Juggling numbers and understanding the complex tax system in Virginia may appear as intimidating as walking on a financial tightrope. Crunching numbers manually or second-guessing your tax obligation is about as practical as paddling upstream without oars! This is where the Virginia tax calculator comes in handy. It’s akin to a financial compass guiding you through the stormy seas of personal finance.

Understanding the ‘Virginia tax calculator’: A Tool for Precision and Ease

Definition and Overview of the Virginia Tax Calculator

A Virginia tax calculator is an online utility that handily computes the amount of state tax you owe based on your income level. Picture it as a personal financial assistant sitting right in your computer, cutting through the murky waters of tax complexity.

Purpose and Importance of Using a Salary Calculator in Virginia

Crafted with precision and simplicity, the salary calculator in Virginia essentially serves two purposes: accuracy and convenience. It’s your handy toolkit for predictability, ensuring you’re neither short-changed nor left overboard with your tax obligations. Like knowing how much fuel you need for a voyage, using a salary calculator Virginia ascertains you have enough budgeted for taxes.

Breezing Through Virginia’s Progressive State Tax: Basics and Brackets

Brief Overview of the Progressive State Income Tax System

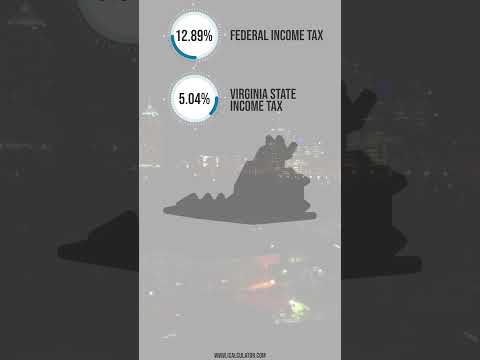

In the financial seascape of Virginia, the state tax system operates progressively. Similar to how the water depths vary across the sea, tax rates in Virginia increase as your earnings rise, ranging from 2% to 5.75%.

Decoding Virginia’s Tax Brackets

Virginia’s tax landscape is divided into four tax brackets. Imagine these as different zones in the ocean, each with its own unique tax rate, and the zone you swim in depends upon your income level.

What is the State Tax Rate in Virginia?

Many Virginians find themselves navigating the deep waters of the top tax bracket, applying to those earning over $17,000. With a state tax rate of 5.75%, it’s critical to plan your journey ahead to prevent any surprise encounters with undue tax liabilities.

Using the VA Tax Calculator for Planning and Savings

How the VA Tax Calculator Helps with Financial Planning

A VA tax calculator acts as a financial lifeguard, enabling you to plan your financial expedition with precision. It can help chart your voyage by providing estimates of your tax obligations, similar to how navigational tools predict a ship’s route and arrival time.

Role of VA Tax Calculator in Optimizing Potential Tax Savings

Much like how every resource on a ship contributes to a successful voyage, every dollar saved in taxes contributes to your financial journey. The VA tax calculator helps you strategize and set your sails towards increased savings.

