Understanding Car Liens: A Comprehensive Guide

Unveiling the Basics: What Is a Car Lien?

A car lien is akin to a safety net—except it’s for lenders and not the high-wire act you’re imagining. It’s a legal claim on a vehicle that ensures those who lend money or services in connection with the car get paid. In the bustling bazaar of the automotive and financial industry, liens are the invisible strings that tether a borrower’s obligation to their dazzling new ride.

A lien essentially tells the world that yep, you may be driving the car, but someone else has a vested interest in it, too. Much like Ali Macgraw in a classic film, a lien is a silent yet formidable presence, underpinning the drama of loans and ownership.

| Category | Details |

|---|---|

| Definition | A car lien is a legal claim on a vehicle by a lender as collateral for a loan or by another party for the payment of a debt related to the vehicle. |

| When a Lien Is Created | A lien is placed on a car’s title when it is financed, securing the lender’s interest until the loan is paid off in full. |

| Lienholder | Typically the lienholder is a bank, credit union, or finance company that provided the vehicle loan. |

| Owner’s Responsibilities | The owner must know the lienholder and meet insurance requirements; steps must be taken if selling the vehicle before the loan is paid off. |

| Selling a Financed Vehicle | The loan must be paid off or the lien properly transferred to the new owner who assumes responsibility for the debt. |

| Adding a Lien on a Title | Requires the vehicle title and a completed Application for Texas Title and/or Registration (Form 130-U) or equivalent in other states. |

| Car Lien Sale | If the debt isn’t settled, the lienholder can notify all parties and may auction the vehicle to the highest bidder after a set date. |

| Lien History Check | A VIN search can reveal any liens on a vehicle and can be done through state motor vehicle departments or private organizations like CarFax. |

| Release of Lien | The lienholder’s release must be notarized upon settlement of the debt, and a new registration and title can then be issued by the DMV. |

| Documentation for Release | The buyer needs to bring the completed and signed forms to the DMV to avoid delays in reissuing a clear title and registration. |

Delving into the Details: The Anatomy of a Lien Title

When discussing the anatomy of a lien title, here’s the skinny:

Buy Then Build How Acquisition Entrepreneurs Outsmart the Startup Game

$15.29

“Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game” is a groundbreaking guide that offers a fresh perspective on entrepreneurship and the path to business ownership. The book advocates for a strategy where instead of starting from scratch, entrepreneurs look to acquire an existing business and build upon its foundation. This approach mitigates many risks associated with startups by leveraging a company that already has a track record, existing customer base, and operational systems in place. Written by acquisition entrepreneur Walker Deibel, the book serves as a roadmap for navigating the complexities of buying a business and scaling it successfully.

The content in “Buy Then Build” is designed to illuminate the benefits and procedural knowledge necessary for taking this less-trodden path to entrepreneurship. It covers critical topics such as identifying suitable businesses for acquisition, securing financing, and conducting due diligence to ensure a wise investment. Readers will find actionable advice on negotiating deals, the transition of ownership, and strategies for growth post-purchase. With practical insights and real-world examples, the book is an invaluable resource for aspiring entrepreneurs who seek a more reliable and calculated approach to business ownership.

Apart from guiding entrepreneurs through the process of business acquisition, “Buy Then Build” challenges the conventional wisdom of the startup ecosystem that glorifies the “from-zero-to-hero” narrative. Deibel emphasizes that by starting with a solid foundation, acquisition entrepreneurs can focus on scaling a business rather than struggling with the initial stages of getting a startup off the ground. This book is not only an eye-opener for those considering their own ventures but also an essential read for investors, business students, and professionals looking to diversify their knowledge on contemporary entrepreneurial strategies. As such, “Buy Then Build” is a pivotal contribution that redefines the entrepreneurship landscape and empowers readers with the confidence to bypass the startup game and jump straight into the role of a successful business owner.

Concrete Evidence: The Importance of Proof of Purchase

Don’t underestimate the clout of a good piece of paper. Proof of purchase is your financial alibi. It’s what keeps you out of the hot water when it comes to car liens. Missing this vital document could mean legal headaches that are trickier than a Rubik’s cube.

