Is 620 a Good Credit Score? Understanding Your Financial Position

Evaluating a 620 Credit Score: Where You Stand in the Credit Spectrum

So, you’ve pulled up your credit score and discovered it’s a 620. Let’s face the facts straight up—is a 620 credit score like wearing black Sneakers to a black-tie affair, or can you walk tall with confidence in the credit world?

A credit score acts as a financial litmus test, painting a picture of your reliability in the eyes of lenders. It’s a three-digit insight into your past and current credit behavior. Scoring models like FICO and VantageScore grade your credit history; the score ranges typically zip from 300, What Is The lowest credit score, to a top-notch How To get 850 credit score.

In this grand credit spectrum, a 620 score is nestled just above the “fair” line, according to current models. It’s not the stuff of legends, but hey, you’re not rooted to the spot. Compared to the current average FICO score of 714, a 620 is a polite nod from the credit gods but far from a standing ovation. And yes, lenders do take notice. While they won’t slam the door, they’ll certainly be tight-fisted with their loan terms.

| **Category** | **Details** |

|---|---|

| Credit Score Classification | 620 is typically considered a “fair” credit score, often categorized as subprime. |

| National Average Credit Score | As of 2021, the average FICO score in the U.S. is 714. |

| Mortgage Qualifications | A credit score of 620 meets the minimum requirement for most lenders to approve a conventional mortgage loan. |

| Mortgage Interest Rates | With a 620 credit score, borrowers can expect higher-than-average interest rates on mortgages compared to those with good credit. |

| Personal Loan Eligibility | Obtaining a personal loan is possible but often comes with high APRs. Scores below 640 may require seeking “bad credit” loans. |

| Impact on Loan Terms | Borrowers with a 620 credit score are likely to encounter less favorable loan terms, such as higher interest rates and fees. |

| Unsecured Credit Cards | Limited options are available for unsecured credit cards; these typically have higher interest rates and lower credit limits. |

| Secured Credit Options | Secured loans or credit cards may be more attainable, requiring collateral but offering a chance to rebuild credit. |

| Auto Loan Accessibility | Auto loans may be accessible, but the terms will likely include high-interest rates and potentially a sizeable down payment. |

| Impact on Insurance Premiums | Some insurance companies use credit scores to determine premiums, so a 620 score may result in higher insurance costs. |

| Credit Rebuilding Strategies | Consistent payment history, debt reduction, and careful management of credit limits can help individuals with a 620 score improve their credit over time. |

| Potential for Credit Score Improvement | There is significant room for improvement, and a focus on credit-building strategies can eventually lead to better borrowing terms. |

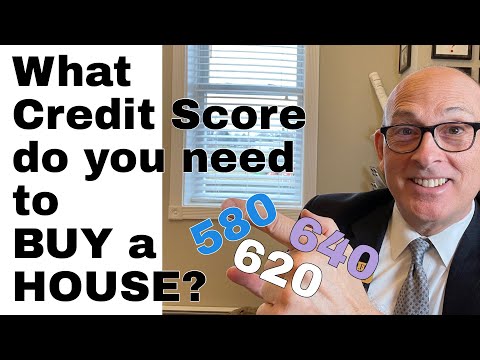

The Significance of Your Credit Score in Mortgage Approvals

Now, is 620 a good credit score when you’re hoping to nest in a new home? Your credit score is like a backstage pass—it gets you into the conversation for prime-property seating. The higher the score, the closer you get to the stage.

For which buyer would a lender most likely approve a $200,000 mortgage? Think of it this way—if your credit score sings a high octave in the 680 or Is 720 a good credit score range, you’re the lender’s star performer. But a 620? You’re in the choir, but not the soloist. The audience (lenders) won’t be throwing roses at your feet, but you might get a nod.

A 620 credit score is the barest whisper above the minimum for conventional loans. It’s the diving board into the pool of homeownership; you can make a splash, but expect a bit of a belly-flop with interest rates.

Good Credit Score Vintage Finance Gift T Shirt

$16.99

The Good Credit Score Vintage Finance Gift T-Shirt is the perfect attire for anyone who takes pride in their financial responsibleness and a stellar credit score. A must-have for financial advisors, accountants, or anyone with a passion for personal finance, this shirt features a unique, retro design that stylishly shows off the wearer’s creditworthiness. Its distressed vintage graphic creates a classic look, making it a trendy piece that matches well with various outfits. This T-shirt serves as a great conversation starter at parties, casual outings, or finance-related events, celebrating the importance of good financial health.

Constructed from high-quality, soft cotton fabric, this T-shirt guarantees not only to spread a message of financial wisdom but also to provide maximum comfort throughout the day. The Good Credit Score Vintage Finance Gift T-Shirt’s durability ensures it will maintain its shape and color through countless washes, embodying the lasting power of excellent credit. Cut in a unisex fit, this T-shirt is suitable for all body types and sizes, making it an inclusive gift for friends, family members, or colleagues. This T-shirt does more than just look good; it feels great to wear it, too.

