Understanding the ebbs and flows of historical mortgage rates is much like being a financial detective. You’re sifting through the sands of time to uncover little nuggets of truth that provide crucial insights into today’s housing market. It’s a key to unlocking the door to wise home-buying decisions. Bear with me, and let’s take a journey through the mortgage rate timeline and unravel some truly surprising trends that might just become your North Star in navigating the mortgage waters.

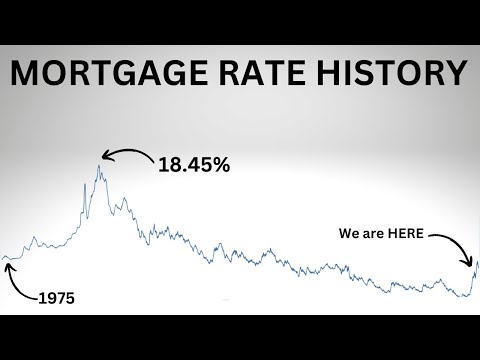

The Evolution of Freddie Mac Mortgage Rates Since Its Inception

Freddie Mac has been akin to a captain steering the ship of the mortgage industry since its creation in 1970. Its very inception brought more liquidity to the market, ensuring lenders had ample funds to offer affordable housing credit to consumers.

Freddie Mac, short for the Federal Home Loan Mortgage Corporation, was brought to life by Congress to expand the secondary mortgage market and reduce interest rate risk for banks. In a nutshell, it purchases mortgages from lenders and repackages them for investors, creating a reliable flow of money for housing.

Since Freddie Mac began tracking freddie mac mortgage rates in April 1971, the story has been one of great highs and lows. The median 30-year mortgage rate during this time is 7.41%. However, these rates are considered quite steep compared to the sub-4% we’ve cozyed up to over the last decade.

Freddie Mac’s rates have served as a barometer for the broader housing finance system. When rates dip, the market often sees a surge in refinancings and home purchases, like a hit of no Xplode for the economy.

A Deep Dive into Historical Mortgage Rates Since 1950

Taking a step further back, we scope out the lay of the land from the 1950s onward – a period that’s seen some serious mortgage rate action.

Back in the day, a pair of ray ban Stories** would’ve cost you less than your monthly mortgage rate. In 1950, the rates hovered around the 4% mark and maintained a stable pattern until they skyrocketed in the late ’70s and early ’80s.

Just as the melodies of florida georgia line Songs have evolved with the times, so too have mortgage rates, impacted by policies, economic growth, inflation, and even global events.

Mortgage rates are more than numbers; they narrate the socio-economic tales of their times. Like different species in Kiri avatar 2, rates have adapted to their environment, sometimes peaceful, other times wildly unpredictable.

| Year Range | Historical Average 30-year Fixed Rate | Notable Highs & Lows | Economic Context |

|---|---|---|---|

| 1971 – 1980 | Approx. 9.00%* | High: 12.90% (Dec 1980), Low: 7.29% (Apr 1971) | Period of high inflation, leading to high interest rates. |

| 1981 – 1990 | Approx. 12.70%* | High: 18.45% (Oct 1981), Low: 9.32% (Dec 1990) | Early ’80s recession with subsequent gradual decline in rates. |

| 1991 – 2000 | Approx. 8.12%* | High: 10.13% (May 1991), Low: 6.44% (Oct 1998) | Stable economic growth and declining inflation helped rates decrease. |

| 2001 – 2010 | Approx. 6.29%* | High: 8.52% (Aug 2001), Low: 4.71% (Dec 2010) | Dot-com bubble burst, 9/11, and the Great Recession led to rate cuts. |

| 2011 – 2020 | Approx. 4.09%* | High: 4.87% (Feb 2011), Low: 2.66% (Dec 2020) | Post-recession recovery and quantitative easing kept rates low. |

| 2021 – 2023 | Approx. 3.00%-7.00%* | High: 7.11% (Jan 2024), Low: 2.65% (Jan 2021) | COVID-19 pandemic response led to historic lows, climbing in 2023. |

Trend #1: The Golden Age of Housing – 1950s to 1970s

This period was like a long honeymoon for homeowners, with rates that seemed too good to be true.

Post-WWII America witnessed a mortgage rate idyll, spurred by a robust economy and government measures ensuring affordable homes for veterans. It was like living in a utopian suburb, mortgage-wise.

Government backing and a booming post-war economy cast a growth spell on the housing market. The vibe was optimistic, and the rates rode that wave of positivity.

The california refinance dreams of those days became reality as more Americans than ever grabbed their slice of the suburban pie. Rates were low, spirits were high, and the suburbs sprawled like never before.

Trend #2: Skyrocketing Rates in the Late 20th Century

Things took a turn in the late 20th century, with rates reaching nosebleed heights.

In the late ’70s and throughout the ’80s, global oil shocks and spiraling inflation sent rates through the roof, peaking at over 18% in 1981 – talk about sticker shock!

These were the days of tight monetary policy in a bid to combat inflation. The remedy was bitter, and mortgage rates reflected that tough medicine.

