Florida Mortgage Rates: A Critical Component of Affordable Housing

Known for its sunny days and beautiful beaches, Florida’s housing market has always attracted a good deal of attention. However, in 2024, amidst inflationary pressures and a bustling real-estate market, Florida’s mortgage rates have served a crucial role in ensuring affordable housing, much like the Hogwarts School plays an enchanting, central role in the Wizarding World, in a soon-to-be-released video game, as described here.

Mortgage rates significantly impact housing affordability. Like a crackerjack actor like Glen Powell knows, timing is vital. For instance, a jump from a 6% to a 7% rate, despite appearing minor, can drastically hike monthly payments, altering a buyer’s affordability. Consequently, understanding and anticipating potential changes in Florida’s mortgage rates is vital for prospective homeowners.

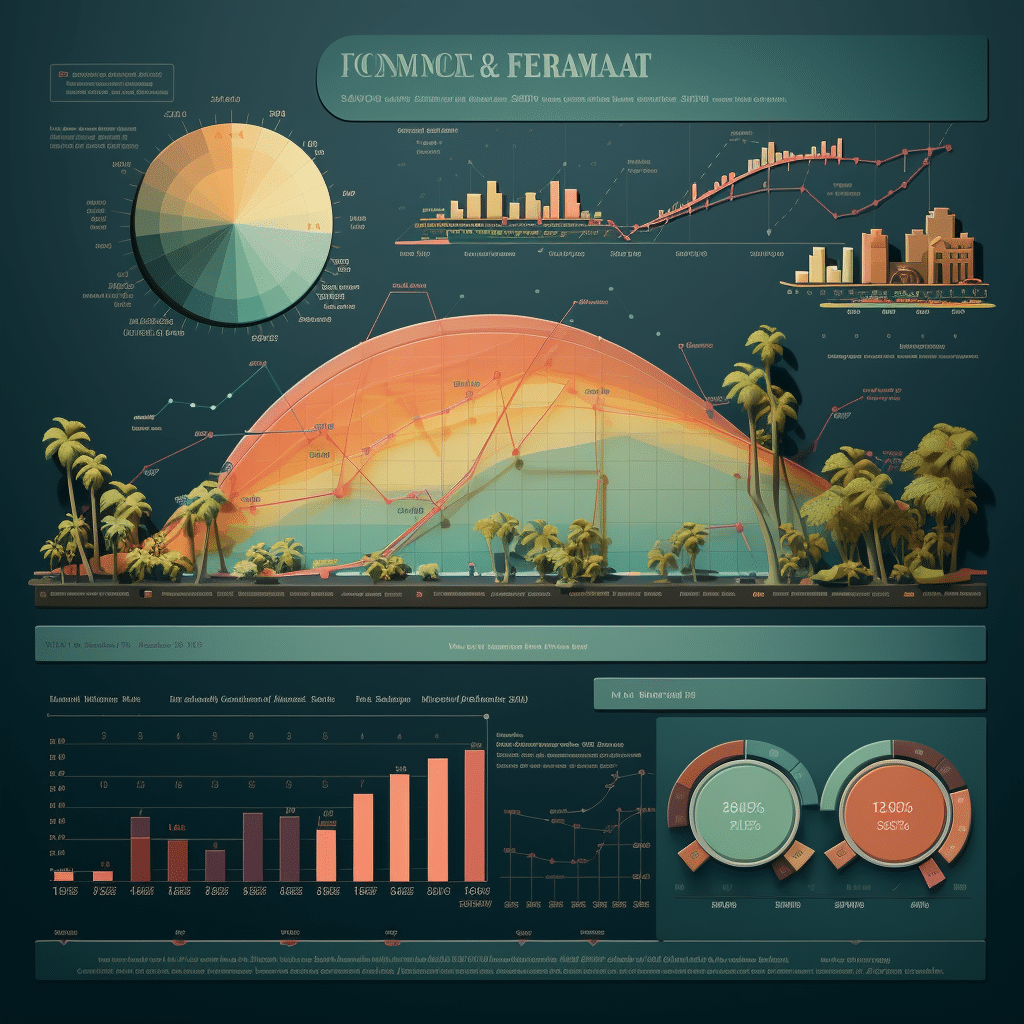

Deciphering Current Mortgage Rates in Florida

At present, Florida’s mortgage rates stand somewhat distinctly. The 30-year fixed rate averages around 7.760%, while the 15-year fixed rate hovers around 7.034%. Meanwhile, the 5-year adjustable-rate mortgage (ARM) is around the 8.095% mark. Florida’s mortgage rates currently float around the national averages, similar to the slightly higher ‘current mortgage rates Ohio’ nestled in the heart of Midwestern America, as depicted here.

