Unveiling The Core Advantages Of A Bridge Loan

Swift Access To Capital For Time-Sensitive Transactions

Imagine you’ve found your dream home but still need to sell your current one. You’re caught in the dilemma of needing funds from your old home to secure the new one. Here is where a bridge loan gallops in to save the day! A bridge loan is a fast-acting financial vehicle, offering swift access to capital precisely when you need it.

This type of loan can be a true lifesaver in time-sensitive transactions. For instance, maybe you’re eyeing a property in a competitive market, and the seller ain’t waiting around for your home to sell. With a bridge loan, you can swoop in like a cash buyer, which is often a game-changer in a hot real estate market.

The speed at which you can get a bridge loan is its standout feature. While traditional loans may drag their feet for months, bridge loans jog to the finish line in just weeks or even days. This rapid relay of funds positions you to seize golden opportunities that come with an expiry date.

Bridging The Gap: Maintaining Real Estate Market Presence

Let’s talk real estate gymnastics – flexibility and timing. To keep your footing in the real estate market, you must be nimble, especially when inventory’s tighter than a snare drum. Bridge loans are the trampoline that keeps you bouncing in the game. They empower you to act now, rather than later, keeping you from missing out on the perfect property.

Reflect on those moments when the market’s hotter than the noon sun in July. You’re more likely to encounter bidding wars or need to make a quick decision. Bridge loans give you the muscle to roll with the punches and stay competitive.

Take Jane and John Doe, for example. Eager to upgrade to a larger home for their growing family but needing to sell their condo first. A bridge loan allowed them to make a successful bid on their dream home without having to wait. Case studies like theirs are not uncommon, and they showcase the bridge loan as a cornerstone of strategic real estate timing.

The Power of Bridge Loans Land More Listings, Win the Bidding Wars, and be a Hero to Your Clients!

$14.99

“The Power of Bridge Loans” is a transformative financial tool designed for real estate professionals eager to elevate their services and offer unparalleled value to their clients. By providing short-term financing options, this product empowers agents to help their clients secure their next home before selling their current one. This eradicates the common dilemma of timing in the home-buying process, allowing sellers to transition into buyers with ease and confidence. It’s a strategic advantage that can differentiate an agent in today’s competitive market, giving them the power to land more listings by offering practical solutions to logistical hurdles.

In a market where bidding wars are the new norm, “The Power of Bridge Loans” serves as a secret weapon for real estate agents. Buyers can make quick, decisive, and competitive offers without the contingency of selling their existing property, dramatically increasing their chances of success. Agents can leverage this ability to outpace competing bids, enabling them to solidify their reputation as formidable and effective negotiators. Consequently, agents not only win more bidding wars but also cultivate a robust portfolio of satisfied clients who are likely to return and refer others.

Being a hero to your clients transcends the mere transactionit’s about sculpting a stress-free and seamless experience. With “The Power of Bridge Loans,” agents can offer peace of mind to clients during what is often one of the most stressful life events. This innovative financial solution mitigates the risk of losing out on a dream home due to tied-up equity in an existing property. Real estate professionals who equip themselves with “The Power of Bridge Loans” emerge as heroes by solving complex timing challenges, ensuring that their clients never have to settle for anything less than their ideal home.

Flexibility In Repayment: A Key Feature Of Bridge Loan Structuring

Now, let’s unpack the repayment flexibility of bridge loans. Traditional loans often come with a fixed payment schedule; you know the drill – monthly payments over years and years. Bridge loans, on the other hand, play by a different set of rules. Many don’t require monthly payments, and they usually have terms from a few months up to a year.

This flexibility is honey for borrowers swimming in complex financial waters. Take real estate magnate Eren Yeager, who leveraged a bridge loan’s flexible terms to shuffle his extensive portfolio without disrupting his cash flow. Rather than a fixed repayment schedule, the focus is on clearing the debt once the original property is sold or long-term financing is secured.

The flexible structuring of bridge loans can fit like a glove for your broader financial strategies. It can prevent you from being cash poor and property rich – a precarious fence to straddle for any investor.

