When you sit down to crunch the numbers on your mortgage, the real wizard behind the curtain isn’t your lender or your sharp pencil – it’s the amortization calculation formula. Now, I know ‘amortization’ can sound as daunting as trying to figure out the best Halloween Costumes for a group of indecisive friends, but trust me, it’s a concept you’ll want to be chummy with, especially if home ownership is a scene you plan to set foot in.

Deciphering the Amortization Calculation Formula in Mortgage Repayment

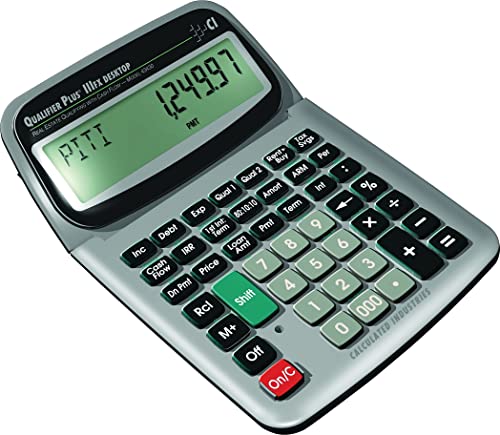

Calculated Industries Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator Clearly Labeled Keys Buyer Pre Qualifying Payments, Amortizations, ARMs, Comb

$62.09

The Calculated Industries Qualifier Plus IIIfx Desktop PRO is an advanced financial calculator designed specifically for real estate and mortgage professionals. With its comprehensive set of features, it enables users to streamline the process of calculating financing options, amortizations, and payment schedules for their clients. Its clearly labeled keys and intuitive layout ensure that complex calculations such as ARMs (Adjustable Rate Mortgages), combinations loans, and FHA/VA loans can be performed with speed and accuracy. This robust desktop calculator is an indispensable tool for agents, brokers, and financiers who require precise and quick financial computations.

One of the standout features of the Qualifier Plus IIIfx Desktop PRO is its capability to pre-qualify buyers efficiently. The device comes equipped with built-in functions to evaluate the financial viability of prospective buyers, helping to save time and provide immediate answers on loan qualifications and potential purchase levels. It makes exploring various financing scenarios simple, whether comparing different loan structures or determining the impact of additional payments on amortization schedules. By having these critical calculations at their fingertips, professionals can offer better advice and close deals faster.

Beyond its calculating prowess, the Qualifier Plus IIIfx Desktop PRO is designed with user convenience in mind. Its large, easy-to-read display coupled with the ergonomic design of the keys allows for comfortable, extended use during busy workdays. Additionally, the device includes comprehensive user guides and customer support, ensuring that even less experienced users can maximize the benefits of the calculator. For real estate professionals seeking to enhance productivity and provide nuanced financial options to their clients, the Qualifier Plus IIIfx Desktop PRO is a powerful ally on the desktop.

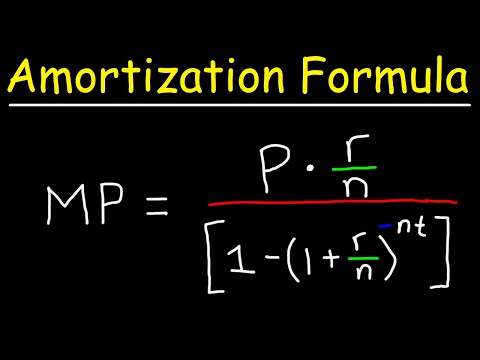

The Mathematical Framework Behind the Amortization Calculation Formula

When it comes to understanding your mortgage, getting to grips with the mathematical framework of the amortization calculation formula is key. Think of it as the very backbone of your loan repayment plan. It’s essentially the nitty-gritty that tells you, down to the cent, how much of your hard-earned cash is whittling down the principal, and how much is just melting away as interest.