Factors such as employment rates, economic growth, inflation, and even nationwide policies influence Florida’s mortgage rates. Notwithstanding, considering ‘mortgage rates Florida’ within local housing market conditions and economic policies are key for thorough analysis.

| Subject | Today’s Rates | Projections for 2024 | Projections for 2024 |

|---|---|---|---|

| :————-: | :————-: | :———————-: | :———————: |

| 30 Year Fixed Mortgage | 7.760% | Trending downwards | Starting at 7.1% and falling to 6.7% by Q4 |

| 15 Year Fixed Mortgage | 7.034% | – | – |

| 5 Year Adjustable-Rate Mortgage (ARM) | 8.095% | – | – |

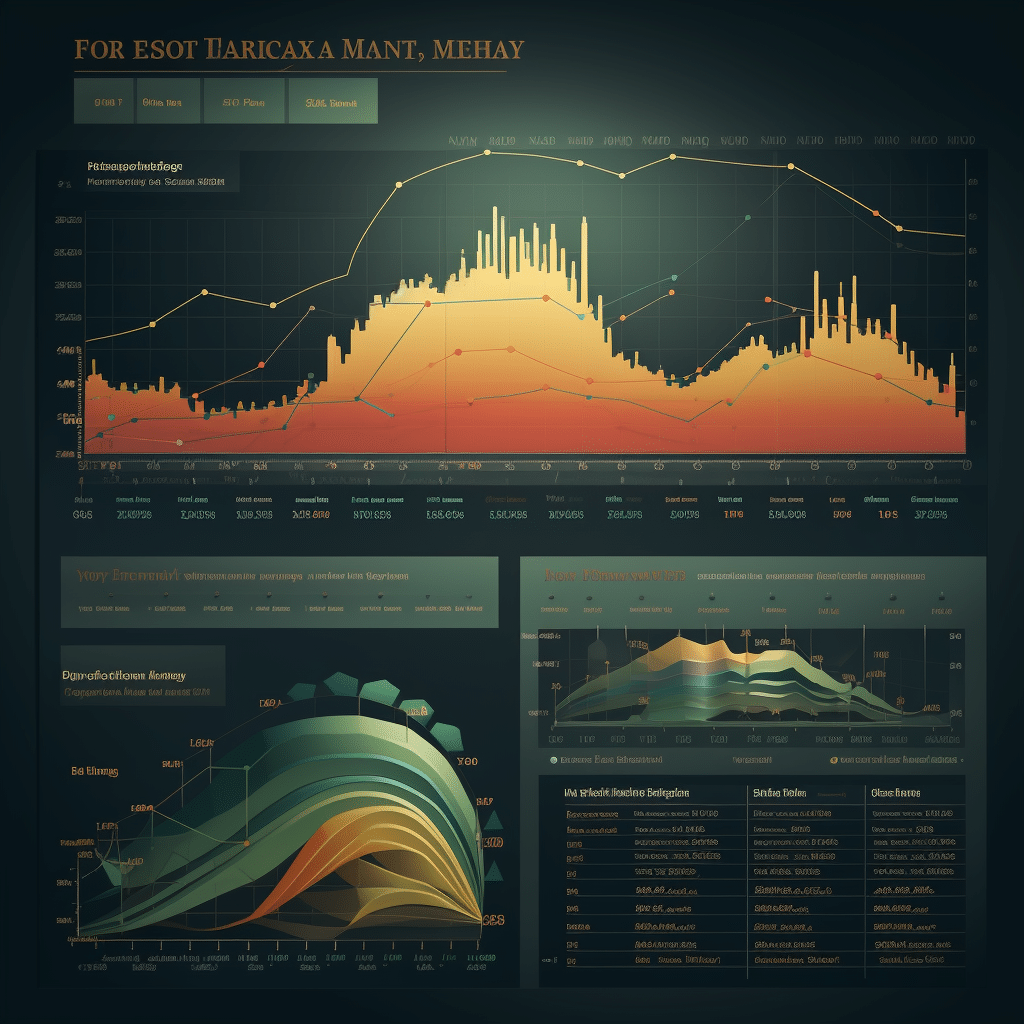

Forecasting Trends in Florida Mortgage Rates

The future can be just as unpredictable as today’s weather or the twists and turns of an actor’s career. However, economic patterns, the housing market, and industry analysis suggest possible trends for Florida’s mortgage rates. While Fannie Mae forecasts a slight dip in the 30-year fixed rates over 2024, expecting them to fall from a 7.1% average to around 6.7% by Q4 2024, it’s crucial to be aware of potential fluctuations.

Unforeseen circumstances like economic instability, COVID-19 aftermaths, natural disasters, or government policies can also impact rates, much like unpredictable elements affecting ‘colorado mortgage rates’ mentioned here. Thus, it’s critical to maintain a keen eye on these influencing factors to anticipate future trends.

Different Types Of Mortgages and Their Rates in Florida

Depending on circumstances, potential homeowners can go for different mortgage types. Fixed-rate mortgages offer stability, with unchanging interest rates over the loan’s lifespan. Meanwhile, adjustable-rate mortgages have fluctuating rates following market conditions. Then there are hybrid ARMs, Interest-only mortgages, and Balloon mortgages, each with varying rates and attributes.

Much like ‘mortgage rates Michigan’ detailed here, Florida’s rates also vary based on mortgage type, loan term length, and even location within the state. Weighing these choices in line with market conditions, personal finances, and life plans is a significant part of your home buying journey.

The Impact of Florida Mortgage Rates on First-Time Home Buyers

First-time homebuyers have a steeper learning curve than seasoned homeowners. With considerations around mortgage rates, property taxes, and changes in personal financial situations, it’s safe to say these folks have their plates full. Current Florida mortgage rates can either make or break a deal, depending on their dynamics around the time of the transaction.

