Owning a home is like having a piggy bank that grows sturdier with time. It’s where that feel-good sensation of financial stability meets the hard, jaw-dropping facts of home equity. You might think tapping into home equity is as easy as cracking open that piggy bank, but hold your sledgehammers, folks—it’s about to get mind-bogglingly insightful! Let’s dive into the nitty-gritty of how to calculate home equity loan and unearth some startling truths along the way.

Harnessing Equity Calculator Tools for Smart Financial Decisions

Hang onto your seats because equity calculator tools are your first-class ticket to making killer financial decisions. There’s more to these online wizards than meets the eye. Peek behind the curtain of the Bank of America’s Home Equity Calculator, and you’ll find a treasure trove of data that could make or break your bank account.

When you want to calculate home equity, figures swirl around like summer shandy on a hot day. But as easygoing as that shandy can be, so can inputting a few numbers into these calculators to get a comprehensive view of your financial standing. Talking accuracy here—imagine they’re like the GPS of home finance, guiding you to the X that marks the spot.

And don’t for a second think it’s all smoke and mirrors. Sure, a face-to-face with a financial pro would be swell, but these calculators give them a run for their money. Real-life scenarios prove time and again that when it comes to your home’s worth, it’s not just about the number on your mailbox.

The Real Impact of Second Mortgages on Your Finances

Ever heard the phrase “counting chickens before they hatch”? It’s what happens when you eyeball that second mortgage without running the hard numbers. A 2nd mortgage calculator is what you need. It’s the difference between navigating treacherous financial waters or cruising the sea of tranquility.

Wells Fargo and Chase are dangling some nifty calculators like a carrot, encouraging homeowners to pull back the curtain on the potential costs and snazzy benefits of a second mortgage. It’s not just about digging into your equity pie—it’s about saving enough crust to live comfortably. Calculate home equity loan payments or risk biting off more than you can chew!

| **Item** | **Details** |

|---|---|

| Home Equity Loan Definition | Amount borrowed against the equity of your home. |

| Home Equity Calculation | |

| Example Loan Amount | $50,000 |

| Example Loan Term | 120 months (10 years) |

| Example Interest Rate | 8.40% |

| Example Monthly Payment | $617.26 |

| 15-year Home Equity Loan Details | $20,000 at 8.89% average rate as of October 16, 2023 |

| 15-Year Loan Monthly Payment | $201.55 |

| 10-Year Home Equity Loan Details | $100,000 at 9.09% average rate as of November 13, 2023 |

| 10-Year Loan Monthly Payment | $1,271.63 |

| Total Interest for 10-Year Loan | $52,596.04 |

| Important Note | Monthly payments do not include taxes or insurance premiums. |

| Payment Impact | Lower interest rates and longer terms result in lower monthly payments, but increase the total amount of interest paid over the life of the loan. |

| Applying for Loan | Applicant must have sufficient home equity and meet lender’s credit and income requirements. |

| Benefits | Provides access to cash for large expenses, potentially tax-deductible interest*. |

| Considerations | Increases debt secured by your home, could put your home at risk if unable to repay. |

| Eligibility | Good credit score, stable income, and a certain percentage of equity in the home (often 15-20%). |

Understanding How Much HELOC You Can Actually Get

Chewing over “how much HELOC can I get” is like trying to solve a labyrinth taylor swift Lyrics puzzle – it’s tricky! But don’t fret; there are clear-cut factors at play when lenders like Discover crank the gears on your HELOC eligibility and borrowing limits. It’s a head-scratcher alright, but we’ve got the key to the riddle.

Here’s the kicker, folks: your impressive credit score, that steadfast income, and the value of your vaunted castle all determine how much you can borrow. And remember, just like green wallpaper can make or break a room’s design, tiny details in your application can significantly influence your HELOC potential.

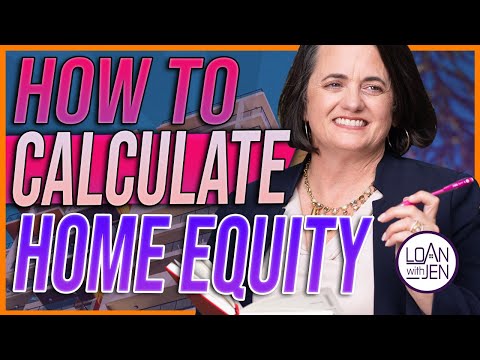

Navigating Monthly Home Equity Loan Payments Like a Pro

If you’re about to saddle up for a home equity loan, you’ll want to wrangle those monthly home equity loan payments like a seasoned pro. This is where a home equity loans calculator becomes your trusty steed. Financial institutions such as Quicken Loans unsheathe these calculators and help you plan for your financial future like you’re plotting a chess match.

