Navigating the intricate world of finance can often feel like a journey through a snow-covered landscape – beautiful yet full of unexpected challenges. The right tools, like a good loancalculator, are essential to chart your course with confidence, just as captivating winter Pictures help you appreciate the beauty amidst the cold. In this in-depth guide, I’ll channel the sense of clarity brought forth by Suze Orman’s educational expertise and Robert Kiyosaki’s practical financial advice, to unveil the top 5 loancalculator finds on Amazon that can aid you in your financial expedition.

Harness the Power of a Quality Installment Loan Calculator

The search for a reliable installment loan calculator is akin to finding a warm shelter in the heart of winter. It should be your financial sanctuary, providing comfort with its user-friendly interface and reliable accuracy. Here are the top picks that have received high praises among users:

LoanCalculator

$0.00

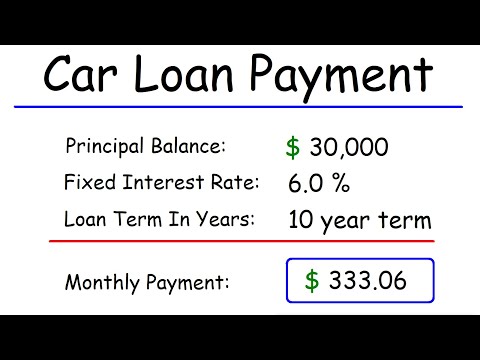

LoanCalculator is an innovative and user-friendly financial tool designed to help individuals and businesses estimate the costs associated with taking out a loan. By inputting basic loan information such as the principal amount, interest rate, and loan term, users can quickly calculate their monthly payments, total interest paid, and the overall cost of the loan. This intuitive calculator is perfect for those looking to finance a home, car, education, or manage any other type of installment loan.

With its sleek and simple interface, LoanCalculator ensures that users of all financial literacy levels can navigate and understand the complexities of loan repayment. The software is equipped with a range of features, including the ability to adjust payment frequency, experiment with different interest rates, and compare multiple loan scenarios side by side. It also provides an amortization schedule, giving users an in-depth view of how each payment contributes to paying off the principal and interest over time.

LoanCalculator is not only a practical resource for individual planning and budgeting but also a valuable asset for financial advisors and loan officers who want to present clear loan options to their clients. Available for both web and mobile devices, LoanCalculator facilitates on-the-go calculations, making it an indispensable tool for quick financial decision-making. With its accurate and reliable computations, LoanCalculator is the go-to solution for anyone wanting to demystify the borrowing process and make informed financial choices.

Calculate Your Interest Payment Seamlessly

Understanding the nitty-gritty of interest Calculations on Loans can be overwhelming, but the right tool can simplify this process. Think of it as having a roadmap that guides you through the often foggy landscape of interest payments. Here are some calculators that do just that:

| Feature | Description | Benefits |

| Principal Amount | The total loan amount borrowed. | Determines the base sum on which interest is calculated. |

| Interest Rate | Annual rate applied to the principal. | Helps calculate the total cost of borrowing. |

| Loan Term | Number of years to repay the loan. | Affects the amount of interest paid and monthly payment. |

| Payment Frequency | How often payments are made (e.g., monthly). | Allows for budgeting according to income schedule. |

| Amortization Period | Time over which the loan is paid in full. | Impacts the payment size and interest costs. |

| Extra Payments | Additional payments towards the principal. | Can significantly reduce interest costs over time. |

| Total Interest Paid | Total amount of interest paid over the term. | Informs borrower of the cost of the credit. |

| Total Payment | The sum of all payments made. | Provides an overview of the total expense of the loan. |

| Loan Type | Fixed or variable rate. | Determines whether payments change over time. |

| Early Payoff Penalties | Fees for paying off the loan early, if any. | Important for those aiming to pay off debt faster. |

Finding the Best Interest Rate Calc for your Needs

An interest rate calc doesn’t just predict future payments; it acts as a financial compass, pointing you towards smart borrowing decisions. After combing through Amazon’s offerings, here are a few that meet our high standards:

Navigate Complex Calculations with a High-Grade Loan Aclculator

Just as actress Gia Ruiz captures her audience’s attention with stellar performances, a high-grade loan aclculator should captivate you with its functionality and ease of use. Here are our standout choices:

Konohan Pieces Digit Calculator, Solar Basic Desktop Calculator Large Display Electronic Calculators Dual Power Handheld Calculator for Home Office School (Dark Blue)

$25.49

The Konohan Pieces Digit Calculator is a Solar Basic Desktop Calculator that marries functionality with ease-of-use in a sleek dark blue design. Its large display enhances visibility, ensuring that every digit is clear and easy to read, preventing common errors during calculation. The calculator operates on dual power, utilizing solar energy for efficient functionality during the day and a backup battery to ensure it remains operational even in low-light conditions. This dependable feature makes the calculator perfect for continuous use whether you’re at home, in the office, or moving between classes at school.

