Guide to Current Mortgage Rates 30 Year Fixed

The buzz in the air is palpable among homebuyers and financial experts alike as we witness a significant shift in the mortgage landscape. “Current mortgage rates 30 year fixed” seems to be rolling off the tongues of potential homeowners with an air of relief and a spark of excitement. Let’s dive deep into this pivotal moment in the housing market – one that might very well be the silver lining for many.

Unveiling the Downtrend in Current Mortgage Rates for the 30-Year Fixed Loan

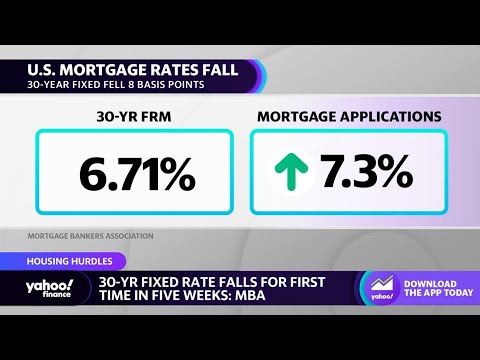

The year 2024 has been a roller-coaster for the mortgage industry. After seeing interest rates climb to a nerve-wracking 20-year high due to inflation and Federal Reserve hikes, the tables are turning, and homeowners are starting to breathe easier. Current mortgage rates for a 30-year fixed have seen a drop from a staggering 6.9% to a more palatable rate that’s flirting with the 6% mark.

This shift isn’t just a blip on the radar. The Mortgage Bankers Association’s February Mortgage Finance Forecast is painting a hopeful future, projecting rates to tumble even further to around 6.1% come the final quarter of 2024. What’s more, they’re pegging them to dip below the 6% threshold as we saunter into 2025.

Historically, current mortgage rates 30-year fixed have been a benchmark for stability in an otherwise turbulent market. Observing the surprising but welcome downtrend, financial soothsayers are buzzing about a revival in homeowner affordability. The rate drop is a distress flare for economic factors that cruise beneath the surface, steering the market in unexpected directions.

The Impact of Declining Current Mortgage Rates on 30-Year Fixed Loans

The drop in the current mortgage rates 30 year fixed is much more than a juicy headline; it’s a game-changer for the housing market. Homebuyers are finding themselves in the sweet spot where affordability crosses paths with real estate dreams. A percentage point drop might seem minuscule on paper, but rest assured, it’s enough to kick open doors to homeownership for many.

The allure of lower monthlies is a siren call for homeowners mulling over refinancing. They’re lining up to capitalize on these rates to shrink their interest payments, which, my friends, is akin to finding an unexpected treasure trove in your backyard.

But the effects on the housing market and investment strategies are long-term knotty affairs. A fall in rates can amplify market demand, sending home prices aloft as more buyers jostle in the playground. Yet, it may also signal a haven for astute investors to carve out healthy returns in real estate.

| Data Point | Information |

|---|---|

| Current Average Rate | *TBD (To offer a precise rate, real-time data is required)* |

| Predicted Q1 2024 Rate | 6.9% |

| Predicted Q4 2024 Rate | 6.1% |

| Predicted Threshold for Q1 2025 | Below 6% |

| Historical Context | Rates at a 20-year high due to inflation and Federal Reserve rate hikes |

| Strategy for Homebuyers | Consider buying now with intent to refinance once rates drop |

| Competitive Market Forecast | Increase in buyer competition expected in upcoming year |

| Potential Rate Range for 2024 | 5.9% to 6.1% |

| Source of Forecasts | Mortgage Bankers Association’s February Mortgage Finance Forecast |

| Impact of Fed Hikes | Direct correlation with rising mortgage rates |

| Refinancing Consideration | Can be beneficial if rates fall as predicted, saving on interest over the long term |

| Expected Timeline for Lower Rates | Gradual decrease throughout 2024 into early 2025 |

| Industry Outlook | Suggests a more favorable borrowing environment in the near future |

A 2024 Comparative Snapshot of Current Mortgage Rates for 30-Year Fixed Loans

Let’s put the spotlight on the industry gladiators offering these attractive fixed mortgage rate. The stalwarts like Wells Fargo, Quicken Loans, and Chase are each extending their own version of the 30-year fixed mortgage olive branch. Shopping around, you’d find current rates skating around 6.1%, with each lender sportingly jousting for your signature.