Imagine this: You’ve got a loan amount, let’s say a comfy number that will get you that white picket fence fantasy. But wait, what’s this interest rate doing here? And the term – is that how long I’ll be paying this off?! These elements perform a delicate dance to spit out your periodic payments. It isn’t a matter of merely dividing the loan amount by the number of months, oh no. It’s about how these monthly payments lessen the principal over time and how the interest takes a back seat as you forge ahead.

Real-Life Application: How Lenders Use the Amortization Formula

Let’s get real – lenders like Wells Fargo and Bank of America aren’t just throwing darts at a board to come up with your payments. They use the trusty amortization formula to get down to business. By plugging in your loan details, they map out an amortization schedule calculator to show you exactly how much of your payment is playing down the principal and how much is a tip to the bank for their services. This isn’t invisible ink; it’s right there in black and white.

5 Astounding Realities of the Amortization Calculation Formula

Accounting, Accountant, Spreadsheet, Cpa T Shirt

$19.99

The Accounting, Accountant, Spreadsheet, CPA T-Shirt is the perfect fashion statement for professionals who live and breathe numbers. Made from high-quality, breathable fabric, this shirt features a witty and eye-catching graphic that includes iconic spreadsheet cells and accounting tools, immediately identifying the wearer as a proud member of the finance world. Whether you’re a CPA crunching numbers or an accountant balancing books, this t-shirt unites comfort with the pride of your profession, making it an ideal choice for casual Fridays at the office or networking events.

The subtle humor interwoven into the design appeals to the insider knowledge that only fellow accountants would appreciate. Each element, from the classic spreadsheet grid to the familiar financial abbreviations, reflects the daily tools of the trade, while also showcasing a sense of humor that’s much needed in the often-serious realm of accounting. The shirt comes in a variety of sizes to ensure a flattering fit for any body type, ensuring that professionals can show off their passion for accounting without sacrificing style or comfort.

In addition to its stylish design, the T-shirt is a conversation starter, perfect for accounting conferences, workshops, or university events where like-minded individuals might gather. It also makes an excellent gift for the CPA in your life, celebrating achievements like passing the CPA exam, promotions, or appreciating their hard work during the busy tax season. Durable and machine-washable, this shirt will maintain its professional look and witty charm wash after wash, making it a staple in any accountant’s wardrobe.

1. Compound Interest Complexity in Calculation of Amortization

Alright, we’ve all heard the term ‘compound interest,’ but how does it waltz in with the calculation of amortization? Friends, the way compound interest stacks up, it can turn a molehill into a mountain over the life of your loan. Initially, it’s like you’re paying just to pay interest. However, with each payment, you nibble away at the principal, and slowly but surely, you whittle the interest down until it’s practically peanuts.

2. The Invisibleness of the Amortization Calculation Formula in Early Payments

Now, don’t fall off your chair, but in the early years of your mortgage, it’s as if you’re tossing coins into a fountain – most of it’s going towards interest. It might feel like your principal is on a treadmill – heaps of effort, not going anywhere fast. But don’t fret; this is the amortization formula at play, subtly shifting the scales as you go along until, eventually, your payments are chomping down the principal like a kid on Halloween candies.

3. Impact of Extra Payments on the Amortization Formula

Here’s a neat trick: chipping in extra payments can have your loan doing the tango, dramatically reducing the total interest you’re paying. By throwing a bit more at your principal when times are good, you can knock off years and dollars from your loan. Quicken Loans and other savvy lenders have observed that borrowers who do this can sometimes save enough to afford a front-row seat at a Pga Liv merger event.

4. The Unexpected Adaptability of the Amortization Formula in Adjustable-Rate Mortgages (ARMs)

Adjustable-Rate Mortgages (ARMs) are like the weather – unpredictable. But here’s a fun fact: the amortization formula is like a top-tier meteorologist, adapting to the fluctuating rates like it’s nothing. Your payments change as rates change, but the formula keeps the show going, recalculating to ensure the performance runs smoothly until the final curtain fall.

