As the year 2024 unfolds, we’re seeing a rather welcomed shift in the financial stratosphere: current 30 year fixed mortgage rates are starting to take a downhill trajectory. With such an economic rollercoaster over the past decade, this dip is a refreshingly positive turn for potential and existing homeowners.

A Brief History of Current 30 Year Mortgage Interest Rates in the Last Decade

The story of mortgage interest rates over the past decade is quite the tale, with twists and turns that could belie definition. Rates have seen their highs and lows, scaling the unforeseen peaks of economic turbulence, and coasting through valleys of fiscal stimulus. In the somber days of 2014, rates hovered around the mid-4% range, a considered norm then, but what would now feel like a mortgage bargain. Fast forward to the pinnacle of the unconventional 2020s, rates plummeted to record lows, with the height of the coronavirus pandemic seeing average 30-year mortgage rates at around 2.65%.

The landscape since then has been a constant juggle, influenced by factors like Federal Reserve maneuvers, inflation battles, and the overall health of the economy. Each economic event, from trade wars to fiscal cliffs, has left an indelible mark on how lenders set their rates.

Understanding the Basis of Current 30 Year Mortgage Interest Rates

Lenders set a course that’s part heartbeat, part hard numbers when determining 30-year mortgage rates. It’s not a decision plucked from thin air, but one that’s intricately linked to the economic policies and conditions set forward by the good old Federal Reserve. They’re kind of like conductors of an orchestra, ensuring each instrument—be it employment rates, inflation, or economic growth—plays its part harmoniously. But when the music hits a sour note, that’s when you see the Fed stepping in with an interest rate hike or cut to set the tempo right.

| Data Point | Detail |

| Current Average 30-Year Rate | *Check Latest Data* |

| Expected Rate End of 2024 | ~6.00% |

| Expected Rate Early 2025 | High-5% Range |

| Factors Influencing Rate Decline | – U.S. economy weakening |

| – Slowing inflation | |

| – Potential Federal Reserve rate cuts | |

| Future Rate Patterns | – Gradual decreases, likely in 25-basis-point increments |

| Historical Rate for Comparison | – Around 2.65% during the peak of the coronavirus pandemic |

| Economic Forecast Summary | – 30-year rates projected to stay high compared to pandemic |

| era but expected to decline slowly |

Evaluating the Impact of Current 30 Year Mortgage Interest Rates on Homebuyers

Now let’s put a face or two to these statistics. Imagine John and Jane, staring dreamily at a white picket fence that borders their potential future—except, their dreams have price tags that wobble with the rates. When interest rates take a hike, so do John and Jane’s prospective monthly payments, tipping the scales of affordability.

However, as we teeter into 2024 and rates begin to dip, their dream inches closer to reality. The affordability equation starts to shift in their favor, making way for hopeful homeowners to plant their stakes in the ground of their own front yard.

Current 30 Year Mortgage Interest Rates in Comparison: 2023 vs. 2024

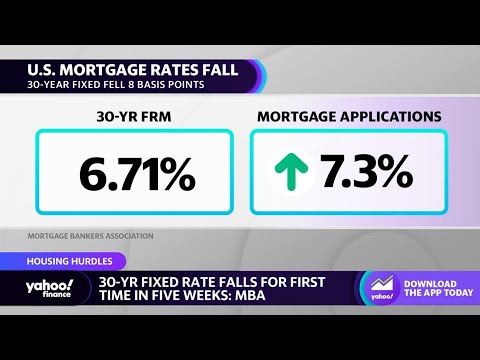

It’s always a game of numbers and narratives. Compared to last year, current 30-year mortgage rates have taken a bow, entering the high-5% to low-6% range—and early predictions for 2025 indicate we may even dip our toes in lower waters. This change could be seen as lenders’ attempts to woo borrowers back, keeping the doors of opportunity ajar amid broader economic cooldowns.

How Major Banks Have Reacted to the Dip in Current 30 Year Mortgage Interest Rates

Major financial titans like JPMorgan Chase and Wells Fargo didn’t just sit back and watch the show; they responded with strategic rate adjustments. These fluctuations have a butterfly effect, influencing the mortgage market and, subsequently, the consumer’s power of choice.

