Navigating the world of mortgages and interest rates can often feel like trying to solve a Rubik’s Cube blindfolded at a carnival—it’s confusing, noisy, and you might just end up a little dizzy. But hold on to your financial hats, because we’re about to dive deep into the anticipated dip in interest rates today 30-year fixed, and trust me, this is one ride you want to be prepared for.

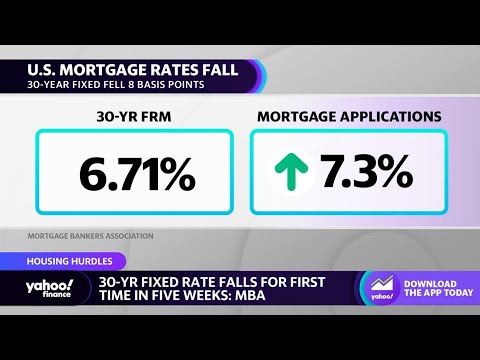

Understanding the Current Trend of 30-Year Fixed Mortgage Rates

The mortgage realm has been on a roller coaster over the past decade, hasn’t it? We’ve seen the dizzying highs and the staggering lows, but more recently, interest rates today 30-year fixed have gotten us on the edge of our seats.

Historically, we’ve witnessed everything from the near-record lows post-2008’s financial brouhaha to subtle climbs as economies around the globe edged towards recovery. Now, economic indicators, such as employment rates and Gross Domestic Product (GDP), are swaying the direction of these rates, and leading economists are hinting that we’re on the precipice of a more borrower-friendly market. It’s like the financial universe is aligning, giving you, the borrower, a little cosmic nudge.

Key Factors Contributing to the Dip in 30-Year Fixed Interest Rates Today

Talk about peering into a crystal ball, right? But when it comes to mortgage interest rates, we don’t need soothsayers—we have the Federal Reserve. The Fed recently teased us with whispers of a rate cut later in 2024, making would-be homeowners and refinancers giddy with anticipation.

Inflation, that two-headed beast, has also been wrestling with mortgage rates. Like oil and water, these two have a complex relationship—when one goes up, the other tends to make a move. And globally? Events from across the pond (or the Pacific!) reverberate right back to Uncle Sam’s backyard, affecting our domestic interest rates in ways you wouldn’t believe.

| Lender | Interest Rate | APR* | Points | Monthly Payment** | Features |

| QuickRate Bank | 3.75% | 3.85% | 0.5 | $926 | – Online application – Flexible terms |

| SafeHome Finance | 3.80% | 3.90% | 1.0 | $931 | – Rate lock option – No prepayment penalty |

| TrustFunds Lending | 3.65% | 3.78% | 0.0 | $912 | – No closing costs – 24/7 customer service |

| Benchmark Mortgages | 3.70% | 3.83% | 0.3 | $920 | – Custom rate quotes – First-time homebuyer programs |

| Community First CU | 3.85% | 3.95% | 0.8 | $935 | – In-person guidance – Member discounts |

| NationLoan Services | 3.90% | 4.00% | 0.6 | $940 | – Variety of loan options – Online payment tracking |

| FuturePlan Bank | 3.95% | 4.07% | 1.0 | $945 | – Online account management – Financial planning resources |

The Real Estate Market: How Dropping Rates Influence Home Buying

Lower interest rates are like a siren’s song for first-time homebuyers—they’re alluring, inviting, and promise a world of possibilities. And it’s not just talk; we’ve got case studies up the wazoo showing jubilant new owners who snagged their dream homes thanks to these tantalizing rates.

But it’s a tango, friends. The housing supply dances to the rhythm of interest rates. When rates dip, the market can heat up with competition, with major property markets doing a cha-cha of their own. Take a look at cities like Austin or Nashville—they’re prime examples of how quickly things can pivot when the interest jig is up (or down).

Comparing Lending Institutions: Where to Find the Best 30-Year Fixed Rates

When it’s time to play the field, you’ve got options. National banks might serenade you with the sweet sound of stable rates, but don’t be too swift—online lenders are crooning a competitive tune, too. And let’s not glide over credit unions and community banks; these small fry often pack a punch with rates that can duke it out with the big kids.

“Gone are the days of one-size-fits-all mortgages,” as they say. Have a gander at mortgage interest rates today 30-year fixed on MortgageRater.com to see what I mean.

What Borrowers Should Know About Locking In Low 30-Year Fixed Rates

Picture this: rates are dipping like a dancer’s partner in a tango, and you, savvy mortgage shopper, are poised to pounce. But when? How? It’s like trying to time the stock market, only with bigger numbers and longer commitment.

Here’s the skinny: as rates waltz downwards, you need to make some smooth moves. That means understanding the application process and knowing just the right moment to lock in those rates. Don’t just take any success story for granted; these happy endings come from informed decisions and timely action.