5. Tax Implications Rooted in the Amortization Formula

Not many folks think about the tax scene when they’re knee-deep in amortization schedules, but hey, the interest portion of your mortgage payments can be like finding a discount you didn’t know you had. It reduces your taxable income, which can sometimes be as satisfying as finding a twenty in your pocket. The tax code looks kindly upon mortgage interest, so getting to know your amortization formula can be as beneficial as having a solid 650 credit score.

| Variable | Symbol | Example Value | Description |

| Principal | P | $100,000 | The initial loan amount or current loan balance |

| Interest Rate (annual) | r | 10% (0.10) | The annual percentage rate (APR) of the loan |

| Loan Term | t | 20 years | Total duration of the loan repayment period |

| Monthly Payment | MP | Calculated | The fixed amount paid each month |

| Number of Payments | n | 240 (20*12) | Total number of monthly payments |

| Payment Number | k | 1 to n | Specific number of the payment cycle (e.g., 1st month) |

| Monthly Interest | MI | Calculated | The portion of the monthly payment that is interest |

| Principal Repayment | PR | Calculated | The portion of the monthly payment that reduces the principal |

| Calculation Steps | Formula & Description | ||

| 1. Calculate Monthly Interest Rate | r / 12 (e.g., 0.10 / 12 = 0.008333) | ||

| 2. Calculate Monthly Payment (MP) | MP = [rP / n * (1-(1+r/n)^-nt)] or use Excel: =-PMT(B2/1200, B3*12, B1) | ||

| 3. Monthly Interest (Month 1) | MI = P * r / 12 (e.g., $100,000 * 0.10 / 12 = $833.33) | ||

| 4. Principal Repayment (Month 1) | PR = MP – MI | ||

| 5. Calculate Outstanding Principal for Subsequent Month | Subtract PR from previous Principal balance to get new Principal |

Mastering the Nuances: How to Calculate Amortization Like a Pro

Practical Steps to Calculate Amortization

Calculating amortization doesn’t require a wand or a cape – it’s something you too can do with ease. Start by taking your principal balance and multiplying it by the interest rate. Divide that number by 12, and you’ve got your monthly interest fee on a silver platter. The rest of your monthly payment is as good as a coat hook – it all goes towards principal. And hey, if you’re more the hands-off type, mortgage amortization calculators from financial maestros like Bankrate can do the legwork for you.

Advanced Insights: Amortization Calculation for Various Loan Types

Just when you think you’ve nailed it, the amortization formula chucks a curveball and adapts itself for auto loans, personal loans, and commercial loans. Like a twitch-a-holic on Twitch TV, every loan type tunes the formula just a bit differently, resulting in a perfectly tailored repayment plan for each scenario.

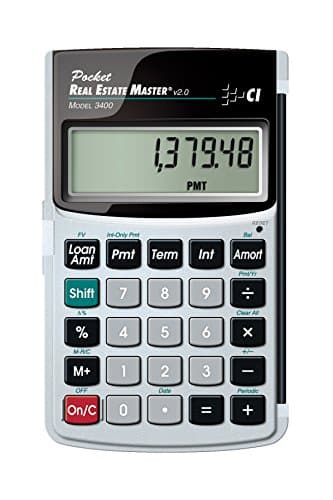

Calculated Industries Pocket Real Estate Master Financial Calculator

$29.19

The Calculated Industries Pocket Real Estate Master Financial Calculator is an indispensable tool for real estate professionals and investors aiming to streamline their financial calculations. Compact and user-friendly, it is designed to easily fit into a pocket or briefcase, thus providing on-the-go access for quick and efficient number crunching. Its specialized functions allow users to compute various real estate centric formulas such as amortizations, loan comparisons, and tax implications, enhancing decision-making accuracy. The intuitive keyboard layout and large, readable display make entering and reviewing financial data straightforward, even for those less familiar with complex calculators.

