The Current State of the 30 Year Mortgage Rate

Today’s 30-year mortgage rate sits at a pivotal juncture. After a seemingly relentless ascent, homeowners and potential buyers are left pondering the path ahead. As it stands, Wells Fargo’s U.S. Economic Outlook reports that the 30 year mortgage rate today hovers around 6.8%. This figure marks a significant climb, underscoring a twenty-year peak that has reshaped the landscape of homebuying and ownership.

Looking back, this sharp uptick follows a historical low, making today’s rates appear particularly steep. Just a few years prior, rates had grazed record-breaking lows, fueling a frenetic housing market. It’s crucial to recognize the forces at play: from the Federal Reserve’s maneuvers to geopolitical tensions, each contributing to the rate’s journey.

Various factors impact the current 30 year mortgage rate. Among them, the Federal Reserve’s policies, inflation rates, and the broader economic climate reign supreme. These components interweave, painting today’s financial backdrop and, in turn, molding the cost of borrowing for homeownership.

How Economic Indicators Influence the 30 Year Mortgage Rate

The Federal Reserve plays a pivotal role in the mortgage saga, their policies often a guiding light for lenders nationwide. By adjusting the federal funds rate, the Fed can indirectly sway mortgage rates, steering the cost of loans for millions.

Inflation, that ever-present specter in the economy, similarly tugs at the strings of mortgage rates. As prices rise, lenders often seek higher returns to buffer against the diminishing power of the dollar. These inflationary tides, in turn, nudge rates upward.

Employment data and consumer spending also cast their lot into the mix. Strong employment and confident consumers can bolster the economy, yet also inspire higher rates as the demand for loans intensifies.

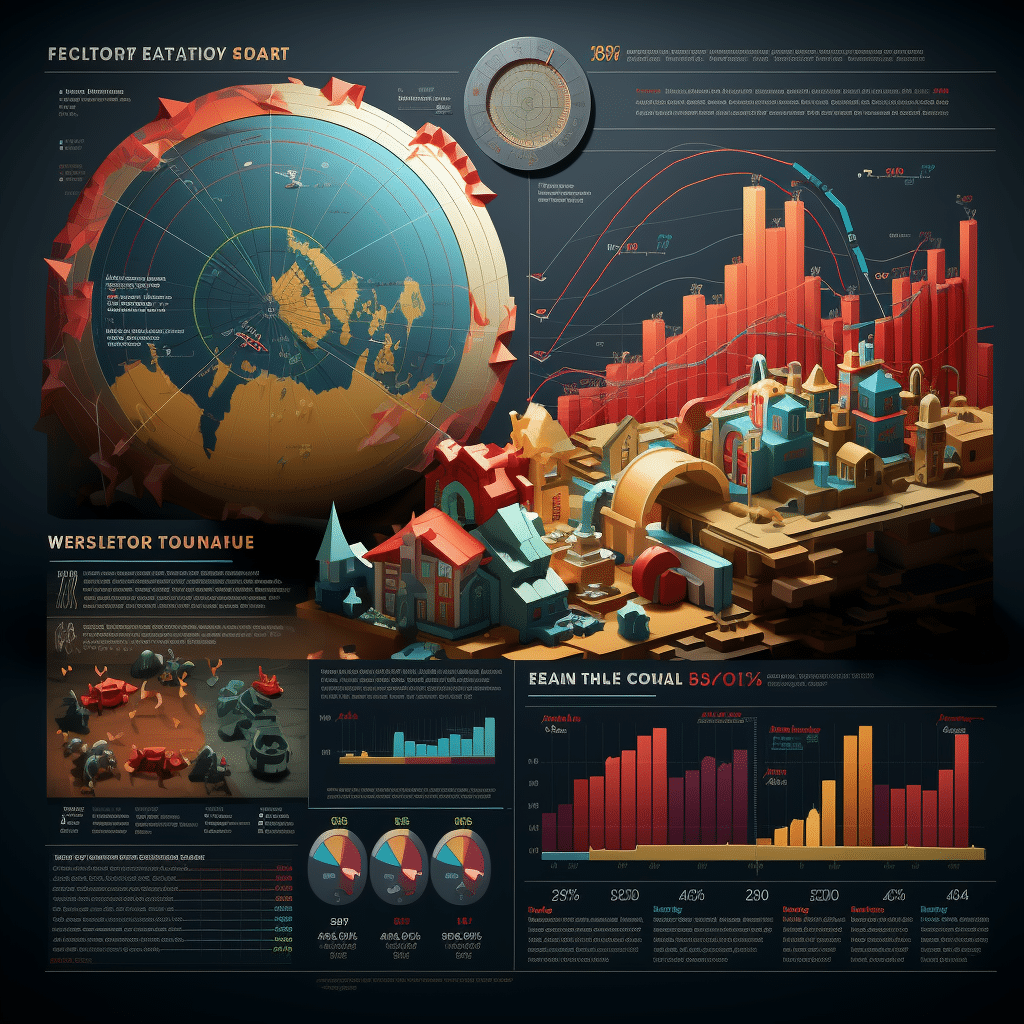

| **Statistic** | **Details** |

|---|---|

| Current 30-year mortgage rate | Varies* |

| Rate outlook for Q1 2024 | Predicted at 6.8% |

| Anticipated rate by end of 2024 | Decline to 6.05% |

| Forecast for early 2025 | Average rate to dip below 6% |

| Factors influencing rates | Inflation, Federal Reserve rate hikes |

| Historical context | Rates at a 20-year high |

| Range for 2024 | Expected to fall between 5.9% and 6.1% |

| Current recommendation for buyers | Consider buying now and refinancing later |

