Demystifying Seller Credit: Your Path to Cost-Saving at Closing

Imagine you’re about to close on your dream home. You’ve got that giddy feeling—like you’re on the edge of greatness—but there’s a cloud hanging over this sunshiny moment: closing costs. It’s like looking at a beautiful long skirt and then getting hit with the price tag. Yeesh! But what if I told you that closing doesn’t have to mean sacrificing your savings? Enter: seller credit.

Seller credit is the secret sauce, the fairy godmother of the real estate world, swooping in to save you from the dizzying pile of costs at closing. But before you wave your wand and wish seller credit into existence, let’s get down to brass tacks and understand how it functions in real estate transactions.

KINGSUM Vertical ID Badge Holders Sealable Waterproof Clear Plastic Holder, Fits RFIDProximityBadge Swipe Cards or Credit Card(Pcs, Vertical)

$9.99

The KINGSUM Vertical ID Badge Holder is an essential accessory for professionals who require quick and easy access to their identification cards. With its clear, waterproof design, the holder ensures that your RFID, proximity badge, swipe card, or credit card remains visible and dry in all working conditions. The sealable top provides an extra layer of protection against dust, spills, and other potential damage without hindering the functionality of your card. Each holder is designed to accommodate standard-sized cards, making them perfect for a variety of professional settings.

Constructed from high-quality, durable plastic, the KINGSUM badge holders are built to withstand daily wear and tear. Their vertical orientation ensures that badges hang neatly and are less likely to flip over or tangle, which is especially useful when they need to be scanned or swiped multiple times throughout the day. The precise fit of the holder ensures that cards slide in easily but remain snugly in place, offering both convenience and security. The transparent material also allows for unobstructed scanning, keeping the authentication process quick and efficient.

This pack of KINGSUM Vertical ID Badge Holders is a practical investment for any organization that prioritizes security and professional image. They are suitable for a wide range of industries, including corporate offices, hospitals, schools, and government agencies. With these badge holders, employees can present a polished appearance while keeping their important cards shielded and accessible. Whether you’re protecting sensitive information on a single card or outfitting an entire workforce, these versatile and reliable badge holders are sure to meet your needs.

Typically, seller credit is utilized in a handful of scenarios—think of it as your knight in shining armor when:

– You’re short on cash to cover the closing costs.

– The home inspection reveals fixes that you didn’t plan for like Anjelica Huston discovering a secret passage in an old mansion.

– Or, in a slow market where a buyer’s bargaining chip is as powerful as a dragon slayer’s sword.

The Impact of Seller Credit on Purchase Agreements

Securing seller credit is like a strategic game of chess; it requires finesse in negotiation and a keen awareness of legal and contractual considerations. This is where the negotiation process for seller credit kicks off—a dance between buyer and seller, where each move is calculated to reach a win-win finale.

But hold your horses! There are legal papers to wrangle. Both parties must understand and agree to the terms set forth in the purchase agreement. And these aren’t terms you can skedaddle away from; they’re as binding as a pact in a restrictive guild of medieval merchants.

| Aspect | Detail |

|---|---|

| What is a Seller Credit? | A contribution from the seller to the buyer at closing to cover various buyer’s costs. |

| Purpose of a Seller Credit | * To cover buyer’s closing costs. |

| * To pay for property repairs. | |

| * To provide financial incentives for the buyer. | |

| Usage Based on Lender Approval | * Closing costs. |

| * Repairs. | |

| * Rate buydowns. | |

| * Other lender-approved expenses. | |

| Typical Closing Costs in Texas | $18,000 – $30,000 on a $300,000 property (including taxes and agent fees). |

| Real Estate Agent’s Commission | Largest expense for the seller – usually a percentage of the sale price. |

| Buyer’s Market Trend | Sellers may offer a rate buydown to attract buyers. |

| Rate Buydown | Seller-paid closing credit to reduce the buyer’s monthly mortgage payments. |

| Debits and Credits in Real Estate | * Debit: Money the buyer owes. |

| * Credit: Money owed to the buyer, as noted in closing statements. | |

| Strategy for Buyers | Negotiate for closing cost credit and include it in the sales contract with the help of an agent. |

| Benefit to Buyer | Reduces out-of-pocket expenses, making the home purchase more accessible or financially manageable. |

| Benefit to Seller | Makes the property more attractive to potential buyers, potentially facilitating a quicker sale. |

How Seller Concessions Make a Difference in Real Estate Deals

Now, let’s not mix up our apples and oranges—seller concessions and seller credit are siblings, but not twins. With seller concessions, the seller agrees to shoulder part of the financial load—it might be a portion of the closing costs, homeowners association fees, or even property taxes.