With the ability to calculate payment solutions, projected cash flows, and return-on-investment values, this financial calculator aids users in assessing property values and understanding the financial implications of their real estate deals. This tool is perfect for providing immediate answers to clients about mortgages, future values, and refinancing without the need for cumbersome manual calculations or relying on internet connectivity. By using the built-in date-math function, real estate professionals can also determine closing and settlement dates with precision, facilitating smoother transaction planning. The Pocket Real Estate Master ensures that realtors and investors have the critical financial information they need at their fingertips.

Durability is a key consideration for professionals on the move, and the Calculated Industries Pocket Real Estate Master Financial Calculator delivers with a rugged case and durable buttons that can withstand daily use. The long-lasting battery life ensures that users won’t be left scrambling for power at critical moments. It’s not just efficient; it also comes with a protective slide cover that safeguards its keys and screen from dust and damage. This combination of reliability, functionality, and portability makes the Pocket Real Estate Master an essential tool for anyone serious about the real estate industry.

Conclusion: Embracing the Impact of the Amortization Calculation Formula in Mortgage Planning

Understanding the amortization calculation formula isn’t just about being good with numbers – it’s about being masterful with your financial future. It’s a significant undercurrent in the ocean of mortgage planning, one that can shape your financial destiny. Knowledge is power, and by utilizing this power, you’re setting yourself up for a brighter, more secure financial journey.

So, embrace it, get to grips with an amortize definition, and let the amortization calculation formula be your guide as you step boldly into the world of homeownership. And remember, a well-amortized loan is the hallmark of a smart homeowner who’s playing the long game in the big league of personal finance.

Discover the Magic Behind the Amortization Calculation Formula

Who knew that crunching numbers and breaking down your loan could be packed with quirky tidbits? Brace yourself for an adventure into the calculative labyrinth of an amortization calculation formula!

The Time-Travelling Table

Let’s kick things off with a wildly fascinating artifact: the mortgage amortization table. Picture this: You’ve just secured a loan to snag that dream home, but what now? This nifty table takes you on a time-traveling escapade into the future of your payments. It’s like having a financial crystal ball! Month by month, it maps out exactly how much of your hard-earned cash is chipping away at the interest versus shrinking that principal mountain. A sneak peek into the future of your finances? Count me in!

The Construction Conundrum Cracked

Hold on! Before dirt is moved, and foundations poured, have you ever scratched your head, puzzled by How Does a construction loan work? It’s like building a mystery without the riddle-solving manual, right? Well, construction loans are a different beast in the loan jungle. They’re more like a high-stakes game of financial Jenga. With payments based on project milestones and a whole different set of numbers, the amortization formula morphs into a unique builder’s blueprint. It goes from strict accountant to a flexible foreman, ensuring that your financial framework stands solid.

Scheduling Your Money’s Marathon

Next up, meet the lean, mean, number-crunching machine: the mortgage amortization schedule calculator. This interactive buddy loves playing with numbers. Think of it as your personal financial trainer, helping you sprint through the repayment race with ease. It tells you when your payments will beef up the principal and trim down the interest. It’s like a workout schedule for your mortgage, keeping you financially fit, and ensuring each payment is a step closer to the finish line—total repayment!

So, there you have it—a dash of fun wrapped up in the seemingly mundane world of amortization calculation formulas. Whether it’s a time-traveling table, a flexible blueprint for constructing your future, or a marathon-scheduling maestro, these tools have got your back. Dive in, play around, and watch as the numbers reveal the path to owning your little slice of the world outright!

What is the formula for calculating amortization?

Sure thing! Here are the SEO-optimized answers all lined up for you:

How do you calculate Amortisation?

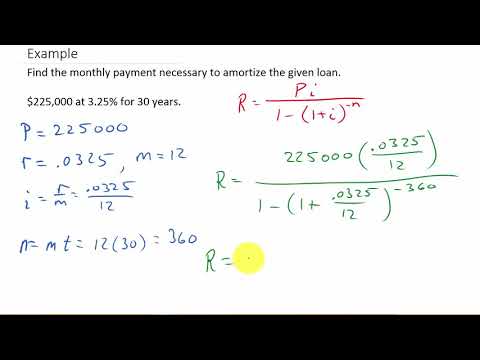

Alright, let’s break down the formula for calculating amortization – it’s not rocket science, I promise! Simply put, you’ll use A = P \frac{r(1 + r)^n}{(1 + r)^n – 1} where A is your monthly payment, P is the principal amount, r is your monthly interest rate, and n is the number of payments. Just plug in your numbers, and voilà – you’ve got your monthly payment figured out!