Securing proof of purchase involves a few steps, but it’s about as crucial as knowing the rules to Monopoly before you start playing. Otherwise, you’re just rolling the dice and hoping for the best.

Caught Off Guard: Recourse When Sold a Car with a Concealed Lien

It’s a scenario that could leave you feeling more duped than an amateur at a poker game: “someone sold me a car with a lien on it without telling me.” Before you know it, you’re in a financial tangle that would leave even Houdini scratching his head.

Legal and financial steps can be taken to untangle this mess. But why walk the tightrope without a safety net? Take precautions like the practiced tightrope walker you are to avoid this scenario when buying a used car.

The Legal Landscape: How Title Holding States Manage Car Liens

Title holding states play by their own rules—like a casino with its own house rules. Here’s the deal: they keep a firm grip on the car title until the lien’s as gone as last season’s fashions. This can trip up both buyers and sellers if they’re not up to speed on the playbook.

Title Holding States have unique strategies you’ll need to thread through the needles of this legal tapestry.

Build a Rental Property Empire The no nonsense book on finding deals, financing the right way, and managing wisely. (InvestFourMore Investor Series)

$16.99

“Build a Rental Property Empire: The no-nonsense book on finding deals, financing the right way, and managing wisely” is an indispensable guide for both novice and experienced real estate investors within the InvestFourMore Investor Series. This comprehensive book is written with a straightforward approach, offering practical advice and proven strategies for building a successful rental property business. Author and seasoned investor Mark Ferguson draws from his own experiences, sharing key insights on how to identify lucrative deals, secure financing effectively, and manage properties for long-term growth and stability. Readers will benefit from Ferguson’s direct style as he demystifies complex concepts, making the journey to real estate wealth accessible to everyone.

Diving into the world of real estate investment, this book focuses on essential tactics for finding the right properties that promise a good return on investment. The author reveals the secrets of his success, detailing the process of evaluating potential properties, understanding market trends, and employing negotiation techniques that work. From single-family homes to multi-unit residential buildings, the book offers an in-depth look at various types of rental investments, providing readers with the confidence to make informed decisions. Whether you’re aiming to buy your first property or expand your portfolio, this guide provides the tools necessary to navigate the often-challenging terrain of finding the right real estate deals.

Financing your property investments wisely is another core theme of this practical guide. With a plethora of financing options available, “Build a Rental Property Empire” breaks down the complexities of mortgages, loans, and creative financing to help investors find the path that best suits their goals and financial situation. Moreover, once the properties are in your portfolio, the book delves into effective property management techniquesâfrom finding and retaining good tenants to handling maintenance and maximizing profitability. This book equips investors with the expertise to manage their properties efficiently, ensuring their rental property empire stands the test of time.

Demystifying the Lien Process: What Is a Lien on a Car Exactly?

Down to the brass tacks: A lien on a car is what keeps everyone honest. Lenders, borrowers, even the stoic folks at the DMV, they’re all bound by this financial force field. It’s the bread and butter of ensuring obligations are met.

Skip out on an active lien and you’re asking for a storm of trouble that no umbrella can shield you from. Know your consequences and responsibilities, or risk playing a financial game of hot potato.

Breaking the Chains: What Is a Release of Lien, and How to Obtain One

Freedom from a lien comes in the form of a release of lien. This step-by-step process is your get-out-of-jail-free card, ensuring you leave no stone unturned and every “i” dotted in your car buying journey.

Neglecting to lock down this lien release is like stepping on stage without knowing your lines. Tips for verification are the rehearsal you need for a clean handoff.

Advanced Insight: How Modern Technologies Influence Lien Management

Modern tech is revolutionizing lien management like smartphones changed the way we talk. No longer are we leafing through dusty records, we’re clicking and scrolling.

Innovative tools are changing the game for car buyers and sellers. Sticking to old methods is a bit like bringing a knife to a gunfight—you won’t stand a chance.

The World According to Clarkson

$14.01

“The World According to Clarkson” is an exhilarating collection of musings and anecdotes from one of Britain’s most outspoken and entertaining personalities, Jeremy Clarkson. Renowned for his straightforward approach and wry humor, “The World According to Clarkson” offers a unique view on the events that shape our time, from the mundane daily annoyances to the most pressing global issues. Each page is infused with Clarkson’s signature wit, guaranteeing laughter and thought-provoking entertainment.

