Understanding The Importance Of A Reliable Mortgage Intrest Calculator

In today’s dynamic housing market, buyers and homeowners need reliable tools to make informed financial choices. A mortgage interest calculator is invaluable for estimating monthly payments, understanding the impact of varying interest rates on your budget, and planning long-term finances. With mortgage rates constantly shifting, a robust calculator can save you time, money, and stress.

Here’s an example: imagine navigating the streets of Baltimore without a reliable map Of Baltimore—chaotic, right? Similarly, a precise mortgage interest calculator is your roadmap to financial clarity.

Top 5 Mortgage Interest Calculators for Precise Rate Estimation

1. Bankrate Mortgage Calculator

Bankrate is synonymous with personal finance expertise, and their mortgage calculator lives up to their reputation. This tool provides detailed payment breakdowns, including property taxes, homeowner’s insurance, and HOA fees, with an easy-to-use interface.

- Unique Insights: Bankrate stands apart with educational resources that help users grasp the many factors influencing mortgage payments.

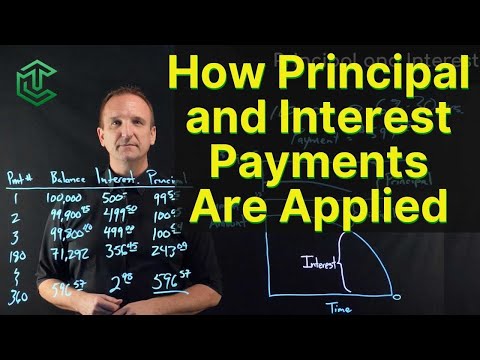

- Advanced Features: View amortization schedules and see how additional payments affect the loan term.

2. Zillow Mortgage Calculator

As a real estate powerhouse, Zillow offers a mortgage calculator that complements its property listings database. Users can swiftly estimate monthly payments and evaluate how different rates and down payments impact their mortgage.

- Original Insights: Zillow’s calculator integrates seamlessly with current home listings, making it simpler to match financial calculations with property searches.

- Data Advantage: Regular updates with the latest mortgage rates ensure accuracy.

3. Mortgage Professor’s ARM & Fixed Rate Calculator

Mortgage Professor, headed by finance guru Jack Guttentag, offers specialized calculators for adjustable-rate and fixed-rate mortgages.

- Deep Dive Analysis: These calculators deliver comprehensive insights into the specifics of various mortgage types, excellent for those wanting to compare options.

- Educational Support: Packed with explanatory content to help users understand complex mortgage terms.

4. Quicken Loans Mortgage Calculator

A leading online mortgage lender, Quicken Loans delivers a straightforward yet detailed calculator.

- Innovative Features: The “Home Affordability” feature helps users estimate what home prices they can afford based on their income and debts.

- Proprietary Insights: It leverages Quicken Loans’ data to provide an accurate reflection of their offered rates.

5. NerdWallet Mortgage Calculator

NerdWallet’s highly customizable calculator lets users play with different financial scenarios, delivering a holistic view.

- Unique Perspective: NerdWallet’s tool is renowned for its comprehensive information, giving insights into loan costs over the mortgage’s life.

- Exclusive Features: Recommends realistic financial pathways based on user entries, backed by advice from certified financial experts.

| Parameter | Description | Example Values |

| Current Market Interest Rates | Range of mortgage rates currently available in the market. | High-6% range (2024) |

| Historical Perspective | Comparison of rates over a specified period to give context. | Early 2022: 3.77% End 2022: 7.06% |

| Low vs. High Rates | Classification of what constitutes low and high mortgage rates over time. | Low: 4% High: above 7% |

| Quote Comparison | Importance of getting quotes from multiple lenders to find favorable rates. | N/A |

| Estimated Monthly Payment Example | Example monthly payments for a typical loan amount under varying conditions. | $500K @ 30 years, 7.1%: $3,360.16 |

| Monthly Payment Range | Estimated range of monthly payments for varying terms and interest rates. | $2,600 – $4,900 |

| 30-Year Fixed Rate Example | Monthly payment based on a 30-year term for a specified loan amount and interest rate. | $200K @ 7%: $1,331 |

| 15-Year Fixed Rate Example | Monthly payment based on a 15-year term for a specified loan amount and interest rate. | $200K @ 7%: $1,798 |

| Feature | Description | |

| Loan Amount Input | Allows users to input the total loan amount they wish to borrow. | |

| Interest Rate Input | Users can enter varying interest rates to see how it affects monthly payments. | |

| Loan Term Options | Option to select different loan terms, such as 15 and 30 years. | |

| Monthly Payment Calculation | Calculates the estimated monthly mortgage payment based on inputs. | |

| Amortization Schedule | Provides a detailed breakdown of each payment’s allocation towards principal and interest. | |

| Total Interest Paid | Computes the total interest paid over the life of the loan. | |

| Benefit | Description | |

| Financial Planning | Helps users understand their potential monthly financial obligations based on different scenarios. | |

| Loan Comparison | Enables easy comparison of different loan offers and interest rates from various lenders. | |

| Budgeting | Aids in identifying a mortgage that fits within the user’s budget. | |

| Informed Decision-Making | Empowers borrowers with data to make well-informed decisions regarding their mortgage options. |

Key Features to Look for in a Mortgage Interest Calculator

When selecting a mortgage interest calculator, consider the following features:

How Accurate Mortgage Interest Calculators Enhance Financial Planning

Accurate mortgage interest calculators are critical for effective financial planning:

An accurate mortgage estimator can mean the difference between financial security and unexpected hardship.

Final Thoughts on Selecting the Best Mortgage Interest Calculator

Whether you’re a first-time buyer or looking to refinance, the best mortgage interest calculator provides accurate, detailed, and tailored insights. Selecting the right tool is crucial for making informed decisions and taking charge of your mortgage journey with confidence.

