What Is Roth IRA and Why Is It Essential for Your Future?

Understanding what is Roth IRA is pivotal for anyone looking to secure a financially stable retirement. A Roth IRA (Individual Retirement Account) allows individuals to invest post-tax income, resulting in tax-free growth. This unique tax structure benefits anyone anticipating higher tax brackets later in life. With the tricks of inflation and rising costs of living, knowing the ins and outs of a Roth IRA can be the difference between a comfortable retirement and financial struggle.

Employing a Roth IRA is like planting a tree—your investment can take time to grow, but it can yield substantial returns down the line. Think of it this way: you invest your money now, pay the taxes, and then watch it dance its way to a tax-free retirement party! With rising national debt and potential tax hikes, starting a Roth IRA sooner rather than later could be your ticket to that dream retirement.

So, how does this magic happen? Tax-free withdrawals during retirement help ensure that you can enjoy your hard-earned savings without worrying about how much Uncle Sam wants to take. Combine that with the ability to withdraw contributions any time without penalties, and you’ve got a solid tool for financial flexibility and peace of mind.

7 Compelling Reasons Why a Roth IRA Could Be Your Best Retirement Option

How Does a Roth IRA Compare to Other Retirement Accounts?

When considering various retirement options, understanding the differences is essential.

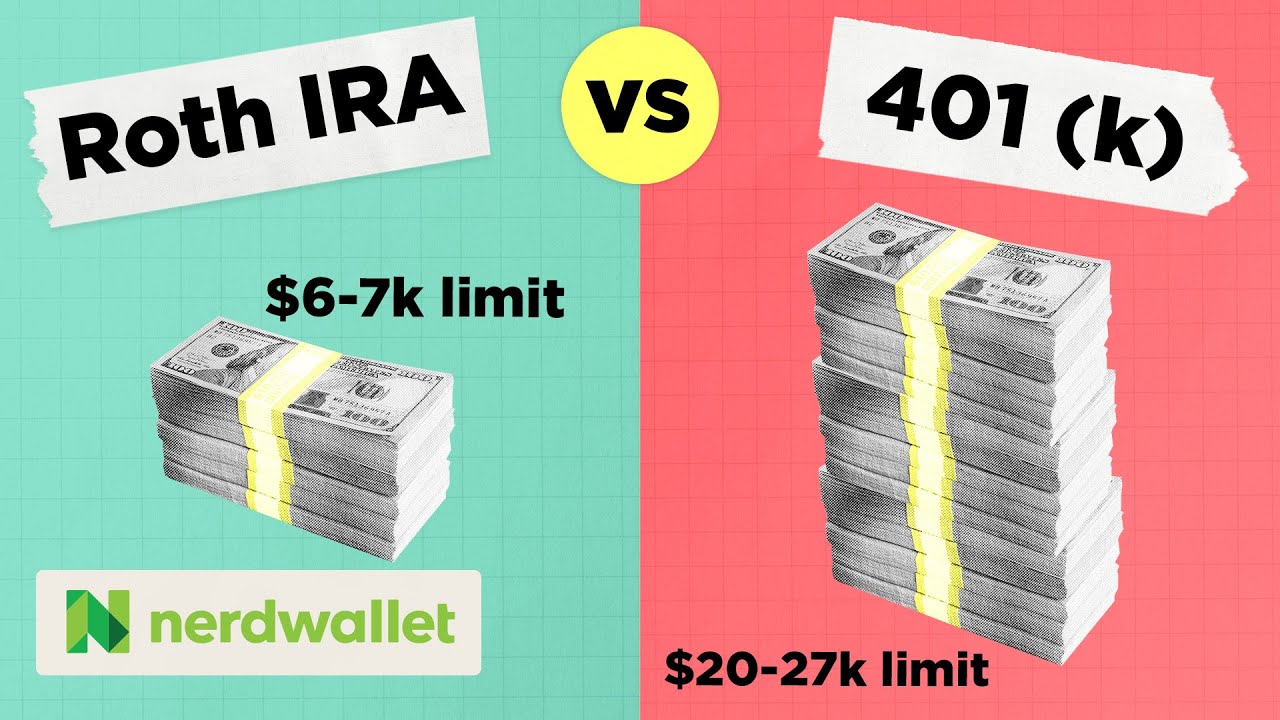

Traditional IRAs give immediate tax deductions but tax future withdrawals. Considering rising tax rates, a Roth IRA often leads to significant savings over time—especially if you start young.