The book is structured as a compilation of his columns published in The Sunday Times, which touch on a variety of topics, allowing readers to indulge in bite-sized segments of Clarkson’s sage yet often hilariously controversial observations. Whether he’s lamenting the complexities of modern technology, critiquing political blunders, or extolling the virtues of a particularly fine motorcar, his prose is engaging and remarkably relatable. Clarkson’s distinct voice ensures that no subject is off-limits, as he tackles anything that strikes his fancy with irreverence and a sharp tongue.

Yearning for both entertainment and a fresh perspective on everything from the everyday to the extraordinary? “The World According to Clarkson” is a delightful journey through the eyes of a man who says what many think, but few dare to express. The book’s undeniable charm lies in its ability to amalgamate humor and candidness, resulting in a read that’s not just a series of opinions, but a reflection of a well-lived life through the scope of one of television’s most enduring personalities. Clarkson fans and newcomers alike will find this book an addictive readâhard to put down and even harder to forget.

Crafting Your Defense: Proactive Strategies to Avoid Lien Troubles

If you’re navigating lien waters, why not carry a compass? Your due diligence checklist is your North Star, guiding you away from potential icebergs.

Sellers aren’t off the hook, either. Disclosure and transparency are your trusty sidekicks. And in the legal maze of liens, a legal counsel is your Gandalf—leading you out of the dark.

Navigating the Lien Minefield: An Analytical Look at Trends and Data

Diving into data and trends on car liens is like strapping on Sherlock’s magnifying glass and deerstalker. What’s the lay of the land? What should you keep your eyes peeled for in the coming years? An analytical look may just save your wallet from a surprise heart attack.

Expert Perspectives: Unique Angles on Managing and Understanding Liens

Expert insights can be as refreshing as an oasis in a desert of misinformation. Legal beagles and financial wizards lift the veil, offering arcane knowledge on the ins and outs of car liens.

Tap into the wisdom of those who’ve been there, done that, and have the war stories to prove it. The advice is exclusive, like a backstage pass to financial stability.

In the Rearview Mirror: Reflecting on the World of Car Liens

Breathe easy—our journey through the world of car liens is steering towards a pit stop. It’s time to reflect on the road traveled and the insights gathered.

Keep a mental snapshot of these learnings; they’re the ace up your sleeve. Whether you’re looking to buy or sell, I’ve dished out my thoughts, a combination of Suze Orman’s wisdom and Robert Kiyosaki’s practical advice, to empower you in this cutthroat vehicular bazaar.

Innovation in lien management is revving up, with the digital landscape shifting gears and propelling us toward new horizons of purchaser empowerment. So, stay sharp, stay savvy, and may your financial paths be as clear as the highway on a sunny day.

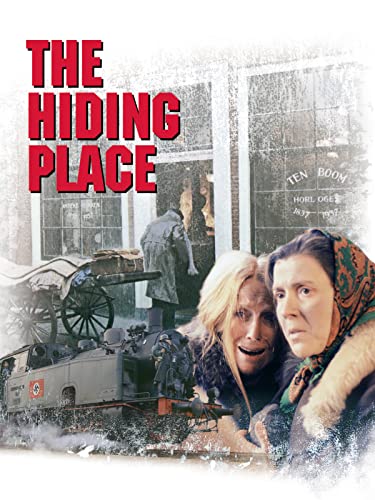

The Hiding Place

$1.99

Immerse yourself in a world of intrigue and secrecy with our latest board game, “The Hiding Place.” Designed for suspense enthusiasts and strategy game lovers alike, this captivating game offers an intense blend of critical thinking and thrilling unpredictability. Players become clandestine characters with their quests, weaving through a labyrinth of safe houses and secret compartments to stash their treasures and confidential information. Each turn is a dance with danger as individuals must outsmart their opponents to protect their cache.

“The Hiding Place” stands out with its beautifully crafted game board and pieces, each detail meticulously designed to enhance the immersive experience. Hidden compartments within the board itself offer players a unique physical interaction that goes beyond traditional gameplay, engaging both tactile senses and strategic prowess. The game is perfect for 2-6 players, ages 13 and up, and each match lasts approximately 60 minutes, keeping everyone on the edge of their seats until the very last moment.