With the right calculator, you empower yourself with crucial knowledge, transforming the often complex process of securing a mortgage into a manageable and rewarding experience. Avoid financial blunders by leveraging these powerful tools to turn your dream of home ownership into reality. And remember, it all starts at Mortgage Rater.

Fun Trivia and Interesting Facts About Mortgage Interest Calculators

The Magic Behind Mortgage Calculations

Ever wonder what makes a mortgage interest calculator so fascinating? It’s no secret that these tools take complex financial data and simplify it. By inputting variables like loan amount, interest rate, and term length, you can quickly see how much your monthly payments will be. But here’s a quirky bit: Did you know that mortgage interest calculators have been around for decades, long before we had the sleek, digital versions we use today? The oldest calculators were mechanical and required a lot more effort to use compared to today’s one-click wonders. If you’re curious, try out a mortgage interest rate calculator to see the magic unfold before your eyes!

Surprising Influences on Your Interest Rate

A fun fact about mortgage interest rates is that they can be influenced by seemingly unrelated factors. Take sports, for instance: Cities that win major sports championships often see a temporary boost in their real estate markets. Imagine the impact of a winning streak from teams like Guadalajara Pumas, leading to a spike in interest rates due to increased home demand. This phenomenon shows how interconnected various aspects of life can be, even in ways we wouldn’t typically expect.

Income Types Matter More Than You Think

When calculating mortgage interest, the kind of income you earn can make a substantial difference. More specifically, portfolio income, which comes from investments, can affect your mortgage interest rates differently than a traditional salary. Lenders often view this income as less stable, influencing your final rates. Isn’t it fascinating that your stock earnings could impact your mortgage terms? Understanding these nuances can make you a wizard with mortgage calculators, unraveling the complexities behind those rates and payments.

Pop Culture’s Impact on Real Estate Trends

Lastly, pop culture can have some pretty unexpected effects on mortgage interest calculations. Did you know that the popularity of certain TV shows can influence real estate trends? For example, the rise of shows featuring luxury homes and celebrity lifestyles can drive interest in specific neighborhoods, causing home prices—and interest rates—to fluctuate. And if you’re a fan of quirky entertainment venues like karaoke rooms, you’ll be delighted to know that such unique attractions can also contribute to neighborhood desirability, affecting mortgage rates more than you’d anticipate.

In summary, mortgage interest calculators do more than crunch numbers; they open a window to a world where sports victories, investment types, and even pop culture can sway financial decisions. So, next time you’re plugging numbers into that calculator, take a moment to appreciate the fascinating influences behind those figures!

Is 6% interest high for a mortgage?

In today’s market, a 6% interest rate isn’t particularly high for a mortgage. It’s considered quite decent, given that rates have hovered around the high-6% range lately. Always shop around and compare offers from various lenders to find the best rate for your financial situation.

Is a 4% mortgage interest rate good?

A 4% mortgage interest rate is considered low in the present market context. Rates have increased significantly, so locking in at 4% would be a great deal compared to current averages.

How much would a 30-year mortgage be on a $500000 house?

For a $500,000 house with a 30-year mortgage at 7.1% interest, your estimated monthly payment would be roughly $3,360.16. Depending on your loan specifics, this payment could vary between about $2,600 and $4,900.

How much is a 30-year mortgage payment for $200000?

A 30-year mortgage payment for a $200,000 loan would be around $1,331 if the interest rate is 7%. The payment amount will differ based on the exact interest rate you secure.

Will rates go down in 2024?

Predicting future mortgage rates is tricky, but many experts hope rates could stabilize or even decrease slightly in 2024. It’s wise to keep an eye on financial forecasts and consult with your lender.

Is 7% interest on mortgage high?

A 7% interest rate on a mortgage is on the higher side compared to historical trends but fits within today’s market norms. It’s not outrageously high, but better rates could be found with a strong financial profile.

Will mortgage rates ever be 3% again?

Mortgage rates dropping back to 3% seems unlikely in the near future. Economic conditions have changed significantly, making those ultra-low rates a thing of the past for now.

What bank has the lowest mortgage rates?

Choosing the bank with the lowest mortgage rates requires some comparison shopping. Rates fluctuate, so look at offers from multiple lenders, including credit unions and online banks, to find the best deal.

What is the interest rate on a $400000 home?

The interest rate on a $400,000 home will depend on various factors like your credit score, down payment, and overall financial health. Currently, rates are generally in the high-6% range.

What credit score do you need to buy a $500,000 house?

To buy a $500,000 house, a credit score of at least 620 is typically needed for a conventional loan. Higher scores usually qualify for better rates and terms, but requirements vary by lender.

What should your income be for a $500000 home?

For a $500,000 home, your income should ideally be around $125,000 annually, depending on other factors like down payment, debts, and overall financial health. This helps ensure you can comfortably handle the mortgage payments.

How much is a 150K mortgage payment?

A $150,000 mortgage payment on a 30-year loan at 7% interest would be roughly $997 per month. This payment amount can vary with different interest rates and loan terms.

What credit score is needed to buy a house?

A minimum credit score of around 620 is generally needed to buy a house, though higher scores often secure better rates and loan options. FHA loans might accept scores as low as 580.

How much income do I need for a 200k mortgage?

To qualify for a $200,000 mortgage, your income might need to be about $50,000 annually, assuming you have minimal debt. Lenders look at your debt-to-income ratio to determine affordability.

How to pay off 200k mortgage in 5 years?

Paying off a $200,000 mortgage in 5 years is possible but challenging. It would require making higher monthly payments of around $3,870, which might be feasible with a substantial income or other financial resources.