Decoding the Arkansas Personal Property Tax Landscape

In the heart of the United States, Arkansas folks face a certain annual ritual—wrangling with personal property tax. But wait, what exactly falls under ‘personal property’ in the Natural State? It’s anything that can be moved and isn’t permanently fixed to land. Yep, we’re looking at cars, boats, and even your beloved RV. Here’s the kicker—every year, by May 31st, you’ve got to assess these movable treasures with your county assessor. Miss the deadline and hello, a late penalty that’s 10% of your tax bill plus a couple of bucks for advertising fees.

Now, personal property tax in Arkansas is a story with many layers, and it underwent a slight rewrite recently. With new legislation, beginning with 2024 tax bills, the good folks in Arkansas can expect a bit of extra relief on their homestead property tax credit, shooting up from $375 to a nifty $425. This sweet slice of tax relief is for your homestead, which is just a fancy term for your main crib, the place you hang your hat.

The Impact of Arkansas Personal Property Tax on Residents

Diving into the nitty-gritty, the financial bite of personal property tax can feel like a sting or a chomp, depending on your stash of personal goodies. Just picture Dale, from Dalton Castle—our regular Arkansas Joe. He’s balancing work, a mortgage, and yes, personal property tax. After forking over his chunk of change for a gleaming speedboat, he’s slapped with a tax bill that makes his wallet wince. For Dale and many others, managing this expense is a yearly dance that requires some smooth financial footwork.

Consider Sasha, who saw a light at the end of the long tax tunnel thanks to the increasing homestead credit. Her main squeeze is her charming bungalow and this boost in tax credit, which in the world of economics could be a first time synonym for “blessing,” brings a sigh of relief.

Census of Randolph County, Arkansas Reconstructed from the Personal Property Tax List

$80.00

The “Census of Randolph County, Arkansas Reconstructed from the Personal Property Tax List” is an invaluable resource for genealogists, historians, and researchers interested in the mid-19th century demographics of Randolph County. Painstakingly compiled, this reconstruction offers a snapshot of the county’s inhabitants, as the original census records may have been damaged or lost over time. This product provides an alphabetical listing of residents based on personal property tax records, which were among the few documents that listed a significant portion of the population, including heads of household, landowners, and other taxpayers.

Each entry in the reconstructed census includes vital information that can aid in painting a detailed picture of life in Randolph County during the period. Details such as the individual’s name, the value of personal property owned, and a reference to the original tax document page and line facilitate further investigation into family histories and the socioeconomic fabric of the region. Users will appreciate the meticulous attention to detail and the preservation of historically significant data, which might otherwise be inaccessible due to the fragility and scarcity of primary source documents.

In addition to its utility for individual research, the “Census of Randolph County, Arkansas Reconstructed from the Personal Property Tax List” serves as a cultural time capsule, offering insights into the economic landscape of the region. Readers will not only discover names and property assessments but also the types of personal property taxed, thereby revealing the economic activities and priorities of residents during the era. This reconstructed census is a must-have for any library collection or individual interested in the rich tapestry of Arkansas’s history, as it illuminates the lives of those who shaped the heritage of Randolph County.

| Category | Details |

|---|---|

| Tax Subjects | Business firms and individuals |

| Property Types | All real and personal property |

| Assessment Due Date | May 31, annually |

| License Renewal Requirement | Must assess vehicle with county assessor before renewal |

| County Tax Payment | Pay all personal property taxes in county of residence |

| Homestead Property Tax Credit | Up to $375 per year, increasing to $425 starting with 2024 tax bills |

| Credit Eligibility | Applicable to the homestead (principal place of residence) |

| Late Penalty for Personal Property | 10% of tax due + $1.75 advertising fee |

| Late Penalty for Real Estate | 10% of tax due + $1.50 advertising fee |

Navigating Through Arkansas’s Personal Property Tax Assessments

Let’s assume definition time: you’re ready to assess. It’s not a trek through the Ozarks but it’s no walk in the park either. Here’s the play-by-play: Arrive at your county assessor’s office (with a coffee in hand, you might need it) and present details of all your personal property. They’ve got formulas and tables that’d make your head spin, but it’s all in a day’s work to determine the value of your stuff. And, between you and me, some Arkansans whisper that these assessments swing like a pendulum—sometimes hitting the mark, other times missing by a mile.

Strategies to Minimize Arkansas Personal Property Tax Liabilities

So you’re thinking, “How do I dodge these tax darts?” Legally, friends, always legally. The savvy savers turn to deductions and exemptions like seniors or disabled veterans might qualify for some breaks. And remember, that homestead credit isn’t there for its health—use it!

In a game of financial chess with neighboring states, Arkansans sometimes feel like they’re in check. But with proper moves like the homestead credit and proper assessment, they might just checkmate that tax burden.