Diverse Usage: How Bridge Loans Empower Varied Real Estate Strategies

Real estate maestros use a symphony of strategies to amplify their success, and bridge loans play first violin. These loans aren’t one-trick ponies; they’re as versatile as a Swiss Army knife. From house-flipping prodigies to rental property moguls, bridge loans offer a quick cash injection to pivot as needed.

Analysis from the mortgage Investors group shows a trend in successful flips and rental conversions made viable through bridge financing. The group’s report highlights the critical role these loans play in allowing investors to act swiftly in purchasing and renovating properties before the market cools.

These savvy investors often have their fingers in many pies, something which traditional loans can’t always accommodate. A real estate investor might be mid-flip on one property and spot a prime rental prospect. A bridge loan can fund the down payment, securing the rental while the flip is finalized and sold. It’s this fluidity that makes bridge loans a favorite tool in the investor’s belt.

Leverage Potential: Maximizing Real Estate Investment Returns

The term ‘leverage’ is music to an investor’s ears. It’s about using a bit of your money to control a whole lot more. With a bridge loan, you’re effectively wielding a financial lever to hoist your investment potential to dizzying heights.

Data shows that strategic use of bridge loans can lead to higher returns on investment compared to other methods of financing. This is because, even though bridge loans come with higher interest rates, they allow you to buy properties you might have otherwise missed.

However, as with any high-stakes game, there are risks to consider. It’s vital to balance the potential for sweet returns with the sour taste of higher costs and the risk of your home not selling by the time the loan’s due. Bridge loan borrowers need to walk the tightrope carefully, being mindful of both the updrafts and the downdrafts.

Bridge Bidding Boxes Set of ,Premium Bridge Kit Bid Buddy,for Bridge Player, Beginner, Bridge Club,Family Cards Night(Navy Blue)

$32.89

The “Premium Bridge Kit Bid Buddy” set in Navy Blue is an elegant and functional addition to any bridge player’s collection, perfect for beginners, seasoned players, and bridge clubs alike. Coming in a sleek navy blue design, each set contains four sturdy bidding boxes, designed to lie flat on the table or stand upright for easy viewing by all players. The high-contrast cards feature clear, large-print fonts and symbols to ensure bids are easily seen from across the table, enhancing gameplay and reducing the risk of miscommunication during the bid phase.

This premium set is crafted with high-quality materials, ensuring durability and a professional feel that will stand up to regular use during family game nights or competitive bridge club sessions. The bidding cards are made from thick, coated paper that resists bending and tearing, and the box’s smooth edges provide comfortable handling. Each box has a reliable bidding mechanism that securely holds the cards in place once a bid has been made, preventing slips or accidental reveals.

Enhance your bridge experience with the “Premium Bridge Kit Bid Buddy,” a kit that promises not only to streamline your game, but also to bring an air of sophistication to your card table. The set’s compact design allows for easy transport to different playing venues, making it suitable for tournaments or social travel gatherings. Whether you’re teaching the game to a family member or engaging in a competitive match, the “Premium Bridge Kit Bid Buddy” is an indispensable tool that will elevate the game for enthusiasts and newcomers alike.

Strategic Assessment: When Does a Bridge Loan Make Financial Sense?

Just like with a Cash-out refinance or biweekly mortgage strategy, bridge loans are not a one-size-fits-all solution. The suitability of a bridge loan depends on the specifics of your situation, such as your financial standing, the real estate market conditions, and your ability to handle risk.

Frameworks for assessment are always evolving. An investor must ponder questions like, “Will the bridge loan’s benefits outweigh its higher costs?” or “How fast can I realistically sell my current home?” If you can sell quickly and snag your desired property, the stars align for a bridge loan scenario.

