It outlines every beat—from price to property condition, right down to the exact date you’ll play house. With the market being as finicky as a monster by Nicki minaj Lyrics, the terms within these agreements are now more scrutinized than ever. Just like the dynamics in “Cloudy with a Chance of Meatballs Cast, each element of the agreement has its critical role, and given the past years’ fluctuating interest rates and inventory, buyers and sellers are advised to know their part down pat.

| Feature | Description |

| Parties Involved | Buyer(s) and Seller(s) involved in the real estate transaction. |

| Property Identification | Legal description of the property, including address, parcel number, and sometimes a legal description. |

| Purchase Price | Agreed-upon amount for the property. Payment terms may also be included (e.g., down payment, financing details). |

| Earnest Money Deposit | A deposit made by the buyer as a show of good faith, typically held in an escrow account. |

| Financing Contingencies | Clauses that outline the buyer’s obligation to obtain financing and the consequences if they cannot secure it. |

| Inspection Contingencies | Allowances for the buyer to conduct home inspections and negotiate repairs or adjustments to the purchase price. |

| Closing and Possession Dates | Dates specifying when the closing will occur and when the buyer will take possession of the property. |

| Seller Assist | Details of any closing cost assistance to be provided by the seller to the buyer. |

| Property Condition | A clause that states the property’s condition and any warranties or representations made by the seller. |

| Included Items | Fixtures or personal property included in the sale (e.g., appliances, lighting fixtures). |

| Title and Survey | Requirements for a clear title and updated property survey to be provided by the seller. |

| Government Requirements | Stipulations for any required certificates, zoning compliance, or other government-related conditions. |

| Default and Remedies | Consequences for either party failing to meet obligations, including potential forfeit of earnest money deposit. |

| Additional Provisions | Any further conditions or clauses mutually agreed upon by the buyer and seller. |

| Signature and Date | Legal acknowledgment by both parties, confirming agreement to the terms, making the contract binding. |

Understanding the Terms and Conditions of the Purchase Agreement

To wrap your head around the purchase agreement is to step into a realm where jargon and legal fine print mingle. This is more than dotting I’s and crossing T’s; it’s grasping the breadth of your rights and the depth of your obligations.

As a protective measure, it’s crucial to absorb every word. There were court cases we’ve seen recently where a dangling modifier left someone’s dream home hanging in the balance. When terms are as essential as the best Earplugs for peace in a raucous world, you don’t want to miss a decibel.

Identifying Contingencies in the Real Estate Purchase Agreement

You’ll want to guard your investment with contingencies, the ‘Plan Bs’ of the real estate world. Think of these as the safety net should your tightrope walk encounter a gusty wind. Financing and inspection contingencies remain the bread and butter of 2024 agreements. And boy, do they matter!

Fresh off the press, a survey indicated that savvy buyers who include a financing contingency—akin to a conventional home loan as their trusty financial steed—fare better in the long run. These are your escape hatches if the money doesn’t arrive, or if the home inspection reveals more horror movie than cozy romcom.

Model Asset Purchase Agreement With Commentary

$280.00

The “Model Asset Purchase Agreement With Commentary” is an essential resource designed to guide legal professionals through the complexities of drafting, negotiating, and finalizing asset purchase agreements. Tailored for attorneys, in-house counsel, and business advisors, this comprehensive manual includes a template agreement supplemented with detailed commentary on each provision. From the initial stages of structuring the deal to the intricacies of due diligence and closing, the document provides practical insights into the strategic concerns and legal challenges that frequently arise in asset transactions.

Each section of the agreement is meticulously annotated, offering clear explanations of the purposes and implications of various clauses, providing the user with an in-depth understanding of the legal mechanisms at play. Practical examples and hypothetical scenarios are interspersed throughout the commentary, illustrating common negotiation points and potential pitfalls to avoid. This invaluable tool also discusses alternative drafting approaches and the potential reactions from the opposing side, enabling practitioners to anticipate responses, streamline negotiations, and effectively protect their clients’ interests.

The “Model Asset Purchase Agreement With Commentary” also keeps the reader well-informed on the latest legal developments, as it includes updates on relevant case law, statutory changes, and evolving market practices. Accompanied by appendices containing checklists, sample provisions, and ancillary documents, the guide ensures that professionals can approach asset purchase deals with confidence. Whether used as a training aid for new associates or as a reference for experienced attorneys, this product is an authoritative source for anyone involved in structuring or scrutinizing asset purchase agreements.

Obtaining Financing Confirmation as Part of the Sales Agreement

Between the lines of your purchase agreement, financing confirmation must sit like the cornerstone of a building. Fail to confirm financing, and the structure (read: your deal) could crumble spectacularly.