The variations in their offers are nuanced, hinging on factors like points and closing costs. Here’s where the rubber meets the road, and consumers need to bring their A-game to the negotiating table. Assessing these slight but crucial differences can spell the difference between a savvy decision and a face-palm moment.

Behind the Scenes: The Forces Driving Current Mortgage Rates Downward

Roll up your sleeves, because we’re about to peel back the layers and peek at the core of what’s muscling down these rates. The Federal Reserve has been puppeteering the show with its monetary policy maneuvers, which largely impact the ebb and flow of mortgage rates.

But don’t overlook the bond market. Those seemingly indecipherable trends and investor appetites are instrumental in setting the tempo for rates. And when the world stage is roiled by economic events, ripples invariably find their way to the shores of the U.S. mortgage market, fervently impacting the interest rates 30 year fixed.

The Smart Borrower’s Guide to Capitalizing on Current Mortgage Rates for 30-Year Fixed Loans

Here’s the meat and potatoes of the matter: if you’re playing in the mortgage market, you need to wrap your head around the playing field. Locking in low rates is a mingling of art and science – one part timing, one part financial finesse. Keep a hawk-eye on your credit score, and know that your down payment is more than a chunk of cash; it’s a bargaining chip.

When it comes to lender quotes, approach them like a detective at a crime scene: scrutinize every detail. I’m not just blowing smoke; understanding the fine print could save you a bundle over the long haul.

Expert Opinions on the Future Trajectory of Current Mortgage Rates for 30-Year Fixed

Here, we listen to the oracles of industry: analysts and economists, who, with their crystal balls, offer us a glimpse into the murky waters of rate forecasts. There’s chatter about inflation rates and housing starts being the mystical indicators that could either buoy us into a sea of stability or send us scurrying into choppy waters.

Financial prophets can’t seem to sing from the same hymn sheet (you know, like the enigmatic lyrics we mull over in “you’re so vain lyrics”), providing us wit’s as many scenarios as there are stars in the sky. Yet, amidst the cacophony of differing opinions, one thing holds true – knowledge is power, and staying informed is non-negotiable.

The Real-World Effects: Homebuyers and Homeowners Share Their 30-Year Fixed Mortgage Experiences

There’s no substitute for lived experiences, and oh, do we have stories to tell! From the Smiths nabbing their forever home thanks to the drop to the Johnsons’ nail-biting refinance gambit that paid off handsomely – these anecdotes stitch a human quilting to the statistical fabric.

There’s wisdom to be mined from these personal tales across the demographic spectrum. Each story shines a light on decision-making processes and financial impacts, often with the colorful flair of a cast Of Barbarians narrative.

Navigating the Drop in Current Mortgage Rates for the 30-Year Fixed Loan

Navigating the mortgage rate maze requires more than just a map; it needs a well-tuned compass. For homebuyers, it’s about striking when the iron’s hot, while also understanding that mortgage planning can be a marathon, not a sprint.

The importance of timing and market analysis is as crucial as finding your dream home. Jumping the gun or dragging your feet could both cost you dearly in the dance of fluctuating rates.

Preparing for the Unexpected: Risks and Considerations Amid Fluctuating Rates

With every dip and surge in the rates resides inherent risk, as market volatility is a beast that often throws a wrench in the most well-oiled plans. And yet, amidst this uncertainty, the 30-year fixed-rate mortgage remains the North Star—offering a beacon of stability and predictability.

But let’s clear the air—misconceptions abound, and believing that mortgage rates are tethered to federal rates as closely as mary lee harvey is to prolific works of Steve Harvey would be folly. Let’s demystify these murky waters together.

A New Era in Home Financing: The Role of Technology in Securing Low Mortgage Rates

Technology has disrupted the mortgage sector with a vengeance, and it’s a sight to behold. Digital knights in shining armor – online brokers and comparison tools – are revolutionizing how we uncover the Holy Grail of low rates.