This T-shirt doesn’t just celebrate fiscal savvy; it also makes for an amusing gag gift for anyone who’s recently improved their credit score or has always been a credit score wizard. Its quirky nature is bound to bring smiles, making it an excellent gift for birthdays, graduations, or any occasion that calls for a bit of financial humor. The Good Credit Score Vintage Finance Gift T-Shirt stands as a badge of honor for those who have worked hard to achieve and maintain their financial credibility. Encourage and inspire others to aim for that 700+ score with this unique, wearable piece of financial pride.

Beyond the Minimum: Aiming for a 680 Credit Score for Better Opportunities

Why stop at 620 when you can be a 680? That jump can pull you into a better neighborhood in the credit world. Here’s why striving for a 680 credit score is worth every effort:

Now, how to scale this credit mountain? Regular payments like clockwork, hacking away at outstanding debt, and keeping those credit card swipes in check. Make these your mantra, and watch your score climb.

The High Achievers: Why a 740 Credit Score Puts You Ahead

Shifting gears from a 620 to a 740 credit score, well now, you’re in premium territory. We’re talking Claudia Jessie-level—a standout in a crowd. A 740 turns heads. You’ll nab rates that would make your 620-self swoon. Loan approvals? Like a VIP list—you’re on it.

The stark differences are real:

– Interest Saved: Hello, more money for your retirement pot!

– Rewards and Benefits: Say yes to those fancy credit card offers with all the sweet trimmings.

– Peace of Mind: A 740 means fewer cold sweats when the loan officer examines your application.

Exploring the Benefits: Is a 620 Credit Score Sufficient for Your Goals?

A 620 credit score won’t lock you out of the credit market, but it won’t usher you into the VIP section either. Let’s talk about what’s not a benefit of having a good credit score for a moment. With a 620, dreams like snagging that charming cottage or funding a start-up might feel a tad out of grasp due to stiffer terms and higher interest rates.

Navigating life with a 620 can feel like you’re paddling upstream:

– Higher Premiums: Insurers might nudge up your rates, squeezing your wallet.

– Security Deposits: Utilities and landlords could ask for cash upfront.

– Borrowing Power: Lower limits and higher interest can be a drag.

Good Credit Score Vintage Finance Sweatshirt

$31.99

Embrace financial wisdom and style with the Good Credit Score Vintage Finance Sweatshirt â a fashion statement that combines comfort with a nod to fiscal responsibility. The luxurious softness of this sweatshirt comes from a high-quality blend of cotton and polyester, ensuring you stay snug and comfy whether you’re crunching numbers or just chilling on the weekend. Front and center, the vintage-inspired design features a classic credit score meter graphic, proudly showcasing the importance of a strong financial reputation. This retro design is perfect for finance professionals, savvy savers, or anyone who appreciates a good credit pun.

The sweatshirt features a versatile, unisex cut that fits a wide range of body types, with ribbed cuffs and hem for a timeless look that never goes out of style. A durable, fade-resistant print means your sweatshirt will maintain its bold colors and sharp graphics through every wash, wear, and conversation about the virtues of maintaining a good credit score. It’s not just fashionâ it’s a conversation starter, ensuring that wherever you go, you’ll spark discussions on financial health and smart money management.

Ideal for casual outings, educational events, or simply lounging at home, the Good Credit Score Vintage Finance Sweatshirt is more than just a cozy layer; it’s a personal endorsement of financial literacy. It makes a thoughtful and humorous gift for anyone with an appreciation for credit scores, from students just starting to navigate credit to seasoned investors. So whether you’re celebrating a credit score milestone or promoting financial awareness, this sweatshirt is sure to make a statement about your commitment to financial success, wrapped up in a package of vintage cool.

The Ideal Credit Card for a 620 Credit Score Holder

Alright, let’s get strategic with the plastic. Finding the ideal credit card for a 620 score is about as crucial as picking the right tool for a repair job. Aim for cards that are forgiving on the interest rates but firm on the credit-building benefits.

Remember, it’s not just about getting any card; it’s about mastering the art of usage. Swipe smart, pay promptly, and keep a lid on your balance—your credit score will thank you.

Minimum Credit Score for VA Loan: Can You Qualify With 620?

Great news for veterans and service members—a 620 might just cut it for a VA loan. The VA isn’t about hard lines on credit scores; they look at the whole battlefield. That means, with a bit of elbow grease, securing a loan with a minimum credit score for VA loan within reach is doable. Persistence and financial savvy can lead to a homecoming success story.