Whether you’re planning a game night with friends or looking for a gift for the puzzle solver in your life, “The Hiding Place” is a surefire hit that will not disappoint. The game includes a variety of scenario cards, ensuring that no two games are ever the same and offering endless replayability. Its combination of strategy, suspense, and physical interaction creates a unique gaming experience that engages the mind and enlivens any gathering. With “The Hiding Place,” players can expect a heart-racing adventure as they hide, seek, and strategize their way to victory.

Can you put a lien on a vehicle in Texas?

Sure thing! Let’s get right to it.

How do I find a lien holder on my car in Texas?

Oh, absolutely! In the Lone Star State, you can slap a lien on a vehicle as quick as a wink if someone’s stiffing you on a debt tied to that car.

How do I remove a lienholder from my car title in California?

Curious about who’s got a financial grip on your ride? In Texas, take a gander at your car title or scoot on over to the DMV to snag that lien holder info.

Can I register a car with a lien on the title in NY?

Once you’ve paid off your car in California, it’s high time to get that lienholder off your back (and your title)! Simply mail the pink slip and a Notice of Transfer to the DMV, and you’ll be cruising clear in no time.

How does a lien work in Texas?

Registering a car with a lien in the Empire State? It’s not a walk in the park, but it’s doable. You gotta prove the lienholder is aware and on board, though, so cross your t’s and dot your i’s!

How long does a lien last in Texas?

In Texas, a lien’s no small fry—it’s a legal claim against your property (like your car) ensuring the debt tied to it gets paid off before you can sell or refinance.

How do I remove a lien from my car title in Texas?

Don’t dilly-dally in Texas, y’all! A mechanic’s lien can hang around for a year, while a judgment lien sticks like barbecue sauce for up to ten years unless you pay up or get it removed.

Does the lienholder hold the title in Texas?

In Texas, shaking off a car title lien’s like a two-step dance. First, pay off the debt. Then, grab your release of lien and skedaddle to the DMV to get that title cleaner than a whistle.

How do I find out if I have a lien against me in Texas?

You betcha! In Texas, the lienholder’s like a dog with a bone, holding onto that title until the debt’s paid off.

Who is responsible for removing the lien to clear the title?

Suspect a lien’s lurking against you in Texas? It’s sleuthing time! Check your property records, court records, or tap the DMV’s shoulder for any sneaky liens trying to hide.

What happens after you make your last car payment?

Straightening out that car title’s the responsibility of the lienholder. Once they get their dough, they’re supposed to cut the lien loose, and voilà, you’re good to go!

How do you get around a lien on a title?

When you send off that last car payment, throw a little party, ’cause soon the title’s all yours! Just wait for the lien release and make that title update at the DMV your next victory lap.

How does a lien sale work in California?

Evading a title lien? That’s a sticky wicket. Better to tackle it head-on by settling the debt or seeking legal advice unless you fancy being knee-deep in hot water.

Can I sell a car with a lien in NY?

A lien sale in Cali is a way to recoup cash when someone skips out on payments. A public auction is held, and the winning bidder takes the wheels, and hopefully, you recoup your greenbacks.

Can I gift a car to a family member in NY?

In NY, selling a car with a lien involves a tug-of-war with paperwork. Secure a lien release, and only then can you pass the baton – uh, I mean the title – to the buyer.

What is required to file a lien in Texas?

Gifting a car in NY? How generous! You’ll need to transfer the title and make sure there are no liens. Oh, and don’t forget, Uncle Sam wants to know about it for tax reasons.

What are the lien laws in Texas?

Filing a lien in Texas? You’ll need evidence of the debt, a detailed notice sent to the debtor, and then file with the county – it’s straighter than an arrow but follow those steps to a T.

When can you file a lien in Texas?

Texas lien laws are like a rulebook, ensuring creditors can claim what’s owed by keeping a legal grip on the debtor’s property until the score is settled.

Can you file a lien in Texas without a contract?

Wanna file a lien in Texas? Timing’s key – typically, you’ve got until the 15th day of the fourth month after the debt occurred for most claims, so don’t drag your boots!