Ergonomically designed for comfortable handling, this handheld calculator fits effortlessly into your hand and can also settle sturdily on a desk surface. The intuitive layout of its high-quality buttons is designed to facilitate quick data entry and reduce strain during extended periods of use. With dedicated keys for essential functions and a generous 10-digit display, complex calculations can be completed with ease, reducing the need for multiple calculations and saving valuable time. The tactile feedback of each key press ensures accuracy for every calculation, making it a reliable tool for all basic mathematical operations.

Created for a wide array of tasks from simple addition and subtraction to more complex financial calculations, the Konohan Pieces Digit Calculator is ideal for students, accountants, and office workers alike. Its subtle, dark blue hue allows it to blend seamlessly into any professional or educational environment without undermining its accessibility. To ensure longevity and reliability, this calculator is constructed from durable materials that withstand daily use and the rigours of travel between work environments. The versatility and durability of the Konohan Pieces Digit Calculator make it an indispensable tool for anyone looking for a reliable and user-friendly calculating solution.

Loan Cal Devices That Are Worth Your Investment

When it comes to a loan cal, you want a trustworthy companion that will be by your side through thick and thin, much like the loyal following of ur mom jokes on the internet. These devices are worth their weight in gold:

Comprehensive Loan Calc Solutions for Everyday Use

Life is unpredictable, and your loan calc should be ready to adapt to varying circumstances, much like actor Rami Malek adapts to his diverse roles in movies and TV shows. The best picks provide reliability and flexibility:

Mastering Your Finances with a Trustworthy Loan Payment Calc

A transparent, trustworthy loan payment calc, like a cherished family recipe, can be the secret ingredient to acing your repayment strategy. Our selections offer advanced features, including amortization schedules and adjustable rates:

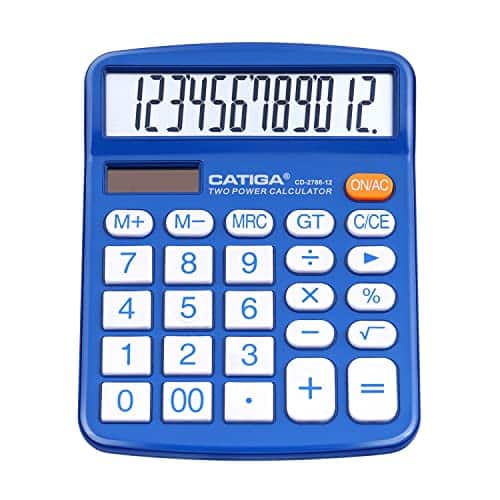

CATIGA Desktop Calculator Digit with Large LCD Display and Sensitive Button, Solar and Battery Dual Power, Standard Function for Office, Home, School, CD (Blue)

$9.99

The CATIGA Desktop Calculator is an essential tool for people in various settings, including the office, home, or school. It comes with a generously sized LCD display that ensures numbers are easy to read at a glance, reducing eyestrain over long periods of use. The sensitive buttons are thoughtfully designed to improve the typing experience, providing tactile feedback that promotes accuracy for frequent users. Finished in an attractive blue, the calculator boasts a modern design that will complement any workspace.

Designed with functionality in mind, the CATIGA calculator offers all the standard functions needed for handling everyday calculations. From complex financial equations to simple arithmetic, the versatility of this calculator accommodates a wide range of mathematical tasks. Additionally, key features like auto shut-off save power, while the large keys prevent common input errors. The device operates on dual power sources, harnessing solar energy for daylight operation and using battery power to ensure reliability in any lighting condition.

Durability and convenience are at the heart of the CATIGA Desktop Calculator’s design, making it a reliable companion for long-term use. The sturdy build is crafted to withstand the rigors of daily use, making it ideal for busy environments like classrooms and offices. Its compact size allows for easy storage in a desk drawer or transportation in a bag. Furthermore, the integration of both solar and battery power ensures that this calculator remains operational whenever you need it, providing a seamless calculating experience without the worry of power disruptions.

Explore the Versatility of Loans Calculators

Loans calculators have evolved to address specific financial needs, and on Amazon, there’s a wealth of versatile options, built to support transactions as diverse as business loans or refinancing. In the same way absorption definition in real estate marks a turning point in property trends, these calculators signify a quantum leap in financial calculations:

Why a Reliable Payment Calc Can Make All the Difference

A payment calc is the sidekick you didn’t know you needed on your personal finance adventure. The gems we’ve found combine the precision required for finance professionals with the simplicity needed for first-time users:

Conclusion: Making an Informed Loancalculator Investment

Choosing a loancalculator is like packing for an epic journey; it’s crucial to select gear that’s trustworthy, versatile, and enlightening. The options we’ve explored here meet the crossroads of innovation and user-friendliness. They provide crystal-clear payment breakdowns and help users understand the subtleties of various loan types. Our curated selections from Amazon stand ready to guide you through the financial labyrinth with poise and authority. Remember, managing personal debts, steering a business, or planning ahead requires more than good intentions; it requires the right tools. These loancalculator finds are the mathematical companions you need to empower your decisions and light the path to a secure financial destiny.