Step-by-step Guide to Use the VA Tax Calculator

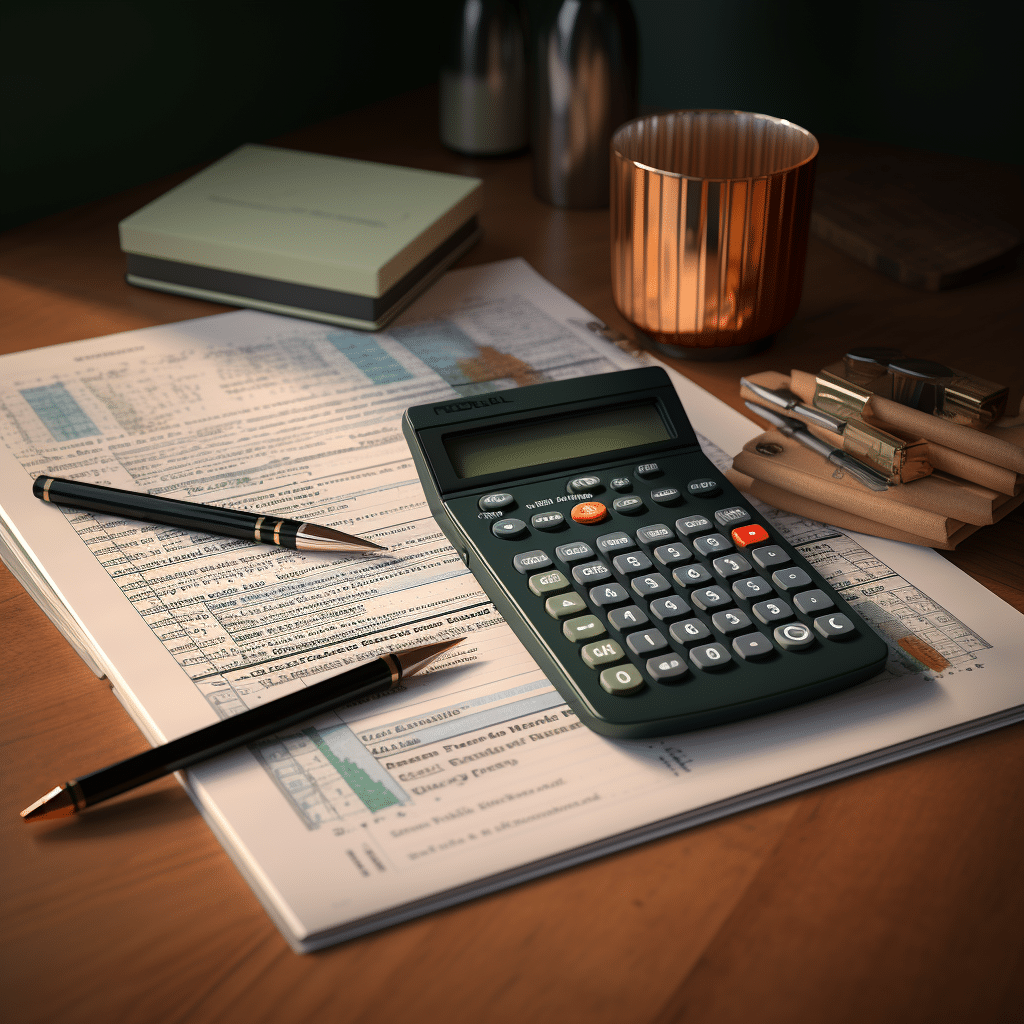

Using the VA tax calculator is as simple as pie. Just input your income and let this nifty tool do the math for you. It’s like having your very own financial navigator at the helm!

Making Sense of Virginia’s Sales Tax: Understanding Rates and Calculations

5.3%: The Common Sales Tax in Virginia’s Locales

Virginia operates with a uniform sales tax rate of 5.3% across most localities. Think of it as the standard tide that ebbs and flows uniformly across the Virginia coastline.

Regional Differences and Additional Taxes

However, much like unpredictable currents, some areas have additional regional or local taxes. These are slight deviations from the norm but can be navigated effortlessly with the Virginia tax calculator.

Reduced Tax Rates on Grocery Items and Essential Personal Hygiene Products

Navigating the financial seas doesn’t need to be rough all the time. It can also bring extra currents of joy like the reduced tax rates of 1% on grocery items and some essential personal hygiene products!

How Do You Calculate Sales Tax in VA?

With a consistent state sales tax rate of 5.3% and occasional local tax rates, using an online VA tax calculator makes calculating sales taxes a breeze. Imagine it as your onboard computer system, swiftly doing the math and keeping you on the right course.

