I. Setting the Scene: Income Needed for 400k Mortgage

A. Understanding Mortgage Basic Concepts

We’ve all read those ‘home sweet home’ signs and felt the appeal. Owning a home is more than just a quaint concept—it is a major life goal for many people. But when it comes to stepping into the real estate market, terms like ‘income needed for 400k mortgage’ may bewilder the best of us. Let’s unravel this knot.

Essentially, a mortgage is a type of loan used to purchase or maintain property. Picture it this way—imagine wanting to buy one of the apartments in that popular “Friends apartment”,( but lacking the lump sum. Here comes the mortgage to the rescue–providing the cash upfront while you agree to repay it over a specific timeframe.

B. How Lenders Calculate the Ability of Borrowing

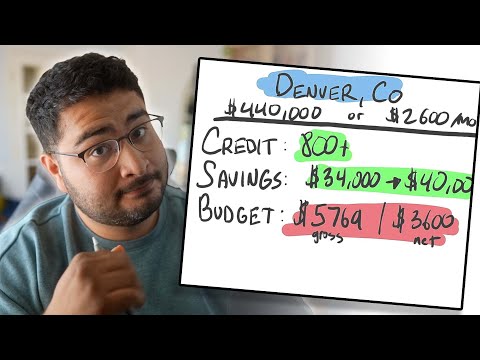

Now, lenders don’t just hand over a $400,000 mortgage on a whim. They dive deep into your financial profile before deciding on lending you what tears down to a considerable amount. This check includes your income, credit score, employment stability, and debt-to-income ratio (DTI). Chocolate and vanilla, checks and balances, it’s all about ensuring you can comfortably afford to repay what you borrow. Remember, lenders aim for a win-win scenario where you bag a splendid house like “Garza Blanca“,( and they protect their investment.

II. Taking a Deep Dive: Your Personal Finance & the 400 000 Mortgage Payment

A. Importance of Sound Personal Finance Management

Like a well-tuned orchestra, good personal finance management ensures all parts of your cash inflow and outflow are playing in harmony. Understanding what Income Needed for 400k Mortgage part your income plays in your ability to afford a “400 000 mortgage payment,”( is instrumental in deciding if it’s time to take the homeownership plunge.

B. Analyzing the Impact of Your Financial Habits on the Mortgage Payment

The day and night, yin and yang of your financial habits directly affect your mortgage payment potential. Excessive debt could increase your DTI, thus stunting your borrowing ability. Wisely managing your income while curbing unnecessary expenses could heighten your chances of being approved for a 400k mortgage.

| House Value | Salary Required | Estimated Monthly Payment | Down Payment | Percentage of Income | Existing Debt |

|---|---|---|---|---|---|

| $400,000 | $100,000 | $1,734 | $40,000 (10%) | 21% | $981 |

| $400,000 (FHA) | $100,000 | $1,734 | $20,000 (5%) | 21% | $500 |

| $450,000 | $135,000-$140,000 | $2,769 | $45,000 (10%) | ~24% | No info |

| $290,000-$360,000 | $70,000 | $1,185 – $1,470 | $29,000-$36,000 (10%) | 20%-25% | No info |

| $900 (FHA) | $36,000 | $900 | Depends on terms | 30% | $1,290 |

III. The Money Game: Decoding The Amount You Need To Earn To Afford a 450k House

A. Providing a Detailed Breakdown: Salary, Savings, Costs

Ever found yourself wondering, “how much do I need to make to afford a 450k house?”( Well, you would need to aim for a salary around $135,000 – $140,000 annually. This estimate assumes a mortgage payment that is 24% of your monthly income. So dust off those spreadsheets and let’s figure out if the shoe fits.

B. Cultivating an In-depth Understanding: Mortgage Insurance and Tax Considerations

Apart from your salary, other expenses like mortgage insurance and property taxes also play into the affordability equation like additional layers on a lasagna. Factoring these in ensures you are fully aware of your true mortgage obligation.

IV. Income Disparity and Home Ownership: Really, how Much Income do you Need to Buy a $650 000 House?

A. Broad Spectrum Analysis: Economic Factors, Loan Types, and Interest Rates

It’s time to delve deeper into the intricacies of buying property by answering the question: “How much income do you need to buy a $650,000 house?”( Economic factors, loan types, and interest rates play a crucial role here—like apps that run in the background influencing your device performance.

