Navigating the world of mortgages can feel like sailing in uncharted waters, but understanding the landscape of the 30 year lending rate is akin to having an experienced captain at the helm. Let’s dive into the current undercurrents and possible future tides in this crucial aspect of home financing.

Understanding the Trends in 30 Year Lending Rates

Gone are the days of volatile rates that made the knees of potential homeowners shake. Instead, welcome to an era where 30 year lending rates have carved out a niche of reliability. Let’s break it down:

The Impact of Economic Policies on 30 Year Lending Rates

Economic policies can steer rates as surely as the wind fills the sails of the economy. Here’s how they’re currently charting our course:

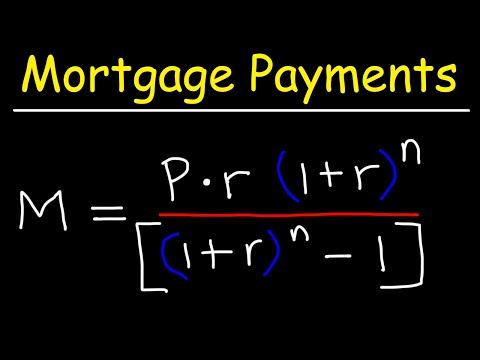

| Category | Description |

|---|---|

| Current Average Rate (30-yr) | 7.12% |

| Date of Rate | March 01, 2024 |

| Rate Stability | Unchanged since last week |

| Comparison to 15-yr Loans | Higher rate due to longer-term & higher risk |

| Bank’s Cost | Higher for 30-year loans |

| 30-yr vs. 15-yr | 30-yr offers smaller monthly payments |

| Benefit of 30-yr Loan | More affordable monthly payments |

| Benefit of 15-yr Loan | Lower overall cost due to lower interest rate |

| Factors Influencing Rate | Economic conditions, Federal Reserve policies |

| Impact of High Rate | Increased cost of borrowing, higher payments |

Comparing Top Financial Institutions’ 30 Year Lending Rates

In this vast ocean, national banks are like great cruise liners, offering 30 year lending rate deals that cater to a wide audience. They are typically the stalwarts of consistency.

But don’t overlook the nimble sailboats – credit unions. They often offer competitively low rates, proving that a tighter crew can sometimes outmaneuver the larger vessels.

And let’s not forget about the new flotilla in town, online mortgage lenders. Check out the Largest mortgage company to see how these digital platforms are disrupting traditional lending with competitive rates and innovative services.

30 Year Lending Rate Predictions: Expert Opinions and Analysis

Forecasting interest rates is akin to predicting the weather; it can be sunny one moment and stormy the next. Yet, experts are pointing to skies that might stay mostly clear for a while.

Leading economists have their telescopes trained on various stars – unemployment figures, consumer spending, global markets – all to predict where 30 year lending rates are heading.

And in today’s digital age, we’ve got our hands on tools sharper than ever before, with AI offering data-driven insights that are changing the game in rate predictions. It’s like having a crystal ball, but one powered by algorithms and machine learning.

How Consumers Can Capitalize on Stable 30 Year Lending Rates

In these stable waters, consumers have the wind in their sails and an opportunity to chart a favorable course for their financial future.

Exploring Innovative Mortgage Products Around 30 Year Lending Rates

The mortgage market, ever on the move to find new horizons, is innovating with products that blend the best of stability and flexibility – think of them as the catamarans of mortgage options.

Success stories are abound, like melissa newman, who deftly navigated the hybrid loan waters to find a mortgage that was a perfect fit for her changing needs.

Future Outlook for the 30 Year Lending Rate Environment

Peering into the spyglass, what might the horizon hold for 30 year lending rates? Here’s the forecast:

Conclusion: Navigating Your Mortgage Options in a Stable Rate Climate

As we dock at the end of our journey, let’s recap the treasures we’ve uncovered about the 30 year lending rate:

And remember, steady as she goes – ongoing education and working with trusted financial advisors, such as getting to grips with What Is a purchase interest charge, will ensure that you maintain a clear course as you chart the sometimes mystifying waters of mortgage rates.

Let’s raise a toast to favorable winds and smooth sailing on your mortgage voyage. The stability of the current 30-year lending rate is a lighthouse guiding you home.

A Journey Through the Past of the 30 Year Lending Rate

Did you know the concept of a 30-year mortgage feels almost as epic as a saga sprawled across centuries? Picture this: a stroll through the epic history Of The world part 2, where the development of this financial instrument plays a starring role. Think of it as a time when the 30 year mortgage interest rate was just a twinkle in the eye of the modern economy, morphing dramatically from the Roaring Twenties to the financial ebbs and flows of the 21st century.

Now, let’s jump into a bit of present-day buzz. Have you ever wondered what the current spectacle of 30 year interest rates today is all about? It’s like tuning in to the latest episode of your favorite drama series. One day, it’s all smooth sailing, and the next day, it’s more up and down than a roller coaster at your local amusement park.

Fun Facts: From Inception to Internet Era

Alright, here comes a curveball – ever heard of Melissa Cohen? You might be scratching your head, wondering what she has to do with the “30 year lending rate, but stay with me. Melissa is the kind of influencer who’d likely have a few fun anecdotes to share about how today’s 30 year loan rates are influencing trends in real estate and home decor. Imagine chatting about interest rates over a cup of coffee – yep, that’s the world we’re envisioning!