In the dizzying pace of 2024, securing mortgage pre-approval is akin to watch The reading of a sprinter; it’s rapid and vital to your home-buying race. What’s enchanting is the techno-revolution reshaping this landscape. Digital wizards are cutting through bureaucratic red tape faster than you can ask,Hey Siri, what’s the difference between Fha And conventional loans? It’s modern-day magic at its finest.

Conducting Due Diligence and Complying with Disclosure Requirements

Due diligence is no snooze fest—it’s the gritty detective work that savvy buyers undertake. Failed to notice that the basement becomes an indoor pool every spring? You didn’t do your homework. Technology now helps to unearth each property’s dirty (or clean) little secrets, transforming the way buyers inspect their potential homes.

Disclosure requirements are that friendly neighbor who tells you your tie’s undone before the big interview. It’s about transparency and dodging those post-sale ‘surprise, surprise’ moments. The 2024 market has seen groundbreaking compliance needs. Neglect these, and the only closing you’ll attend might be of the legal case against you.

Closing the Sale and Finalizing the Real Estate Purchase Agreement

Closing in 2024 is like hitting the apex of a rollercoaster—you’re just a loop-de-loop away from homeownership. This year’s seen innovations that compress the timeline tighter than a well-packed suitcase. With digital signatures zipping through cyberspace, closings now can happen as swiftly as a foodie’s sprint towards a new gourmet burger joint.

But hold your horses—while the market conditions may have shifted the process towards a more streamlined approach, attention to detail is paramount. Skip a step, and that tasty morsel of property might slip right through your grasp.

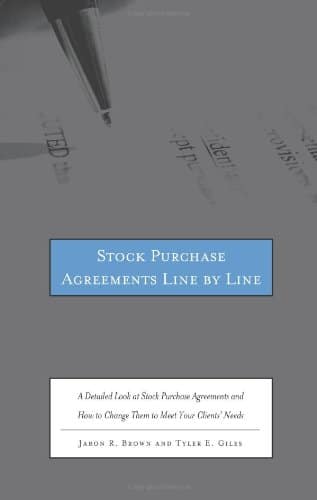

Stock Purchase Agreements Line by Line A Detailed Look at Stock Purchase Agreements and How to Change Them to Meet Your Clients’ Needs

$99.00

“Stock Purchase Agreements Line by Line: A Detailed Look at Stock Purchase Agreements and How to Change Them to Meet Your Clients’ Needs” is an invaluable resource for both novice and experienced attorneys navigating the complexities of stock purchase agreements (SPAs). This comprehensive guide dissects SPAs meticulously, exploring each clause and its legal implications, thereby empowering legal professionals to negotiate and tailor agreements that best serve their clients’ interests. From the preamble to the signature blocks, the book illuminates the nuances of these vital contracts, which are instrumental in the acquisition or sale of company shares, ensuring the reader grasps the significance of every term included.

The authors provide clear, accessible explanations of the legal jargon and technicalities associated with SPAs, ensuring that readers are equipped with the knowledge to draft, review, and negotiate these documents with confidence. The guide also highlights common pitfalls and offers practical tips on how to avoid them, drawing from real-world examples and case studies. Each chapter delves into a different component of the agreement, offering clause-by-clause analyses and suggesting alternative provisions that can be used to better protect the interests of the client.

What sets “Stock Purchase Agreements Line by Line” apart is its focus on adaptability and customization. The text guides the reader through the intricacies of tailoring an SPA to fit a variety of scenarios, taking into account the size of the transaction, the industry of the business, and the specific goals of the buyer and seller. Lawyers and business professionals alike will find that this book is more than just an academic tome; it is a user-friendly toolkit that provides actionable guidance and empowers them to craft documents that are both legally robust and fully aligned with their clients’ aspirations.

Ensuring Legal and Regulatory Compliance Through the Purchase Agreement

The purchase agreement is your shield and buckler in the regulatory battlefield. As the rules of engagement morph with new directives, recall that ignorance wears no armor. The legal landscape in 2024 is a jungle, and this little piece of parchment is both your guide and protector.

Tales from the legal frontline demonstrate this vividly. Remember that couple who mistook legalese for a casual chat? Poor souls. Now they could teach law, given how thoroughly they were schooled by their oversight.

Common Mistakes to Avoid in a Sales Agreement

Good folks have tangled themselves in tricky situations; contracting woes aren’t for the faint of heart. Imagine thinking you’ve scored on discount points on a mortgage only to realize you’ve misunderstood the terms entirely. Nobody wants to be that protagonist who overlooks the fine print and ends up stuck in Act One.