With a keen eye on these rates, savvy consumers can strategize their mortgage moves much like selecting the right pair of Walmart Crocs—opting for comfort and affordability amidst variable conditions.

Expert Opinions on Current 30 Year Mortgage Interest Rates and Future Predictions

Once you delve into the minds of financial analysts and mortgage brokers, the consensus is cautious optimism. Forecasts suggest a tempered decline in rates, with gradual cuts bubbling beneath the surface of 2024. Predictive models based on data analysis are hinting at the potential of landing closer to 6% by year’s end.

Experts are staunch in their belief that rates will remain statuesque compared to the historic lows spurred by the pandemic. Yet, homebuyers could find solace in these projected easing rates, steadying their financial sails as tides turn slowly in their favor.

The Global Perspective: How US 30 Year Mortgage Interest Rates Compare Internationally

Comparatively, the US mortgage realm stands at a crossroads, sized up against the international market. As global economic events unfold—a Brexit here, a trade agreement there—the reverberations reach the shores of the US housing market. The current rates, while dipping domestically, must be embraced within the context of an intermingled world economy, where each nation’s financial health tugs at the other’s.

Current 30 Year Mortgage Interest Rates and the Bond Market Dynamics

The dance between mortgage rates and bond yields is as intricate as a ballet, a performance of cause and effect. When bond yields take a nosedive, mortgage rates often echo this movement. The recent bond market behavior, with a soothing descent, hints at why current 30 year mortgage interest rates are showing signs of restraint.

The Influence of Government Policy on Current 30 Year Mortgage Interest Rates

A quick glance at government housing policies could give us a crystal ball into the future. Policies aiming to sustain or revitalize housing markets can play a pivotal role in swaying interest rates. The projection sees policymakers wielding their influence to curb or cushion these rates, keen on nurturing a stable housing ecosystem.

Borrower Strategies in Light of the Current 30 Year Mortgage Interest Rates Forecast

Now, let’s roll up our sleeves and strategize. As a would-be homebuyer or existing mortgage holder, the forecasted slide in rates beckons a few moves. It’s about weighing the permanence of fixed-rate mortgages against the potential savings of adjustable-rate options, all in the context of the current economic milieu.

Walking this financial tightrope requires a blend of foresight and flexibility, much like finding the opportune moment to venture through the aisles of East Point mall, balancing between the best deals and personal budget.

Interactive Technology and Tools for Tracking Current 30 Year Mortgage Interest Rates

Tech tools and apps have sprawled up, transforming how we track current 30 year interest rates. These platforms have become indispensable, moving beyond neat widgets to becoming core to financial planning with their tireless number crunching and alert systems.

Diligent research reveals that while these tools are trustworthy comrades, they reflect a dynamic market, necessitating users to stay engaged and always seek a second opinion—much like consulting with a range of doctors before serious surgery.

Exploring Case Studies: Success Stories in the Current 30 Year Mortgage Rate Environment

Real-world stories abound of borrowers playing their cards right in the current mortgage rate climate. From Jill, who jumped on a rate dip for a swift refinance, to Jack, who locked in a low rate for his first home just as the market began to sway, their narratives are testimony to strategic thinking and swift action, setting benchmarks for others to aspire.

They’ve navigated the nuances of current 30 year mortgage rates and emerged with tales of victory, harbingers for others looking to make their mark in the realm of real estate investments.

When to Lock In: Timing Your Mortgage with Current 30 Year Interest Rates

Timing is everything, and nowhere is this truer than in locking in a mortgage rate. With the prediction of easing rates, the question of when to strike becomes the $300,000 question—or however much that dream house costs.

In-depth research indicates that while rate lock periods offer a haven from volatility, understanding the terrain and strategic timing can tilt the scales in the borrower’s favor. Just as one would discern the perfect time to listen to a Barbie Benton record, there’s a sweet spot for locking in that mortgage rate.