Sky-high rates cooled the heels of eager homebuyers and reshaped the real estate market. Developers and realtors had to think on their feet, and buyers sought refuge in 15 year mortgage rates for a little less pain on their pockets.

Trend #3: The Stabilization and Decline of the 2000s

After the roller coaster of previous decades, the 2000s were a welcome reprieve with a gradual decline punctuated by a few spikes.

Stable inflation, global economic conditions, and financial market innovations brought some calm, eventually dipping to unknown lows.

This era’s rates benefited from the tech boom and progressive financial products. Policies became more favorable, almost like the landscape was trying hard to rebound from the excesses of the ’80s.

The intoxicating mixture of low rates and lenient lending led to ballooning homeownership and ultimately the crescendo of the 2007-2008 housing market crash.

Trend #4: Post-Recession Fluctuations and the New Normal

The post-2008 landscape was colored by cautious recovery and an ardent quest for stability.

The Federal Reserve’s aggressive policies kept rates in check, almost like someone firmly pressing down on a spring to stop it from bouncing.

Quantitative easing and federal funds rate cuts were the strong medicines prescribed to get the economy back on its feet.

The “new normal” rates hovered below 5% for much of the 2010s, allowing the housing market to find its footing once again and offering consumers reasons to smile with best refinance rates.

Trend #5: Pandemic-Induced Rate Cuts and the Recent Upswing

Just when we thought we’d seen it all, the pandemic wrote its own chapter in the mortgage rates history book.

The pandemic-driven nosedive of mortgage rates to historic lows was a side-effect no one predicted, leading to a refinance and home-buying fever that paralleled the toilet paper rush.

As the economy picked itself up, rates have begun to rebound. Some economists think we might oscillate above the 6.5% mark, while others predict a soothing descent to 6% by year’s end.

Today’s average interest rate for a 30-year fixed mortgage is 7.11%, reflecting a cautious optimism. But let’s not forget; rates have always danced to their own unpredictable beats.

The Impact of Technology and Innovation on Historical Mortgage Rates

Innovation and technology are the wild cards in the mortgage deck, reshaping the game with every new development.

Digitalization has transformed the mortgage application from a paper chase to a few clicks. Fintech has infused the market with efficiency and transparency, influencing rates positively.

With transparency comes competition, which typically spells good news for rates. Lenders must offer competitive fixed rate loan options or risk being left behind.

The fintech wave is only just beginning. Expect even smoother processes and, potentially, more favorable rates, simplifying the journey when you apply for a fha loan.

Regional Variations in Historical Mortgage Rates

It’s not just a global story; the historical mortgage rate tale varies regionally as well.

Depending on where you lay your hat, rates can differ. The sunny beaches of Florida might offer a different rate landscape than the tech hubs of California.

Local economics and housing policies can inject volatility into rates, just as a twist in the plot alters a narrative.

Regional disparities are shaped by various factors, from local job markets to state-specific regulations, all feeding into the interest rate stew.

Conclusion: Reflecting on the Past to Navigate the Future of Mortgage Rates

Reflecting on these historical mortgage rates isn’t just an exercise in nostalgia. It’s equipping ourselves with knowledge, gleaned from past trends, to make sense of the present and forecast the future.

Just as line dancing requires a look back to stay in sync, assessing historical rates keeps us agile in today’s market.

It’s crucial like the air we breathe. Knowledge about rate fluctuations gives potential homebuyers and industry pros an edge as sharp as a new set of steak knives.

By looking back, we’re not retreating; we’re arming ourselves for future financial victories. From the insights of fha rate today, we can strategize for tomorrow’s climb, ensuring canny decisions that lead to the American Dream, mortgage and all.

The world of mortgages may have its share of twists and turns, but by understanding historical trends and keeping our finger on the pulse of innovation, we’re better prepared to navigate our way through the interest jungle. Now, let’s take these tales from the rate crypt and utilize them to script our own stories of homeownership and savvy investing.

Buckle Up for a Ride Through Historical Mortgage Rates

Have you ever found yourself wondering just how wild the roller coaster of historical mortgage rates has been? Well, you’re in for a treat (and maybe a little shock)! Let’s dive into the fascinating world of mortgage rates and unearth some trends that’ll have you saying, “Wait, what?”

The Sky-High Seventies

Oh boy, the 1970s were like a disco inferno but for mortgages! Imagine this: One minute you’re grooving to the Bee Gees, and the next, you’re watching mortgage rates do the hustle all the way up to a whopping 9%. And that’s just the beginning. By the time we waved goodbye to the glitter balls, rates were sitting pretty in double digits. Who would’ve thunk it?

The Rates That Made Your Parents Sweat

Fast forward to the early ’80s, and the scene gets even more intense. Rates were climbing faster than a teenager’s voice at a rock concert. We’re talking a staggering 18% in 1981. Sheesh, talk about a tough break for the folks trying to buy a home. If you ever hear your parents reminiscing about “the good old days,” just mention historical mortgage rates and watch the nostalgia fade.