To avoid mishaps, our preventative strategies amplify your preparations as you approach the purchase agreement. After all, who desires to learn via the high cost of hindsight?

The Future of Real Estate Sales Agreements

Flash forward, and what do we glimpse on the horizon? The real estate sales agreement, ever the stalwart document, isn’t immune to evolution. As trends shift and people increasingly yearn for the rock-solid certainties of blockchain and AIs, we sense great change brewing.

We foresee an era where “agreement” translates to seamless, digital algorithms that substantiate and secure the wishes of buyer and seller alike. This future is not only imagined; it is impending.

Conclusion: Sealing the Deal with Confidence

Yes, sailing the seas of a purchase agreement demands a robust compass and an eye on the horizon. With a judicious employment of acumen and informed assertiveness, you will not only navigate but master these waters.

Stay vigilant, for the real estate landscape continues to transform, puzzle-like, before our very eyes. With the right preparation, the knowledge gained, and an eye on emerging technologies, you’ll not only endure but triumph in the dynamic dance of property acquisition.

In the amphitheater of real estate, may your purchase agreement be the script from which you confidently deliver a command performance.

The Ins and Outs of a Purchase Agreement

Hey homebuyers! Buckle up because we’re diving into the nitty-gritty of what makes a purchase agreement tick. Whether you’re a first-timer or a seasoned property swapper, understanding these key steps could mean the difference between a dream home and a not-so-happy ending.

Settling on the Sale Price

Now, don’t get all antsy just yet! Before you can daydream about painting the picket fence, you’ve gotta lock down that sale price in your purchase agreement. It’s like haggling at a yard sale, only with a few more zeros. Remember, the price you agree on isn’t just a number – it can impact everything from your mortgage payments to how much you’ll be ponying up for closing costs. Speaking of which, ever wondered What are discount Points on a mortgage? These little nuggets can save you a bundle on interest over time.

Picking Your Possie

Next up, you’ll want to choose the possession date, which is sorta like calling dibs on when you move in. Balancing your eagerness with the seller’s timeline is crucial. Negotiating a solid possession date makes sure you aren’t left out in the cold, or worse, hot-footing it to find temporary digs.

Inspecting the Inspector

Get this—the purchase agreement should always include a clause about a home inspection. Think of it like a backstage pass—it gives you a sneak peek at what’s behind the scenes, I mean drywall, before the final “show”. A good inspection can reveal showstoppers that might even make the “cloudy with a chance of meatballs cast” do a double-take! Be thorough; it’s no good crying over spilt milk—or a leaky roof—later.

Fine-Tuning Financing

Here’s where stuff gets as detailed as Navarone Garibaldis guitar solos. Your purchase agreement should have a financing contingency clause. This little gem ensures that if your loan falls through faster than a toupee in a hurricane, you’ll get your earnest money back. So, don’t skip the beat; ensure your ducks are in a row and your finances are tighter than a drum.

Dodging Foreclosure Drama

Now, imagine if you’re buying a home that’s whispering “foreclosure.” Scary thought, huh? Don’t fret; being informed is your silver bullet. Find out How To stop foreclosure because, folks, knowledge is power. Your purchase agreement should protect you from the previous owner’s financial boogieman, ensuring no nasty surprises creep up after you’ve signed on the dotted line.

And there you have it, the cliff notes on what makes a purchase agreement fresher than a pillow with a mint on it. Just remember, these key steps are your roadmap to a smooth home-buying journey. So cross your T’s, dot your I’s, and don’t be afraid to get down to brass tacks. Happy house hunting!

Vehicle Purchase Agreement Forms (Part) (per Pack) Auto Dealer Dealership Car Bill of Sale Purchase Agreement

$27.00

The Vehicle Purchase Agreement Forms (Pack) provides an essential document suite for auto dealers and private sellers alike, facilitating a smooth and legally sound transaction process for the sale and purchase of vehicles. Each pack comes with an organized set of forms designed to capture all necessary information clearly, including buyer and seller details, vehicle description, price, and any special terms or conditions of the sale. These professionally crafted documents ensure a comprehensive and binding agreement, safeguarding both parties from future disputes by delineating the rights and responsibilities of each.

Robust and easy to understand, these forms have been formulated to comply with standard vehicle purchase regulations, ensuring they are valid in a variety of jurisdictions. Each pack includes multiple copies of the agreement form, allowing for instant redundancy and record-keeping, thus meeting the requirements of both small and large dealerships. The forms also feature sections for additional services or products purchased with the vehicle (such as warranties or maintenance packages), allowing a dealer to customize the agreement to the specifics of each sale.