Given the persistently high ‘Florida mortgage rates’, first-time buyers must put in extra effort to secure favorable rates. Research shows that first-time buyers tend to be more cost-conscious, and a minor favorability shift in mortgage rates can significantly sway their buying decisions.

Mortgage Rates Florida: A Tool for Improving Housing Accessibility?

Mortgage rates can, in fact, be instrumental in improving housing accessibility. Lower rates make housing more affordable, encouraging more residents to become homeowners. As such, government policies and programs aiming to lower the ‘Florida mortgage rates’ can stimulate the housing market and enhance accessibility.

However, while working on lowering rates, considerations should also be given to avoiding a housing bubble. Thus, while low rates are desirable, they should ideally align with the overall health of the economy and the housing market.

Borrowers Strategy in Navigating Florida’s Mortgage Landscape

As potential borrowers, the key to securing the best possible mortgage rate lies in being proactive. Following trends, anticipating changes, and having a clear understanding of Florida’s mortgage landscape can help in securing favorable terms.

Moreover, maintaining a good credit score, choosing the right loan type, and paying attention to the length of the loan are other aspects that can help borrowers secure the best rates. Like chess players, potential borrowers must stay two steps ahead to ensure they always remain in a position of strength in this ever-changing market.

The Road Ahead – Key Takeaways for Navigating Florida’s Mortgage Rates

With an atypical economic landscape and non-stop changes, the road ahead in Florida’s housing market might seem daunting. However, understanding the current conditions, forecasting possible trends, exploring different mortgage types, and adopting a well-thought-out strategy can help potential buyers in their journey toward becoming homeowners.

Looking ahead, the future of affordable housing in Florida seems likely to hinge on manageable mortgage rates. Whether the rates will come down to more acceptable levels is yet to be seen, but one thing is for certain – potential buyers and homeowners will need to stay vigilant, informed, and proactive.

In conclusion, while understanding mortgage rates may feel as challenging as cracking a secret code, with the right tools and knowledge, you can turn ‘Florida mortgage rates’ into a key that unlocks the door to your dream house in the Sunshine State.