Experts recommend these loans primarily for borrowers with a clear exit strategy. Without one, you might find yourself in deep water, with a costly loan eating into your finances like a starved squirrel in a nut basket.

| Feature | Description |

|---|---|

| Loan Type | Bridge Loan (also known as a bridging loan or swing loan) |

| Purpose | To provide short-term financing to bridge the gap between buying a new home and selling the current one; used to maintain momentum in real estate transactions when funds are temporarily unavailable. |

| Terms Duration | Typically 6 months to 1 year; can range from 90 days to longer periods depending on the lender’s policies and borrower’s needs. |

| Interest Rates | Higher than traditional mortgages, reflecting the increased risk and short-term nature; can vary but may start from around 0.52% per month. |

| Collateral Required | Often secured by the borrower’s current home. |

| Loan Amount | Depends on the equity in the current home and the lender’s loan-to-value ratio requirements; varies by lender and borrower’s circumstances. |

| Costs & Fees | Includes high interest rates, valuation payments, front-end charges, and lender legal fees; transaction costs can be significantly higher than those associated with long-term financing options. |

| Benefits | – Allows for competitive purchasing without waiting for a current home to sell. |

| – Provides immediate funding to bridge financial gaps. | |

| – Utilizes the equity in a current home for the new property’s down payment. | |

| Risks & Drawbacks | – Costly due to high interest rates and associated fees. |

| – If the current home sells for less than the bridge loan amount or not at all, there may be a financial shortfall. | |

| – Market conditions and the feasibility of the home selling within the loan term contribute to the risk. | |

| – Required to take a mortgage with the same lender may limit shopping for competitive mortgage rates. | |

| Special Conditions | – Some lenders may require that the borrower also take out a longer-term mortgage with them. |

| – The equity in the current home typically determines the maximum loan amount. | |

| Loan Repayment | Bridge loans must be paid off in full either when the first property sells or at the end of the term, potentially requiring refinancing if the home hasn’t sold. |

| Typical Users | – Homeowners who are purchasing a new home before selling their current one. |

| – Real estate investors who need immediate funds to close a deal while pending the sale of another property. | |

| Availability | Offered by various lenders, including banks, credit unions, and private lenders specializing in short-term financing. |

Pioneering Perspectives: Challenging Conventional Loan Wisdom With Bridge Loans

You’ve likely heard the mortar-and-brick mortgage wisdom: “Go long-term, play it safe, stick to the beaten path.” But the modern mortgage market is more like a bazaar than a grocery store. There’s more than one way to finance your real estate quest.

Bridge loans shake up the conventional wisdom. They’re the mavericks of mortgage strategies, serving up short-term solutions with long-term impacts. Innovative minds, such as those at Mortgage Rater, have seen these loans become increasingly relevant in an environment where flexibility and nimbleness are king.

Digging into the nitty-gritty, financiers encounter refreshing bouts of outside-the-box thinking. For example, in Adam Sandler’s new movie, a plucky protagonist turns a dilapidated mansion into a five-star resort using nothing but bridge loans and moxie. While Hollywood hyperbole that might be, it shows how bridge loans can finance bold ventures that traditional loans might not touch.

Conclusion: The Bridge Towards Your Real Estate Ambitions

In wrapping up, we’ve toured the landscape of bridge loans and highlighted their transformative power. These loans aren’t just bridges; they’re launch pads for your real estate aspirations, giving you a shot at opportunities that would otherwise slide by.

The future of bridge loans looks as spirited as the endeavors they support. In a real estate finance world ever-evolving, bridge loans adapt and thrive, empowering investors to make confident, assertive moves.

Bridge Scorecards, Pack Replacement Score Sheet Tally Pads Must Have Accessories for Game Night Classic WeThey Bridge Playing Card Game Scoring

$7.99

Bridge Scorecards are a must-have addition to any bridge player’s collection, providing a seamless way to keep track of scores during game night. Each pack contains a generous number of replacement score sheets, enough to last through countless rounds of your favorite card game. These tally pads are specifically designed for the classic WeThey Bridge playing card game, featuring a clear and organized layout that makes scoring simple and efficient. High-quality paper ensures that writing is smooth and the ink doesnt bleed through, keeping each score legible for the entire game.

Enhance your Bridge experience with this essential pack of scorecards that is both practical and elegantly designed. The tallies incorporate specific sections for recording bids, bonuses, and penalties, adhering to the traditional scoring rules of WeThey Bridge. The score sheets are conveniently sized to fit alongside your playing cards and bridge bidding boxes, making them an integral part of your game night setup. The user-friendly design caters to all levels of players, from beginners to seasoned bridge enthusiasts.