But why would a seller go for this? Well, as the saying goes, you’ve got to give a little to get a little. Seller credit comes with a bouquet of pros, such as a quicker sale or a higher offer price. But, let’s not gloss over the cons—it might mean less cash in the seller’s pocket at the end of the day.

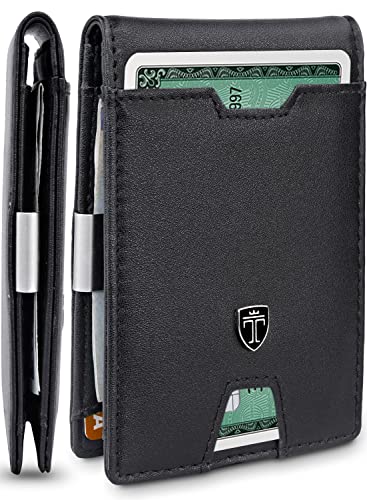

TRAVANDO Mens Slim Wallet with Money Clip AUSTIN RFID Blocking Bifold Credit Card Holder for Men with Gift Box (Black)

$29.95

The TRAVANDO Mens Slim Wallet with Money Clip AUSTIN is a sleek and functional accessory for the modern man, combining security with style. Crafted from high-quality materials, the wallet is presented in an elegant black finish that is both sophisticated and versatile, suitable for any occasion. This bifold wallet doesn’t just hold your cards and cash, but organizes them in a slim profile, ensuring it slips easily into any pocket without the bulk. The integrated money clip allows for quick access to bills, while the smart distribution of card slots ensures you can carry all your essentials.

Enhanced with RFID-blocking technology, this wallet offers state-of-the-art protection against electronic pickpocketing and identity theft. Each of its card slots is shielded to secure your personal information stored in credit cards, debit cards, and identity cards against unauthorized scans. This forward-thinking technology is essential in today’s digital age, providing peace of mind for the security-conscious user. The TRAVANDO wallet is valuable not just for its functionality but also for the additional layer of safety it provides.

Arriving in a tasteful gift box, the TRAVANDO Mens Slim Wallet with Money Clip AUSTIN makes an excellent gift for birthdays, holidays, or any special occasion. The presentation box reflects the wallet’s premium quality, making it an impressive and thoughtful present for friends, family, or colleagues. The compact size and practical features of this wallet, combined with its elegant packaging, make it a hit for men who appreciate both form and function in their everyday carry essentials. Whether for personal use or as a special gift, this wallet is a refined choice for those who value security, convenience, and style.

Crafting the Deal: Negotiating Seller Credit Successfully

For buyers out there, here’s a hot tip—approach the conversation about seller credit like you’re asking someone out on a date. Be respectful, present your case thoughtfully, and, most of all, be realistic. Use market analysis as your love letter; let the numbers do the talking, charming the socks off the seller.

And for sellers, when should you consider fluttering your eyelashes and offering credit? It’s all about reading the room—or market, in this case. Is it colder than a winter in Siberia? With rising interest rates causing buyers to tighten their belts, seller credit can be the warm fur coat they’ve been searching for.

Seller Credit in Action: Real-World Applications and Outcomes

Let’s swap fairy tales for the real deal. There are success stories aplenty where seller credit helped seal the deal. This isn’t just a happily-ever-after story; it’s an economic strategy that can turn the tide of the housing market.

However, where there’s a hero’s tale, there’s a cautionary one too. Beware the dragons of seller credit mishaps—miscommunications, overextensions, and last-minute backouts can leave everyone feeling like the town’s been pillaged.

Financial Implications of Seller Credit for Both Parties

Moving past the charm, seller credit has some concrete impacts on your wallet. For a buyer, it’s about more than just upfront savings—this game-changer can affect your financing, future mortgage payments, and the size of your throne room.

For sellers, it’s about balancing immediate gains with future prosperity. Think like a shrewd merchant—weigh the potential boost in sale price against what you’re handing over. And don’t forget about Uncle Sam; tax implications can be a double-edged sword, rewarding in some slices, sharp in others.

COOLANS Wristlet Bracelet Keychain Pocket Credit Card Holder Purse Tassel Keychain Bangle Key Ring for Women (Silicone Bead Bracelet+Card Purse (Black))

$12.80

The COOLANS Wristlet Bracelet Keychain is a stylish and practical accessory designed to ease the daily hustle for modern women. Combining fashion with function, its chic silicone bead bracelet sports a detachable tassel keychain, allowing you to keep your keys conveniently on your wrist while adding a touch of elegance to your outfit. The flexible bracelet is designed to fit comfortably around your wrist, ensuring that your keys are easily accessible, whether you’re running errands, working out, or enjoying a night out.