| Potential benefit of buying now | Avoid increased competition next year |

2024 Economic Outlook and Its Potential Impact on Mortgage Rates

What does 2024 hold? Financial institutions and economists eye the horizon, anticipating variables that may influence our economic landscape. Wells Fargo forecasts a gentle dip to 6.05% by year’s end, inching below 6% as we usher in 2025.

But the crystal ball isn’t clear-cut. Geopolitical events loom, each with the potential to disrupt economic stability and, by extension, mortgage rates. Housing market trends too cast their shadow, potentially heralding shifts in affordability and availability that resonate with mortgage costs.

Will the 30 Year Mortgage Rate Drop in 2024? Expert Predictions

Analysts don varied lenses to surmise the future of the 30-year mortgage rate. The spectrum of projections spans from cautious pessimism to guarded optimism, with moderation often deemed the most likely course. Looking to historical patterns may offer some solace or strategy, yet each cycle charts its own unique course.

Amidst these educated guesses, be it from the folks at Mortgage Rater or the Wall Street sages, one thing crystallizes: certainty is a luxury seldom afforded in the realm of economic forecasting.

Key Factors That Could Lead to a Decrease in the 30 Year Mortgage Rate

As we gaze forward, there’s a cadre of factors that could press down on the 30-year mortgage rate. Monetary policy may pivot, whether through Federal Reserve wizardry or congressional fiscal maneuvers. Technological advances also stand to reshape the lending landscape, potentially easing rates downward.

International developments shouldn’t be overlooked; our globalized economy ensures that ripples from across the pond can swell into waves hitting America’s financial shores, mortgage rates included.

What Homebuyers Can Expect with the 30 Year Mortgage Rate Today

So where does this leave homebuyers considering a 30-year loan at today’s rates? The climbing rates gnaw at buying power, constricting affordability like a tightening belt. However, strategies abound for navigating these choppy waters.

Financial advisors champion locking in rates swiftly, positing that a bird in the hand (today’s rates) beats two in the bush (potential future rates). With projections pointing to softening rates, purchasing now with an eye on future refinancing could prove savvy.

Best Practices for Mortgage Shoppers in 2024

Any worthwhile advisor echoes the refrain: credit scores, substantial down payments, and choosing the right loan type are cornerstone practices for mortgage hunters. Every percentage point and credit score increment can swing doors wide to more favorable rates.

Moreover, the landscape brims with lender options. From the brick-and-mortar bastions to nimble, innovative online platforms, comparison shopping is more than just due diligence—it’s financial survival.

Analyzing the Long-Term Perspective for 30 Year Mortgage Rates

Peering through the long lens, 30-year mortgage rates have ebbed and flowed, with today’s numbers paling against the peaks of yesteryears. The interplay of these rates with housing trends and the broader economy becomes a dance of cause and effect, both informing and responding to market forces.

For those entrenched in mortgage dealings, whether greenhorn buyers or seasoned homeowners, the historical patterns offer context—though rarely concrete guidance.

Actionable Tips for Homeowners and Refinancers in a Volatile Market

In an erratic market, the refinancing quandary often looms large. Timing can be as critical as the rate itself, with personal circumstances and market pulses dictating the opportune moment to strike.

The decision to shuffle from a 30-year to a 15-year mortgage (or vice versa) cannot be taken lightly. Each route carries its own set of benefits and burdens, a balance of monthly outlays against long-term interest accrual. Meanwhile, risk tolerance takes the reins when riding out rate fluctuations, a financial rodeo not for the faint of heart.

Conclusion: What to Really Expect from the 30 Year Mortgage Rate in 2024

To sum up, the 30 year mortgage rate today is a tapestry of economic indicators, expert analysis, and best-guess prognostications. 2024 may whisper promises of easing rates, yet savvy players in the mortgage game would do well to keep a finger on the pulse, poised to pivot as the financial winds shift.

In this world of fiscal twists and turns, staying informed and proactive in your mortgage journey isn’t just advice—it’s imperative. So arm yourself with knowledge, and let forethought be your guide through the ever-unfolding story of the 30-year mortgage rate.

Understanding the Ebb and Flow of the 30 Year Mortgage Rate Today

Just like a hearty episode from The reluctant traveler Episodes can take you on an unexpected journey, so too can the history of the 30 year mortgage rate today. It’s almost as if mortgage rates have a personality of their own—sometimes they’re calm as a well house, and other times they’re bouncing around like a Packback full of energy. Predicting their movements? Well, that’s about as easy as nailing gelatin to the wall.