Many employers will match contributions to a 401(k), which is fantastic! But when your contributions exceed those match limits, a Roth IRA serves as an excellent supplementary savings tool, beckoning young professionals for its benefits.

Knowing what is Roth IRA in comparison helps you plan better, making informed decisions for a secure retirement.

Future Trends: What is POS and Why It Matters to Your Roth IRA Strategy

As we approach 2026, financial strategies are evolving. What is POS (Point-of-Sale systems) is a game-changer, revolutionizing how people interact with their finances. By integrating these technologies into buying strategies, retirees using Roth IRA funds for investments in new tech or startups can maintain their buying power.

The Meme Generation: Investing Wisdom for the Young

Social media is reshaping financial education. The “Meme Generation” leverages platforms like Reddit’s WallStreetBets to educate themselves about investment opportunities. This trend isn’t just playful; it enables savvy investing strategies that can complement the contributions to a Roth IRA.

Understanding the cultural nuances of investing is paramount. Today’s younger investors appreciate humor and community while making savvy choices. By integrating what they share and learn, they can strategically bolster their Roth IRA accounts—turning memes into money!

Innovating Your Financial Future: Preparing for Retirement in a Changing World

Today’s retirement landscape demands flexibility, foresight, and a comprehensive understanding of options like the Roth IRA. Knowing its benefits and staying abreast of market trends can help you create a flourishing financial future that stands the test of time.

Transitioning from traditional methods to more contemporary practices empowers you to realize your retirement dream. In navigating this economic landscape, prioritizing strategic investments through a Roth IRA can lead to genuinely fulfilling golden years without financial worry.

With all your options in play, remember to leverage platforms like Chase Login credit card for your financial dealings and to discover opportunities, like What Is Chime, to supplement your savings goals. Getting ready for retirement successfully means creating a balanced approach that includes understanding your investment tools.

In essence, the importance of knowing what is Roth IRA can’t be overstated—it’s the key to unlocking your dream retirement. Embracing its advantages today can mean living free from financial stress tomorrow.

What Is Roth IRA?

Understanding what is Roth IRA is crucial for anyone looking to fund their retirement effectively. A Roth IRA is an individual retirement account that allows your money to grow tax-free, meaning you won’t owe any tax on withdrawals during retirement, provided certain conditions are met. This can be a game-changer for many folks, especially in today’s financial landscape, where tax rates can fluctuate significantly.

The Origins of the Roth IRA

You’d be surprised to know that the Roth IRA is named after Senator William Roth, who played a pivotal role in its creation in 1997. Originally, the idea was to encourage long-term savings among Americans, and it has done just that. Much like Rufus Sewells versatility as an actor, a Roth IRA is adaptable — it can suit various retirement planning styles, whether you’re solely investing in stocks or diversifying into bonds and mutual funds. In fact, having a variety of investments within your Roth IRA can mirror someone meticulously designing a garden like the Edens Garden project, focusing on growth and beauty in investment strategy.

Tax-Free Growth and Fun Facts

Now, here comes the fun part! What makes a Roth IRA particularly enticing is that contributions are made with after-tax dollars. This means you pay taxes on your money before it goes into your IRA, but the growth and withdrawals can be tax-free. It’s kind of like finding the perfect hotel near me with pools—an unexpected pleasure during a stay that can make the trip way more enjoyable. Speaking of enjoyment, check this out: anyone can contribute to a Roth IRA as long as they have earned income, but high earners might face limitations—think of it like the fake Mums in the garden, beautiful but sometimes tricky to manage.

Your Retirement, Your Way

Investing in a Roth IRA is an attractive option not just for tax reasons, but also for its flexibility. You can withdraw your contributions at any time without penalties, allowing for a degree of freedom that feels refreshing. It’s a bit like the thrill of watching your favorite episodes of The Loud House, where there’s always something entertaining and relatable. Folks with a Roth IRA can keep their savings fluid and ready for whatever life throws at them, similar to how you’d manage an evolving journey through areas like South Central los angeles—where the real and raw experiences contribute to personal growth. So, if you’re pondering what is Roth IRA, think of it as more than just an investment account, but a key to unlocking a fulfilling retirement experience!