Understanding FHA Loan Limits in Florida in 2024

Here in sunny Florida, the FHA loan limit—the maximum amount a borrower can get through an FHA loan program—changes periodically. These limits are critical for homebuyers looking to finance their dream homes. To most potential homeowners, these adjustments mean a little more purchasing power. But what has led us to the current FHA Loan Limits Florida in 2024?

Historical Overview of FHA Loan Florida Limits

The FHA loan regulations have seen considerable changes, with movements significant enough to sway the real estate landscape in Florida. The past five years have seen these limits soar, influenced by economic factors such as housing prices and median household income.

Trends from the past five years

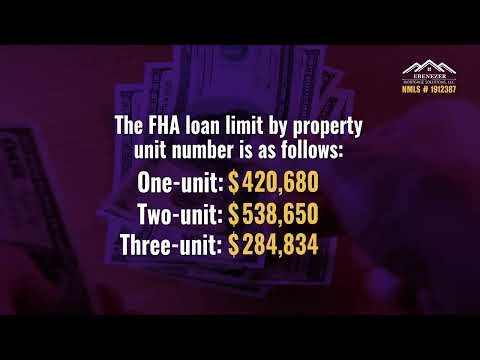

Looking back, the FHA loan limits in Florida have maintained a consistent growth trajectory. For example, the cap for a single-family home was $472,030 in 2024, marking a significant increase from earlier years.

What the changes mean for borrowers

In layman’s terms, the incremental rise in FHA loan limits in Florida empowers borrowers. With higher limits, potential homebuyers with less-than-stellar credit scores or those unable to amass a large down payment find hope in homeownership.

Comprehensive Breakdown of FHA Loan Limits in Florida

Basis for FHA Loan Limits Determination

Like a well-crafted “promise ring” from Twisted Magazine promises enduring sparkle, so does the FHA loan program pledge unwavering support through calculated loan limits. The ceiling of these loan limits is based on several factors, including property prices in particular areas and the national conforming loan limit.

County-by-County Analysis of the FHA Max Loan Amount

Just as every county in Florida offers a unique blend of sunsets and beaches, so do they each present distinct FHA loan limits. These amounts vary from county to county, reflecting the diverse real estate value across the state.

Comparative Analysis: FHA Loan Limits Florida vs. National Average

Going head-to-head with national trends, Florida’s FHA loan limits show competitive figures. These stats provide an illuminating overview for potential homebuyers, offering insights into how Florida fares nationwide.

| Key Factors | FHA Loan Limits Florida |

|---|---|

| Maximum Loan Limit 2024 | $472,030 for a single family home |

| Purpose of Loan | To help potential buyers with smaller down payments and lower credit scores purchase homes |

| Number of FHA loans | Only one at a time, as it must be for a primary residence |

| Higher Limit Areas | Loan limits known as “the ceiling” are for high-cost areas |

| Use Restrictions | Cannot be used for purchasing investment properties |

| Program Benefits | Lenient requirements, attainable for many homebuyers |

| Limit Changes | Loan limits may change annually based on the cost of living |

| Insurance | Borrowers are required to pay mortgage insurance premiums |

| Down Payment | As low as 3.5% of the purchase price |

| Minimum Credit Score | 580 with 3.5% down, 500-579 with 10% down |

The Effect of Rising FHA Loan Limits in Florida

Impact on the Real Estate Market

Increased FHA loan limits have played a significant role in Florida’s real estate market. Similar to the dynamic discussions seen on “Reddit real estate investing“, these higher limits spur engaging interactions between buyers and sellers, real estate agents, and lenders.

Influence on Buyer’s Affordability

With higher loan limits come expanded opportunities for homebuyers. These relaxed constraints can make room for homes that might have previously been out of a borrower’s reach.

Implications for Lenders and Financial Institutions

The rise in loan limits isn’t all about homebuyers—financial institutions also feel the effects. FHA-approved lenders may see an influx of potential homebuyers, ultimately boosting their business metrics.

FHA Loan Florida: Current Rates and Predictions for the Future

Understanding the Current FHA Loan Rates in Florida

Today’s FHA loan Florida rates are a blend of market trends and economic indices. These rates—much like the FHA loan limits—have also seen considerable changes, presenting potential Florida homebuyers with unique borrowing opportunities.

