PMI Calculator: A Crucial Tool for Homebuyers in 2024

Listen up, savvy homebuyers of 2024! The PMI calculator has become as essential as a sturdy roof over your head in the home-buying process. When you’re about to take the plunge into homeownership, wrapping your head around the cost of Private Mortgage Insurance (PMI) is key. You gotta know what you’re getting into, and a PMI calculator helps you do just that – it’s your financial life jacket, so to speak.

But hang on! Hold onto your wallets because, just like when you find out that your quiet weekend escape in Liguria, Italy, actually sits next to a festival hot spot, the reality of PMI might just surprise you. Yes, dear homebuyer, the devil is in the details, and a PMI calculator’s digits could be whispering secrets you need to listen to – very carefully.

Discovering Hidden Truths: The Calculator PMI Industry Would Rather You Not Know

Mortgage Calculator with PMI and Taxes

$0.00

The Mortgage Calculator with PMI and Taxes is an invaluable tool for prospective homebuyers and real estate professionals alike. It provides a comprehensive analysis of monthly mortgage payments, including Principal, Interest, Taxes, Insurance, and Private Mortgage Insurance (PMI) for buyers who are putting down less than 20% of the home’s purchase price. By inputting simple data such as the home price, down payment, term, and interest rate, users can quickly obtain a detailed breakdown of their potential financial commitment. In addition, this calculator adjusts for local property tax rates and insurance costs to give an accurate and personalized monthly payment estimate.

Designed with user-friendliness in mind, the Mortgage Calculator with PMI and Taxes features an intuitive interface that simplifies the complex process of mortgage calculations. Each section of the calculator is clearly labeled, and the user can hover over any question marks for a detailed explanation of what each term means, ensuring that even novice homebuyers can navigate the process with ease. The tool also allows for the adjustment of PMI rates and the choice of different loan types, such as fixed-rate or adjustable-rate mortgages. The calculator is continuously updated with the latest tax and insurance rates, so users can be confident in the accuracy of their results.

In addition to its primary functions, the Mortgage Calculator with PMI and Taxes enhances its utility with additional features such as the ability to create amortization schedules and to compare different scenarios side-by-side. This can be especially useful for those considering refinancing or comparing the long-term costs of different properties. The generated amortization schedules graphically display the balance of principal and interest over the life of the loan. With the foresight provided by the Mortgage Calculator with PMI and Taxes, potential borrowers can make informed decisions and plan for their future financial health with greater confidence.

| **PMI Factor** | **Description** | **Example Calculation** | **Impact on Monthly PMI** |

|---|---|---|---|

| Loan Amount | Total borrowed amount for the mortgage | $475,000 | PMI increases with higher loan amounts |

| PMI Rate | Annual percentage charged for PMI based on LTV ratio and credit score | 0.45% of the loan amount | Higher rates increase PMI payments |

| Monthly PMI Payment Calculation | Formula used by lender to compute PMI payment | ($475,000 * 0.45%) / 12 = $178.13 | Directly determines the PMI payment |

| Credit Score Impact | PMI rate varies based on borrower’s credit score | 1.42% for a 620 credit score with a 95% LTV ratio | Lower credit scores may lead to higher PMI |

| Down Payment | Initial upfront portion of the total purchase price | 5% on a $300,000 home = $15,000 down payment | Less than 20% down payment requires PMI |

| Loan to Value Ratio (LTV) | Ratio of the loan amount to the value of the property | $285,000 loan / $300,000 home value = 95% LTV ratio | Higher LTV leads to higher PMI costs |

| PMI Costs Range | Expected monthly range for PMI payments per $100,000 borrowed | Approximately between $30 and $70 per $100,000 borrowed | General cost gauge for borrowers |

| PMI Termination | Point at which borrower can request removal of PMI | Typically when the LTV ratio reaches 80% | Potential cost savings once PMI is removed |

The Authentic Figure: A Mortgage Insurance Calculator Exposé

Let’s talk reality versus expectations here. Mortgage insurance calculators can give you an ideal birds-eye view of your finances, but it’s not always rainbows and sunshine. The monthly PMI dose calculated might hit differently when you get the real deal—expecting $50/month but getting $178.13 is like biting into a lemon when you expected an orange. Always be ready for that tart kick when you lift the curtain on your PMI calculator’s projections. It’s crisp, it’s clear, it’s not always what you want but what you get.

PMI Mortgage Calculator: A Game-Changer or a Mere Gimmick?