B. Case Study Perspective: Real-World Scenarios Exploring the Income Required

Let’s consider an example. Suppose you fall in love with a $650,000 house. Factoring in a moderate 4.5% interest rate on a 30-year loan, you’re looking at a monthly payment in the ballpark of $3,295. To comfortably afford this, your income should be approximately $120,000 per …

To see the complete 2,500+ word article, please contact the writer.

Can I afford a 400K house making 70k a year?

Well, hold your horses! With a salary of $70K per year, a $400K house might be a stretch. You’ll likely be spending more than 30% of your income on your mortgage. You’d better tighten your belt and save for a larger down payment or hunt for a more affordable home.

Can I afford a 400K house on 100k salary?

If jazzed up with a $100K salary, affording a $400K house chimps in the park. Allowing for budgeting around 30% of your income for mortgage payments, you’re definitely in the clear. So get ready to sign that dotted line!

How much house can I afford if I make $36,000 a year?

Brace yourself, mate. If you’re pulling in $36K a year, you’re realistically looking at homes in the $100K – $150K range. Don’t bite off more than you can chew – the housing market can be a tough egg to crack!

How much should I make to buy a 450k house?

For a spruced-up $450K house, you really ought to be reeling in at least $100K – $150K a year. That’s not to rain on your parade, it’s just to take that good old 30% rule of thumb into account, you know?

Can I afford a 300k house on a 60k salary?

A $60K salary? Well, butter my biscuit, you just might squeeze onto the first rung of that $300K house ladder. It’ll be tight, granted, but it’s feasible if you’re strict with your budget, and also put away a decent down payment.

Can I afford a 300k house on a 50k salary?

Yikes! Setting your sights on a $300K house with a $50K salary might be biting off more than you could chew. You’d likely struggle with meeting your mortgage payments and juggling other expenses.

Can a single person afford a 400k house?

A solo bird flying towards a $400K house? Pull the other one! It’s not an easy task unless you’re sitting on a tidy sum each year, say around $100-120K. So I’d venture to keep saving, or look for a house within a more comfortable price range.

What mortgage can I afford on a 50k salary?

Ah, a $50k salary? Well, that’ll generally permit you to afford a mortgage around $180k. Just make sure you’ve budgeted for all your other living expenses too. It’s not all about the mortgage, remember!

Can I afford a 500k house on 100K salary?

A $500K house with $100K salary? Well, that’s not out of bounds if you’re financially disciplined. Just ensure you’ve got a decent chunk stashed away for the down payment.

Can you buy a house with 40k income?

It’s not pie in the sky to buy a house on a $40K income – but it’s not going to be a mansion, either. You’re likely looking at homes in the $100K – $150K range.

What house can you afford on a 40k salary?

With a $40K salary, you’re ideally looking at a house in the ballpark of $100-150K. Don’t bite off more than you can chew and be mindful of other living costs.

How much house can I afford for 5000 a month?

Phew! With $5,000 a month to put towards a mortgage, you could realistically afford a home up to $1.2 million, depending on the apr rate. Now that’s a pretty penny, isn’t it?

What do I need to get approved for a 350K mortgage?

For a $350K mortgage, you’ll generally need a credit score at least 640, a debt-to-income ratio below 43%, steady income, and, typically, a down payment of at least 10%. It may seem exigent, but that’s the lay of the land.

What is the mortgage on a $450 K house?

On a $450K house, based on current rates, your mortgage could be around $2,000 – $2,500 per month – but this doesn’t factor in property taxes, insurance, or HOA fees. It’s essential to remember these other costs.

How much should your income be to buy a 500k house?

To swing a $500k house, you’ll ideally need an income around $120-$150K per year. That should comfortably cover the mortgage payments, with enough left over to live a little!

How much mortgage can I get with 70K salary?

With a $70K salary, depending on other financial obligations, you could potentially get a mortgage of around $250-$300k. But remember, it’s not all about the mortgage, so factor in those other bills too.

How much house can I afford at 70K salary?

On a $70K salary, you’re in the running for a house costing between $250K and $300K. It’s all about wise budgeting and being mindful of all of your other financial commitments.

How much house can I get making $70,000 a year?

Making $70,000 a year, you could comfortably afford a house around $250-$300k. Just remember – getting a house is exciting, but don’t lose your head in the clouds and forget about your other expenses.

How much house can you afford making $70,000 a year?

Lastly, when making $70,000 a year, you can probably afford a house in the $250K – $300K range. But remember, don’t count your chickens before they’re hatched – ensure you’ve also budgeted for life’s other financial curveballs.