Accompanying the wristlet is a sleek, pocket-sized credit card holder purse, presented in a versatile black that is both classic and matches any attire. This petite purse is perfect for carrying essential cards and cash, featuring a secure button snap closure to ensure your valuables are safe. The compact design fits effortlessly into smaller bags or can be carried alone for minimalists who prefer not to be weighed down by a large purse.

This product is not just a fashionable accessory; it is tailored for convenience, aiming to simplify the life of any woman on-the-go. The COOLANS Wristlet Bracelet Keychain makes a thoughtful gift or a personal treat, catering to the modern necessity of keeping essentials within arm’s reach, all while maintaining a sense of style and sophistication.

Shifting Dynamics: Seller Credit in the 2024 Real Estate Market

Seller credit isn’t a stagnant pond; it’s a river that keeps on flowing. In 2024, we’re seeing seller credit evolve like never before. With the right approach, it can be as dynamic as a caped hero swooping in to save the day.

In this shifting landscape, staying up-to-date is key. Whether you’re a buyer or seller, you need to be as adaptable as a chameleon in a box of crayons. Use the latest market data to color your negotiation tactics and stay ahead of the curve.

Final Reflections: The Nuanced Art of Seller Credit in Real Estate

Breathe in, breathe out, and reflect on seller credit as the nuanced art it truly is. It’s a brushstroke in the masterpiece that is your real estate transaction. When used with finesse, it could turn a simple countryside painting into the Mona Lisa of deals.

Still, remember it’s a tool in your arsenal, not a magic wand. Use it wisely, strategically, and in line with the dance of the market. Seller credit can help pave the golden road toward your real estate goals. So here’s to saving on closing costs, and making the savvy choices that define ownership of this journey.

Tom Clancy’s Rainbow Six Siege Currency pack Rainbow credits Xbox One [Digital Code]

![Tom Clancys Rainbow Six Siege Currency Pack Rainbow Credits Xbox One Digital Code Tom Clancy'S Rainbow Six Siege Currency Pack Rainbow Credits Xbox One [Digital Code]](https://www.mortgagerater.com/wp-content/uploads/2023/11/Tom-Clancys-Rainbow-Six-Siege-Currency-pack-Rainbow-credits-Xbox-One-Digital-Code.jpg)

$9.99

The Tom Clancy’s Rainbow Six Siege Currency Pack provides players with Rainbow Credits for Xbox One, available as a digital code for immediate redemption. This virtual currency pack allows gamers to enhance their gameplay experience by acquiring new operators, weapons skins, charms, and more. With this purchase, players are armed with a convenient and fast way to personalize their gameplay and express their individual style on the battlefield without having to grind through challenges and missions for in-game currency.

Upon purchasing the Rainbow Six Siege Currency Pack, gamers receive a digital code that can be easily redeemed on their Xbox One console. This process is designed to be user-friendly, enabling players to add the credits to their account swiftly and securely, so they can jump right back into the action. The credits are added directly to the player’s game account, ensuring that they are readily available for use in unlocking the desired content.

Rainbow Credits offer players the flexibility to choose from a wide range of cosmetic and gameplay-enhancing items in Rainbow Six Siege’s in-game store. Whether it’s to stand out amongst your peers with unique character customizations or to gain access to the latest operators to expand your tactical options, these credits provide a valuable boost. Furthermore, since the game is constantly updated with new content and features, having Rainbow Credits on hand ensures that players are always ready to take advantage of the latest additions to the game.

What is a seller credit?

What is a seller credit?

Whoa, saddle up there! A seller credit’s not some fancy financial mumbo-jumbo—it’s basically when a home seller gives the buyer a break by covering part of their closing costs. It’s like the seller saying, “Hey, I got your back on some of those pesky fees.” Super helpful for buyers trying to save some extra cash!

What does the seller pay for at closing in Texas?

What does the seller pay for at closing in Texas?

In the Lone Star State, don’t mess with a seller’s closing costs because they’ve got their own to wrangle! Sellers in Texas typically fork over dough for their real estate agent’s commission and might also pay for a title insurance policy, not to mention a portion of the escrow fees. Yee-haw to that!

What is a seller credit buy down?

What is a seller credit buy down?

Now, hang on to your hat because a seller credit buy down is a mighty clever move. It’s where sellers help buyers lower the interest rate on their mortgage for the first few years. They pony up some cash at closing, and in return, the buyer gets a breather with smaller monthly payments early on. Smart, right?

What does credit mean in real estate?

What does credit mean in real estate?

In the real estate rodeo, “credit” isn’t just a shiny plastic card; it’s the amount of money buyers get to hang onto during a property purchase. It could come from earnest money deposits, seller credits (there’s that friendly term again), or lender credits. It all goes towards closing costs and down payments, making the buyer’s wallet heavier. Cha-ching!

