Unlocking the Advantages of Principal Paydown

Understanding Principal Paydown in Mortgage Management

When it comes to managing your mortgage, the terms ‘principal’ and ‘interest’ are as inseparable as yin and yang, yet they couldn’t be more different. Your mortgage payments are a tango of these two components: the principal being the bulk of your loan – the real McCoy you borrowed – and the interest being the lender’s charge for loaning you those funds.

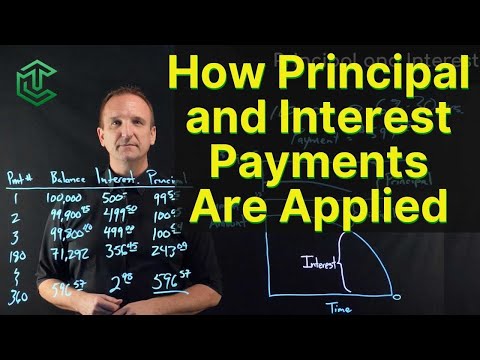

Delving into the nuts and bolts of mortgage payments, you’ll discover they’re structured so that at the beginning, you’re mostly paying off interest with just a smidgen of your payment chiseling away at the principal. However, as time marches on, this balance shifts, and you start paying down the principal at a swifter pace—a process that can feel as slow as molasses for many homeowners.

But here’s a little secret for ya – principal paydown isn’t just a waiting game. It’s an active strategy where making additional payments towards the principal can mean big savings, faster equity, and a slew of other benefits. So, let’s dive into it like diving into a pile of autumn leaves!

Benefit 1: Reduced Interest Payments Over the Life of the Loan

Paying down the principal early is like finding money in an old pair of black Boots, it’s a pleasant surprise that keeps on giving. By tipping the scales in favor of the principal early on, you’re essentially reducing the balance that the interest can feast on. It’s straightforward: less principal means less interest over time, which means more money in your wallet.

Let’s paint a real-world picture: say Sam Lutfi decided to throw a bit extra at his principal each month. Over the course of his loan, he could end up paying significantly less interest than his neighbor, who’s just making regular payments. It’s a move that can save you not just thousands, but tens of thousands, depending on the size and term of your loan.

| Attribute | Description | Impact on Borrower |

| Principal Amount | The initial amount of money borrowed to purchase the property | Dictates monthly payment size and total interest paid over the life of the loan |

| Amortization Schedule | A timetable for paying off the principal plus interest | Shows how principal reduces over time, slower at first and quicker towards the end |

| Equity | Portion of property’s value owned outright | Increases as principal is paid down, can be borrowed against in home equity loans |

| Interest vs. Principal | Components of each mortgage payment | Early payments are mostly interest; later payments are more principal |

| Principal Reduction | Extra payments made toward principal balance | Decreases total interest paid and can shorten loan term |

| Loan Balance | Remaining amount of principal to be paid | Decreases with each payment; final target for loan payoff |

| Refinancing | Replacing existing mortgage with new one, often with a new principal | Can adjust payment amount, term, and interest rate; might access equity |

Benefit 2: Accelerated Equity Build-Up

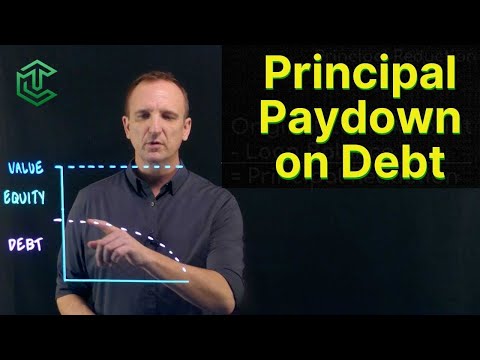

Home equity isn’t just a buzzword; it’s the part of your home you truly “own” – and boy, does it feel good to watch that number grow! When you crank up the volume on your principal payments, you’re not just dwindling down what you owe; you’re swelling the equity you have in your home. It’s as if you’re inflating a giant safety net beneath you.

Imagine Ms. Frizzle taking the Magic School Bus for a ride through the wonders of equity growth. As your principal shrinks, your stake in your home inflates at an accelerated pace, which can be a powerful tool in your long-term financial strategy. Whether it’s harnessing that equity for a major renovation or funding a child’s education, that “equity pool” is there for you, ready to dip into when you need it.

Benefit 3: Shortening the Loan Term

Every homeowner dreams of the day their loan ceases to exist, like a disappearing act performed by Wolfgang Van halen on stage. By advancing principal payments, this dream manifests into reality sooner than you might expect.

Dive deep into that loan amortization schedule, and you’ll detect how with each additional principal payment, the finish line gets a little closer. Not only does this mean you’ll be mortgage-free faster, but it frees up your financial bandwidth for other ventures or retirement planning—like finally taking that trip you’ve always wanted, or funneling money into investments, all without the noose of a monthly mortgage payment around your neck.

