Navigating the ever-shifting sands of home financing can feel like a Herculean task, but when you’ve got a trusty companion like UWCU (University of Wisconsin Credit Union) by your side, the journey can be less daunting and more rewarding. Let’s break it down together, shall we?

Navigating the UWCU Mortgage Rates Landscape

Credit unions like UWCU have this special knack for offering lower mortgage rates—a delightful perk courtesy of borrowing against themselves and answering to depositors, not shareholders with dollar signs for eyes. Let’s crack open the history books and see how UWCU has shaped up over the years before we zoom in on their mortgage rates as of 2024.

Analyzing the Competitive Edge in UWCU’s Rates

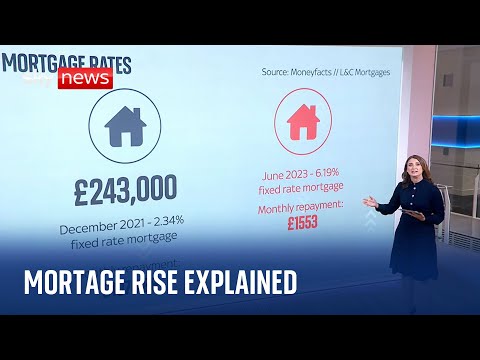

Now, let’s pit UWCU against the big dogs — national mortgage rates. Plus, we’ll snoop around to dig up any juicy trends and rate ripples over at UWCU.

Comprehensive Breakdown of UW Credit Union Financing Options

UWCU’s got a loan for nearly every occasion—home purchases, you name it. Let’s dissect what’s on offer and mop up any confusion around these mortgages.

Unlocking the Benefits of UWCU’s Loan Programs

If you’re dipping your toes in the housing market pool for the first time, UWCU’s got your back with programs and incentives. The seasoned property gladiators among you will appreciate the specialty loan offerings, while anyone looking to switch up their mortgage game should give UWCU’s refinancing a gander.

| Product | UWCU Mortgage Rate Details | Features | Benefits for Borrowers | Comparison to Average Rate |

|---|---|---|---|---|

| UWCU 5-Year Fixed Mortgage | * Rates may be lower due to credit union model | * Fixed-rate for stability | * Potentially significant interest savings | * Likely lower than the current 5.22% average, membership required |

| UWCU 30-Year Fixed Mortgage | * Historically fluctuating rates, enquire for current offering | * Longer term with fixed payments | * Consistent payments over the life of the loan | * Potentially lower; highly market-dependent |

| UWCU 15-Year Fixed Mortgage | * Offering competitive rates, enquire for current offering | * Shorter term, higher payments, less interest | * Pay off mortgage faster, equity building | * Potentially lower; dependent on credit union rates |

| UWCU Adjustable-Rate Mortgage (ARM) | * Adjusts with market, may start lower than fixed rates | * Lower initial rate, may adjust later | * Flexibility, initial savings | * Varies; initial rate likely lower than 5.22% average |

Customer-Centric Approach: Testimonials and Case Studies

Nothing speaks louder than the stories of folks who’ve walked the mortgage road with UWCU. Let’s peek into their journeys.

Evaluating the Service: Beyond the Numbers

Sure, numbers are neat, but how does UWCU treat you when you’re knee-deep in the home loan process? Let’s walk you through their approach and highlight what makes their fees and costs worth your time.

Tools and Resources Provided by UW Credit Union

UWCU doesn’t just hand you a loan and wave goodbye—they equip you with tools and wisdom for the voyage ahead.

Member Education: How UWCU Empowers Its Clients

With a slew of workshops and one-on-one chats, UWCU turns bewildered borrowers into savvy homeowners.

Inside UW Credit Union: Industry Recognition and Awards

UWCU’s trophy cabinet isn’t just for show—it’s stacked with accolades proving they’re top-notch.

Staying Ahead of the Curve: Technological Advances at UWCU

When it comes to keeping things fresh tech-wise, UWCU is chopping at the cutting edge.

Quantifying the Impact of UWCU’s Community Engagements

UWCU doesn’t just take—they give back in bucketloads, fostering growth and community spirit.

Future Trajectory: Predicting Developments in UWCU Mortgage Rates

Let’s whip out our crystal balls and peer into what the future might hold for UWCU’s rates.