Is seller credit good?

Is seller credit good?

Oh, you betcha! Seller credit’s a sweet deal—it’s like finding money in the sofa cushions. It helps buyers afford closing costs, and can make a home more appealing without lowering the asking price. Talk about a win-win!

Is a seller credit a selling expense?

Is a seller credit a selling expense?

Sure as shootin’, a seller credit is a selling expense. Think of it like a coupon the seller offers to the buyer at closing; it cuts down the seller’s profit but makes the deal more attractive. It’s all about moving that property quicker than a jackrabbit!

Who pays closing costs in Texas buyer or seller?

Who pays closing costs in Texas buyer or seller?

Well, howdy partner, in the barn dance of home buying, both the buyer and seller do a little do-si-do with closing costs in Texas. Buyers usually get the bigger slice of the pie, covering lender fees and such, but sellers aren’t off the hook—they’ve got their own jig to step with like agent commissions. It’s a two-step process!

How much are closing costs in Texas 2023?

How much are closing costs in Texas 2023?

Clutch your wallets because closing costs in Texas for 2023 are like a bull at a rodeo—they can buck anywhere from 2% to 5% of the home’s purchase price. So, if you’re buying a homestead for $300,000, you’re looking at around $6,000 to $15,000. Time to break open that piggy bank!

Who typically pays for title policy in Texas?

Who typically pays for title policy in Texas?

Y’all ready for this? In Texas, the tradition’s been as steady as a prairie sunset that sellers usually pay for the title policy. Now, it ain’t a law or anything, but it’s as common as cactus in the desert. But, hey, everything’s negotiable in the wild, wild west of real estate.

What is the difference between seller credit and price reduction?

What is the difference between seller credit and price reduction?

Alrighty, let’s untangle this one: a seller credit is cash the seller gives to help with the buyer’s closing costs, while a price reduction is just slicing the sale price right off the bat. Credits are like “now” money for upfront costs, and a price drop is like a long-term saving. Different horses for different courses!

Why would a seller want a higher down payment?

Why would a seller want a higher down payment?

Here’s the scoop: a higher down payment makes a buyer’s offer stronger than a cowboy’s handshake. It shows they’re serious and have more skin in the game. Plus, it might mean a smoother, quicker closing since lenders love seeing more cash up front. Money talks, folks!

Who pays for a buy down?

Who pays for a buy down?

When it comes to buying down a mortgage, the buyer usually pays, but there’s a twist: the seller or builder can chip in as part of a deal-sweetener. It’s like someone else tossing in extra chips for your poker game—it’s a boon for the buyer’s wallet.

Why do buyers ask for money back at closing?

Why do buyers ask for money back at closing?

Alright, here’s the deal: buyers might ask for money back at closing to cover closing costs without dipping into their piggy banks. It’s like haggling at a garage sale to keep a few extra bucks for a rainy day. Clever, huh?

Is it better to ask for closing costs or lower price buyer?

Is it better to ask for closing costs or lower price buyer?

Well, it’s as tricky as a fox—asking for closing costs keeps more cash in your wallet now, but a lower price means less mortgage to pay off. It’s a toss-up: pay less now or less overall. Choose your adventure!

Is earnest money a credit to the seller?

Is earnest money a credit to the seller?

Oh, think again! Earnest money is like the buyer’s promise ring—it shouts, “I’m committed!” That cash becomes a credit for the buyer, not the seller, at closing—it’s applied to the down payment or closing costs, trimming what the buyer owes.

What are the three common credit terms sellers offer buyers?

What are the three common credit terms sellers offer buyers?

The three amigos of seller credit terms coming right up: first, you’ve got the good ol’ closing cost assistance; second, points or mortgage rate buy downs; and third, throw in a home warranty for peace of mind. They sweeten the pot like sugar in iced tea!

What is seller’s credit reddit?

What is seller’s credit reddit?

Searching for the lowdown on Reddit, huh? Seller’s credit is a hot topic in online forums where folks gab about it giving buyers a financial let-up at closing. It’s a community show-and-tell with real-life stories, tips, and, of course, a meme or two for good measure.

How to calculate closing costs?

How to calculate closing costs?

Put on your thinking cap for this one: closing costs are a combo of lender fees, title insurance, taxes, and other fun stuff. To ballpark it, plan on 2% to 5% of the home’s price. But for an exact number, use an online calculator or ask a local expert to tally up the bill for you.

What does earnest money mean?

What does earnest money mean?

Earnest money, now that’s a buyer’s pledge to seal the deal—it’s serious business. Chuck down some cash when you make an offer as a show of good faith that you’re not just kickin’ tires, you’re ready to roll. It tells the seller, “I’m all in!”