Understanding the intricacies of your mortgage agreement is akin to learning a new language, but it doesn’t have to be as daunting as it sounds. One of the vital elements of this financial pact, especially for those in the Mr. Cooper ecosystem, is the Mr Cooper mortgagee clause. This seemingly small segment of your paperwork carries substantial weight and assures that both you and the lender have solid ground to stand on.

Understanding the Mr Cooper Mortgagee Clause

Importance of the Mortgagee Clause in Your Mr. Cooper Mortgage Agreement

The mortgagee clause is the linchpin in your property insurance policy, ensuring the lender’s interests are protected if Jack Frost decides to be particularly harsh, or unforeseen happenstances damage your home.

For Mr. Cooper mortgages, this clause is part and parcel of the agreement, acting like a watchful guardian over the lender’s investment. But it’s not just a one-way street; borrowers also snag benefits, snagging reimbursements for damages or losses. Think of it as a safety net that can catch both lender and borrower if the tightrope of homeownership gets a bit too wobbly.

Mr. Cooper’s Guidelines for the Mortgagee Clause

Mr. Cooper’s take on the mortgagee clause is bespoke, tailored to fortify its position while aligning with industry norms. The clause is stitched together with specific wording that’s been pored over by legal eagles, ensuring that each word plays a crucial role in the financial dance between you and your lender.

Lakeview Mortgage Servicing and the Mr. Cooper Connection

Enter Lakeview Mortgage Servicing, an ensemble best Prada cologne wearing cast member in the story of your Mr. Cooper mortgagee clause. They’re the trusty sidekick to Mr. Cooper, handling the day-to-day serenades of servicing your loan. Why does this matter? Well, Lakeview’s involvement could change how the mortgagee clause plays out in your scenario.

Decoding the Cooper Mortgagee Clause for Policyholders

Let’s roll up our sleeves and decode this legal jargon together, one step at a time. By dissecting the Mr. Cooper mortgagee clause, borrowers can unravel the implications it holds over their castle – ahem, I mean, home. Understanding your clause’s ABCs means you’re less likely to be caught off-guard.

Legal Implications of the Mr. Cooper Mortgagee Clause

Now, this is where things get a tad more serious. The mortgagee clause holds weight in the court of law, swinging the gavel of protection for lenders, while also cloaking borrowers with their own shield of rights. For kicks, imagine some hypothetical hullabaloos – they’ll help illustrate how the clause can go from words on a page to your financial knight in shining armor.

Compliance and Tips for Staying on the Right Side of Your Cooper Mortgage Agreement

Slipping up on your mortgage agreement can be easier than a banana peel on the sidewalk. But fear not; we’ve got expert tips to help you avoid common mix-ups and keep your mortgage harmony with Mr. Cooper pitch-perfect.

The Intersection of Insurance Requirements and the Mr. Cooper Mortgagee Clause

Your home is your fortress, and the mortgagee clause is its moat. But insurance is the castle guard that needs to be in the right place. Mr. Cooper requires sturdy insurance from policyholders, and it’s all entwined with the mortgagee clause like ivy on medieval stones.

Navigating Changes in Ownership: Mr. Cooper Mortgagee Clause Considerations

Let’s say you decide to hand over the keys to another worthy homeowner or dip your toes in the refinance pool. Here, the Mr. Cooper mortgagee clause does a little dance and might need a tweak or two. It’s a straightforward procedure but one you need to be clued up on to proceed without hitches or glitches.

Impact of Service Transfers on Your Mr. Cooper Mortgagee Clause

What happens when your Mr. Cooper mortgage finds a new home with another service? Keep calm; it’s just another verse in the song. There are simple steps you can take to make sure the handover is smoother than a Sinatra tune.

Technology and the Mr. Cooper Mortgagee Clause: Streamlining Compliance

In the digital age, managing your mortgage can be as easy as a few clicks. Mr. Cooper has embraced this tech transformation, offering tools to help you keep a hawk-eye on your mortgagee clause compliance, all without breaking a sweat.

Borrower Experiences with the Mr. Cooper Mortgagee Clause: A Case Study Approach

The proof is in the pudding – or in this case, real borrower stories. We’re gathering the grapevine gossip to distill valuable lessons from those who’ve tangoed with the Mr. Cooper mortgagee clause and lived to tell the tale.

Frequently Asked Questions About the Mr. Cooper Mortgagee Clause

No stone left unturned here – we’re tackling the questions that keep borrowers up at night, providing expert answers that might just help you catch those Zs with peace of mind.

Future of Mortgage Clauses: Innovations and Trends Affecting Mr. Cooper’s Approach

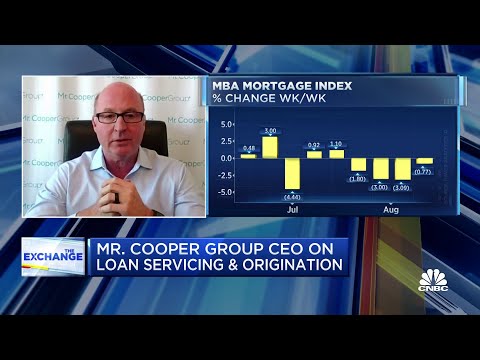

The mortgage industry doesn’t stand still, and neither does Mr. Cooper. We’re peering into the crystal ball of mortgage clauses to predict how evolving legislation, technology, and market forces could jazz up Mr. Cooper’s approach in the near future.

A Deeper Dive into the Mr. Cooper Mortgagee Clause: Significance for the Mortgage Industry

The Mr. Cooper clause doesn’t operate in a vacuum; it’s part of the vast web of the mortgage industry. We’ll be putting it side-by-side with other major players, giving you the full lowdown on how Mr. Cooper stands out in the crowd.