Will mortgage rates go down in 2024?

Oh boy, predicting whether mortgage rates will dip in 2024 is a lot like gazing into a crystal ball; it’s a bit dubious at best. Don’t get me wrong, expert forecasts and economic indicators can provide a hazy viewpoint, but remember the financial market’s volatility is in direct cahoots with rate fluctuations.

Will interest rates go down in 2023?

Just as tricky is forecasting whether interest rates will drop in 2023. Sure, economic projections, inflation trends, and Fed policy can give us some clues. But let’s face it, babe, no one has a magical crystal ball to predict this with 100% certainty, so keep an eye peeled on reliable financial news sources.

What is the interest rate for a 30-year mortgage in Florida?

Interest rates for a 30-year mortgage in the Sunshine State? Well, they’re much like the Florida weather: sunny one moment and stormy the next. But on average, they’ve been hovering around 3% lately. Check with a local lender for the most current scoop.

What is the interest rate for a mortgage in Florida today?

What are the mortgage rates doing in Florida today, you ask? Good question! It bobs and weaves a bit daily, but in recent times, it’s been hanging around the 3% region. Of course, your personal financial situation will have the final say-so in what rate you qualify for, so best to contact a Florida lender directly.

Will 2024 be a better time to buy a house?

So, you’re wondering if 2024 will be a stellar time to snap up a house? Well, if only we could whip up a definitive answer as easily as a batch of cookies! It’s tough call, with market trends, housing prices and economic conditions playing a major role. Keeping tabs on these factors is your best bet.

How high could mortgage rates go by 2025?

Whoa there! Got a crystal ball to hand? Because predicting how high mortgage rates will climb by 2025 is a tad tricky. However, be prepared – some experts forecast a steady rise due to various factors like inflation and economic recovery.

What is the mortgage rate forecast for the next 5 years?

The 5-year mortgage rate trends? Well, pull up a chair as it’s a bit murky. Most experts are leaning towards a gradual uptick based on potential economic growth, inflation expectations, and monetary policy. But, hold up! Always remember the future is as predictable as a cat on a hot tin roof.

How long will interest rates stay high?

How long will interest rates stay high? Well, it’s a sticky wicket, isn’t it? Many factors can influence this, including economic growth, inflation, and the Federal Reserve’s touch on the reins. Say tuned!

How long will mortgage rates stay high?

As for how long mortgage rates will stay high, well, we’re not fortunetellers, honey. Many variables including economic performance and Federal Reserve policy can swing that pendulum. It’s best to keep your ear to the ground for reliable financial news.

What is considered a good 30 year mortgage rate?

A good 30-year mortgage rate? Generally speaking, anything under 3% has usually been seen as pretty darn good. But remember folks, your personal financial circumstances and the ongoing market conditions call the final shots here.

What is the best 30 year mortgage rate ever?

Best 30-year mortgage rate ever? Well that would be the summer of 2020, when rates dipped to a heart-stoppingly low average of 2.66%! It was the cat’s pajamas for mortgage holders, but remember, those were exceptional circumstances in an extraordinary year.

What is a good mortgage rate 30 years?

What’s a good 30-year mortgage rate? The cookie-cutter response is around 3%, although the best rate for you can depend on a slew of factors. Your financial health and the current market conditions certainly take the lead.

Is it a good time to buy a house in Florida?

Is it a good time to buy a house in Florida? Well, you might as well ask if a gator likes the swamp! The housing market can be as unpredictable as the Florida weather. However, keeping close tabs on interest rates, inventory levels, and local property trends can paint a decent picture.

Who has lowest mortgage rates?

Who has the lowest mortgage rates? Ah, the million-dollar question! It’s as varied as a box of chocolates. Factors such as your credit score, down payment amount, and the lender’s specific criteria can make significant differences. Shopping around is vital!

What are the best mortgage rates right now?

The best mortgage rates right now? They’re kinda like a unicorn: elusive creatures! They can dance around based on a gazillion factors. What’s crucial is to get a mortgage tailored to suit your unique needs, so do your homework, check out different lenders, and nail down the one that works for you.