Let’s get down to brass tacks. On a $50,000 loan for 120 months at an 8.40% interest rate, you’re looking at a monthly payment of $617.26, not counting those pesky taxes and insurance premiums. But hold your horses, because you need to balance these payments with other financial commitments like a Birkin bag on each arm.

The Astonishing Facts Behind Calculating Home Equity

Strap in, because we’re about to soar over the landscape of calculating home equity, and the view will boggle your mind. Here, we dig into the variables that can yo-yo your equity calculations faster than you can say “bubble burst.” Brace for a dive deep into the financial soup, where common assumptions get turned on their heads.

To crunch those numbers, you’ve got to play a high-stakes game of subtraction—pinning down your home’s appraised value, then ticking off all the loans secured by your humble abode. You think you know What Is The equity in your home? Think again, because the numbers can dance to a tune you’ve never heard before.

Conclusion: Rethinking How You Calculate Home Equity Loan

Hats off to you, reader, for sticking through a rollercoaster ride of revelations on how to calculate home equity loan. It’s time to don a new thinking cap and crunch home equity numbers with a dash of finesse and a pinch of skepticism. Here’s your cheat sheet recap:

– Equity calculator tools are your financial compass

– Second mortgages are more than just money—they’re a commitment

– HELOC vibes are all about the details

– Monthly home equity loan payments demand respect, not a backseat

– True home equity is a shapeshifter, keep your eyes peeled

Financial wizardry isn’t about flashy spells and wand-waving. It’s about diving into courses like How To Calculate Equity and tackling concepts such as Variable Interest rate with the tenacity of a honey badger. Don’t just stand on the sidelines—get into the game. MortgageRater.com may well be your playbook, so study it like your financial future depends on it because, frankly, it does.

Remember, dear readers of MortgageRater.com, navigating the mortgage landscape is akin to sailing uncharted waters. Smart tools, clear understanding, and a touch of daring make for smooth sailing. Until we meet again, here’s to your ever-growing wealth and wisdom in the world of home equity! 🏡💸

Get Your Math On! Calculate Home Equity Loan Like a Pro

Calculating your home equity loan can feel like you’re trying to solve a Rubik’s Cube, right? But hold onto your calculators, folks, because we’re diving headfirst into the world of home equity with some jaw-dropping facts that will have you spinning those colorful squares like a champ!

Ain’t No Mountain High Enough: Climbing to New Equity Heights

Did you know that as you climb the mountain of mortgage repayments, you’re actually building your very own financial Everest? With every payment, you conquer a little more of that debt peak, which means your equity—that sweet, sweet slice of home ownership pie—just keeps on growing. And that’s some serious dough we’re talking about!

Remember, when you’re ready to tap into that mountain of equity, it’s not just about counting your chickens before they hatch. A meticulous plan with a blueprint-like precision, like the experts at Americas home place, ensures you maximize that equity potential without a single false step. Don’t underestimate the climb; it’s steeper than it looks, but oh boy, the view from the top is worth it!

The Time-Travelling Money Machine: Your Home!

Ready for a trip back to the future? Brace yourself: your home isn’t just your castle; it’s a bona fide time-travelling money machine. Every month you zing back to the bank’s past by paying your mortgage, you’re also zipping forward to a future where you’ve got cash to splash. And when it comes time to calculate home equity loan options, that’s when you realize — Great Scott! — you’ve been hoarding a golden goose eggs nest without even wearing a pair of futuristic silver shades!

I mean, who would’ve thought your regular old house could turn into the Delorean of dollars? Exciting, isn’t it? Just make sure you don’t get too carried away and start wearing tin foil hats or anything. We’re not actually travelling through time—yet.

The Feast of Equity: A Cornucopia of Cash

Time for a celebration, folks, because when you’ve got enough equity, it’s like Thanksgiving came early! You get to carve up that turkey of wealth, doling out pieces left and right — whether it’s for renovating the kitchen or finally taking that dream vacation (hello, Bora Bora!).

Now, don’t just sit there like a turkey the night before Thanksgiving. Get to work and calculate your home equity loan feast, because knowing exactly how much you can borrow is like getting the biggest drumstick at the table. Sure, it might seem a bit nutty to go all Pilgrim on your finances, but grabbing that financial cornucopia by the horn can lead to some seriously bountiful feasts down the road. Just don’t forget to pass the gravy!

The Hidden Treasure Chest in Your Backyard

Ahoy, mateys! Ye be sitting on a hidden treasure, and ye didn’t even need a map or a parrot to find it! Aye, ’tis true — your very own landlubber’s abode is more than just bricks and mortar. It’s a chest brimming with sparkling, shiny equity doubloons.

Calculate your home equity loan, and it’s like X marks the spot. But instead of digging up your backyard (please don’t, that’s a whole other can o’ worms), you’re simply unlocking the treasure trove with the key of financial savvy. So hoist the mainsail and get ready to set sail on the sea of solvent opportunity — but keep an eye out for those pesky credit sharks, me hearties!