Making the Choice: Is a UWCU Mortgage Right for You?

Decision paralysis, begone! Here’s a streamlined approach to sussing out if UWCU is your mortgage destiny.

Reflecting on the Competitive Loan Landscape: UWCU in the Bigger Picture

UWCU’s not a lone wolf—they’re part of a broader mortgage ecosystem that’s constantly evolving.

Charting Your Path to Homeownership with Confidence

So, we’re coming in for a landing. Here’s the lowdown on why you might want to dock your home-buying ship with UWCU.

Weighing your options with UWCU’s mortgage rates could very well be the smartest move in your financial journey. In the grand scheme of it all, a dash of thoughtful consideration and a good dose of research will serve you well as you scout for the home of your dreams. At UWCU, they get it—they’re here not just to help you sleep with peace of mind but to stand with you every step of the way, from that first ‘just looking’ moment to the hearty slap of the doormat welcoming you home.

Fun Facts and Trivia: UWCU’s Mortgage Marvels

Ready to dive into the nifty tidbits about UWCU’s mortgage rates? Buckle up, because we’re about to lay down some interesting facts that’ll make you view this lender in a whole new light. And who knows, by the end of this, you might just find yourself itching to join the UWCU family!

The Allure of UWCU Mortgage Rates

Ever wondered why people are singing praises for UWCU mortgage rates? Well, put on your trivia caps, because here’s the skinny: UWCU is hailed for their competitive rates, which can make other lenders do a double-take. They’re like the pros of weaving financial dreams with reality, ensuring that you’re never in over your head when it comes to home financing.

Did Someone Say History?

Okay, here’s a bit of a curveball. Imagine finding the perfect home, the mortgage rate is just right, and then bam! You discover it comes with a spooky past. Before you get cold feet or start wondering if you’ll need to bunk with the Ghostbusters, check out if someone died in house. Yep, that’s a thing, and it could be a game-changer for superstitious buyers. With UWCU, though, you get transparency that’ll keep those skeletons out of your closet!

Tiny Homes, Huge Dreams

If you’re smitten with the tiny house movement, you’re not alone. But how much does it cost to build a tiny home? UWCU isn’t just about traditional houses; they’re clued up on the tiny trend, too. Their mortgage rates can help bring those tiny dreams to life without draining your piggy bank. Pretty nifty, huh?

Choice on a Silver Platter

When you’re deciding on a mortgage, it’s like being at a buffet. You want options, right? That’s why diving into a lenders one review is a solid plan. You’ll see that UWCU offers a variety that’s sure to tickle your fancy, all while keeping rates on the down-low.

A Mortgage Fable

Now, for a cheeky left turn. Ever heard the one about how UWCU’s mortgage rates are so appealing, you’d think you sleep with step mom to get a deal like that? Just to be crystal clear, you absolutely don’t need to engage in any scandalous activities to benefit from their rates. It’s family-friendly all the way, folks – pure, clean-cut, and nothing but professional service.

There you have it, friends – some quirks and facts about UWCU that might have you grinning from ear to ear. Knowing these tidbits not only makes for great conversation starters, but it also gives you insider insight into why UWCU might just be the right financial partner for you. So, are you ready to make that move? Because UWCU is waiting with open arms (and great rates) to welcome you home!

Why are credit union mortgage rates so low?

Well, credit union mortgage rates often knock your socks off with their low numbers because credit unions are not-for-profit organizations. They’re like that friend who doesn’t chase after every penny and focuses on members’ benefits instead, passing savings on to you!

What banks have the best mortgage rates right now?

Scouting for the top dog in mortgage rates? It’s a game of cat and mouse since rates can change faster than a hiccup. But as of late, lenders like Wells Fargo, Chase, and Quicken Loans are often seen leading the pack. It’s smart to shop around, though, ’cause the best bank for Tom might not be the best for Jerry.

What is the current mortgage rate?

Talk about the here and now, the current mortgage rate is like the weather—it can change any minute. As each lender sets their rates daily, it’s like playing whack-a-mole for the latest numbers. Your best bet? Check out rate comparison sites or a lender’s own website for the most up-to-date info.

What were the lowest mortgage rates?

