Homeownership is a journey filled with excitement and sometimes, anxiety. One of the most critical steps in this journey is figuring out your potential monthly mortgage payments. That’s where a house payment calculator comes in handy. It’s more than a tool—it’s a financial compass that turns confusion into clarity and plans into action. Precision and trustworthiness are crucial here, and that’s exactly what you’ll find with the best house payment calculator.

Why a Reliable House Payment Calculator is Essential

Buying a home is likely the biggest financial decision you’ll ever make. Balancing your dreams with fiscal responsibilities demands meticulous planning. Here lies the value of an accurate house payment calculator. By evaluating potential monthly mortgage payments, you can plan accordingly and ensure you aren’t caught off guard by unforeseen expenses.

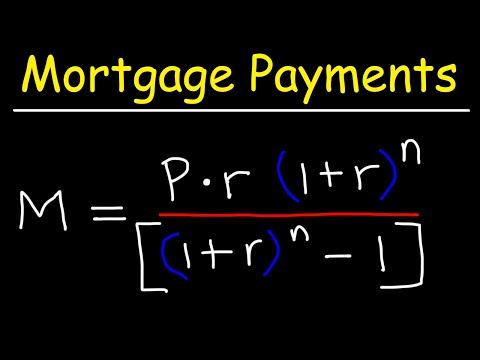

When families budget for their new home, knowing the exact monthly outlay is pivotal. Your house payment calculator will break down payments into manageable bits like principal, interest, property taxes, and PMI (private mortgage insurance). This level of detail paints a clearer picture of your monthly financial obligations.

Given the dynamic nature of real estate markets and interest rates, a reliable house payment calculator is indispensable. For example, the average mortgage interest rate fluctuates, affecting your monthly payments significantly. A trustworthy calculator helps keep you ahead of these changes.

Here’s a quick snapshot: Suppose you’re eyeing a $400,000 mortgage. At a 6% interest rate, your monthly payment for a 30-year loan would be $2,398, whereas for a 15-year loan, it soars to $3,375. Such stark contrasts emphasize why an accurate house payment calculator is essential.

Top 7 House Payment Calculators of 2024

1. Bankrate House Payment Calculator

Bankrate’s calculator offers a blend of precision and user-friendliness. It details everything from principal payments to PMI, enabling you to explore various financial scenarios. With advanced features such as extra payments or prepayments, this tool offers a comprehensive financial forecast over the loan term.

2. Zillow Mortgage Calculator

Zillow’s house payment calculator integrates seamlessly into its real estate listings, combining current mortgage rates, property taxes, and insurance costs. This holistic approach provides an accurate monthly payment estimate and helps users visualize the impact of different down payments and loan terms.

3. NerdWallet Mortgage Calculator

NerdWallet’s calculator stands out with its versatility, accounting for FHA and VA loans. It offers detailed amortization schedules and comparisons across different loan scenarios. Coupled with educational articles and financial advice, NerdWallet’s platform equips you with all the information needed to make informed decisions.

4. Quicken Loans (Rocket Mortgage) Calculator

With a reputation for speed and accuracy, Rocket Mortgage’s calculator provides detailed views of potential mortgage payments. It integrates current market data, ensuring that your financial projections are spot-on. The calculator breaks down monthly payments into principal, interest, insurance, and taxes, giving you a holistic financial picture.

5. Chase Mortgage Payment Calculator

Chase offers simplicity without compromising on detail. Its calculator highlights how varying loan terms, interest rates, and down payments influence monthly obligations. Additionally, it provides valuable insights on how fluctuating market conditions and interest rates impact long-term mortgage costs.

6. Redfin Mortgage Calculator

Redfin’s tool makes transitioning from home browsing to financial planning seamless. By integrating property listings, it allows instant mortgage cost calculations on homes of interest. Sliders for interest rates, down payments, and loan terms make complex calculations visual and straightforward.