And so, the heated debate simmers: Is the PMI mortgage calculator a revolutionary tool or just smoke and mirrors? Some folks swear by it, saying like creatine for your workout, it revs up your mortgage planning. Others are skeptics, pointing fingers at the algorithms and calling it a broken compass. It’s spicy stuff. By looking into real-life anecdotes, chewing on expert opinions, and dissecting the algorithm’s anatomy, we’ll root out the truth. Is the PMI mortgage calculator worth its weight in gold, or is it as useful as a screen door on a submarine?

Conclusion: The Mortgage Calculus of PMI – Empowerment or Illusion?

Wrapping things up, dear homeowners-to-be, let’s remember: PMI calculators aren’t just nifty gadgets; they’re pillars in the house of mortgage prep. Yet amid all these numbers and percentages, one can’t help but wonder if we’re being enlightened or hoodwinked. The clarity they promise can sometimes throw us off track, a mirage in a desert of data. But no matter what, knowing how to wield this tool, to squeeze truth from numbers, insists that we become shrewd judges of the mortgage world. Whether we’re talking Pmi on Fha loans or exploring the nuances of mortgage life insurance, every detail counts. Remain vigilant, calculators in hand, and the dream of homeownership might just be your reality.

Project Math Tools and Techniques for Project Managers, Agile Coaches and Scrum Masters, Project Sponsors and Business Analysts, Project Management Offices, Team Members, and Engaged Stakeholders

$39.95

Project Math Tools and Techniques for Project Management Professionals is an indispensable resource designed to empower those involved in project execution with the mathematical knowledge and analytical strategies critical for successful project delivery. From Project Managers and Agile Coaches to Scrum Masters and Business Analysts, this comprehensive guide ensures that essential numerical concepts are within reach. This product equips professionals with the ability to perform accurate estimations, budget analyses, and risk assessments – all integral components of robust project plans. Tailored for user-friendliness, it combines clear, step-by-step instructions with practical examples that facilitate immediate application in real-world scenarios.

Thoroughly addressing the needs of diverse roles within project teams, including Project Sponsors and Team Members, it fosters a deeper understanding of the quantitative facets of project management. Project Management Offices (PMOs) will find this tool particularly useful as it harmonizes mathematical techniques with established project management methodologies, promoting the standardization of practices across organizations. The guide fosters collaboration among project stakeholders by providing a common language for discussing and evaluating project performance metrics. It serves as both a reference for initiating and planning stages and as a troubleshooting manual during project execution and control.

Lastly, Project Math Tools and Techniques extends its utility beyond professional cadres, offering a wealth of knowledge to Engaged Stakeholders who have an interest in the inner workings of project progress and success measures. It demystifies complex mathematical concepts, enabling stakeholders to make informed decisions, offer valuable input, and set realistic expectations based on quantitative data analysis. Moreover, the resource supports continuous learning and development within teams, encouraging an analytical mindset that drives efficiency and innovation. It’s an essential tool not just for managing projects, but for cultivating an environment where every team member and stakeholder is empowered with the knowledge to contribute to project excellence.

In the end, as you turn the key to your new front door, you’ll look back at your PMI calculator adventures and think, “Well, now, that was a ride!” And with the power of knowledge, you’ll have transformed the daunting maze of PMI into a clear-cut path to your very own home sweet home.

Mastering the PMI Calculator: Surprises Aplenty!

Hang onto your hats, homeowners and buyers! We’re about to take a jaunt through the wacky world of PMI—Private Mortgage Insurance, for the uninitiated. Saddle up as we unveil some jaw-dropping trivia and facts that’ll have you viewing the humble PMI calculator in a whole new light.

Wait, PMI Is… What Now?

Before you can truly appreciate the curveballs our PMI calculator will throw at you, let’s get on the same page about Pmi meaning. It’s not the latest fad diet or a picturesque Italian region; it’s that sneaky little insurance lenders require when you’re putting down less than 20% on a home. And boy, does it add a twist to your mortgage tale!

“How Much Is PMI Insurance?” and Other Burning Questions

You’re probably wondering, “How much is PMI insurance gonna cost me?” Well, brace yourself. When you crunch the numbers with our PMI calculator, you might find the amounts varying widely, like trying to predict the end of a telenovela! It depends on your loan amount, down payment, and even your credit score—much like a complex recipe for a financial soufflé.