Ah, the lowest mortgage rates – they were like seeing a unicorn, truly a thing of wonder! Historically, they dipped below 3% during the pandemic-driven economic upheaval. Those were the good ol’ days for borrowers, a dreamy time that’s slipped into the annals of mortgage lore.

How to negotiate lowest mortgage rate?

Alright, getting the lowest mortgage rate isn’t rocket science, but you’ve gotta play your cards right. Start the dance by polishing your credit score till it shines, then compare, compare, compare! Don’t be shy to haggle like you’re at a flea market—the worst they can say is no, and you might just get a sweet deal.

Is it better to go with a local bank for a mortgage?

Is the local bank the way to go? Well, they can be more personal, like a friendly neighbor, and they might value your relationship more than the big guys. However, don’t put all your eggs in one basket – ensure you explore all avenues because sometimes the grass is greener on the other side.

Will mortgage rates go down in 2023?

Gazing into a crystal ball for mortgage rates in 2023? Hah, if only it were that simple! Experts’ predictions are as steady as a house of cards, but many say there’s a chance they’ll go down a tad after the wild ride we’ve been on. Keep your fingers crossed, but don’t bet the farm on it.

Will 2023 be a good year to buy a house?

Considering buying a house in 2023? Well, it’s not black and white. With potential shifts in the market and interest rates playing seesaw, this year could be a roller coaster. Do your homework, keep your ear to the ground, and maybe catch a break if the market cools down a smidge.

Will interest rates drop again?

Will interest rates drop again, you ask? It’s all up in the air—like expecting last-minute heroics in a football game. Economic factors like inflation and government policy are key players, but it’s anyone’s guess if rates will take a nosedive or stay put.

What type of mortgage is best right now?

Choosing the best mortgage right now? With rates acting like yo-yos, fixed-rate mortgages are the belle of the ball, giving you the peace of mind of knowing your rate won’t suddenly jump up. But keep an eagle eye on adjustable rates—sometimes they’re your golden ticket if you won’t be nesting for long.

Are mortgage rates expected to drop?

Crystal ball time again, and are mortgage rates expected to drop? Some number whisperers reckon they might because they can’t stay sky-high forever, right? But remember, it’s about as predictable as a frog in a sock, so don’t count your chickens just yet.

Will interest rates go down in 2024?

Interest rates in 2024? If we could see into the future, we’d all be sunning on our yacht. But the general vibe? Some say rates might simmer down a tad as the market catches its breath, but take it with a grain of salt, capisce?

Will rates ever go back to 3?

Rates going back to a breezy 3% is like waiting for a bus in a ghost town—possible, but don’t hold your breath. It could happen if the stars align and inflation chills out, but it’s like a needle in a haystack, and waiting for it might just be wishful thinking.

How high will mortgage rates go in 2023?

How high will mortgage rates go in 2023? That’s the million-dollar question! They’ve been climbing like a squirrel on a tree, but most folks hope they won’t hit the moon. Bet your bottom dollar they won’t rise indefinitely though—what goes up must come down, right?

What is the highest mortgage rate in history?

The highest mortgage rate in history was like a bad haircut, downright ugly—peaking around 18% back in the wild ’80s. Those were grim days for homebuyers, something today’s crowd wouldn’t touch with a ten-foot pole!

Why do credit unions have better loan rates?

Why do credit unions have better loan rates? Simply put, they’re all about passing the buck back to their members. No fat-cat shareholders to feed means more meaty savings in your pocket. They cut the mustard by aiming for service, not just profits.

Do credit unions have better interest rates than banks?

When it comes to credit unions dishing out better interest rates than banks, you bet your boots they usually do. Being not-for-profit gives them wiggle room to sweeten the deal for members—making banks look like penny pinchers in comparison.

Do credit unions have higher loan rates?

Got higher loan rates at credit unions? That’s about as rare as hen’s teeth. They’re known for keeping rates low and manageable. If you hear otherwise, it’s wise to give it the ol’ side-eye and check the facts yourself.

Do credit unions make more sense than banks when it comes to their rates for loan and savings products?

Credit unions vs. banks? It’s like comparing apples and oranges sometimes, but for rates on loans and savings products, credit unions can be your bread and butter. They often spread the savings thick for their members, which can make a world of difference to your wallet!