7. Realtor.com Mortgage Calculator

More than just a monthly payment estimator, Realtor.com’s calculator comprehensively covers real estate transactions. It shines with insights on closing costs, insurance, and property taxes, helping you fully grasp the true cost of homeownership.

| Category | Details |

| Loan Term | 15 Years vs. 30 Years |

| Interest Rate Example | 6% and 7% |

| Example Loan Amount ($) | 200,000; 400,000 |

| Monthly Payment Amounts ($) | |

| – 30-Year Fixed at 7% for $200K | $1,331 |

| – 15-Year Fixed at 7% for $200K | $1,798 |

| – 30-Year Fixed at 6% for $400K | $2,398 |

| – 15-Year Fixed at 6% for $400K | $3,375 |

| Qualification Example | |

| – Monthly Payment Qualification | $1,400 |

| Loan Amount Qualified for ($) | $204,913 |

| Purchase Amount with Down Payment ($) | $224,913 (with $20,000 down payment) |

| Additional Costs | Cash reserves and closing costs |

| Calculator Features | |

| – Loan Term Options | 15 years; 30 years |

| – Interest Rate Input | Customizable at user’s discretion |

| – Down Payment Input | Customizable |

| – Payment Frequency | Usually monthly |

| – Qualification Estimation | Yes (based on monthly payment capacity) |

| Benefits | |

| – Financial Planning | Helps plan monthly budget |

| – Loan Comparison | Compare different loan terms and interest rates |

| – Affordability Insight | Understand how much home you can afford |

| – Customization | Tailor inputs for a more accurate estimation |

Factors to Consider When Choosing a House Payment Calculator

User Interface & Usability

A house payment calculator must be user-friendly. Tools like Bankrate and Zillow excel with intuitive layouts that guide users seamlessly through the process. Easy navigation ensures you don’t miss out on essential details while toggling financial variables.

Accuracy & Comprehensive Data

Accuracy isn’t just a nicety—it’s a necessity. Calculators from Quicken Loans and NerdWallet integrate real-time market data, maintaining impeccable accuracy. They consider all cost factors including PMI, insurance, and taxes, giving you reliable projections.

Additional Features

Applying extra features, such as amortization schedules and loan scenario comparisons, adds immense value. NerdWallet’s educational resources and Chase’s market insights exemplify how these features can deepen your financial understanding.

Mobile and Online Accessibility

In our digital age, responsive design across desktops and mobile devices is crucial. Redfin and Rocket Mortgage offer highly adaptable tools that support financial planning on the go.

Maximizing the Use of a House Payment Calculator

Using a house payment calculator is just the beginning. Revisit and tweak variables regularly as market conditions, interest rates, and your finances evolve. By doing this, you can better prepare for shifts and make more secure home-buying decisions. A proactive approach means fewer surprises down the road.

Also, take advantage of interest calculator mortgage and other financial tools to cross-check your calculations. This ensures that you’re not leaving any stone unturned.

Exploring the Future of House Payment Calculators

Technology continues to revolutionize how we manage finances. Future house payment calculators will likely feature advanced AI for personalized financial projections. Imagine a tool that goes beyond predicting payments—it could also optimize payment plans and suggest strategies based on real-time market trends. It’s a fascinating prospect that could redefine homeownership.

Conclusion: Embracing Your Financial Future

In sum, the best house payment calculator transforms the daunting task of financial planning into a manageable exercise. It’s not just about crunching numbers; it’s about visualizing your future and making informed decisions today. These tools are indispensable allies on your path to homeownership. So, embrace them wholeheartedly and stride confidently towards a secure and sustainable future.

Bookmark www.MortgageRater.com, share this with friends, and tap into the comprehensive tools and information that will guide you through your home-buying journey. Together, let’s unlock the doors to your dream home with precision, trustworthiness, and confidence.

Best House Payment Calculator – Accurate & Trustworthy

Why a House Payment Calculator is Your Best Friend

Thinking about buying a home? A house payment calculator is like a portal that opens up a clearer understanding of what you’ll be paying monthly. But, did you know they’re not just about numbers? They pack in a bunch of fascinating tidbits, too. For instance, have you heard how mortgage calculators have evolved? Maricela Cornejo, known for her in-depth reporting, once detailed how these tools transitioned from basic math equations to sophisticated online resources.

Intriguing Mortgage Interest Calculations

Let’s delve deeper into the nitty-gritty of mortgage calculations. Ever wondered what really goes into calculating your mortgage interest rate? Using an interest rate calculator mortgage could feel like solving a complex puzzle, but it’s actually super efficient. Here’s a fun fact: the first known use of an interest rate table dates back centuries! These calculators now seamlessly integrate various factors, from credit scores to housing market trends. And speaking of trends, have you checked out the trending rates for conventional loans lately? Many are still surprised at how these rates fluctuate with economic conditions.