And here’s a nugget of trivia just as sparkling as Melissa’s insights. Picture the 30-year lending rate not just as a number but as the lifeblood of the American Dream, pumping vitality into the pursuit of home ownership for countless individuals. It’s pretty incredible to think that with every tick upwards or dip downwards, a family’s trajectory toward their forever home can shift in the blink of an eye.

So, as we wrap this up, keep your eyes peeled and your ears to the ground. The 30-year lending rate might not sound like the stuff of legends, but in the world of finance and dreams, it’s as mighty as they come. As unpredictable as a cliffhanger and as influential as the main character in the story, it’s worth keeping this in your collection of cocktail party trivia. Who knows? Next time you’re at a soirée, throwing out a factoid about the ever-changing world of mortgage rates just might make you the most interesting person in the room.

What is the 30 year interest rate right now?

– Hold your horses—looking for the latest on 30-year mortgage rates? As of Friday, March 1, 2024, you’re looking at an average rate of 7.12%, which hasn’t budged since last week. So, if you’re in the market, that’s the number to beat!

What are 30 year mortgage rates today?

– Paging all home buyers: the magic number for today’s 30-year mortgage rates holds steady at 7.12%. Yep, no curveballs here; it’s the same as it was last week, folks!

What is the federal interest rate for 30 year loan?

– Alright, let’s talk shop about federal interest rates for a 30-year loan—well, the feds don’t set mortgage rates directly, but they influence ’em for sure. As for a 30-year fixed mortgage, the current average is sitting pretty at 7.12%.

Do 30 year loans have higher interest rates?

– So, do 30-year loans usually pack a higher interest rate? You betcha. Longer loans are riskier for banks and cost them more over time, so they charge you a bit more interest to cover their bets.

Is 3.25 a good mortgage rate for 30 year?

– Is 3.25% a unicorn mortgage rate for a 30-year these days? Absolutely! With rates hovering around 7.12%, snagging a 3.25% is like hitting the mortgage jackpot—definitely a good rate in our book!

What was the lowest 30 year mortgage interest rate?

– Wondering about the lowest 30-year mortgage interest rate on record? It’s like looking back at a fairy-tale era—once upon a time, rates dipped below 3%. So, anything close to that is pretty stellar today.

Are interest rates going down in 2024?

– Are interest rates expected to mosey on down in 2024? Well, crystal balls aside, it’s a bit of a guessing game. But for now, they seem to be sticking like glue around 7.12%.

Are 30-year mortgage rates dropping?

– On the hunt for signs of 30-year mortgage rates dropping? Look, they’ve been playing it cool at 7.12% for a spell, so if you’re waiting for a dip, keep your eyes peeled but don’t hold your breath.

Are mortgage rates expected to drop?

– Hoping mortgage rates will take a plunge soon? Well, we’re all in that boat, but predicting rates is like trying to nail jelly to the wall—tricky at best. So, keep an ear to the ground and watch the market trends.

What is best mortgage rate today?

– Searching for the cream of the crop in mortgage rates today? If you’re gunning for a 30-year loan, the benchmark’s 7.12%. Anything lower, and you’re in the money, mortgage-wise!

What is a good mortgage rate?

– What’s considered a good mortgage rate? Look, anything that leaves you feeling like you’ve won the lottery, considering current trends. These days, with 30-year rates around 7.12%, scooping up anything lower is a definite win.

Why are mortgage rates so high?

– Racking your brain about why mortgage rates are through the roof? It’s a mix of economic voodoo—think inflation, market jitters, and demand. Basically, it’s the cost of borrowing money on steroids lately.

What is today’s prime rate?

– What’s today’s prime rate, you ask? Drumroll, please… Well, it’s typically a few percentage points above the federal funds rate, but you’ll need to check with banks for the nitty-gritty, as it can change faster than a chameleon!

Why would someone choose a 30-year mortgage?

– Why pick a 30-year mortgage? For starters, you get lower monthly payments spread over more years, which can be a breath of fresh air for your budget—even if the total cost over time is a bit higher.

Why is a 15-year loan better than a 30?

– Leaning towards a 15-year loan versus a 30? Smart cookies know it’s mostly because you’ll pay less interest overall. Shorter loans are like a sprint; you pay more monthly but save cash in the long run.

What is the current Fed interest rate?

– Wondering about the current Federal Reserve interest rate? Oh, it’s a hoot trying to keep up, but it basically sets the pace for other rates—think of it as the heart rate of the banking world.

What is the current prime interest rate?

– Curious about the current prime interest rate? It’s like a chameleon, always changing colors—the prime rate moves up or down with the feds. Hit up your bank for the latest gossip there!

Are interest rates going down in 2024?

– Still on the edge of your seat about interest rates in 2024? They’ve been playing some serious hardball lately, not giving any relief from that average of 7.12%. But who knows? Any day could bring a new game.

What is best mortgage rate today?

– On the prowl for today’s best mortgage rate? Well, my friend, if you lock in something under the current average of 7.12%, you’re ahead of the game. Keep an eye out, be swift, and may the rates be ever in your favor!