Perfect for tournaments, clubs, or casual play at home, these Bridge Scorecards ensure that your game progresses smoothly without the hassle of improvising scorekeeping methods. This pack is a smart purchase for anyone passionate about the game, as it keeps the focus on the play rather than on scorekeeping. Not only does it specifically cater to the precise scoring needs of bridge, but the pack also serves as a great accompaniment to any bridge gift set. With these scorecards, you’re always ready for a competitive or friendly game, and they uphold the tradition of one of the most intellectually stimulating card games known worldwide.

For those who dream of real estate conquests and have the guts to navigate high interest rates and fast turnarounds, a bridge loan might just be the wind beneath your wings. They hold the promise of a fleeting but mighty advantage, an innovative financial solution that, when wielded wisely, can catapult you into the next chapter of your investment story.

Bridge Loan Trivia: Unpacking the Perks

Get ready, folks, for a rapid-fire round of bridge loan trivia that’s as energizing as an espresso shot of finance fun! Dive into this smorgasbord of facts, so next time you’re pondering over quick finances, you’ll be grinning like you just scored front-row tickets to an Adam Sandler new movie.

The Quick Switcheroo

Just like Adam Sandler switching roles in a flick, a bridge loan swoops in for a smooth transition. Imagine selling your home and spotting your dream house. But oops! Your funds are tied up. Enter bridge loan! This nifty loan acts like a convenient stepping stone, where funds from your future home sale cover the cost of your new pad. It’s like “Click” but for your mortgage, bending time in your favor.

Financial Flexibility with Flair

Speaking of flexibility, it’s like when Steffiana de la Cruz partners with Kevin James in a scene, playing off each other’s comedic timing. Similarly, bridge loans offer financial flexibility, letting you snag that new home whilst waiting for your current one to sell. No more missing out just because your assets are playing hide-and-seek. Leap into that purchase like it’s a well-timed punchline.

Speed is the Name of the Game

Here’s a fun tidbit for you: securing a bridge loan is like browsing through 4chan pol—things move fast! Traditional loans can take months to close, but a bridge loan is the Usain Bolt of the lending world, often securing funds in a couple of weeks. Swift and efficient, this loan doesn’t dilly-dally. And, since time is a pretty big deal in the property game, speed can mean the difference between nabbing your dream home or waving it goodbye.

Credit Scores Take a Backseat

Wait, what? Yeah, you heard that right. While credit scores are like the Hollywood A-listers of the finance world, they sometimes take a backseat with bridge loans. While important, lenders are often more focused on the equity in your current home. So, if your credit score has been through a few plot twists, a bridge loan might be your ticket to a happy ending, financially speaking.

Only Pay When You Play

Alright, let’s wrap this trivia up with a kicker. With some bridge loans, you may not need to make immediate monthly payments. It’s like being given a hall pass from mortgage payments until your old house sells. But hey, just like organizing a viewing party for Steffiana de la Cruz’s latest blockbuster, make sure you understand the terms before you jump in.

And there you have it, folks—a few zesty nuggets of knowledge about bridge loans that make handling your money seem like a walk in the comedy aisle. Next time you’re eyeing that bridge loan, you’ll be armed with facts that even your quirky neighbor would tip their hat to. Now, don’t just stand there; go forth and bridge the gap to your financial goals!

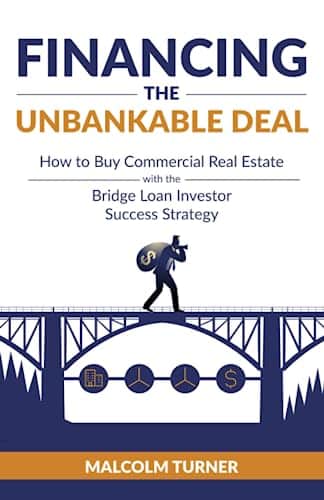

Financing The Unbankable Deal How to Buy Commercial Real Estate with the Bridge Loan Investor Success Strategy

$19.99

“Financing the Unbankable Deal: How to Buy Commercial Real Estate with the Bridge Loan Investor Success Strategy” is an invaluable resource for investors seeking to dive into the lucrative world of commercial real estate through the use of bridge loans. This comprehensive guide demystifies the often complex process of securing short-term financing for properties that may not qualify for traditional bank loans due to various risk factors or time constraints. Tailored for both novices and seasoned investors, it provides step-by-step instructions on identifying potential deals, approaching bridge loan lenders, and effectively managing the loan for maximum benefit.