Efficiency and access are the watchwords here, providing a crystal-clear lens on current mortgage rates for a 30-year fixed. As these platforms evolve, so too does the landscape of the mortgage industry, possibly forever altering the path to homeownership.

Setting the Record Straight: Debunking Myths About Current Mortgage Rates for 30-Year Fixed

Time to set the record straight and dispatch some of the myths swarming around mortgage rates like bees around a honeypot. Federal rates are merely a piece of the puzzle, not the whole darn picture. And if you think the mortgage application process is akin to rocket science, let’s bring you back down to earth—it’s not.

Clarification is key, and navigating this with finesse could see you leapfrogging over the common pitfalls that trap the unwary.

Innovate Strategies for Sustaining Homeownership Amidst Rate Fluctuations

Now, let’s talk turkey about financing options. Adjustable-rate mortgages and rate locks are not just terms thrown around at a high-stakes poker game; they’re tangible tools in your arsenal. And don’t turn your nose up at government programs—they can hitch your wagon to homeownership without breaking the bank.

It’s about elegance in strategy; finding a path through the jungle of rate changes while maintaining the endgame of affordability.

Embracing Opportunity in a Changing Market: How to Leverage Low 30-Year fixed mortgage rates for Investment and Growth

Consider this: current mortgage rates take a dip, and suddenly, real estate investments start looking as appetizing as a prime cut of steak. But there’s no free lunch here—robust financial planning is the cornerstone of leveraging low rates.

Forge forward with a clear sight of property investment decisions. It’s a tapestry of timing, insight, and a dash of boldness that could see you flourishing in the wake of the current rate drop.

The narrative we’ve woven is as intricate as it is illuminating. With current mortgage rates for a 30-year fixed expected to shimmy down to a cozy 5.9% to 6.1%, there’s a buzz in the real estate hive. And as these economic pollinators do their dance, it might just be the perfect time for you to collect some sweet, sweet honey of your own in the land of mortgages and homeownership.

A Deep Dive into Current Mortgage Rates 30-Year Fixed

Hey there, future homeowners and financial buffs! Get ready to tackle some juicy details on the ever-evolving world of mortgages. While we’re all crossing our fingers for those current mortgage rates 30-year fixed to take a nosedive, let’s sprinkle in some brainteasers and jaw-droppers that might just make you say, “Well, I’ll be darned!”

Now, it’s no secret that mortgage rates can be as unpredictable as the plot twists in a classic movie. Speaking of twists, did you know that the iconic “You’re So Vain” might have found its way into conversations about vanity, but it’s also an apt metaphor for how most of us feel about interest rates? We often think that rate changes are about us—impacting our life plans, much like the elusive subject of Carly Simon’s classic tune. When you’re fretting over the Ebbs And Flows Of interest rates, just remember, you’re not alone in this financial soap opera.

As we pivot from melodies to movies, let’s grab some popcorn and chat about the number seven—specifically, the Holland 7. This name might remind you of those grandiose movie theaters where complex stories unravel, but it’s also an incredible coincidence with mortgages. Every seven years, statistically speaking, homeowners are likely to refinance or move—almost as if there’s a script dictating our housing destiny. So, the next time you’re at the cinema, pondering whether to catch the latest blockbuster, consider how the drama of fluctuating rates( could be the next riveting saga on your financial journey.

Mortgage Rate Mayhem and Trivia That Sticks

Well, butter my biscuit, let’s keep the ball rolling with even more snippets of wisdom! At the most recent Ces 2023, all sorts of cutting-edge tech were unveiled. But amidst the glitz, glam, and gadgets, a humble observation was made: technology evolves much like our beloved mortgage rates. They both share an ability to transform our lives in the blink of an eye. Keep this in mind: as you’re contemplating what might be the best move for your nest egg, remember that innovation—and mortgage rate anticipation—never( sleeps!

And before we put a pin in it, let’s not forget that while we track the trends of current mortgage rates 30-year fixed, these numbers are more than just figures on a page. They represent dreams, life shifts, and sometimes, a gamble on the future. It’s a whirlwind world of numbers that we ride, like a financial rollercoaster, with highs, lows, and the occasional loop-the-loop!