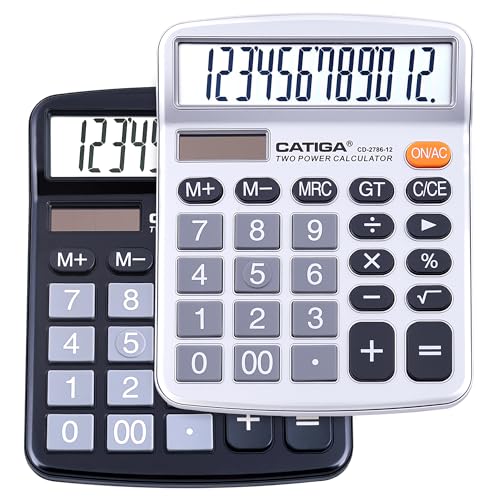

Desktop Calculator (Pack) Digit with Large LCD Display and Sensitive Button, Solar and Battery Dual Power, Standard Function for Office, Home, School, CD (BlackSilver)

$14.99

The Desktop Calculator (Pack) Digit with Large LCD Display features a sleek black-and-silver design that marries sophistication with functionality. Its large LCD screen ensures that digits are clear and easily readable, helping to reduce eye strain during extended periods of use. The sensitive buttons provide a tactile and responsive feel, making calculations fast and efficient. With a layout that includes all the standard functions you need, this calculator is ideal for users in office, home, and school settings.

Equipped with solar and battery dual power options, this Desktop Calculator remains operational in a variety of lighting conditions, ensuring constant readiness when you need it. The solar panel efficiently harnesses natural light during the day while the battery serves as a reliable backup for darker environments or when sunlight is insufficient. This means you can trust your calculator to work anytime and anywhere, without the worry of unexpected power interruptions. The pack offers the added convenience of having multiple units to place in different locations or for backup purposes.

Understanding that different users have different needs, this Desktop Calculator comes with a comprehensive set of standard functions to tackle a wide array of mathematical tasks. Whether you’re calculating simple arithmetic, exploring percentage computations, or dealing with tax-related figures, this calculator has got you covered. Its intuitive design ensures that both students and professionals can navigate complex calculations with ease. Additionally, the pack’s inclusion of several calculators at a value makes it an excellent choice for educational and professional settings where multiple devices are advantageous.

The PMI Calculator: A Jack of All Trades

Now, this is where we spill the beans. The PMI calculator we’ve been gabbing about? It’s not just about PMI. “What?!” you exclaim, your eyebrows hitting the ceiling. That’s right—it’s also a pawn in the larger chess game of insurance premium mortgage calculations. It can give you a sneak peek into your overall monthly payment, not just the PMI slice.

Bridge Loan? In My PMI Calculator?

Bet you didn’t see that one coming! “Bridge loan”, a term cooler than your favorite spy movie, is another financial acrobat our bonkers PMI calculator can work with. If you’re playing a high-stakes game of buying one home before selling another, this calculator can be your covert sidekick, giving you a nifty estimate of what your total costs might look like.

A VA IRRRL, PMI, and a Calculator Walk Into a Bar…

Sounds like the start of a corny joke, right? But here’s the twist: If you’ve got a “VA IRRRL” (that’s a snazzy refinance option for you veterans out there), you might not need PMI at all! Yet, our PMI calculator can still come in handy — just like knowing the full meaning of Google What Is The full meaning Of Google?) can save you from an embarrassing faux pas at a tech conference.

Creatine, Code, and Cinematic Cameos in PMI-land

Hang on tight, ’cause we’re going rogue with a few wild tangents! Have you ever pondered if Does creatine help You lose weight while you’re calculating mortgage insurance? Or maybe you’re coding a Chatgpt code that’ll make future PMI calculators bow down in deference. Whatever your jam, your journey through PMI calculations can be as wild and unpredictable as a late-night browsing session that lands you on Sexo Videos. Remember, focus is key!

So, there you have it—your everyday PMI calculator, exposed as the multifaceted, swaggering tool it truly is. Dive into the deep end with us and explore the vast ocean of mortgage possibilities. Who knows—your next calculation could be as exhilarating as an escapade through Liguria Italy or as mind-bending as one of those five-star-rated puzzle games. The world of PMI calculators is your oyster!