Pop Culture and Mortgage Calculators

A quirky connection you might not expect – the world of anime has its share of numerically savvy characters. Take, for instance, the one piece Trans character from your favorite anime. Their strategic mind and quick calculations sometimes feel akin to how a mortgage calculator processes data in the blink of an eye. This might pique your interest: how can a simple mortgage calculator handle such intricate details with ease?

The Modern Loan Mortgage Payment Calculator

In today’s digital age, a loan mortgage payment calculator does more than just number crunching. It’s about showing you the big picture. Just imagine, with one simple tool, you can assess various scenarios of loan amounts, interest rates, and payment schedules. A side note: have you ever come across Epstein’s list and wondered how many times financial irregularities were overlooked simply because the right tools weren’t in place? It’s a stark reminder of the importance of accurate tools in financial planning.

A house payment calculator is not just a tool—it’s your financial compass, guiding you through the intricate paths of homeownership. So, the next time you sit down to crunch those numbers, remember, it’s a gateway to a wealth of fascinating insights and useful knowledge.

What’s the average house payment on a $300000 house?

For a $300,000 house, the monthly payment will depend on your interest rate and loan term. For example, with a 6% interest rate on a 30-year mortgage, you’re looking at roughly $1,798 a month.

What’s the average mortgage payment on a $200 000 house?

A $200,000 house with a 30-year fixed mortgage at a 7% interest rate has a monthly payment of around $1,331. If you opt for a 15-year fixed loan, your monthly payment would be about $1,798.

How much would a house payment be on a $400,000 house?

For a $400,000 house, with a 6% interest rate, a 30-year mortgage would mean monthly payments of about $2,398. A 15-year mortgage at the same rate would have you paying around $3,375 per month.

How much house can you buy for $1,400 a month?

With a $1,400 monthly payment, you qualify to borrow about $204,913. Adding a $20,000 down payment, you can afford a home priced at around $224,913, but don’t forget you’ll need extra cash for reserves and closing costs.

Can I afford a 300K house on a 60k salary?

A $60K salary might make it tight to afford a $300K house. Consider other debts, your down payment, and the loan’s interest rate. You might want to chat with a mortgage broker to get a clearer picture.

What credit score is needed to buy a $300K house?

Aiming to buy a $300K house would typically require a credit score of at least 620, though a higher score will get you better loan terms and interest rates.

Can I afford a 200K house on 50K a year?

On a $50K salary, affording a $200K house can be challenging, but it depends on your debt, down payment, and other financial factors. Running your numbers through a mortgage calculator can help you see if it’s doable.

What credit score is needed to buy a house?

To buy a house, you’ll generally need a credit score of at least 620. However, better credit scores get you better rates and loan terms, so it’s worth aiming higher if you can.

Can I afford a million dollar home with 200K salary?

A $200K salary might make it possible to afford a million-dollar home, but it depends on your overall debt, down payment, and the interest rate. Doing detailed budget planning and consulting a mortgage broker is a smart move.

Can I afford a 400k house with 50k salary?

A $50K salary usually isn’t enough to afford a $400K house unless you have a hefty down payment and minimal debt. You’d be stretching your budget pretty thin.

How much house can I afford if I make $70,000 a year?

If you make $70,000 a year, you could afford a house priced between $280,000 and $350,000, assuming you’re not swamped with other debts and have a decent down payment handy.

How much income do I need for a 300k mortgage?

For a $300K mortgage, you’d typically need an income of about $75,000 to $80,000 annually, depending on your other financial responsibilities and the loan’s interest rate.

How much house can I afford if I make $36,000 a year?

On a $36,000 yearly income, affording a house would likely be in the $140,000 to $160,000 range, taking into account your other debts and how much you can put down upfront.

Can I afford a house making $2000 a month?

Making $2,000 a month could make home ownership tough without a significant down payment and minimal other debts. Less expensive housing options, like condos or townhomes, might be more feasible.

Can I buy a house if I make 25K a year?

With a $25K annual income, buying a house gets tricky and depends on your local housing market, debts, and down payment. Exploring affordable housing programs could provide some help.