Crafting Your Financial Future: Leveraging Knowledge of the Mr. Cooper Mortgagee Clause

Let’s get strategic – understanding the mortgagee clause isn’t just trivial pursuit; it’s a powerful weapon in your financial arsenal. We’re dishing out advice on leveraging this know-how for a brighter financial horizon with Mr. Cooper.

Final Reflections on Navigating the Mr. Cooper Mortgagee Clause Terrain

In the labyrinth of mortgage clauses, knowledge is both your map and compass. We’ve journeyed through the significance of the Mr. Cooper mortgagee clause together, and now it’s up to you to use this wisdom to steer your ship through the choppy waters of homeownership with confidence and savvy. Stay informed, be proactive, and remember: your mortgage agreement isn’t just fine print; it’s the script of your home’s financial epic.

Where do I find the mortgagee clause?

Digging into the nitty-gritty of your mortgage paperwork, huh? You’ll typically find the mortgagee clause nestled in the insurance section of your mortgage agreement — it’s the spot that lists the lender’s information for insurance purposes. Just give your paperwork a once-over, or shoot a call to your lender; they’ll point you in the right direction.

What did Mr. Cooper mortgage used to be?

Ah, the times they are a-changin’! Mr. Cooper mortgage wasn’t always goin’ by that snazzy name; it used to be known as Nationstar Mortgage. A little rebranding jazzed things up a bit, but it’s the same company at heart.

Is Mr. Cooper mortgage legitimate?

As legit as they come! Mr. Cooper is a big player in the mortgage game, fully equipped with the whole nine yards of licensing and accreditations. Worry not, this lender is on the up and up.

What is the new name for Mr. Cooper mortgage?

Out with the old, in with the… Cooper? Mr. Cooper mortgage is the refreshed, rebranded persona of what was once Nationstar Mortgage. They decided to shake things up with a new name but rest assured, it’s business as usual under the new moniker.

Is the mortgagee clause just an address?

Well, it’s not just for sending pretty postcards! The mortgagee clause is an essential bit in your mortgage that gives the lender’s official address and details insurance companies need if they gotta send checks or notices regarding your home insurance.

What is the A13 mortgagee clause?

The A13 mortgagee clause might sound like secret agent code, but it’s just a specific version of a standard clause used by financial wizards in the mortgage industry. It’s got the key details your insurance folks need to keep things sorted if there’s a claim.

Why did my mortgage change to Mr. Cooper?

Don’t you hate it when things change without you knowing? A mortgage switchover to Mr. Cooper can happen when your original lender sells the loan. It’s like your mortgage just got a new babysitter, but for your wallet!

Why is Nationstar now called Mr. Cooper?

Nationstar pulled a bit of a magic trick and poof! Now it’s Mr. Cooper. They switched the name to give the brand a facelift, hoping to make the whole mortgage experience more, well, neighborly. It’s all part of their charm offensive.

Does Mr. Cooper own my mortgage?

“Own” is a strong word, but it’s likely Mr. Cooper is just managing the nitty-gritty of your mortgage — think of them as the new caretakers. Although, if the stars align, they might also own the loan if they bought it. Depends on what’s written in the stars, ya know?

Is Mr. Cooper being sued?

Ugh, talk about a headache. There have been a few whispers and legal mumbo jumbo about lawsuits with Mr. Cooper, dealing with stuff like questionable business practices. It’s like they say, even in the mortgage world, nobody’s perfect.

What bank is behind Mr. Cooper?

Behind every great mortgage company, there’s a… well, it’s complicated. While Mr. Cooper operates on its own, it’s got relationships with different banks and investors for funding. They’re kinda like a conductor in an orchestra, but for money.

How long does Mr. Cooper take to foreclose?

Tick-tock, tick-tock. If you’re falling behind on payments, you’re probably wondering how long until Mr. Cooper drops the foreclosure hammer. It’s not cut and dried; each state has its rules, but they usually give you a grace period before they start knocking.

Who is Mr. Cooper owned by?

Mr. Cooper isn’t under anyone’s thumb; they’re their own independent company. But like all publicly-traded companies, it’s owned by shareholders. They’re like the distant relatives everyone has but doesn’t really talk about much.

Did Wells Fargo sell my mortgage to Mr. Cooper?

The game of mortgage hot potato is real, and yes, Wells Fargo might toss your loan over to Mr. Cooper. It’s all part of the business — buying, selling, and trading mortgages like they’re baseball cards or something.

Did USAA sell to Mr. Cooper?

Well, it wouldn’t be the first time a big company bought out another. USAA did sell a chunk of its mortgage servicing rights to Mr. Cooper, sort of like passing the baton in a relay race but with more paperwork.

Do I need a mortgagee protection clause?

A mortgagee protection clause? Heck yeah, you do! It’s your safety net, ensuring the lender gets their money if your home is damaged or you’re up the creek without a paddle. Always read the fine print; it’s not just a bunch of mumbo jumbo!

What clauses are included in a mortgage?

Mortgages come with more clauses than Santa’s contract — there’s the acceleration clause, due-on-sale, escrow… the list goes on. Each one’s like a puzzle piece fitting into the home-owning journey.

What is the mortgage clause for US Bank?

Need the 411 on the mortgage clause for US Bank? It’s tucked away in your loan documents or contact them to get the scoop. It’s like a homing pigeon for your insurance to know where to send money if things go sideways.

What is the name of the clause found in a mortgage instrument?

Fancy a bit of legal lingo? The “acceleration clause” is the name of the game. It’s in every mortgage, and it’s the one that says “Pay up pronto!” if you break the rules. It’s like the strict teacher of the mortgage world.