Beyond the Rate: Other Essential Factors When Considering a 30 Year Mortgage

Rates are just the tip of the iceberg. Dive deeper, and you’ll grapple with fees, closing costs, and penalties that complete the financial puzzle. It’s the APR—Annual Percentage Rate—that deserves the spotlight, offering a truer gauge of the loan’s cost and serving as a compass in the search for the right mortgage.

Taking an all-encompassing view, much like appreciating a meal beyond just the taste, involves savoring the service, ambiance, and overall experience—is critical when courting long-term financial commitments, like a mortgage.

A Prospective Outlook: Where Are Current 30 Year Mortgage Interest Rates Heading?

Blending expert analysis with economic indicators rounds off a forecast that sees current 30 year mortgage interest rates meandering towards a milder climate. The implications of these trends herald both challenges and opportunities for the housing market and the broader economy. As the rates continue their dance, the spotlight turns to affordability, market stability, and economic growth potential.

An Innovative Wrap-Up: Synthesizing Insights on Current 30 Year Mortgage Rates

In summary, the trajectory of current 30 year mortgage rates paints a cautiously optimistic future. As we edge into a year of potential economic softening, borrowers may find themselves in seats of opportunity, provided they remain astute, informed, and ready to act.

Armed with insights from this comprehensive overview, may readers turn the page emboldened, ready to harness the ebbs and flows of the mortgage rates in 2024 and beyond. For those poised to make the leap, now could well be the time to draw up plans and ready the pens for signatures that spell “home.”

Unpacking the Dip in Current 30 Year Mortgage Interest Rates

Well, buckle up folks because the world of home financing is as wild as a rollercoaster—speaking of wild, did you know that current 30 year mortgage interest rates have been on a thrilling ride themselves? Picture this: you’re on the cusp of sealing the deal on your dream home, and boom! Rates take a dip, much like your heartbeat right after a thrilling sexual experience, making your dream that much more attainable.

Mortgage Rates: Fun Facts & Oddities

Now, let’s sprinkle in some trivia to spice things up a bit. Did you ever stop to think about how these percentages that we tend to obsess over actually came to be? It’s almost like the art of brewing the perfect cup of coffee; it involves a meticulous blend of economic trends and fiscal policy—no sugar-coating here! When the economy’s as unpredictable as a cat on a hot tin roof, then bam! Those elusive current 30 year mortgage interest rates tick down, and suddenly everyone’s ears perk up.

Holding onto that nugget, have you ever pondered the sheer vastness of the mortgage market? It’s mind-boggling, really. To put it in perspective, let’s just say you’re more likely to find your dream house with that freshly cut lawn smell than to fully map out the zigzags of the interest rate landscape. And just when you think it’s snooze-ville, the rates prove they’ve got more ups and downs than your last chaotic game( of Monopoly.

The Ebb and Flow of Rates

Crafting the perfect analogy, you could say tracking these rates is like trying to catch soap in the bath—utterly slippery and unpredictable. One day, you’re planning your budget tighter than a new pair of shoes, worried about high interest gnawing at your wallet. The next day, the news drops that current 30 year mortgage interest rates are down, and it’s as if a weight has been lifted. Suddenly, that white picket fence fantasy no longer seems light years away.

In closing this merry dance around rates, just remember: mortgage rates might not be the life of the party, but they surely do love to make an entrance. And as your friendly neighborhood finance aficionado, I’ll keep you posted on their next move—because, in the end, who doesn’t love a good surprise?

What is the 30-year interest rate right now?

– Hold on to your hats, folks! Current 30-year fixed mortgage rates are doing a bit of a high-wire act these days. They aren’t exactly sky-high, but you won’t catch them lounging in the bargain basement either. To pin down an exact figure, you’ll need to check the latest quotes, as they can change faster than the weather in April.

Are 30-year mortgage rates dropping?

– Ah, the crystal ball question! Well, buckle up because it looks like 30-year mortgage rates are poised to take a bit of a dip later this year. It’s not gonna be a nosedive, but with the economy showing signs of a slow jam and inflation cooling its heels, we’re eyeing a gentle slope down into the low-6% range. That’s right, no steep drops, just a soothing glide downwards.