Technological Advances in Managing Arkansas Personal Property Tax

Look around, and you’ll see tech transforming almost everything, even how Arkansas handles personal property tax. Gone are the days of only stubby pencils and paper forms. Now, a tap here and a click there on an online tax system and voila, you’re done. They’re aiming for user-friendly, but only the survey among the user would tell how well they’ve scored on that front.

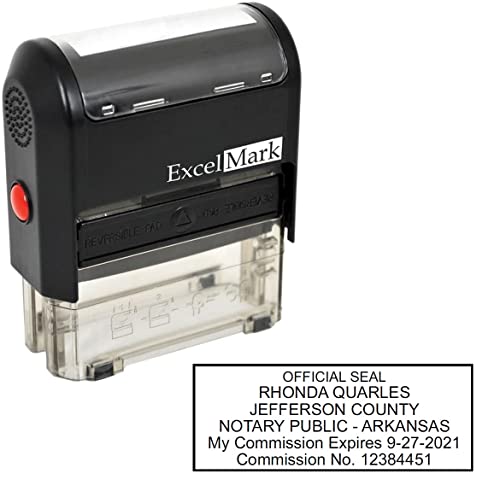

ExcelMark Self Inking Notary Stamp Arkansas

$16.99

The ExcelMark Self Inking Notary Stamp for Arkansas is an essential tool for any notary public operating within the state. It delivers sharp, clear impressions with every use, thanks to its precision components and durable construction. This reliable stamp is specifically designed to meet the state of Arkansas’s notarial requirements, making it a must-have for authenticating documents with efficiency and accuracy. The self-inking mechanism ensures a consistent and clean impression, eliminating the need for separate ink pads and reducing mess in the workspace.

With its ergonomic design, the ExcelMark Self Inking Notary Stamp prioritizes ease of use and comfort, allowing notaries to process a high volume of paperwork without fatigue. The stamp is refillable and comes with a replaceable ink cartridge that can be easily swapped out for a fresh one, ensuring long-term functionality. Its compact size means it fits neatly on any desk or in a briefcase, making it suitable for notaries on the move or with limited space. The re-inking process is straightforward, ensuring that even during busy periods, the stamp can be quickly refreshed and ready for action.

Customization of the ExcelMark Self Inking Notary Stamp is carefully tailored to the individual notary’s licensed details, including their name, commission number, and expiration date as per Arkansas state regulations. This high level of personalization ensures that each stamp is unique and fully compliant with state law. The stamp’s impression features crisp and professional-looking text, which is essential for maintaining the integrity of notarized documents. Moreover, users can trust in the long-lasting ink that ensures documents remain legible over time, safeguarding the legal validity of the notarization.

Arkansas Personal Property Tax Reforms – What’s on the Horizon?

Whispers of tax reform blow through the pines of Arkansas. What’s it all mean for your wallet? Well, while the specifics are as clear as a foggy morning in the Ouachitas, one thing’s certain: change is on the legislative agenda. Institutions like Sabine State bank keep a keen eye on these changes, understanding the ripple effects it can have on the overall fiscal health of communities.

How Arkansas’s Personal Property Tax Compares to National Trends

Let’s put Arkansas under the microscope and see how it stacks up against the rest of the country. On the national level, the personal property tax dance is a diverse routine, with each state stepping to its own tune. Some point to Arkansas’s moderate approach, balancing revenue needs with taxpayer relief, as a middle-of-the-road model—a far cry from both tax havens and heavy-handed tax landscapes.

Giving Voice to Citizens: Arkansans’ Opinions on Personal Property Tax

When it comes to personal property tax, Arkansans have opinions as varied as the state’s landscape. Some begrudgingly accept it as a necessary evil, others are as thrilled as a catfish on a hook. But it’s this colorful spectrum of feedback that shapes the future of tax policies. After all, it’s their hard-earned dough at stake.

ExcelMark A Self Inking Round Rubber Notary Stamp State of Arkansas

$23.99

The ExcelMark A Self-Inking Round Rubber Notary Stamp for the State of Arkansas is a must-have tool for notaries who value precision and efficiency in their official transactions. This practical stamp device comes pre-loaded with specially formulated ink that ensures thousands of crisp and clear impressions without the need for a separate ink pad. The round design of the stamp includes all the required information for Arkansas notarial acts, including the notary’s name, commission number, and expiration date, in accordance with state guidelines.

Crafted with high-quality materials, the ExcelMark A stamp is built to withstand the rigors of daily use, making it an ideal choice for busy professionals. Its ergonomic design and smooth pressing mechanism reduce hand strain and provide a comfortable stamping experience. The stamp’s self-inking feature re-inks the rubber die onto its inner ink pad before each impression, offering consistent quality and eliminating the risk of smudging.