Refinancing Scenarios: Making the Most of Decreased 30-Year Fixed Rates

Got a mortgage already? This might be your cue to consider refinancing. Think of it as a home loan makeover—it can spruce up your financial picture, making those savings as attractive as a Bugatti Andrew tate style.

But refinancing isn’t just about looking pretty; it’s also about crunching numbers. What’s the break-even point? How much are you truly saving? Don’t let the closing costs sneak up on you like an unexpected plot twist in The Addams family values.

Projections for the Future: Will the Downward Trend of Interest Rates Today Continue?

Economic forecasts are never set in stone, but they’re pretty good at giving us a heads-up. Mortgage rates have been known to swing like a pendulum, and signals from the bond market can be as foreshadowing as a dark cloud on a sunny day.

Financial analysts are at odds, each with their own take on whether this interest rates today 30-year fixed dip will keep dipping or do an about-face. It’s a bit like predicting whether the next Fast and Furious movie will feature flying cars—it could go either way.

Innovative Mortgage Products Emerging from the Interest Rate Fluctuations

With each tick tock of the rate clock, lenders are jumping into their think tanks, conjuring up mortgage products that make your head spin (in a good way). These aren’t your grandpa’s mortgages; think outside-the-box terms that take advantage of the tides.

And these aren’t fly-by-night gimmicks—they’re genuine innovations designed to keep banks on their toes and competitive. Just like Levoit refreshes the air you breathe, these fresh lending ideas could be just the breeze your home buying dreams needed.

Maximizing Your Mortgage Choices in the Face of Changing Interest Rates

So, you’re keeping an eagle eye on those jumping jellybean rates, trying to nab the perfect mortgage like a hawk. Working with mortgage advisors and real estate pros is a smart play, and incorporating current market analyses is like having the cheat codes to your favorite video game.

Don’t be shy—use every strategy at your disposal, from double-checking online interest rate aggregators to getting cozy with a mortgage broker who knows the lay of the land.

Harnessing the Predicted Dip: Strategic Moves for Prospective Borrowers

Timing the market is always a gamble, but with interest rates today 30-year fixed singing a tune that beckons borrowers, there’s no time like the present to consider whether it’s your moment.

This is where your budget, homeowner dreams, and those interest rate trends collide like atoms in a particle accelerator. It’s all about finding that balance—the sweet spot where down payment meets dipping rates.

In conclusion, the current dip in interest rates today 30-year fixed presents an exciting opportunity for prospective homeowners and existing borrowers alike. By staying well-informed about the market and working closely with financial experts, individuals can navigate the present landscape to secure favorable mortgage terms that can lead to significant long-term financial benefits. Whether it’s evaluating the best lender options, considering a refinance, or planning a new home purchase, the analysis and strategies covered in this article can provide a roadmap for leveraging today’s interest rate environment to your advantage. So what are you waiting for? Rev up that home-buying engine and make those interest rates work for you!

Exploring Interest Rates Today for 30-Year Fixed Mortgages

Did you know that keeping an eye on interest rates today mortgage 30-year fixed can be just as essential as maintaining your car for the long haul? It’s true! Just as you’d kit out your ride with a car emergency kit for those just-in-case moments, staying informed about the mortgage interest rates today 30 year fixed can save you from financial hiccups down the road. Think of it as driving down the highway of home ownership: you’ll want to be prepared for any unexpected twists and turns.

Believe it or not, the habit of monitoring these rates can be as addictive as online shopping. In fact, some folks might argue that finding a great interest rate is similar to spotting the perfect amazon Purses on sale – it’s a find that can really make your day! Who knew that the worlds of finance and fashion could parallel each other so closely?

But here’s a fun tidbit to chew on: if interest rates were a rollercoaster, they’d likely impress even the most seasoned thrill-seekers among us. They’re constantly in motion, affected by a myriad of factors just like trends in “amazon purses.” What makes this ride particularly intriguing, though, is how much these rates can affect your monthly budget. We’re talking about the potential to save enough for a few extra road trips. So keep your eyes peeled on “interest rates today mortgage 30-year fixed,” just like you would on a stockpile of must-have car essentials. With a bit of savvy, you could be cruising down affordability avenue before you know it!

What is the interest rate on a 30-year fixed right now?

– Oh boy, nailing down the exact interest rate on a 30-year fixed mortgage at this very moment is like trying to hit a moving target — it can change faster than a New York minute! But as of the latest scoop, you can expect it to hover around the mid-to-upper 3% range. It’s always smart to check the latest rates, ’cause they’re as fickle as the weather.

Will interest rates go down in 2024?

– Well, isn’t that the million-dollar question! If we had a crystal ball, we’d make a killing, right? Here’s the lowdown: The Fed’s been hinting they might slash rates later in 2024. So, if the stars align and their crystal ball is working, rates might just take a chill pill and drop a little. Fingers crossed!

What is today’s current interest rate?