What is the federal interest rate for a 30-year mortgage?

– For the nitty-gritty on federal interest rates, look no further! If we’re talking about the rates Uncle Sam is slinging for a 30-year mortgage, expect them to shadow the market trends. So, while the Fed isn’t handing out rates directly, their moves are like a mood ring for the market. And with some chatter about rate cuts on the horizon, that mood is looking cautiously optimistic!

Are mortgage rates going down in 2024?

– Gazing into the future, are we? Well, if predictions are worth their salt, we’re likely to see mortgage rates mosey on down in 2024. Sure, we’re not expecting any dramatic plunges, but rather a leisurely stroll to more wallet-friendly territories, with rates potentially cozying up around 6% by the year’s end.

Are mortgage rates expected to drop?

– You betcha, mortgage rates might just be getting ready for a bit of a chill session. With the economy taking a breather and inflation putting its feet up, there’s talk of rates getting a trim. Now, don’t expect a buzz cut to those historic lows, but a tidy little haircut to more manageable levels? Definitely in the cards!

Who is offering the lowest mortgage rates right now?

– Alright, gather ’round bargain hunters! Spotting the lender with the lowest mortgage rates is like finding a needle in a haystack, and a constantly moving one at that. These rates are shifty characters, changing daily, so your best bet is to keep your eyes peeled, compare deals frequently, and jump on it like it’s the last slice of pizza.

Will interest rates ever go back to 3?

– Going back to 3% interest rates is like hoping for a reunion of your favorite band from high school—it’s a nostalgic dream, but don’t hold your breath. While we all miss those rock-bottom rates from the pandemic days, the word on the street is that we shouldn’t count on an encore performance anytime soon.

What is the mortgage rate forecast for 2024?

– For your mortgage rate weather forecast in 2024, expect partly cloudy with a chance of rate drops! We’re looking at a gentle slide into the low-6% range, so think less monsoon, more steady drizzle. And hey, don’t forget to bring an umbrella—just in case the forecast tweaks a bit.

What is the lowest rate ever for a 30-year mortgage?

– Historical low for the 30-year mortgage rate? Picture this—it was a wild time during the pandemic when rates were so low they could limbo under a toddler’s high chair. The record-smashing low of about 2.65% was a sight to behold, but like all good things, it didn’t stick around forever.

What is current Fed rate?

– The current Fed rate? Well, it’s like a celebrity—always on the move and in the spotlight. As of now, they’re holding the purse strings a bit tight, but if you want the latest juicy details, a quick online search will give you the scoop—as fresh as today’s doughnuts.

What are interest rates today?

– “Interest rates today” sounds like a hot topic at your local coffee shop. And rightly so! They’re juggling around, with 30-year mortgage rates enjoying the trapeze act. For the most accurate number, better check the latest quotes, as they’re more fickle than a cat deciding whether to go outside.

What is a good debt to income ratio?

– Talking about a good debt to income ratio (DTI) is like discussing a recipe for a perfect pie—it varies, but in the world of lending, you’re aiming to whip up a number below 43%. That’s the sweet spot lenders typically gobble up when they’re deciding if you’re a good candidate for a loan.

Will 2024 be a better time to buy a house?

– Is 2024 shaping up to be a house-hunting paradise? Well, it’s looking like the real estate market might be rolling out the welcome mat! With rates potentially tipping their hats goodbye to their recent peaks and waving hello to more affordable realms, your home-buying odyssey could hit a high note.

What will mortgage rates be in 2025?

– Fast forward to 2025 and we’re not just blowing smoke when we say mortgage rates might be trimming the hedges a bit more. Slipping into the high-5% territory by early in the year is what the tea leaves are suggesting. So, if you’re playing the long game, you might just hit the jackpot.

Where will mortgage rates be in 2026?

– As for what 2026 holds for mortgage rates, well, it’s a bit like trying to predict the season finale of your favorite show. The plot could go in a million directions! But if current trends are our scriptwriters, expect the unexpected with a side of anything’s possible. Stay tuned!