Auto Dealer Dealership Car Bill of Sale Purchase Agreement packs are printed on high-quality paper to ensure durability and a professional appearance, bolstering the confidence of buyers in the transaction. They are designed with both clarity and convenience in mind, including prompts and checkboxes for easy completion during the high-paced environment of auto sales. Dealers can easily integrate these forms into their sales process to accelerate the paperwork while simultaneously reassuring the customer with a tangible record of their significant investment. Each pack is an indispensable tool for streamlining the vehicle purchase process and fostering trust and reliability between dealers and their clients.

What is in a purchase agreement?

Well, hold your horses, let’s break it down! A purchase agreement is chock-full of important stuff—it outlines the terms and conditions of a property sale. Think of it as a road map from “For Sale” to “Sold,” including the sale price, closing date, and any contingencies that need sorting before you get the keys.

What is a purchase agreement called?

Call it what you will—purchase agreement, sales contract, or buy-sell agreement—it’s all the same hat with different names. This document is the big cheese when it comes to home buying, a written handshake sealing the deal.

Is a purchase agreement the same as closing?

Nope, a purchase agreement is not the grand finale—that’s closing. Think of it as more of the dress rehearsal. You’ve still gotta dot the i’s and cross the t’s before popping the champagne at the closing table.

What are the three purposes of the purchase contract?

The three musketeers of purchase contracts have got your back: they set the sale price, outline the terms, and light the way for the sale to close. Without them, you’d be all at sea!

Can a seller back out of a purchase agreement?

Yikes, indeed they can! Though a seller’s as bound by the purchase agreement as a kangaroo in a corral, they might have a change of heart and try to hop away. But backing out can be a legal mess, so it’s best not to pull the reins unless absolutely necessary.

What is the purpose of a purchase agreement?

Listen up: the purpose of a purchase agreement is to put the nitty-gritty down in black and white, ensuring everyone’s on the same page about the sale terms. It’s like a pinky promise in legalese.

Who sends the purchase agreement?

It’s usually the buyer’s agent who whips up the purchase agreement and sends it over to the seller. Think of them as the mail carrier of your home-buying dreams!

What happens after a purchase agreement is signed?

After a purchase agreement gets the John Hancock from everyone, it’s off to the races. Inspection dates, mortgage approvals, and appraisal hoops come into play. And boy, don’t forget to keep that pen handy for any additional paperwork!

How binding is a purchase agreement?

As binding as granny’s knitted sweater! Once both parties sign on the dotted line, you’re locked in tighter than a drum, with legal oomph to back it up.

Is a purchase agreement a closing document?

Nah, a purchase agreement isn’t the final act. It’s more like the cue cards; the essential prep work before the grand closing performance where the nitty-gritty gets ironed out.

Do purchase agreements expire?

Tick-tock! Yes, purchase agreements usually have an expiration date, like milk—after which you might be crying over spilled opportunities.

Is there a difference between a purchase agreement and a contract?

While they’re often two peas in a pod, “purchase agreement” might sound fancier. In essence, they both mean “Let’s make a deal,” but we lawyers like to dress things up a bit.

What are the advantages of a purchase agreement?

Playing your cards right with a purchase agreement means peace of mind, a clear plan of attack, and avoiding a Wild West shootout of misunderstandings as the deal goes down.

What are the 3 main requirements for a contract?

Contracts 101 coming at ya: offer and acceptance, mutual consent, and a little something to sweeten the pot—consideration—are the holy trinity of a contract.

What are the three 3 stages of a contract?

Think of contract stages as a three-legged race: there’s the offer leg, the negotiation wobble, and finally, the sprint to the finish sign-off.

What are the basic elements of an offer of purchase and contract?

Alright, the basic fixins for an offer to purchase and contract include the deal’s dough, the who’s who, a description of what you’re snagging, and the timeline to wrap it all up.

What makes a purchase agreement legally binding?

What makes it legit? Oh, just a dash of legal intent, signatures from all the cool cats involved, and enough details to ensure nobody’s left guessing.

What is the difference between a purchase agreement and a purchase contract?

Splitting hairs between “purchase agreement” and “purchase contract”? They’re really just doppelgangers—different words, same dance.

How do you write up a purchase agreement?

Ready to craft a purchase agreement? It’s like baking a cake—follow the recipe. Include a clear offer, buyer and seller details, the property lowdown, price tag, and all the sprinkles like contingencies and closing details. And don’t forget to pre-heat the legal oven with valid signatures!