Who knew that 30 year mortgage interest rates have a history as rich and frothy as the beloved pink whitney on a Friday night? They’ve seen the highs of the economic boom times and the lows when the economy hit the skids, like a dramatic climax in lioness season 2. But here’s a kick: did you know that despite these thrills, the 30-year mortgage has remained one of the most popular options for homebuyers since its inception after World War II? Yep, it’s been a mainstay, providing the stability of a well-known character in a long-running series.

What is the interest rate on a 30 year fixed right now?

– As of knocking on your screen, the word on the street is that the 30-year conventional mortgage rate is hovering around 6.8%. But hey, hang tight because Wells Fargo Bank’s brainy bunch forecasts a dip to 6.05% by the year’s end. So, grab your surfboards, folks, ’cause it looks like we’re in for a gentle slide down rate hill!

What are 30 year mortgage rates today?

– Today’s 30-year mortgage rates are strutting around at 6.8%, according to the latest buzz from Wells Fargo’s eggheads. Don’t let that number scare ya—grapevine’s got it that we’re looking at a possible shimmy down to 6.05% by the time we’re singing Auld Lang Syne for 2024.

Are 30 year mortgage rates dropping?

– Are 30-year mortgage rates dropping? Well, if we peek into Wells Fargo’s crystal ball, they’re not just dropping; they’re on a slow-motion swan dive from 6.8% to a more relaxed 6.05% by the time we’re poppin’ the 2024 champagne. So, fingers crossed, we might just be riding a downhill trend!

Are mortgage rates expected to drop?

– Expected to drop? You betcha! The soothsayers at Wells Fargo predict that by the end of this year, we’ll be toasting to a more cozy 6.05% on the 30-year rates. And if that’s not enough, whisperings suggest a dip below the 6% mark early in 2025. Time to keep your eyes peeled and wallets ready!

Are interest rates going down in 2024?

– In 2024, interest rates are looking to play a bit of hide and seek, but word on the block is they’ll sneak down to somewhere between 6.05% and 5.9% by the year’s end. Better news? The gurus reckon a tumble below 6% come 2025. So, yeah, looks like what goes up must come down!

What is best mortgage rate today?

– Hunting for the best mortgage rate today? Well, it’s a jungle out there, but as of now, the 30-year fixed-rate mortgage is strutting its stuff at 6.8%. Not exactly party numbers, but with chatter of rates taking a chill pill later this year, keep your ears to the ground!

What is the interest rate for a 700 credit score FHA loan?

– For the folks sporting a shining armor credit score of 700, an FHA loan interest rate can look like the belle of the ball. Usually, you’d be swooning over rates slightly lower than conventional loans, with your 700 charm possibly locking in below that 6.8% average. Remember, lenders love a good credit waltz!

Will interest rates come down?

– Will interest rates come down, you ask, biting your nails? According to Wells Fargo’s economists, the 30-year mortgage rates will indeed shimmy down a notch to about 6.05% as we bid adieu to 2024. So, yes, they’re gearing up to take a little hike…downward!

Is 3.25 a good mortgage rate for 30 year?

– Oh, 3.25% for a 30-year mortgage rate? Talk about the good ol’ days! Right now, we’re waltzing around 6.8%, but if you’re dreaming of rates that low, keep those fingers crossed. The future’s as unpredictable as a game of bingo, but hey, history does love a good throwback!

Will mortgage rates ever be 3 again?

– Will mortgage rates ever be 3 again? As much as we’d love to step back into those comfy shoes, it’s a long shot with today’s dance at 6.8%. But hey, never say never. With the economy boogying in mysterious ways, one can only hope for an encore of those rock-bottom rates.

What has been the lowest 30-year mortgage rate?

– Ready for a blast from the past? The lowest 30-year mortgage rate in living memory turned the party up at an unheard-of 2.65%. Happened back in January 2021, when the world was a bit topsy-turvy. A rate worth daydreaming about at today’s 6.8%, huh?

What was the lowest 30-year mortgage interest rate?

– The lowest 30-year mortgage interest rate ever recorded was akin to spotting a unicorn—2.65%, can you believe it? This magic moment hit the history books in January 2021, and with today’s rates doing the limbo around 6.8%, that feels like catching lightning in a bottle.

Should I lock in my mortgage rate today or wait?

– Should you lock in your mortgage rate today or wait? Ah, the million-dollar question! With rates expected to rendezvous with 6.05% by the end of 2024, you might think to bide your time. But beware of the old bait and switch; rates are as slippery as a wet bar of soap!

What is the lowest ever mortgage rate?

– The lowest ever mortgage rate was like finding a four-leaf clover—in January 2021, some lucky ducks nabbed a 30-year rate at a measly 2.65%. Nowadays, we’d need a time machine to get back to that happy place!

How can I get a lower mortgage interest rate?

– Dreaming of a lower mortgage interest rate? Well, roll up your sleeves and get ready to charm your lender. Spruce up your credit score, stack up your down payment, and don’t forget to shop around like it’s Black Friday. Play your cards right, and you might just slice a sliver off that rate!