In addition to its functionality and durability, the ExcelMark A Self-Inking Round Rubber Notary Stamp is also designed for easy customization. Clients can submit their specific notary information online, which will then be accurately incorporated into the stamp’s design to meet the State of Arkansas’s official requirements. Compact and portable, this notary stamp ensures that every document is endorsed with official seals that are clean, authoritative, and compliant with state standards.

Personal Property Tax and Its Role in Arkansas State Revenue

Money talks, and in Arkansas, personal property tax has the floor. It’s no small potatoes—it’s a crucial cog in the wheel of state revenue, funding everything from roads to schools. Think of it as the unsung hero of public services—it doesn’t get much applause, but without it, the show couldn’t go on.

The Unseen Ripple Effects of Arkansas Personal Property Tax on Local Economies

What happens in the world of personal property tax doesn’t stay there. It trickles down to Main Street, affecting everything from mom-and-pop shops to local services. If the tax is too hefty, it could send businesses packing. An equilibrium is the goal—enough to fill state coffers without bleeding local economies dry.

A Future Perspective on Arkansas Personal Property Tax

Peering into the crystal ball, the future of Arkansas personal property tax seems poised for evolution. Legislators, armed with insights from experts and the hum of public sentiment, are plotting a course that balances fair taxation with economic growth. It’s a delicate tightrope walk, but hey, Arkansans are known for their balance.

Revolutionizing Our Understanding of Arkansas Personal Property Tax

As we wrap up this deep dive into the world of Arkansas personal property tax, let’s not forget the big picture. High-quality content like this isn’t just about spelling out the facts—it’s about sparking a conversation. Whether you’re forking over the dough for that boat or finding relief in tax credits, it’s all part of the great fiscal tapestry that is Arkansas. With new reforms and rising credits, the state continues to refine its approach, keeping both the economy and the taxpayers’ interests in mind. So here’s to understanding this complex puzzle—may it guide you to smarter decisions and a thicker wallet.

In the ever-changing landscape of personal property tax, knowing the rules of the game is half the battle. With the insights you’ve gleaned here, you’re better equipped to navigate, anticipate, and maybe even mitigate the tax tide. After all, a well-informed citizenry is the bedrock of a thriving democracy, and in Arkansas, that’s something everyone can bank on.

Arkansas Personal Property Tax: Quirky Tidbits!

When you think of fascinating facts, perhaps personal property tax might not jump to the top of your list, but hold your horses! Arkansas’s approach to personal property tax has a few surprises up its sleeve that are sure to pique your interest.

A Tax Unlike Any Other

Alright, so personal property tax isn’t exactly the talk of the town, but get this: In Arkansas, it’s as essential as sweet tea at a Southern picnic. Every year, Arkansans register their personal property—think vehicles, boats, and even livestock (yes, Bessie the cow counts!)—to be taxed. This isn’t just some small change we’re gabbing about; this tax is a cornerstone of local county revenue, and it’s as unique as the Natural State itself.

Say What? Tax Deadlines on Personal Property

Mark your calendars! The deadline to assess personal property tax in Arkansas is May 31st, and if you’re a minute late, woe betide you. Late fees are the state’s way of saying, “We’re not mad, just disappointed…and here’s your fine.” But honesty is the best policy, and keeping up with deadlines is the secret sauce to staying in the clear.

Dollars and Sense: Understanding the Numbers

Oh, and before you think it’s all take and no give, the personal property tax rate in Arkansas tends to skedaddle around the 20-mill mark. That’s a lot less than what some other states might commandeer from your wallet. Yet, it still does a bang-up job funding local needs like schools and emergency services. So, in a way, it’s your good deed for the ‘hood!

Shopping Around? Don’t Forget the Arkansas Sales tax!

If you’ve got shopping on the brain and you’re plotting some major purchases in The Land of Opportunity, remember there’s an “arkansas sales tax” to consider. You see, when you’re out there snagging deals, remember that tax isn’t just a buzzkill; it’s a big part of what keeps the state buzzing with services and infrastructure. So, shop till you drop—but keep an eye on those tags, won’t ya?

So there you have it—an offbeat look into the world of Arkansas personal property tax. From bovine billing to crucial community cash, it’s all part of the eclectic charm of the state. Remember, paying taxes isn’t just adulting, it’s contributing to the quirks and perks of living in Arkansas.

Fatal Glass of Beer

$N/A

Title: Fatal Glass of Beer

The Fatal Glass of Beer stands as an unforgettable piece of breweriana that encapsulates the spirit and lore of an era long passed. Itâs not just a simple glass of beer; itâs a replica designed to embody a darkly humorous anecdote from the prohibition period, providing not just a beverage but a conversation starter. The high-quality glass is crafted to mimic the bygone aesthetic of the early 20th century, featuring a delicately etched illustration of an old-time tavern scene complete with patrons and a barkeep whispering secrets of speakeasies. The glass comes packaged in a vintage-themed box, complete with a brief history of prohibition and the origin story of the “fatal” title, ready to be a prized possession for history buffs or the centerpiece of a classic pub collection.