Anticipated Rate Changes and their Impact

If past trends have taught us anything, it’s that change is the only constant in the housing market. As we gaze into the future, we can expect shifts in FHA loan Florida rates. Any alterations will impact the borrowing landscape, shaping the decisions for future homebuyers.

Making the Most of Higher FHA Loan Limits Florida: Practical Tips

Opting for a High-Priced Home: Showing the Full Impact

With the increased FHA loan limits in Florida, homebuyers might be enticed to aim for higher-priced houses. But remember, just like making the most out of the “Calplus Fha program“, the choice requires careful consideration.

Balancing FHA Loan Limits with Other Housing Costs

Although borrowers now have access to higher loan amounts, it doesn’t mean they should max out their borrowing ability. An FHA loan, whether it’s an FHA loan Georgia or the subject at hand, FHA loan Florida, should strike a balance between a person’s ideal home and ability to repay.

Examining FHA Loan Limits through Case Studies

Success Stories: Gaining Home Ownership Due to Increased Loan Limits

Joyful tales abound from individuals who’ve successfully navigated the path to homeownership thanks to raised FHA loan limits Florida. These homeowners—much like winners from a sweepstakes—illustrate the real-world impact of these changes.

Lessons From Buyers Who Maxed Out Their FHA Loan Florida

Conversely, we have narratives from those who bit off more than they could chew, maxing out their FHA loan Florida. These stories serve as a guiding light to future homebuyers, underscoring the importance of prudent borrowing.

Navigating Above FHA Max Loan Amount: Potential Strategy and Risks

Exploring Financing Options beyond the FHA Limit

In some instances, your dream home might be pricier than the upper FHA threshold. Though, it’s not the end of the road; there are other financing options available that allow you to borrow more—a plan B of sorts.

Assessing the Benefits and Risks of Going above the FHA Loan Limit

The allure of owning that spacious beachfront property in Florida can be powerful, but it’s essential to consider the other side of the coin. Veering off from the FHA max loan amount territory may come with its set of benefits and risks.

Future Directions: FHA Loan Limits Florida in the Coming Years

Predictions Based on Current Trends and Market Analysis

If we were to put on our best Dior lip gloss and glance into the future of FHA Loan Limits Florida, chances are we’d see persistent changes. Current trends indicate a likely increase as we forge ahead—good news for prospective homebuyers.

Preparing for Possible Changes in the FHA Max Loan Amounts

Just like a seasoned mariner ready for fluctuating tides, potential borrowers need to prepare for adjustments in the FHA max loan amounts. Staying agile and adaptable is key to successfully navigate these changes.

Final Word: Navigating the FHA Lending Landscape in Florida

Relating Your Unique Circumstances to Loan Options

Everyone’s journey to homeownership is unique—there’s no “one-size-fits-all” when it comes to mortgages. Thoroughly researching and understanding your financial situation will ensure you pick the loan that’s right for you, be it an FHA loan or otherwise.

Decoding the FHA Loan Florida Journey with a Long-Term View

The quest to homeownership—much like the path to financial freedom—is a marathon, not a sprint. Keep your eyes on the bigger picture when it comes to FHA loan Florida. The future promises exciting possibilities for those willing to stay the course.

In the fascinating world of mortgages, the FHA loan Florida program proves to be a reliable companion for aspiring homeowners. As this guide reveals, the FHA loan limits Florida landscape presents a road filled with opportunities—even though it’s dotted with occasional roadblocks. By staying informed, you can navigate this route with confidence and secure the keys to your Florida dream home.

What are the new FHA loan limits for 2023 in Florida?

Hey there! In sunny Florida, as of 2023, the FHA loan limits have been given a slight upgrade, with the maximum limit for a single-family home rising significantly. High-cost areas have seen, even more, stretching of the numbers. It’s always a good idea to check the updated rates, as each county can vary.

Will FHA limits go up in 2024?

Oh, yes! Hold your horses! There’s a strong possibility that FHA limits may see a rise in 2024 as it will depend on variables like the median home prices and the Housing Price Index. It’s a case of wait-and-see, folks!