Crafting a Path to Credit Excellence: Steps to Enhance a 620 Credit Score

Take heart—your 620 isn’t a life sentence. To boost that number:

1. Analyze: Get your hands on your credit report. Correct any errors faster than a typo in an important email.

2. Budget: Like dieting, but for spending. Keep your debt lean.

3. Autopay: Automate those bills. Late payments are a no-go.

4. Credit: Manage it like your reputation—keep it spotless.

Avoid the pitfalls: maxed-out cards, late payments, and the allure of quick fixes. Patience is your ally here.

It’s All Fun And Games Until Your Credit Score Is About T Shirt

$14.99

Stay playful yet informed about the importance of credit responsibility with our eye-catching “It’s All Fun And Games Until Your Credit Score Is” T-shirt. This clever tee features bold lettering that captures attention, reminding everyone that financial decisions can bring real-world consequences. It’s the perfect conversation starter for anyone who loves a good laugh but also understands the significance of maintaining a healthy credit score.

Crafted from high-quality, soft cotton material, this shirt ensures you stay comfortable whether you’re out with friends or attending a casual financial literacy event. The durable fabric holds up well to everyday wear and frequent washings, so you can spread the message time and time again without losing its shape or appeal. Its classic fit flatters all body types and the unisex design makes it an ideal choice for both men and women who are passionate about personal finance.

Not only does this T-shirt feature a witty bit of wisdom, but it also comes in a variety of sizes to ensure a perfect fit for anyone looking to add a dash of humor to their wardrobe. Whether you’re dressing down for a casual day or looking to spark conversation at a credit counseling session, this shirt makes it clear that you’re savvy about the serious side of spending. With its unique blend of fun and function, our “It’s All Fun And Games Until Your Credit Score Is” T-shirt is a must-have for anyone aiming to merge style with financial awareness.

In-Depth Analysis: How a 620 Credit Score Influences Financial Choices

Case study time! John had a 620 and needed a loan. He secured one, but the rates were sky-high! If he’d had a 620 credit score and used credit check total services, he could’ve known where he stood and what to fix. With expert guidance, he prepped his score for better opportunities. Boom—financial doors started opening.

Your Financial Future with a 620 Credit Score: Outlook and Next Steps

Predictions ahead—lenders might get choosier with scores. Don’t get left in the dust! Set goals and sketch out your road map. A 620 today? No worries. But aim for higher grounds, and you’ll see greater rewards.

Embracing the Journey from 620 to Financial Greatness

The journey of financial empowerment often starts with understanding and enhancing one’s credit score. While a 620 credit score may not be the pinnacle of credit health, it is certainly not the end of the road. The path to greater financial opportunities is paved with informed decisions, diligent practices, and an unwavering commitment to personal growth. As we’ve peeled back the layers of what a 620 credit score means for various financial aspects, it’s clear that the power lies in leveraging what you have today while aiming for what you can achieve tomorrow. Let your 620 credit score be the starting point to a brighter financial future, not the defining limit of your possibilities.

Credit Score Club High Credit Score Funny Financial Premium T Shirt

$22.99

Introducing the irreverent yet on-point fashion statement for financially savvy individuals, the Credit Score Club High Credit Score Funny Financial Premium T-Shirt! This exclusive tee is the perfect blend of humor and pride for anyone who relishes in the achievement of a sterling credit score. Featuring a bold, eye-catching design that playfully boasts a member’s status in the “700+ Credit Score Club,” this shirt is a conversation starter whether you’re out for a casual meetup or attending a financial seminar.

Crafted from high-quality, soft fabric, the T-shirt is designed to provide both comfort and durability for everyday wear. The premium material ensures the shirt holds up through countless washes without losing its shape or vibrancy, ensuring that your financial flair remains intact. With its unisex fit, the tee is an excellent choice for anyone who wants to flaunt their fiscal responsibility and great credit management in style.

It’s not just an ordinary shirt; it’s a badge of honor for those who have worked diligently to maintain excellent credit. It’s the perfect gift for that friend who’s always checking their credit score or for personal gratification if you’re proud of your financial achievements. So why not let the world know you’re credit-savvy with a sense of humor to boot? Slip into the Credit Score Club High Credit Score Funny Financial Premium T-Shirt and enjoy the blend of comedy and comfort that reflects your high score personality.

What can a 620 credit score get you?

Whew, a 620 credit score—on the fence, isn’t it? It could open a few doors, like qualifying for some types of credit cards or a personal loan, but let’s just say the terms and interest rates won’t be the cream of the crop. You’re in the “fair credit” ballpark, so lenders might play ball, but they’ll be keeping an eagle eye on the risk.

Can I buy a house with 620 credit score?

Well, ain’t that something? Yes, you can buy a house with a 620 credit score, buddy. But hold your horses, it might be a bit of a bumpy ride. You’re looking at potentially higher interest rates and a chunkier down payment. It’s like getting that fixer-upper on the block—you can work with it, but it’s no walk in the park.