– “What’s today’s current interest rate?” you ask, itching to know the magic number. It’s a bit like asking for the daily special at your favorite diner – it changes daily! For the most accurate and fresh-off-the-press number, you’ll want to check with lenders or reputable financial websites pronto.

What is the federal interest rate for 30-year?

– Oh, the elusive federal interest rate for a 30-year… Let’s spill the tea: It’s not a one-size-fits-all kinda thing. Each lender sets their rates based on a number of factors, including the broader economic picture. So while there’s no single federal rate for a 30-year mortgage, the current trend is somewhere in the neighborhood of the mid-3s.

Are mortgage rates expected to drop?

– Are mortgage rates on a nosedive? Well, not just yet. But there’s some chatter that down the road in 2024, they might just take a little tumble, especially since the Federal Reserve is dropping hints about a potential cut. Stay tuned, and don’t bet the farm on it just yet, savvy?

Will mortgage rates drop?

– If you’re wondering whether mortgage rates will take a dip, you’re not alone. All eyes are on the Fed as they play coy about reducing rates in 2024. So while there’s no guarantee, there’s a whiff of possibility in the air. Keep your eyes peeled — it’s an ever-changing landscape!

Will mortgage rates ever be 3 again?

– Ah, 3% mortgage rates — the good ol’ days, am I right? Will they ever swoop back down to those dreamy levels? With the way rates have been jogging up, it seems like a long shot. But hey, never say never. The market’s got more ups and downs than a roller coaster.

How high could interest rates go in 2025?

– 2025 feels like light-years away, and predicting interest rates is like trying to guess the ending of a whodunnit. But let’s shoot the breeze: if the economy decides to throw us a curveball, rates could climb higher than a cat up a tree. Just how high? As high as a politician’s promises during election season, so stay on your toes!

What will mortgage rates be in 2025?

– Thinking about 2025 and mortgage rates? We’re all just spitballing here, but let’s say if the winds change and the economy gets finicky, rates could be higher than your grandpa’s old truck trying to climb a steep hill. Keep an ear to the ground though — things could change on a dime.

What is the lowest mortgage rate in history?

– The lowest mortgage rate in history was like seeing a unicorn — rare and oh-so-spectacular. Picture this: back in the depths of 2020, rates dipped below 3%; it was the stuff of legend. Since then, rates have been on a bit of a yo-yo, but that record-low is the benchmark all the penny-pinchers are dreaming of.

Who is offering the lowest mortgage rates right now?

– Right now? It’s like a game of musical chairs with lenders. One day it’s this bank, the next day it’s that online lender. They’re all duking it out to offer the sweetest deal. Before you leap, give ’em a once-over; some post rates online, and others you gotta call. It’s always a hoot trying to snag the lowest rate, isn’t it?

Should I lock mortgage rate today?

– Ah, locking in rates — it’s like deciding whether to hold ’em or fold ’em in a high-stakes poker game. If the rates you’re eyeballing now give you the warm and fuzzies and you’ve got a hunch they’re as low as they’ll go, by all means, lock ’em down! But if you’re as patient as a cat stalking its prey, you might wait and see if they dip further.

Will 30 year interest rates go down?

– Will 30-year interest rates drop their bags and stay a while? It’s all up in the air like a pop-fly ball at a baseball game until the Fed makes their move. There’s some buzz about a rate cut in 2024, so keep your mitt ready — there might just be a chance for a catch!

Is 30 interest rate high?

– Is a 3% interest rate high? Compared to the days of 2-ish percent, it might feel like a mountain, but in the grand timeline of mortgage rates, it’s more like a molehill. So while it’s a wee bit higher than the rock-bottom rates of yesteryear, it isn’t hitting the stratosphere… yet.

What will interest rates be in 2024?

– Going out on a limb here, but if the chatter’s anything to go by, the Fed has floated the idea of cutting rates in 2024. Echoing the whispers, we could see them dip, but as with any prediction, take it with a grain of salt. It’s a bit like trying to predict the ending of a mystery novel – you never know what twist is next!

Will 30-year interest rates go down?

– Will 30-year mortgage rates go down? Frankly, my dear, I wish I knew. There’s some rumbling from the Fed about a possible rate cut in 2024, which could mean good news for rates. But then again, predicting rates is like trying to read tea leaves in a hurricane – take it with a grain of salt.

Is 2.75 a good mortgage rate?

– Is 2.75% a good mortgage rate? You bet your bottom dollar it is! That’s like snagging a ticket to a sold-out concert of your favorite band – a steal! In today’s climate, if you spot a 2.75% rate, grab it faster than a kid in a candy store.

Who is offering the lowest mortgage rates right now?

– Who’s offering the lowest mortgage rates right this second is a bit like trying to pin the tail on the donkey while blindfolded — it’s always moving! The best advice is to shop around like it’s Black Friday, ’cause different lenders can have different deals based on your credit and other factors. Ready, set, shop!