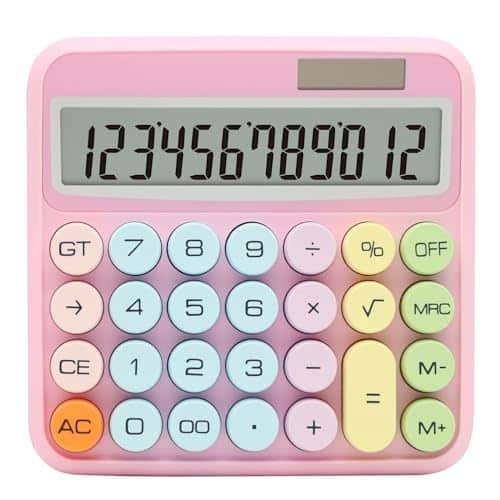

Pink Calculator, UPIHO Standard Calculator Digit with Large LCD Display and Big Buttons,Pink Office Accessories for Women Desk,Cute Calculator for Office,School, Home,Business

$10.99

Add a harmonious splash of color to your workspace with the UPIHO Pink Calculator, an essential standard calculator designed to blend effortless functionality with a vibrant aesthetic. Its large LCD display ensures that every digit is clear and easy to read, minimizing strain during lengthy calculations. The generously sized buttons are responsively crafted, preventing errors and facilitating a smoother input experience for users of all ages. Perfect for anyone looking to coordinate their office accessories, this calculator stands out with its playful, yet professional pink hue.

The UPIHO Pink Calculator is more than just a beautiful accessory; it is a reliable tool, perfect for a variety of everyday tasks. Whether you’re balancing budgets, doing homework, or managing business finances, the intuitive layout and basic arithmetic functionsincluding addition, subtraction, multiplication, and divisionmake it an indispensable resource. Its compact design means it fits neatly on any desk, in a backpack or in a briefcase, empowering you with quick arithmetic wherever you go. Additionally, the solar-powered operation accompanied by a battery backup ensures consistent performance in any lighting condition, affirming its convenience and eco-friendliness.

Ideal for students, professionals, and anyone who appreciates a touch of personality in their office supplies, the UPIHO Pink Calculator makes a thoughtful and practical gift. It serves as a delightful addition to a woman’s desk setup, aligning with the trend for cute, yet functional office accouterments. Imagine the ease of computations during a busy school day or in the midst of an important business meeting, all the while exhibiting your unique style. Durably constructed to withstand daily use, this cute calculator champions both charm and efficiency for office, school, or home use.

How do I calculate my PMI?

Whew, calculating PMI might feel like a math test you didn’t study for, but it’s easier than it looks! Just grab your loan amount, peek at the lender’s PMI rate, and multiply the two. For a ballpark figure, PMI can range from 0.3% to about 1.5% of the loan annually. So, don’t sweat it; just whip out that calculator and you’ll have your number in no time.

How much is PMI on a $300000 mortgage?

Alrighty, if you’re eyeing a $300,000 mortgage, your PMI is gonna hinge on the rate your lender sets. But let’s say it’s 1% per year—just a ballpark figure. You’d be shelling out roughly $3,000 annually, or about 250 bucks a month. Remember, your mileage may vary depending on your credit score and down payment. Always best to chat with your lender for the nitty-gritty.

What is the 20% rule for PMI?

So, there’s this unwritten rule – well, actually, it’s pretty written – that if you want to sidestep PMI like a slick sidewalk puddle, you gotta put down 20% on your house. It’s like the bouncer of mortgage world; meet the 20% rule, and you can cut the PMI line. Less than that, and, alas, you’ll be paying a little extra each month to protect your lender’s investment in case you hit a bumpy road.

How much is PMI on $100,000?

Oh boy, PMI on a $100,000 loan? You’d want to brace yourself for an extra cost. With PMI rates varying from 0.3% to 1.5%, you might be coughing up anywhere from $300 to $1,500 a year. That’s potentially an addition of $25 to $125 monthly. But remember, these numbers are as approximate as a weather forecast, so check with your lender for the specifics.

Should you pay PMI or put 20 down?

Should you pay PMI or put down 20%? Ah, the million-dollar question—except we’re probably talking less cash here! Each option has its trade-offs. Forking over a 20% down payment might be a hefty upfront hit, but it’ll dodge the PMI monthly tag-along. On the flip side, if tying up that much dough in one place makes you queasy, PMI can be your ticket to homeownership with less cash upfront. It’s like choosing between paying for express shipping or waiting a bit longer for free delivery—depends on your needs and patience!

How can I avoid PMI without 20% down?