Breaking Down Your Paycheck Deductions in Virginia

Overview of Paycheck Deductions

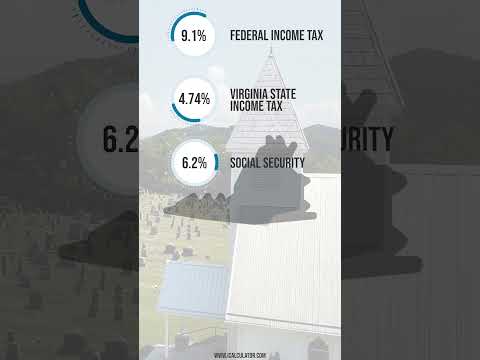

Navigating your paycheck deductions can be trickier than traversing uncharted waters. Virginia implements a series of deductions from Medicare to Social Security, similar to the varied elements you’d encounter on a voyage.

Understanding the Amount Taxed From Your Paycheck

The portion of your paycheck sailing towards tax obligations often differs according to your earnings. Moreover, it’s essential to account for federal withholdings. Understanding these deductions can feel like decoding a treasure map. Using a Virginia tax calculator can make this task simpler!

How Much Tax Is Taken Out of Paycheck in Virginia?

Well, the raw answer depends on different variables from gross income to the number of exemptions claimed. However, the Virginia tax calculator provides a clear compass, revealing what part of your paycheck will sail towards the tax mainland.

Case Analysis: A Closer Look at A $400,000 Salary

Theoretical Tax Deductions from a $400,000 Salary

As a sailor would prepare for a long voyage, the earner of a hefty $400,000 salary needs to chart their tax strategy beforehand. Should you fall into this bracket, you’ll be taxed $148,217.

Net Pay Per Year and Per Month

Subtract your tax liabilities from your gross income, and voila! Your net pay would be $251,783 per year, or roughly $20,982 per month. This would be the financial wind in your sails, propelling your ship after paying tax dues.

How Much Is $400,000 After Taxes in Virginia?

You’d pocket $251,783 after navigating the oceanic taxes on $400,000. Deductions have a unique way of turning what seems like an ocean of cash into a significantly smaller stream, don’t they?

Positioning Virginia’s Tax System on the Fiscal Spectrum

Virginia’s Ranking on the State Business Tax Climate Index for 2023

On the vast economic ocean, Virginia’s tax system ranks 26th on the 2023 State Business Tax Climate Index. This mid-ranking indicates that the state offers a relatively well-balanced environment for businesses.

Alluring Factors of Virginia’s Tax System for Businesses

Various factors make Virginia’s financial waters attractive for businesses. Its progressive tax system, reasonable tax rates, and potential overall savings opportunities all serve as favourable winds for businesses sailing in Virginia’s economic seas.

Quick Tips for a Smooth Sailing through Virginia’s Tax Waters: An Infallible Five

- Stay Informed: Keep updated with tax laws. It’s like ensuring your nautical charts are current – you wouldn’t navigate with outdated maps, would you?

- Utilize the Virginia Tax Calculator: As we’ve covered, this tool is your financial compass. Harness its power!

- Claim Available Tax Credits: These are akin to favorable winds helping you navigate effortlessly.

- Monitor Regional Differences: Know your local tax rates as well as the state taxes to avoid hidden icebergs in your financial journey.

- Seek Professional Help if Needed: Sometimes, hiring an experienced sailors (tax professionals) can help steer your financial ship smoothly.

Leaving No Stone Unturned: A Final Word on Virginia’s Tax Landscape

Understanding the complexities of Virginia’s tax system and effectively utilizing resources like the Virginia tax calculator can make a world of distinction to your financial sailing journey. Like the difference between having a fitness tracker and not for weight loss. From reaching your destination (paying your taxes) successfully to encountering pleasant surprises along the way (tax savings and deductions), having a mature grasp on matters of tax is essential.

Indeed, armed with the right tools and information, navigating Virginia’s fiscal waters can be less of a daunting task and more of a predictable, manageable voyage.

In the game of financial navigation, remember, the point isn’t just to reach the destination but also to enjoy the journey by reducing unnecessary leakages. So, chart your course, get your financial compass in order and set sail! You have a world of potential savings to discover, and the Virginia tax calculator is here to help you navigate the tax seas!