Transferring real estate property can sometimes be like navigating an uncharted financial maze, filled with complexities and legal nuances. One tool that makes this maze slightly less labyrinthine is a Grant Deed. Although it might seem like just another legal document, truly grasping its essence is pivotal in managing property transactions.

Understanding the Concept: What Is a Grant Deed?

When it comes to property transactions, a grant deed is your main co-pilot.

Definition of a grant deed:

A grant deed, in simple terms, is a legal document that effectuates the transfer of a property’s title from a seller (known as the grantor) to a buyer (known as the grantee). In practice, a grant deed works much like a certificate of authenticity in other areas of commerce, verifying that the seller rightfully owns the property and is free to sell it.

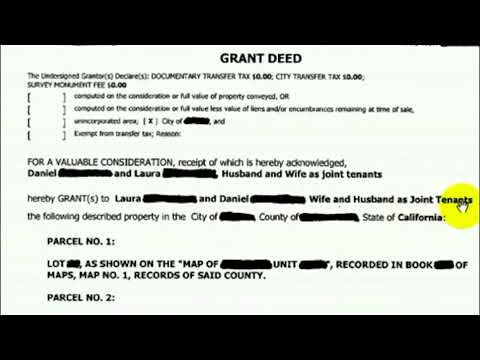

Fundamental elements of a grant deed:

A typical grant deed contains critical information such as the names of the grantor and grantee, legal descriptions of the property, and the date of transfer, making it a lot more informative than a map on a treasure hunt. Most importantly, it includes certain warranties or guarantees that the grantor presents to the grantee.

Difference between a grant deed and other property deeds:

While a grant deed may sound similar to other deeds like the quit claim deed – a fine distinction exists. Unlike a quit claim deed, which only transfers any interest the grantor might have in the property, if any exist at all. Check out this link, “quit claim deed form,” for a deeper understanding of quit claim deeds. Comparatively, a grant deed comes with guarantees that the grantor owns the property and that no undisclosed liens or encumbrances exist, putting the grantee’s mind at ease.

The Significance of a Grant Deed in Property Transfers

From the movie ‘Jaws,’ we learn that when venturing into unmapped waters, it’s always comforting to have a reliable guide. In the realm of property transfer, a grant deed serves as this guide.

Role of a grant deed in property transfers:

A grant deed plays an integral role by formalizing the transfer, assuring the buyer of the seller’s legal ownership, and protecting the seller against future claims.

Protection offered to both buyer and seller through a grant deed:

Think of a grant deed as an insurance policy or your trusty sidekick. It offers protection to both parties involved in the transaction- the seller by recording their transfer of ownership and the buyer by guaranteeing that the property title is clear of secreted issues.

How a grant deed enforces property rights:

Purchasing a property without a grant deed would be like trying to navigate Jake Lacy’s intricate career path without This comprehensive guide. It enforces your property rights by confirming lawful ownership and guarding against future disputes or fraudulent claims.

| Deed Type | Description | Guarantees/Covenants | Recording Process | Cost Involved |

|---|---|---|---|---|

| Grant Deed | In Texas, conveys title to real property with implied covenants. Includes the words “grant” or “convey” | Grantor has not transferred title to anyone other than the grantee; property is free from impediments at the time of transfer | Record it with the County Clerk in the county where the property exists | Depends on the property’s value and the county’s recording fees |

| Gift Deed | A gift deed is a special type of grant deed that “gifts” ownership of real property interest to another person or entity | Transfer was not subject to a sale, and the grantor received no monetary compensation | Same as Grant Deed | Minimal, as there is no sale involved |

| General Warranty Deeds | A deed that provides the most protection to the grantee as it includes all the covenants of title | Grantor holds the title and possession, guarantee against all property faults, including those that existed prior to the grantor’s ownership | Same as Grant Deed | Depends on property’s value and the county’s recording fees |

| Special Warranty Deeds | Less protective than general warranty deeds; only guarantees against faults or encumbrances that occurred during grantor’s tenure | Guarantee only for the period of the grantor’s ownership | Same as Grant Deed | Depends on property’s value and the county’s recording fees |

| No Warranty Deeds | Offers the least protection to the grantee as it does not provide any warranty | No guarantees are provided | Same as Grant Deed | Depends on property’s value and the county’s recording fees |

| Quitclaims | Carries no guarantee that the title is clear; generally used to clear up title issues or during divorce settlements | No guarantees are provided; the grantor does not claim to own the property | Same as Grant Deed | Depends on the property’s value and the county’s recording fees |

Comprehensive Walkthrough: The Lifecycle of a Grant Deed

The journey of a grant deed is like going through a blockbuster movie’s production stages (minus the camera crew).

Examination: The importance of conducting a title search before executing a grant deed:

Before that emotional “scene” of signing a grant deed, a title search is necessary to scrutinize any hidden plot twists – liens, claims, or encumbrances.