How do you calculate amortization on a financial calculator?

Well, how do you calculate amortization? It’s like baking a pie — follow the steps. First, snag the total loan amount. Next, find your monthly interest rate by dividing the annual rate by 12. Then, determine the number of monthly payments you’re going to make. Mix these all together using the amortization formula or a handy loan calculator, and you’ve got a clear picture of what you’ll be paying over time.

What is the formula for Amortisation in Excel?

To calculate amortization on a financial calculator, you’ll be punching in numbers quicker than a barista whips up a latte. Just enter your loan amount, interest rate, and the total number of payments. Then hit the magic amortization button – if your calculator has one – or use the payment calculation function to get your monthly payment. Presto, you’ve got your number!

What is an example of amortization?

Oh boy, the formula for amortization in Excel is like a secret recipe that makes life easier! You’ll use the PMT function: simply type =PMT(rate, nper, pv) into a cell. Replace ‘rate’ with the monthly interest rate, ‘nper’ with the total number of payments, and ‘pv’ with the loan amount. Hit enter, and Excel does the heavy lifting – calculating your monthly payment is a breeze!

How do you calculate monthly payments on a loan?

An example of amortization? You bet! Let’s say you’ve got a $200,000 mortgage at a 4% annual interest rate for 30 years. Using the amortization formula, you’d dish out monthly payments of about $954.83. Over time, you’ll see the interest you pay decrease and the principal you pay increase with each payment – that’s amortization in action, like a sun setting on your debt!

Is amortization based on monthly payments?

To calculate monthly payments on a loan, grab a calculator and get comfy. You’ll use the standard formula: M = P \frac{r(1 + r)^n}{(1 + r)^n – 1}. Here, M is your monthly payment, P is the principal, r is the monthly interest rate, and n is the number of payments. Crunch those numbers, and there you have it – your monthly installment, clear as day!

What is amortization and mortgage and its formula?

Yep, amortization is all about those monthly payments. It’s the process where you chip away at your loan balance with regular, scheduled payments over time. A portion covers the interest, and the rest whittles down the principal. It’s like a slow dance where the end goal is zeroing out what you owe.

What is the difference between loan term and amortization?

Amortization and mortgage go together like peanut butter and jelly. The formula’s pretty straightforward: A = P \frac{r(1 + r)^n}{(1 + r)^n – 1}. That’s where A is your monthly payment. This covers both the interest and principal of your mortgage, spreading the cost evenly over the life of the loan – so you can keep your financial ship steady as you sail toward being mortgage-free!

What is the difference between depreciation and amortization?

Now, the difference between loan term and amortization can trip folks up, but here’s the scoop. The loan term is the time you’ve got to pay back the loan fully, whereas amortization refers to how those payments are spread out across the term. Think of the loan term as the marathon, and amortization is your pace; both get you to the finish line but in different ways.

Can Excel do amortization?

Diving into the difference between depreciation and amortization is like comparing apples to oranges in the accounting world. Depreciation is all about tangible assets losing value over time, like cars getting older and less vroom-vroom. Amortization, on the other hand, deals with paying off intangible assets, like patents or a loan — more like a countdown or a ticking clock on value.

What is Amortisation in balance sheet?

Can Excel do amortization? Heck yes, it can! Picture Excel as your finance-savvy buddy. Just create an amortization table using functions like PMT for monthly payments or use the CUMIPMT and CUMPRINC to track interest and principal amounts over time. Simply set up your terms, and let Excel crunch those numbers like it’s binge-watching its favorite spreadsheet series.