Can I get a $10000 loan with a 620 credit score?

Can you snag a $10,000 loan with a 620 credit score? Sure, it’s possible, but remember, it’s not just about score—it’s the whole kit and caboodle. Lenders check your income, debt, and history, too. Let’s just say you won’t be swimming in the best terms, but you aren’t exactly up a creek without a paddle either.

How to improve credit score from 620 to 700?

Oh, you wanna level up from 620 to 700? Roll up your sleeves; it’s game time! Start by always paying bills on the dot, whittling down your debt, and keeping old credit lines open for the age boost. It won’t happen overnight, but with some elbow grease, you can build up to a score that opens more doors.

How to go from 620 to 720 credit score?

Jumping from 620 to 720 is quite the leap, but it’s not rocket science! You’ll need a solid plan—think checking your report for errors, reducing your credit utilization, paying debts like it’s going out of style, and avoiding new credit inquiries. Patience is key. It’s a marathon, not a sprint, so pace yourself.

Can I get a $5000 loan with a 620 credit score?

Hankering for a $5,000 loan with a 620 credit score? You’re in luck-ish territory. While you’re not holding the best hand, it’s not a total fold situation either. Lenders might entertain your application, but be prepared—they’ll likely want higher interest to sweeten the deal for ’em.

What credit score is needed for a 300k house?

Dreaming of a 300k house? Better have your credit ducks in a row for that one! Aim for a score upwards of 620, probably more like 680 or higher for the best terms. It’s like getting a backstage pass; the higher your score, the closer you are to the front row.

Would a 620 be considered a poor credit score?

Would a 620 score be considered poor? Nah, not poor—let’s say it’s fair, okay? It’s the middle kid of credit scores. Not quite the head of the class but definitely not flunking out either. There’s work to do if you’re aiming for the credit valedictorian, though.

What is a good credit score for my age?

“What’s a good credit score for my age?” is like asking “How long is a piece of string?” It varies! Generally, higher is always better, no matter your birthday. Folks in their 20s are just starting the credit journey, so don’t sweat it if you’re not top of the heap just yet.

How much is a $10,000 loan for 5 years?

So you’re eyeing a $10,000 loan for a 5-year stint, huh? Well, the cost will boil down to your interest rate—thank you, credit score. It’s a bit of a “how long is a piece of string” situation, but expect anything from a few grand to a small fortune in interest over those years.

Can I get a jumbo loan with a 620 credit score?

Think a jumbo loan with a 620 credit score is a slam dunk? Err, not so fast. Jumbo loans are the big leagues, and a 620 is kind of JV team material in the credit world. You might find a lender, but they’ll probably want more skin in the game like a bigger down payment or additional reserves.

What is the easiest loan to get approved for?

Easiest loan to get approved for, you say? Look towards payday loans or short-term lenders—they’re often less fussy about credit scores. But heads up: they can come with interest rates that’ll make your eyes water. High risk means high reward for them, but a potential headache for you.

How to raise your credit score 200 points in 30 days?

Raise your credit score 200 points in 30 days? That’s aiming for the stars! It’s ambitious and usually not realistic since credit bureaus update monthly. For a moonshot like that, you’d need to correct major errors on your credit report or ride a unicorn. Slow and steady usually wins this race.

How to increase credit score by 100 points in 30 days?

Boost your credit score 100 points in a month, can you? Well, that’s a tall order. If there are glaring errors on your report, resolving them stat can boost your score dramatically. But for most cases, it’s like expecting to be gym-fit in a week—it takes consistent effort over time.

How fast does credit score go up?

How fast does your credit score rise? It’s more tortoise than hare, my friend. Timely payments and smart credit use will set you on the upward path, but think months, not moments. Consistency is king, so keep chipping away!

What credit limit can I get with a 620 credit score?

Credit limit with a 620 score? Don’t expect the keys to the kingdom—a modest limit is more likely, not the VIP lounge access. Lenders will offer you enough rope to climb, but not enough to hang yourself with. Prove you’re good for it, and they’ll loosen the reins over time.

Is a 620 credit score good for a 20 year old?

Is a 620 score good for a 20-year-old? Hey, you’re on the board! It’s a decent starting point, but there’s room to grow. Just like moving out of the dorms and into your own place, you’ve got a taste of freedom but still a ways to go.

Will a 620 credit score get me an apartment?

Will a 620 credit score fetch you an apartment? Sure, many landlords might give you the thumbs up. But remember, just like job interviews, make a good impression—show proof of steady income or offer a larger deposit to ease their worry-wrinkles.

Is 700 a good credit score?

Is 700 a good credit score? Oh, you bet! It’s like having a VIP pass to the financial funfair—better loan rates, credit cards, and the nod of approval from lenders. So yes, it’s like being in the credit score club where the bouncer almost always lets you in.