The product details the crucial aspects of bridge loan financing, explaining the importance of interest rates, loan-to-value ratios, and the intricacies of exit strategies to ensure profitability. It outlines the best practices for conducting due diligence, a key factor in mitigating the risks associated with ‘unbankable’ deals and ensuring a solid return on investment. The author’s expertise shines through in case studies and real-world scenarios which offer a practical perspective on overcoming challenges and capitalizing on opportunities within the commercial real estate market.

In addition to the technical knowledge, “Financing the Unbankable Deal” includes exclusive tips on cultivating relationships with bridge loan investors and understanding the psychology behind their lending decisions. It emphasizes the role of strong negotiation skills and the art of presenting deals in a manner that aligns with the investor’s goals, thereby unlocking funding for projects that traditional financial institutions may overlook. For anyone looking to expand their real estate investment portfolio, this strategy guide is an essential tool for navigating the world of nontraditional financing and unlocking the potential of underutilized properties.

What is a bridge loan and how do they work?

Sure thing! Check out these answers, tailored just for your SEO needs:

What does a bridging loan do?

A bridge loan is kinda like a quick fix, y’know? It’s a short-term loan that helps you bridge the gap when you’re juggling the purchase of a new property before selling your old one. They work by giving you the funds upfront to snatch up that new dream home, and then you’ll repay the loan once your old place sells. Think of it as a financial tightrope that gets you from Point A to Point B real smooth-like.

Is it a good idea to get a bridge loan?

Bridging the gap, literally – that’s what a bridging loan does. It acts as a temporary financial Band-Aid, giving you the cash needed to purchase a new property before you’ve sold your existing one. It’s the duct tape in the toolkit of property transactions, holding things together till you can make a permanent fix.

What is the disadvantage of bridge loans?

Is getting a bridge loan a brainwave or a brainache? Well, it could be a good idea if you’ve found the perfect new pad and need to close the deal pronto before selling your current digs. Just remember, bridge loans can be a tightrope – great for crossing over, but with a bit of a risk if you don’t tread carefully.

What is the credit score for a bridge loan?

Ah, bridge loans – they’re handy, but they come with a catch or two. The downside? Typically, they’ve got higher interest rates and shorter repayment periods, which can add up to a financial squeeze if your old home doesn’t sell as fast as you’d hoped. Don’t let the bridge turn into a tightrope without a safety net, alright?

Why would a homeowner take out a bridge loan?

When it comes to bridge loans, you’ll need a credit score that’s not just good but pretty darn solid, often north of 650 or even 700. Lenders wanna make sure you’re a safe bet before they let you walk their financial tightrope.

How much deposit do I need for a bridging loan?

Homeowners might take out a bridge loan as a convenient shortcut – it lets them pounce on a new property before their current home sells. It’s a bit like having your cake and eating it too, nabbing your next home sweet home without waiting for the dough from the old one.

How hard is it to get a bridge loan?

Ready to take the leap with a bridging loan? Hold your horses – you’ll typically need a decent-sized deposit, potentially 20-30% of the combined value of your current home and new purchase. It’s like the bouncer at the club, making sure you’ve got enough skin in the game.

Do you pay monthly for a bridging loan?

Getting a bridge loan isn’t a cakewalk, folks. With strict lending criteria and the need for a strong credit score and a hefty amount of equity, you’ll have to jump through some hoops to get approved. But for the right borrower, it’s a hop, skip, and a jump to securing that dream home.

What is the difference between a bridge loan and a home equity loan?

Do you pay monthly on a bridging loan? Well, sort of. You might have the option to pay the interest monthly, but many bridging loans are set up so you pay the whole shebang – interest and principal – at the end of the term. It’s like running a marathon and dealing with the pain all at once at the finish line.

What is an example of bridge financing?

A bridge loan’s like your quick fix – fast money, short term, usually with one lump sum payment. On the flip side, a home equity loan is more like a chill long-term relationship, you borrow against your house’s value and pay it back over time with regular, monthly love letters to the bank.