So there you have it, folks. Just a bit of fun within the serious game of snagging the best mortgage rate. Keep your eyes peeled and your ear to the ground—the next headline you see might just read “current mortgage rates 30-year fixed plummet” and when it does, you’ll already be one step ahead with these trivia tidbits in your back pocket.

What is the interest rate on a 30-year fixed right now?

– Well, buckle up, because mortgage rates have been on a roller-coaster ride! If you’re wondering about today’s 30-year fixed rate, it’s hovering at heights that might give you the jitters: think 20-year high. As trends go, that’s about 6.9% as of now. But hey, don’t let that number put a wrinkle in your plans!

Are mortgage rates going down in 2024?

– Are mortgage rates going down in 2024? You bet your bottom dollar they are! The wise folks at the Mortgage Bankers Association are seeing a light at the end of the tunnel, forecasting a dip from the peaky 6.9% to a more manageable 6.1% by the time we’re singing Auld Lang Syne in 2024.

Are mortgage rates expected to drop?

– Expected to drop? Absolutely! The crystal ball—aka industry experts—suggest we’ll see those stubborn rates take a humble bow, slipping from their lofty perch throughout 2024. They might even sneak below that coveted 6% mark as we step into 2025. Fingers crossed!

What is today’s current interest rate?

– So, you want the skinny on today’s current interest rate? Hold onto your hats, because as it stands, we’re staring down the barrel of a 6.9% rate. Yup, it’s enough to make your wallet feel a little light.

Who is offering the lowest mortgage rates right now?

– If you’re hunting for the lowest mortgage rates, word on the street is it’s a fierce competition out there. But keep your eyes peeled; some lenders are more thirsty for your business than others and might just dangle that juicy carrot of lower rates.

What is the lowest 30-year mortgage rate ever?

– The lowest 30-year mortgage rate ever? Oh, that’s a trip down memory lane to those golden days when rates dipped to a jaw-dropping 2.65% in January 2021. Those were the days, huh?

Will mortgage rates ever be 3 again?

– Will mortgage rates ever hit 3% again? Never say never, right? But with the way things are looking, that’s like waiting for pigs to fly. Still, who knows—stranger things have happened.

Will 2024 be a better time to buy a house?

– Pondering whether 2024 is your year to snag a new pad? It might just be! With rates expected to mellow out and a less cutthroat market, it could be the sweet spot for signing on the dotted line.

How low will mortgage rates go in 2025?

– How low they’ll go in 2025 is anyone’s guess, but rumblings from the wise owls at the Mortgage Bankers Association suggest we could be seeing rates sneak below that elusive 6% mark. Here’s hoping!

Should I lock in my mortgage rate today or wait?

– To lock or not to lock, that is the question. With rates taking us on a bumpy ride, locking in today might save you from biting your nails tomorrow. But then again, if you’re feeling lucky—waiting could be your golden ticket.

What is a good mortgage rate?

– Good question! A good mortgage rate is like finding a four-leaf clover—rare and oh-so-fortunate. These days, anything under the current 6.9% is like striking gold. But remember, ‘good’ is in the eye of the beholder (and your budget!).

What will mortgage rates be in 2025?

– Picture this: It’s 2025, and if the prognosticators are on the money, we could be basking in the glory of sub-6% mortgage rates. Start the countdown!

Who has the highest interest rates right now?

– Who’s the king of the hill with the highest rates? Now, that’s a race nobody wants to win. Lenders with the highest rates are about as popular as a skunk at a garden party. Shop around; your perfect match with lower rates is out there.

Why are mortgage rates so high?

– So, why are we squinting at sky-high mortgage rates? In a nutshell, inflation and the Fed’s hikes are throwing their weight around like bouncers at a nightclub. The result? A 20-year high that’s turning wallets inside out.

How do you buy down interest rate?

– You wanna score a lower interest rate, huh? It’s all about buying down, friend. Shell out a little extra cash upfront, grab those points and watch your interest rate fall. It’s like a little financial magic trick, but with paperwork.