The Financial Swiss Army Knife: Your Home Equity

Let’s get down to the nitty-gritty, shall we? When you’ve gotta calculate your home equity loan, you’re basically turning your house into the handiest tool in your belt — a financial Swiss Army knife, if you will. Whether it’s for consolidating debt (snip, snip!), investing in your future (ka-ching!), or just keeping afloat during an unexpected flood of bills, your home is like that trusty do-it-all gadget you just can’t live without.

So there you go, a bunch more equipped than a boy scout on a camping trip — ready to whip out that multi-use equity tool at a moment’s notice. But remember, folks, always handle with care; a Swiss Army knife is super handy, but you don’t want to cut yourself in the process.

So, whether you’re climbing high, travelling through time, feasting big, treasure hunting, or multitasking like a pro — calculating your home equity loan can unlock a world of possibilities. And always remember, it’s not just about the numbers; it’s about the smart, savvy, and sometimes downright insane ways you can make your home work for you. Now, go forth and calculate like a math wizard, or at least like someone who’s got a really neat calculator app on their smartphone. Happy calculating!

How much would a $50000 home equity loan cost per month?

Alrighty, let’s break it down, one by one:

How do you calculate home equity loan?

– Whew, a $50,000 home equity loan’s monthly cost can vary! It depends on your interest rate and loan term, but say you’ve got a 5% interest rate on a 10-year term, you’d be looking at around $530 a month. Remember, that’s just ballpark!

How much would a 20 000 home equity loan cost per month?

– To figure out a home equity loan, you gotta know two things: the market value of your home and how much you still owe on your mortgage. Subtract your mortgage balance from your home’s value—voilà, that’s your home equity! Lenders usually let you borrow a percentage of that number.

How much is the payment on a 100 000 home equity loan?

– A $20,000 home equity loan might cost you somewhere around $200 to $300 per month. But hey, this is a rough guess—it hinges on your loan’s interest rate and term.

What is the payment on $150000 home equity loan?

– If you snag a $100,000 home equity loan, your monthly payment could range from $900 to over $1,000, depending on the interest and term. But remember, that’s a ballpark figure.

How much is the payment on $75000 home equity loan?

– Making payments on a $150,000 home equity loan? You might be forking over $1,400 a month or more, but it’s all about the terms and rates you’ve got.

What is a risk of taking a home equity loan?

– For a $75,000 home equity loan, you could be paying somewhere in the neighborhood of $700 to $800 a month, but hey, that’s just a guesstimate.

Can you pay off a home equity loan early?

– Taking out a home equity loan isn’t child’s play—it can be risky! If you can’t make the payments, you could lose your home. That’s a pretty huge gamble!

Are home equity loans tax deductible?

– Pay off a home equity loan early? You betcha! But check for prepayment penalties first so you don’t get hit with extra fees. Better safe than sorry!

How much is a $20000 loan over 5 years?

– Are home equity loans tax deductible? Sometimes! If you use the loan for home improvements, Uncle Sam might let you deduct the interest. But don’t take my word for it—consult a tax pro.

What is the monthly payment on a 25000 home equity loan?

– Borrowing 20 grand over 5 years, huh? Depending on the interest rate, you could be looking at monthly payments from $350 to $450. Rough estimate, of course.

What bank has the best home equity loan?

– A $25,000 home equity loan on, let’s say, a 5-year term with a decent rate might cost you about $450 – $500 each month. But that’s not written in stone!

Is 3.5% a good HELOC rate?

– The best home equity loan bank? That’s the million-dollar question! It changes like the weather, so shop around! Interest rates, fees, customer service—they all matter.

What is the monthly payment on a $200 000 home equity loan?

– Is a 3.5% HELOC rate good? Heck yeah! That’s like finding a four-leaf clover. Rates have been creeping up, so lock that in if you can.

How much would a $100000 loan cost per month?

– Monthly payment on a $200,000 home equity loan? Brace yourself, because it might be $1,000 – $2,000, depending on your rate and term. Oof, that’s a chunk of change!

What is the monthly payment on a 25000 home equity loan?

– Shelling out for a $100,000 loan each month might have you coughing up $1,000 or more. It’s all about those terms and rates, folks.

What are monthly payments on home equity loan?

– Got déjà vu? The monthly payment on a $25,000 home equity loan? Think in the ballpark of $450 to $500 once again, depending on the loan’s details.

How is a $50000 home equity loan different from a $50000 home equity line of credit?

– Monthly payments on home equity loans are like snowflakes—no two are exactly alike! They’re calculated based on how much you borrow, your interest rate, and how long you’ve got to pay it back.

What is typical payment terms for a home equity loan?

– Home equity loans and lines of credit are cousins, not twins. A $50,000 loan gives you a lump sum and fixed payments. A line of credit is more like a credit card—you draw money as you need it and pay interest only on what you use.