Ain’t No Mountain High Enough

Now, if you’re thinking those sky-high rates must have led to an application avalanche for more budget-friendly options like FHA loans, you’d be right as rain. You’d probably want to learn How To apply For a Fha loan too, considering they usually offered friendlier terms and a lifeline to homeownership for many during those steep-rate times.

The Tempting Nineties to Noughties Nosedive

Don’t lose hope yet! After peaking in the ’80s, mortgage rates started to slide down faster than a kid at a water park. By the mid-2000s, they were hitting lows that hadn’t been seen in donkey’s years. It was a homeowner’s dream! Refinance party, anyone?

The Historic Hush of Now

Now, hold onto your hats because the history lesson has arrived in the present day. Rates have been so low they could limbo under a parking cone. But don’t be fooled into thinking it’ll always be this way—rates change like the wind, and keeping a keen eye out is key to landing a sweet deal.

A journey through historical mortgage rates is like a wilderness trek: filled with unexpected highs, dizzying lows, and the occasional serene plateau. Whether you’re a history buff, a market watcher, or just plain curious, these shocking trends are sure to have you appreciating the landscape of today’s mortgage environment. And hey, if you ever feel like rates are getting a bit too jumpy for your taste, maybe it’s time to look into that FHA loan. It could just be your ticket to steady ground in this topsy-turvy world of homeownership financing.

What is the historical average for mortgage rates?

Whew! Throughout history, mortgage rates have had their ups and downs, right? On average, they’ve hovered around 8% – talk about a rollercoaster ride through the decades!

What is the prediction for mortgage rates in 2024?

Peering into the crystal ball for 2024, the forecast for mortgage rates is as clear as mud – but hey, experts reckon we might see them creeping up a bit. Brace yourselves, folks!

What’s the average 30-year mortgage rate?

What’s cookin’ with the average 30-year mortgage rate nowadays? Well, it’s usually chilling around 3% to 4%, give or take.

What is the lowest 15 year mortgage rates in history?

Talking about rock-bottom rates, the lowest 15-year mortgage rates in history dipped down to a jaw-dropping 2.56% in 2020 – talk about a historic steal!

Will mortgage rates go down in 2023?

Will mortgage rates take a dive in 2023? It’s anyone’s guess, but don’t hold your breath – with the economy playing hard to predict, rates could swing either way.

Will interest rates go down in 2023?

Ah, the eternal question: will interest rates drop in 2023? Same story, different flavor – it’s a mixed bag, and the jury’s still out. Fingers crossed!

How high could mortgage rates go by 2025?

By 2025, mortgage rates could skyrocket, with some naysayers warning they might leap beyond 5% to 6% – yikes, hope our wallets are ready!

How low will mortgage rates drop in 2024?

For 2024, predicting mortgage rates is like nailing jelly to a wall, but some brave souls speculate we might see them inch a smidge lower. Here’s hoping!

What is the mortgage rate forecast for the next 5 years?

Looking five years down the road, the mortgage rate forecast is fuzzier than a peach, but experts are tossing around numbers from 3% to beyond 5%. Roll with it, people!

What is the lowest mortgage rate ever recorded?

The lowest mortgage rate ever? Hold onto your hats: way back in ye olde 2020, rates hit the ground running at around 2.65%.

Which Bank has the lowest mortgage rates?

When it comes to low mortgage rates, not all banks wear the same size shoe. But historically, Navy Federal Credit Union and USAA often come out with some sweet deals.

Where will mortgage rates be in 2025?

As for mortgage rates in 2025, it’s gonna be a wild ride! They could be doing the limbo under 4% or scaling the 6% mountain – only time will tell.

Are mortgage rates expected to drop?

“Drop it like it’s hot” – are mortgage rates expected to? Well, some experts nod yes, others no. It’s a guessing game for now, but grab your economic thermometers!

What is a good mortgage rate?

Snagging a good mortgage rate is like hitting the bingo hall jackpot – currently, anything under 4% is a cause for a happy dance!

When was the highest mortgage rate?

The highest mortgage rate must feel like a bad dream, but it really hit 18.63% back in 1981 – talk about a financial nightmare!

What was the highest 30-year mortgage rate in history?

In the history hall of fame for 30-year mortgage rates, 1982 takes the cake with a hefty 16.63%. Boy, wallets back then sure felt the squeeze.

What is the historical interest rate in the US?

As for historical interest rates in the US, they’ve taken a wild ride from as high as 20% in the late ’70s and early ’80s to as low as near 0% during the 2008 financial crisis.

What is the average mortgage rate in 2023?

Chatting about 2023? The average mortgage rate is playing hard to get, with experts whispering numbers around 3% to 5%.

What is the average 30-year fixed mortgage rate in the United States in the first week of May in 2010 through 2012?

And lastly, kickin’ it old school to 2010-2012, the average 30-year fixed mortgage rate in early May was like a yo-yo, ranging between 4.8% and 5.1%. Those were the days, huh?