Growing a nest egg, buying a house or planning a retirement – no matter the financial goal, one can’t turn a blind eye to the impact of taxation. Settling in the “Garden State” of New Jersey means having to grapple with a quite perplexing tax system. Read on as we dive into the “New Jersey tax rate” and offer you an exciting five-step strategy to navigate your taxes successfully.

I. Engaging the New Jersey Tax Rate Reality

Understanding the complexities of NJ tax

Welcome to New Jersey, a place constantly under the spotlight for its unique tax system. With everything from impressive skyscrapers to beautiful coastlines, the state’s complex tax structure can be a head-scratcher, even if you’re as tough as heavyweight bodybuilder Nick Walker.

How New Jersey’s tax system stands out amongst the rest

Unlike the quiet, uncomplicated life in Vejas, financial living in New Jersey can unravel layers of complexity, particularly when it comes to the tax rates. If we draw a comparison, NJ’s tax system stands out for its comprehensive approach, which includes income tax, property tax, and sales tax.

II. The Current NJ Tax Brackets 2023

A breakdown of the graduated individual income tax

As of 2023, New Jersey has embraced a graduated individual income tax system. Simply put, the rate of taxation climbs higher with your income, loosely ranging from 1.40 percent to a mountainous 10.75 percent.

Overview of the Corporate income tax rates

Much like the hiker’s adrenaline rush when he ascends the peak, corporations in NJ can expect a tax climb too! The corporate income tax rate can range from 6.5 percent to a staggering 11.5 percent!

III. What is the income tax rate in New Jersey?

Examination of income tax brackets

In New Jersey, there’s no such thing as one-size-fits-all with income tax – it’s a matter of brackets. These brackets, akin to steps on a ladder, are a great way to understand the tax you’ll need to pay based on your earnings.

How income tax rates affect different income groups

If the income tax was a sporting event, how different income groups fare would certainly be the highlight reel. It’s truly a gamut, with lower-income folks paying as little as 1.4% while higher-earning inhabitants can see rates as high as 10.75%.

IV. The Reality of New Jersey as a High Income Tax State

Ranking as 6th highest tax burden in the U.S.

According to a WalletHub study, the NJ tax rate positioned “The Garden State” in 2023 not as a rosy 6th place finisher in a race, but rather as 6th in the nation for the highest tax burden!

Comparisons with other high income tax states

When placed alongside other states like California or New York, New Jersey’s high tax burden creates a taxing trifecta. You’d be hard-pressed to find other states that can top the NJ tax bracket 2023.

Is NJ a high income tax state?

As clear as the fourth of July fireworks, NJ IS indeed a high income tax state. Its complex tax structure coupled with high rates makes it a standout.

V. 5 Crazy Steps to Best Handle Your Taxes in New Jersey

Identifying the impact of taxes on your income

The first step to solving a puzzle is identifying the problem. Understanding your gross income and finding out how much you will be left with after taxes is crucial.

Practical approaches to dealing with New Jersey’s graduated individual income tax

If the NJ tax rate has your head spinning, turn your dilemma into a strategy. Employ tax reductions and exemptions where possible – think mortgages and homeowners’ insurance. While the latter isn’t directly linked to taxation, knowing If Homeowners insurance Is Tax-deductible can be a real game-changer.

Savvy methods to navigate New Jersey’s corporate income tax rates

Being clever with business expenditures and identifying deductions can help corporations manage the NJ tax rate. Making use of tools like the mortgage interest tax deduction calculator can aid here.

Tips to comprehend sales tax and its exemptions

Sales tax, the sneakiest fellow of them all, can be managed well if you know what’s taxable and what isn’t. The New jersey Sales tax Rate is a handy guide to understand the specifics of 6.625% sales tax and its exemptions.

Guidance on Planning for the future considering the NJ tax rate

Remember, taxation isn’t a sprint; it’s a marathon. Planning your financial moves considering the NJ tax rate can help you better preserve and grow your wealth.

VI. Is NJ Sales Tax 7%?

Delving into the specifics of New Jersey’s sales tax

Join us as we delve into the detail of the New Jersey sales tax rate. At 6.625%, it is a little below the round-figure assumption of 7%.

How sales tax impact buying and selling decisions

Much like pebbles on a beach impacting our stride, sales taxes can influence buying and selling decisions. The 6.625% rate levied on most products and services can add up to a significant amount, influencing behavior.

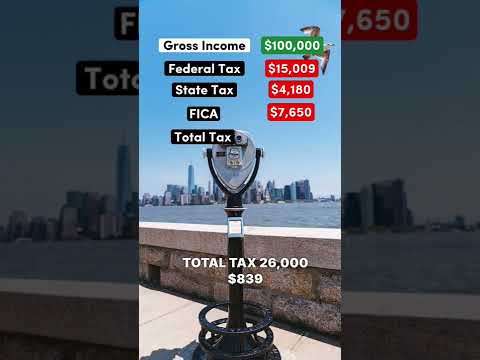

VII. How much is $100,000 after taxes in New Jersey?

Figuring out net pay from gross income

Let’s solve this riddle together. If you earn $100,000 a year in NJ, you can expect a tax knock of $25,917. That leaves you with $74,083 of net pay per year. Finding out your take-home pay can inform financial decisions from investment to expenditure.

Tax implications for different income levels in New Jersey

Much like an orchestra, different income levels play a different tune when it comes to taxes. For $100,000 earners, the tax equations may mean a duet with the taxman taking up to 25% in taxes.

VIII. The No-Tax Paradise: Looking at States Without Income Tax.

List of tax-free states

While Jerseyans deal with high taxes, there are states where residents enjoy a tax-free life. These no-tax paradises include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Comparing New Jersey with tax-free states

Unsurprisingly, living tax-free can feel like a dream compared to NJ’s complex tax landscape. However, these states may have other ways to fund public services, like higher sales taxes or property taxes.

IX. Putting it all together: Your Tax Journey in New Jersey

Recap of the factors affecting the tax rates in New Jersey

To recap, your tax journey takes into consideration the graduated income tax, the corporate tax structure, the sales tax rate, and how these combine to form the NJ tax rate.

Navigating through the tax landscape

The NJ tax landscape can seem like a maze, but with practical steps and diligent planning, it can transform from a beastly challenge into a surmountable task.

At the end of your NJ tax journey, remember taxes are just a part of the bigger financial picture, and strategy matters!

Remember, taxation is merely a single color on the vibrant canvas of your financial picture. How you manage your NJ tax rate can significantly impact how your financial landscape turns out. So equip yourself with knowledge, stay astute, and conquer your taxation journey!