Preparation: Understanding the components of a grant deed:

The carefully scripted “script” that is the grant deed must include vital elements such as the property description, names of parties involved, and specific guarantees.

Execution: Notary public’s role in the execution and approval of a grant deed:

Like an acclaimed director, a notary public’s role is to witness the signing, verify the authenticity of the transaction and ensure the grantor’s willful involvement, preventing any hints of forgery.

Recording: The recording process of a grant deed and why it matters:

The all-important “premiere” is the recording of the deed at the local County Recorder’s Office. This not only validates the transaction but also helps against future ownership disputes – ensuring your Hollywood ending.

In-Depth Analysis: How Does a Grant Deed Impact Homebuyers and Sellers?

Just like how the world is now divided into “pre and post Google AI era”, thanks to the fantastic way Google ai Has transformed Our Lives, there are also “pre and post grant deed” periods in a property transaction.

Why homebuyers should always insist on a grant deed:

Homebuyers are like explorers venturing into the unknown, hoping they’ve found their dream property. However, insisting on obtaining a grant deed is as crucial as a reliable compass, providing irreplaceable protection against potential fraudulent claims or unwelcome surprises.

How a grant deed can provide peace of mind for sellers:

While selling a property, the seller is like the quest giver guaranteeing that the mission (property) is as claimed. Issuing a grant deed allows the seller to transfer property rights with conviction, knowing they’ve fulfilled their assurance and legally cleared themselves of future responsibilities attached to the property.

The role of a grant deed in a mortgage transaction:

In a mortgage transaction, the lender is like a discerning investor putting their money on your dream. Here, a grant deed is an essential document ensuring the grace of the property deal – a key deciding aspect of mortgage approval.

Advanced Knowledge: Dealing with Grant Deed Complexities

Like any good adventure, property buying comes with its set of challenges. And while this isn’t “The Da Vinci Code,” complexities with grant deeds can and do occur.

How to handle common complications encountered with grant deeds:

Whether it’s disputes about the property’s legal description, issues with outstanding liens or encumbrances, or handling special cases like gift deeds – dealing with grant deed complications can feel like a thrilling detective story, requiring careful investigation, expert advice, and smart resolutions.

Addressing property liens and how a grant deed comes into play:

Property liens, the hidden monsters of property deals, can be quite a bit of a nightmare. But fear not – a grant deed, like your ever-reliable monster repellent, can assure you a clean title by guaranteeing that such hidden encumbrances do not exist.

Proactive steps to avoid grant deed complications:

Stay one step ahead, and you can avoid most pitfalls. Thorough title searches, properly filled grant deeds, understanding the difference between various deed types like quit claim deed in California, and timely consultation with an attorney can ensure a smooth transaction.

Grant Deed Vs. Title Insurance: Discovering The Ultimate Safety Measure

In terms of property transfer safety, there’s an age-old debate – is a grant deed enough, or should one really invest in title insurance?

The role of title insurance in property transfers:

While a grant deed equates your brawny hero capable of bearing guarantees, a title insurance acts as your stealthy spy, offering yet another layer of protection by insuring against potential losses resulting from property defects undisclosed by the public records.

Exploring the interplay between grant deeds and title insurance:

Imagine an action-packed movie where the hero (grant deed) and spy (title insurance) team up for maximum safety. In real estate, this collaboration can cover maximum bases – with grant deed’s covenants guarding against undisclosed liens and title insurance prepared to handle those unexpected title defects.

When to use either or both for maximum security:

While the combined power of a grant deed and title insurance provides an absolute safety net, the decision should hinge on the property’s circumstances, risk tolerance, and careful consideration of factors like potential title defects, purchase price, and local norms.

Future Outlook: The Evolving Dynamics of Grant Deeds in 2023 and Beyond

Much like how the plot unfolds in a riveting sci-fi movie, the dynamics of grant deeds also continue evolving owing to legal changes and new regulations.

Impact of recent regulations and legal changes on grant deeds:

Legal changes throw twists in the story. In Texas, for instance, new regulations as of 2023 now stipulate that property is legally transferred when the grantee accepts the signed deed, putting added emphasis on the grant deed’s validity.

Expected changes and trends regarding grant deeds in the future:

Much like the evolution of filmmaking, one can expect the function and process of grant deeds to advance, given the rapid digitalization of real estate transactions and rising complexities in property laws.

Final words on how a grant deed continues to be an essential tool for property transfers:

Despite the winding path ahead, it’s evident that the grant deed will continue to be the reliable vehicle for navigating property transfers, adapting and evolving to suit the changing landscapes of real estate.

Beyond the Wordings: Tying Up Your Insight into Grant Deeds

In wrapping this up, remember – comprehending grant deeds isn’t just about understanding legalese but about taking control of your property journey.