Loancalculator: Not Just Number Crunching but A Story Teller Too!

You know, crunching numbers with a loancalculator can be as engaging as watching a twisty plot unfold in one of Rami Malek ‘s thrilling Performances. While Malek dives deep into his characters, a loancalculator dives into your finances, revealing the secrets of your potential mortgage deal. Just as a movie has highs and lows, so does the journey of finding the perfect mortgage rate. Let’s have some fun and explore some intriguing tidbits about your trusty financial tool—the loancalculator!

Did You Say “Antique” Loancalculators?

Hold your horses! Before we had these nifty gadgets and apps, loancalculators were as manual as it gets. Picture this: folks sitting at a desk with a ledger, using a slide rule or an abacus, painstakingly figuring out interest rates. Kinda like how filmmakers edited movies before computers—talk about a “cut” above the rest!

Mortgage Math Magicians

Ever feel like you need to be a math wizard to understand mortgages? Well, here’s something that’ll knock your socks off: your loancalculator is the Gandalf of number-crunching! It can transform confusing terms and percentages into a story that makes sense to mere mortals. Abracadabra, and you’ve got your monthly payment without needing to pull out your hair!

Talk About a Time Machine

Using a loancalculator isn’t just about numbers; it’s like hopping into a DeLorean and zooming into your financial future. Seriously! You type in some digits, hit calculate, and—voilà!—you get a glimpse of what your budget will look like for years to come. Don’t you wish it could also predict lottery numbers?

Keeping It Real Estate

Ever used a loancalculator and thought, “Wait, is that for real?” Well, buckle up, because they keep it as real as it gets. Loancalculators use the same principles banks do. So, while you might hope for a Hollywood ending with lower payments, this little guy keeps you grounded in the reality of interest and amortization. No sugar-coating here, folks!

The Pocket-Sized Negotiator

Did you know your loancalculator could be your best buddy at the bargaining table? Not kidding! When you’re knee-deep in home buying, whip out that calculator, and you might just impress the socks off the seller. It’s like having a secret weapon or a sidekick that knows its way around the block.

So, there you have it, a handful of fun facts about the trusty loancalculator! It might not be glitzy like a Hollywood premiere, but it sure as heck can offer you a starring role in the story of your financial future. Keep it by your side, and who knows, you might just live happily ever after with those monthly payments!

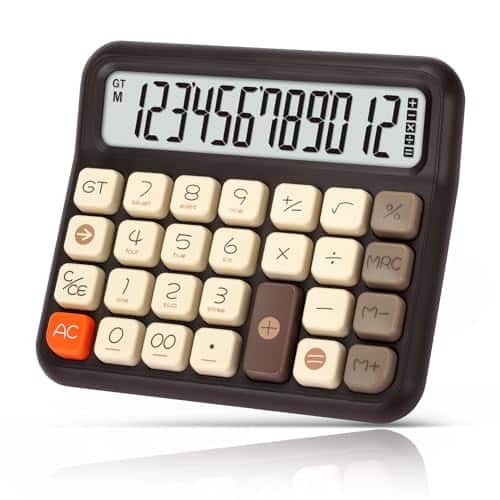

Pendancy Calculators Desktop Digit, Cute Basic Calculator with Extra Large LCD Display and Buttons, for Office, School, Home Use

$14.99

The Pendancy Calculators Desktop Digit is an essential accessory for anyone seeking efficiency and charm in their mathematical tasks, perfect for a diverse range of environments from office desks to school backpacks, and home offices. This cute basic calculator stands out with its playful design, inviting individuals of all ages to engage with their numerical chores with a touch of whimsy. With an extra-large LCD display, users can easily read their calculations without straining their eyes, ensuring that both small and large numbers are crisp and clear. The big, tactile buttons facilitate smooth and accurate input, minimizing the chances of errors during rapid calculations.

Durability meets style in the Pendancy Calculators Desktop Digit, which is constructed with a robust casing to withstand the rigors of daily use. Its simplistic layout and intuitive interface make it an ideal choice for students learning basic arithmetic or professionals needing quick calculations on the fly. The large buttons are not only easy to press but thoughtfully spaced to prevent accidental presses, a common issue with smaller calculators. Additionally, its attractive design comes in a variety of colors, allowing users to choose one that best fits their personal style or coordinates with other desk accessories.

The Pendancy Calculators Desktop Digit also boasts energy-efficient operation, making it an environmentally conscious choice for eco-minded individuals. It’s equipped with an auto-off feature to conserve battery life when not in use, ensuring that the calculator is always ready to go when you need it. The calculator is lightweight and portable, making it simple to carry from place to place, whether you’re moving between meetings or classes. Whether for quick tax calculations, schoolwork, or everyday household budgeting, the Pendancy Calculators Desktop Digit combines functionality, ease of use, and delightful design to make it a must-have tool for anyone dealing with numbers.