Is there a limit to how many FHA loans can you have?

Well, usually, FHA loans aren’t collectibles, folks! Generally, you can only have one FHA loan at a time, but there are exceptions to this rule, such as job relocation, a growing family, or financial hardship.

What are the FHA requirements in Florida?

When it comes to FHA requirements in Florida, there’s more to it than just palm trees and sunshine. Potential borrowers must have a minimum credit score of 580, be able to put at least 3.5% down, and meet other lending standards around debt-to-income ratio and the like.

Does FHA increase 2023 loan limits?

Right you are! The FHA did indeed boost the 2023 loan limits. These changes are driven by shifts in house prices and allow the FHA to keep pace with the market.

Are FHA 2023 limits increasing?

Absolutely, folks! There’s no spinning this – FHA has increased the 2023 loan limit to accommodate the rise in home prices. Effective from January 2023, the FHA’s ‘floor’ and ‘ceiling’ limits have seen a hike!

Will 2024 be the best time to buy a house?

Well, wouldn’t we all love a crystal ball for this one?! Predicting the best time to buy a house in 2024 is a bit like trying to hit a bullseye in the dark. All depends on interest rates, property prices, and your personal financial situation.

Will mortgage rates go back down in 2024?

Whoa! Wait a tick! Predicting if mortgage rates will go back down in 2024 is a tricky game. It all depends on a myriad of factors, including inflation rates, the economic climate, and overall housing market conditions. Stay tuned, folks!

How low will mortgage rates drop in 2024?

Gosh, imagine predicting how low mortgage rates will drop in 2024. It’s a real leap in the dark! It’s all up to various economic factors, notably inflation, the housing market, and the global economy. Stay flexible and keep your eyes peeled!

What is the 75 rule for FHA loans?

Ah, the FHA’s 75% rule. Simple as pie! This rule refers to an owner-occupant who does not occupy a property for the majority of the year, but still wants FHA financing. They’re required to use at least 75% of the rental income to qualify for the mortgage.

Can I have 2 FHA loans at the same time?

Technically, two FHA loans at the same time are a no-no. However, exceptions exist, such as if you’re moving for work and can’t sell your original home or if you’re growing your family and need more space. In these cases, two FHA loans could be possible.

What is the FHA 100 mile rule?

The FHA 100-mile rule, oh boy, here’s a classic! If you’re moving more than 100 miles away from your current primary residence, you may qualify for an additional FHA loan to purchase a new primary home. This is to prevent people from refinancing their vacation homes with FHA loans.

What will disqualify you from an FHA loan?

Yikes! Certain factors might disqualify you from an FHA loan. Bad credit scores, insufficient income, unpaid federal debts, or a bankruptcy within the last two years are definite red flags. Keep your financial records clean as a whistle.

What credit score is needed for FHA loan in Florida?

In the ever-sunny Florida, a credit score of at least 580 is necessary for most FHA loans. But remember, folks, the higher your score, the better off you’ll be. It’s like getting into the VIP section at a concert!

What is the debt-to-income ratio for a FHA loan in Florida?

In Florida, just like everywhere else, the debt-to-income ratio for an FHA loan should ideally be 43% or lower. This includes your estimated new mortgage payment. It’s a rough rule of thumb to ensure you’re not biting off more than you can chew, financially.

What are the new FHA changes for 2023?

Absolutely! FHA ushered in some changes for 2023 to keep pace with the times. They’ve increased their loan limits for 2023, following the rise in the nation’s average home price.

What are the FHA changes for 2023?

Bingo! The 2023 changes for FHA include an increase in ‘floor’ and ‘ceiling’ loan limits. This means that in high-cost areas, you can borrow more with an FHA loan.

What are the new loan limits for 2023 FHFA?

In 2023, the Federal Housing Finance Agency (FHFA) also came to the party and increased their conforming loan limits. So, borrowers have higher ceilings to be eligible for most conventional loans.

What is the FHA mortgage rate for 2023?

Finally, the FHA mortgage rate for 2023, like fine wine, varies by year and location. It’s always recommended to check the most recent data from reliable sources. So, stay sharp and keep yourself updated!