A takeaway snapshot of grant deeds and their importance in property transfers:

Grant deeds are like lighthouses, guiding ships safely to the shore. They protect buyers by providing ownership guarantee and sellers by recording their transfer of ownership.

High-level points to remember when dealing with grant deeds:

Grant deeds give you control, protection, and peace of mind when buying or selling property. To use this tool effectively, it’s essential to understand its components, the process of issuance, and how it differentiates from other deeds like a quit claim deed

The potential impact of recent and forthcoming changes on grant deeds and property transfers:

Stay alert to the evolving landscape of real estate law that affects grant deeds. In this ever-changing environment, being aware and adapting to changes can mean the difference between smooth sailing and troubled waters in property transfers.

No matter what the property climate may be, understanding the mechanics of a grant deed, its lifecycle, associated complexities, and implications for buyers and sellers alike is akin to having an insider’s guide to the world of real estate. Consider investing time in getting to grips with this essential tool in property transfer – it’ll be worth it.

What is the difference between a warranty deed and a grant deed?

Well, here’s the scoop: the main difference between a warranty deed and a grant deed lies in the type of protection offered. A warranty deed effectively says, ‘Yes siree, I fully guarantee I own this property.’ It provides full legal protection against any claims. On the flip side, a grant deed only guarantees that the property wasn’t sold to someone else before you, not giving quite the same level of assurance.

What is a grant deed example?

Looking for a grant deed example? Imagine you’re selling your lake house. You’d hand a grant deed to the buyer, essentially saying ‘As far as I know, no one else has dibs on this place.’ Don’t have your ducks in a row? Don’t stress out. It doesn’t include any warranty against hidden title defects.

What is a grant deed in Georgia?

In the peach state, Georgia, a grant deed isn’t a common practice. Instead, they hoof it on a different track using warranty deeds. They’re more comprehensive, providing a full-on guarantee from the seller to the buyer that the property has a clear title and can be sold outright.

What kind of deeds are used in Texas?

Well, well! In the Lone Star State, Texas, they chose to do things their way. They typically use general warranty deeds and special warranty deeds. Each offers different protection levels to the buyer, with the general warranty deed offering the strongest protection.

What type of deed is best?

You might wonder what the Cadillac of deeds is. Most real estate buffs would tell you that the best type of deed is a general warranty deed. This deed gives the strongest level of buyer protection, as it guarantees that the seller owns the property free and clear.

What type of warranty deed is best?

Speaking your language, the Rolls-Royce of warranty deeds would definitely be the general warranty deed. It comes with bells and whistles, like guaranteeing the property has no hidden liens, encumbrances, or third-party claims.

What is the most common deed in Georgia?

You would ask about Georgia! In these parts, the most common deed is the general warranty deed. It’s the Southern way to ensure the buyer gets the full monty: unobstructed title to their new property.

How do I transfer a property title in Georgia?

You fancy some property in Georgia and wonder about the procedure? Hold your horses, it ain’t tough. In Georgia, to transfer a property title, you need to fill out a deed (generally a warranty deed), have it notarized, and file it with the county’s deed recorder. Bob’s your uncle!

How do I get the deed to my house in Georgia?

Oh, you want the deed to your house in Georgia, huh? Just mosy down to your local county recorder’s office. You can request a copy there. Piece of cake, ain’t it?

What is the most commonly used deed?

Curious about the most commonly used deed, huh? Well, it’s the general warranty deed. Like your mom’s apple pie, it’s the most reliable. It offers full protection to the buyer by guaranteeing them a clear title.

What is the most common form of deed?

Between you, me, and the gatepost, the most common form of deed is the warranty deed. It’s the gold standard, offering the buyer peace of mind with a COMPLETE guarantee against any hiccups in the title.

Can anyone get a copy of a deed in Texas?

Anyone in Texas can get a copy of a deed? Well, I’ll be! Yes they can. Texas records are as open as a 24-hour diner. Just contact the county where the property is located and they’ll help you rifle through the records.

Why are warranty deeds rarely used in California?

Wondering why warranty deeds are as rare as hen’s teeth in California, eh? It’s because they use what’s called a grant deed. California prefers it because it doesn’t legally oblige the seller to defend the title against third parties.

What type of ownership has definite rights of survivorship?

Hands down, joint tenancy is the type of ownership that has definite rights of survivorship. To put it plainly, if one owner kicks the bucket, their share automatically goes to the surviving owner(s).

What is a deed conveying real property without covenants called?

A deed conveying real property without covenants? Ah, well, that’s a quitclaim deed there. It’s the equivalent of saying, ‘Whatever interest I have in this place, it’s yours. But don’t hold me to anything.’

Which type of deed is used by a grantor whose interest in the real estate may be unknown?

Okie dokie, the kind of deed used by a grantor whose interest in the real estate may be unknown is a quitclaim deed. It’s a bit of a gamble though, as it comes without guarantees.