Benefit 4: Improved Creditworthiness and Borrowing Power

In the world of lending and credit, your mortgage is like a heavyweight title, and how you manage it can significantly sway your credit score. Regularly chipping away at your principal can pack a punch in boosting your creditworthiness, showcasing your reliability to future lenders.

So, what does this mean when you’re scanning through Zoe Kravitz Movies And tv Shows, contemplating a big purchase or a loan for a shiny new car? It means with a lower principal and a dazzling credit score, you can snag more attractive loan terms. And if you’re eyeing refinancing options, a lower principal could land you a better interest rate, bless your bank account, and be kind to your monthly budget.

Benefit 5: Flexibility and Security in Financial Planning

Let’s talk turkey about financial uncertainty—it’s as certain as death and taxes. A principal paydown strategy is like having an extra ace up your sleeve. It gives you room to maneuver when life throws you a curveball, and, believe me, it will.

Should the landscape of interest rates shift like sands in the desert, or should you need to tweak your mortgage through refinancing or modification, a lower principal balance stands as a bulwark, offering a refuge of security. Your home isn’t just where your heart is—it’s where your smart is if your principal is kept in check.

Conclusion: Maximizing Financial Wisdom Through Principal Paydown

Consider this the “encore” of our enlightening journey through the benefits of principal paydown. Whether you pay a little more each month or capitalize on larger infrequent payments, the key is to be consistent and intentional. It’s the prepayment of your mortgage that can transmute a seemingly insurmountable pile of debt into a manageable molehill.

Embracing a principal paydown strategy ensures you’re not just going through the motions of homeownership—but actively steering the ship towards a brighter financial horizon. You’ll cut through the interest fog, build steadfast equity, reel in the end of your loan term, shine up your credit score, and stand on solid, flexible ground in the face of financial headwinds.

So, take the wheel, good folks, and remember that every penny put towards your prince—err, principal—is a penny that paves the way to financial stability and prosperity. Grab ahold of these tips with the excitement of a child in a candy store and integrate principal paydown into your financial portfolio. It’s a decision that, with a dash of dedication and a pinch of patience, will serve to sweeten your experience of homeownership for years to come.

Now, if you’re ready to set sail on the voyage of managing your mortgage like a champ, steer your vessel towards the haven of helpful knowledge that’s just a click away. Check out our in-depth articles on Points, “Prepayment, and the ever-thorny Prepayment Penalty to anchor your understanding and navigate those mortgage seas with confidence.

Remember, in the grand tapestry of fiscal health, the threads of wise decisions weave the strongest patterns. So be bold, be savvy, and pay down that principal. Your future self will thank you.

Unlocking the Mysteries of Principal Paydown

When it comes to slicing and dicing the details of a mortgage, the Principal is like the hero of the story – you know, the one who’s doing all the hard work but doesn’t always get the spotlight. Let’s buckle up and journey through the magical world of principal paydown, where every payment is a step towards financial freedom. And hey, it’s as exciting as a ride on the Magic School Bus with Ms. Frizzle herself!

Waving Goodbye to Interest

Oh, snap! Did you know that each time you chip away at your principal, you’re also telling a portion of your interest “Bye, Felicia”? That’s right! It’s kind of like a buy one, get one deal, where you’re not just reducing what you owe, but also the pesky interest that’s been tagging along for the ride.

The Equity Express

Hold onto your hats, folks! Pumping up your principal payments is like hopping aboard the Equity Express. Each dollar you throw against that principal nudges your home equity up just a notch. And before you know it, you’ve got a nice, cushy cushion of home value that’s all yours. Plus, you can use it for all sorts of cool stuff, like a home equity loan or even funding your kid’s trip to college (talk about aiming for the stars, right?).

The Freedom Countdown

Picture this: every time you make a principal payment, you’re knocking time off your mortgage’s life sentence. It’s like your money’s got superpowers, zooming you towards the day when you can finally say, “I own this place outright!” Imagine throwing your own mortgage-burning party, no time machine required!

The Credit Score Booster Rocket

Here’s a juicy little secret: paying down your principal might just give your credit score a sweet little bump. Think of it as your financial report card getting better grades because you’ve shown you’re responsible with credit. Who wouldn’t want a bit of that action?

The “No More PMI” Jubilee

If you’ve been forking over Private Mortgage Insurance (PMI) every month, you’ll be thrilled to pieces when that principal gets low enough to kick PMI to the curb. It’s like throwing a “No More PMI” party every month with the extra cash you’ll have on hand. Who’s the life of the party now? That’s right, your wallet!

So there you have it – a delightful dish of Principal facts that’s equal parts enlightening and entertaining. Just remember, chipping away at that principal might seem like a slow burn, but it’s the kind of plot twist that’ll have you living happily ever after in your debt-free castle. Keep on trucking, and you’ll be the main character in your very own financial success story!