A hearty welcome, folks! Let’s dive straightaway into the nitty-gritty of the tax system of the Land of Lincoln – Illinois. If you’ve ever been perplexed about your tax payments, you’re not alone. This article will provide you with insights into the tax calculator Illinois, the flat income tax rate, and other nuances to hack your payments. Sprint through this maze with us and emerge enlightened on the other side!

![Property Tax Calculation [Illinois Real Estate Broker Exam Prep]](https://www.mortgagerater.com/wp-content/cache/flying-press/8rkQbwx5-Fc-hqdefault.jpg)

I. Exploring the Illinois Tax System: Tax Calculator Illinois

First thing’s first, my friends. Understanding taxes isn’t rocket science; it just needs a smidgen of patience and a sprinkle of curiosity.

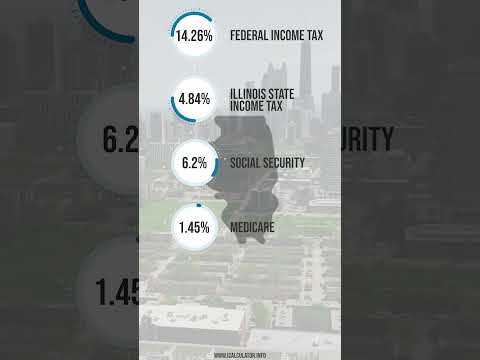

A. Understanding the Flat Income Tax of 4.95%

You wanna know a secret? Unlike the “oregon tax Brackets“, Illinois has a simpler system. This state believes in simplicity and follows a flat income tax system, where everyone, regardless of their income, pays a tax at a rate of 4.95%. No fancy brackets, no confounding percentages, and certainly no city-specific local income tax added! As clean-cut as a fresh haircut!

B. Role of Allowances: Recommendations and W-4 Rules

Done pondering about the flat income tax? Good! Now, let’s gab about allowances. To keep it simple, these allowances reduce the amount of pay on which you need to pay taxes. Zero to five allowances is what most of us claim, but do peek into the W-4 rules to get a clearer picture and avoid stepping on landmines.

II. Navigating Tax Calculators: Top 5 Fast Ways to Hack your Payments

Hold onto your hats, folks, because we’re about to turbo speed into the realm of tax calculators. These clever tools can help you slice through your tax troubles like a hot knife through butter.

A. Hacking Payment 1: Utilizing the Illinois Tax Calculator for easy estimations

The tax calculator Illinois is your new best friend. It gives you a no-nonsense, point-blank tax estimation based on your income. So whip it out and start crunching numbers!

B. Hacking Payment 2: The Colorado Tax Calculator and its Applications

Just for kicks, let’s meander into the Rockies territory. The Colorado tax calculator can shed light on potential tax scenarios if you’re considering moving states.

C. Hacking Payment 3: In-depth look at the NC Income Tax Calculator

Heading southeast, the NC Income tax calculator is yet another tool in our box. It’s as useful as a Swiss army knife for North Carolina locals and those considering becoming one.

D. Hacking Payment 4: Engaging the Sales Tax Calculator Missouri for accurate tax calculations

Don’t fret about shopping in the Show-Me State! You can keep Mississippi-sized surprises at bay by using the Sales Tax Calculator Missouri for precise sales tax calculations.

E. Hacking Payment 5: Combining different tax calculators for comprehensive results

Finally, the master hack of all – utilizing different tax calculators for comprehensive results. Think of it as your tax-heist crew, each with their unique skill, working together to crack the tax safe!

III. How much tax is taken out of my paycheck Illinois? An investigation

Now comes the billion-dollar question, “How much tax is taken out of my paycheck in Illinois?”. Let’s decode this by studying some real-life numbers and cut through the fog.

IV. The Art of Estimating Tax Bills: Breaking Down Taxable Income

A. How do you calculate how much tax you will pay? A step-by-step guide

I’m no “public speaker agent“, but let me give you a quick, easy-to-follow rundown on how to calculate your taxable income. Let’s start with your gross income, then subtract any tax deductions. Whatever’s left is your taxable income, and voila! You’ve cracked the code!

V. A Closer Look at Illinois Taxation: Real-world Examples

Let’s visualize this with some numbers. If you’re earning 10 grand a year in Illinois, you’d be taxed $1,260. So, your net income rounds up to about $8,740. Not too bad for a start, huh?

A. How much is $10000 after taxes in Illinois?

Hold onto your hats! If you’re pulling in $10,000 in the Prairie State, after tax deductions, you’d be left with something close to $8,740 per annum. Divvy it up monthly, and you’re looking at about $728. Ain’t that a breath of fresh air?

B. Taxation Dynamics: How much is $80000 a year after taxes in Illinois?

Let’s crank it up a notch. If you’re raking in a lofty sum of $80,000, you’d end up paying a tax amount of $20,448. So, you’re left with a neat net income of $59,552 or roughly $4,963 per month. Not too shabby, eh?

VI. Utilizing these Strategies for Optimized Tax Payment: Making the most out of Illinois Tax System

Now that we’ve spilled the tea on the tax calculator Illinois, detailed its calculations, and shown you some real-world examples, it’s time to get down to business. Use these calculations, compare them with calculators from other states like “maryland income tax“( “ct state income tax“( and formulate a strategy tailored to your needs. Remember, the goal here is not to game the system but to understand, plan, and optimize your taxes.

Speak to a financial advisor or a professional to help you through this journey. Remember, the tax system isn’t a “hot Girls“( club you need to gatecrash but a system you can understand, predict, and work with for financial wellness.

Crack that whip on your taxes, my friends! Here’s to you becoming tax-savvy!

: How many allowances should you claim? Most people claim 0-5 allowances, check W-4 rules for details.

: Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What’s left is taxable income. Then we apply the appropriate tax bracket to calculate tax liability.

: If you make $10,000 a year living in Illinois, you will be taxed $1,260. That means that your net pay will be $8,740 per year, or $728 per month.

: If you make $80,000 a year living in Illinois, you will be taxed $20,448. That means that your net pay will be $59,552 per year, or $4,963 per month.