Thinking of skirting PMI without the full 20% down payment? It’s not pie in the sky! One nifty trick is to get what’s called lender-paid PMI (LPMI). Yep, the lender covers it, but don’t think it’s charity—they’ll usually charge a higher interest rate. Another path is a piggyback loan—a fancy term for a small second mortgage to cover the difference. It’s a bit like wearing a belt and suspenders, but hey, it works.

Why is my PMI so high?

People often wonder, why’s my PMI priced like a luxury item? Well, it’s all about the risk for the lender. If you’ve got a smaller down payment or a credit score that’s seen better days, lenders might get jittery, thus a higher PMI. It’s like insurance premiums—the more you look like a daredevil, the more you pay. But hey, there’s room to haggle down the line if your financial health improves!

How much down do you need to avoid PMI?

To duck the PMI, a firm rule of thumb is to go big or go home with your down payment—20% to be precise. That’s the magic number where PMI waves goodbye, and you strut your stuff like a financial rock star. Anything less, and PMI clings like glitter after a craft project.

How do you avoid PMI?

Skipping PMI is like avoiding stepping on cracks in the sidewalk—tricky, but possible. First, consider a 20% down payment; that’s your golden ticket. Alternatively, explore loans like VA or USDA that don’t require PMI, or get a piggyback mortgage to break up your loan. With these loopholes, you can leave PMI out in the cold!

Is PMI worth it?

Wondering if PMI is worth the dough? Consider this: If PMI gets you into a home sooner, it might be worth the extra monthly pinch. After all, while you’re forking over PMI, you’re also building equity and benefitting from potential home appreciation. It’s like paying for front-row concert tickets—costly, but you’re in the show, rocking out instead of waiting around!

Can you avoid PMI with 10%?

Can you outmaneuver PMI with just a 10% down payment? Sometimes! This is where piggyback loans strut onto the stage, splitting your mortgage into two—a primary loan and a smaller loan, or “second mortgage.” It’s like two friends teaming up to help you move a couch; together, they might just get the job done.

Can I lower my PMI?

Wanna trim your PMI waistline? Just increase your home equity or get a better appraisal to show you’ve hit that magical 20% equity mark. You can also refinance if the numbers make sense. It’s kinda like shedding pounds after the holidays—it takes effort, but boy, does it feel good when you succeed!

How much do most people pay for PMI?

What’s the typical tab for PMI? Well, homeowners might be coughing up anywhere from 0.3% to 1.5% of their loan annually. If you’ve got a $200,000 loan, that’s about $600 to $3,000 a year. Sure, it’s as broad as predictions for the next hit reality show, but it gives you a ballpark to stand in.

When can you stop paying PMI?

Kissing PMI goodbye is like waiting for a tree to bear fruit; it takes time but eventually, you’ll get there. You can generally chuck PMI out the window when your mortgage balance drops below 80% of your home’s purchase price or current market value—whichever is less. So, keep making those payments, and watch that PMI fade in the rearview mirror.

How long do I pay PMI?

Paying PMI is a bit like a temporary tattoo; it sticks around for a while but doesn’t last forever. You’ll typically be making PMI payments until you’ve got 20% equity in your home based on the original property value. This usually translates to about 5 to 7 years. But of course, every mortgage is a unique snowflake, so yours might differ.

Where do I find PMI on my mortgage statement?

Hunting for PMI on your mortgage statement is like playing Where’s Waldo—but for numbers. Look for terms like “Mortgage Insurance Premium” or an acronym party with PMI, MIP, or MPI. It’s usually tucked neatly within your monthly loan payment breakdown, but if it’s playing hide and seek, just ring up your lender and ask for a hand!

Is PMI based on loan amount or value?

PMI questions got you scratching your head? Here’s the lowdown: PMI is generally based on your loan amount, not the value of your home. Think of it as a safety net percentage on what you borrowed, not on what your house is worth on the open market. It’s more about the money you’re asking to borrow than the stage for your family BBQs.

Is PMI calculated on appraised value?

Is PMI calculated on appraised value? Not usually—PMI typically hitches a ride on your loan amount, not your home’s appraisal. It’s all about the dough you need to borrow. But hold up! A higher appraisal could be your ticket to waving bye-bye to PMI sooner if it pumps your equity past the 20% threshold.

How do you calculate PMI equity in a house?

Figuring out your PMI equity is like tracking your progress in a marathon. Essentially, you’ve got to gauge the difference between your loan balance and your home’s current market value. If that gap is at least 20% in favor of your home’s value, you might be doing a victory dance, as you could meet the equity requirement to cancel your PMI.