This product is more than a vessel for your favorite ales; it is an immersive piece of historical art. Each sip taken from the Fatal Glass of Beer is designed to transport you to the smoky, jazz-filled speakeasies where every hushed conversation could lead to intrigue or danger. Perfect for themed parties or as a unique gift for beer enthusiasts, this glass adds a touch of historical drama to the drinking experience. With its artisanal quality and attention to detail, the Fatal Glass of Beer serves as a tribute to an age when a simple glass could signify so much more than just a drink.

Equipped with the Fatal Glass of Beer, owners are not merely purchasing glassware; they are acquiring a slice of Americana. It’s an excellent prop for theatrical productions set during prohibition or as an educational tool to illustrate the storytelling of past prohibitive laws against alcohol. For collectors, it’s a distinctive piece that stands out from the common breweriana, with its blend of historical context and practical use. Whether held in hand during a toast or resting on a shelf as a decorative item, the Fatal Glass of Beer is sure to stir up curiosity and admiration from all who lay eyes on it.

Is there a personal property tax in Arkansas?

Certainly! Here’s how that would look:

Do you pay property tax on vehicles in Arkansas?

Oh, you betcha! Arkansas does have a personal property tax on the books. This means your belongings like furniture, cars, and equipment can’t dodge the tax man.

What is the homestead tax credit in Arkansas?

Yup, in Arkansas, your set of wheels will feel the pinch of property tax. Better to budget ahead than get caught off guard when it’s time to fork over some cash.

How much is the late fee for personal property tax in Arkansas?

The homestead tax credit in Arkansas is a real gem for homeowners, offering up to a $350 break on property taxes for your main squeeze of a residence.

How do I pay my personal property tax on my car in Arkansas?

Ouch! Miss the deadline for your personal property tax in Arkansas, and you’re looking at a 10% late fee. It pays—literally—to be punctual!

How much is Arkansas vehicle tax?

Paying your personal property tax on your car in Arkansas? Piece of cake! Whip out your computer or smartphone, visit your county’s website and pay online, or drop a check in the mail. Easy-peasy!

What happens if you don t pay your personal property taxes in Arkansas?

In Arkansas, when buying your ride, you’ll pay a 6.5% state sales tax on its purchase price. And remember, the pricier the wheels, the heftier the tax.

Why did my personal property tax go up in Arkansas?

Forget to pay your personal property taxes in Arkansas? Bad move. Expect penalties, interest, and worst-case scenario, even a lien on your belongings. Yikes!

How much does it cost to register a car in Arkansas?

When your personal property tax in Arkansas goes up, it’s often because your stuff got fancier or pricier. New car or improvements? That’ll do it.

At what age do you stop paying personal property taxes in Arkansas?

Registering a car in Arkansas isn’t free, unfortunately. It’ll set you back anywhere from $3 to $25 for regular plates, plus other potential fees. Yeah, it adds up!

Are property taxes high in Arkansas?

Sweet freedom! In Arkansas, if you’re a senior (65 and older) or disabled, you can say goodbye to paying personal property tax on your vehicle. Celebrate that!

What qualifies as a homestead in Arkansas?

Compared to the rest of the country, Arkansas property taxes are pretty low—so don’t sweat it too much. It’s not as bad as some of those other high-tax havens!

How long do you have to pay property taxes in Arkansas?

In Arkansas, your homestead is your personal slice of heaven—your primary residence. It could be a house, a condo, or even a mobile home, as long as it’s your main spot.

What is the property tax discount in Arkansas?

Tick tock! You’ve got from January 1st to October 15th to pay property taxes in Arkansas. Procrastinators beware: that deadline sneaks up on you!

When can you get personal property tax assessed in Arkansas?

Who doesn’t love a discount? Pay your property tax early in Arkansas, and you could score a 5% discount. Not too shabby for being ahead of the game!

What is considered personal property in Arkansas?

In Arkansas, mark your calendar! January 1st to May 31st is your window to get personal property like your car assessed. Don’t miss out!

What taxes do you pay in Arkansas?

In the land of opportunity, personal property means a lot of things—cars, boats, jewelry, and even livestock. If you own it, Arkansas probably considers it personal property.

Why did my personal property tax go up in Arkansas?

In good ol’ Arkansas, you’ll pay state income taxes, sales taxes, and the aforementioned personal property taxes. But on the bright side, no inheritance or estate taxes!

When can you get personal property tax assessed in Arkansas?

(Same as number 8)