A Deep Dive into Current 30 Year Fixed Mortgage Rates in california

When we gaze upon the sprawling landscapes and cities of California, the dream of homeownership flickers like the starlight in the Pacific sky. The Golden State, known as the california capital, presents a dynamic real estate canvas, where the stroke of a 30-year fixed mortgage rate paints one’s future among its vast terrains. A 30-year fixed mortgage provides the stability in payments that most homeowners crave amidst the economic tides, making it a crucial focus for buyers and refinancers alike. What is Current 30 Year Fixed Mortgage Rates California?

Historically, the trends of 30 year fixed mortgage rates California have been as unpredictable as the state’s notorious fault lines. Just as we anchor our homes against the shake and tremble of the earth, understanding these trends offers stability in our financial planning. Over the past decade, rates have soared and dipped like the roller coasters at Santa Monica Pier, amplified by national economic shifts and local market demands.

Reflecting on our past through the lens of 5 years ago, today’s rates may seem daunting, but historical context offers a canvas of understanding. As the brushstrokes of the past shape our present perspective, let’s delve into the colorful palette of today’s mortgage marketplace.

Comparing 15 Year and 30 Year Fixed Mortgage Rates in California

It’s a crossroads many face: the allure of a 15-year mortgage with its siren’s call of lower interest rates versus the steady hum of the 30-year’s manageable payments. Both paths lead to the promised land of homeownership, but the journey differs. Here’s where the road splits:

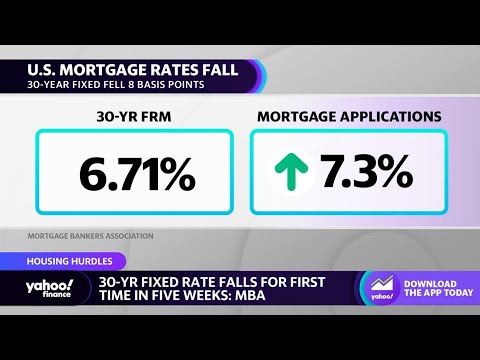

To snag a snapshot of these rates, take a look today: current mortgage rates california 30-year fixed sit at 7.359%, and 15 year fixed mortgage rates california beckon at 6.512%.

| Mortgage Term | Current Rate (As of May 2, 2022) | Trend Projection for 2023 |

|---|---|---|

| 30-Year Fixed | 7.359% | Expected to decrease |

| 15-Year Fixed | 6.512% | Expected to decrease |

| 5-Year ARM | 8.029% | Expected to decrease |

The Current State of 30 Year Fixed Mortgage Rates Today in California

The tapestry of 30 year fixed mortgage rates today California is ever-evolving, with warp and weft influenced by the whims of the economy. Lately, rates have been climbing, making borrowers tighten their belts.

Economic factors are swinging the pendulum—one day it’s the Federal Reserve’s move, the next, it’s employment stats that are shaking things up. To grasp the full picture, we’ve sought out industry pros, picking their brains about this ever-changing mosaic. Their collective advice? Keep a keen eye on the horizon and ride the waves of change with thoughtful, informed strategies.

The Long-Term Look: 50 Year Mortgages in California

Picture this: a mortgage stretching half a century. In California, the concept of a 50 year mortgage california is more than a fantastical mirage. It’s an option for those seeking to stretch their payments across a longer horizon, reducing monthly dues—but often with greater interest costs over the loan’s life.

This option might sound alluring, but the decision shouldn’t be taken lightly. When we put the 50-year term on the scales against the current 30 year fixed mortgage rates california, we see both weighty pros and stern cons. It’s pivotal to speculate not only on the monthly obligation but also on the overall financial commitment you’ll be signing up for.

Understanding Current 30 Year Mortgage Rates Across California

California, like a quilt, is stitched together with diverse locales, each with its own flavor of 30 year fixed mortgage rate california. What does this mean for homebuyers?

- The 30 year mortgage rates california in tech-savvy San Francisco might have you reaching for a Silicon Valley-sized wallet, while the rates in sunny San Diego could offer a more tempered approach.

When you’re scouting the landscape for the best mortgage rates california 30 year fixed, remember the local economy, housing demand, and even regional policies can shift the sands beneath your feet.

Current 30 Year Fixed Mortgage Rates California

The Impact of National Trends on California’s 30 Year Fixed Mortgage Rates

It’s no secret that national currents tug at California’s mortgage rates, which often sway to the rhythm of broader economic indicators. The dance between them is choreographed closely, with the Federal Reserve often leading the pas de deux.

Recently, researchers have forewarned that the 30-year rates will march downwards through 2023 and 2024, giving a nod to directional trends. But as national and state trends tango, one must wonder: will california 30 year fixed mortgage rates follow the national choreography, or freestyle to their own beat?

Unpacking the Nitty-Gritty of Current Mortgage Rates 30 Year Fixed in California

When dissecting current mortgage rates 30 year fixed california, there’s more than just the headline rate to consider.

You also need to ponder the long-term impact—an amortization schedule that spells out how much of your payment goes to paying down the principal versus interest. It’s a revealing read, like peering behind the curtain to see how the magic happens. And for those pondering a refi, current rates may sway your decision to dive into new financial waters.

Prospective Buyers’ Guide: Locking in the Best 30 Year Fixed Mortgage Rates in California

To lock in the best 30 year fixed mortgage rates california is like finding the holy grail—

it takes strategy, patience, and a bit of financial savvy. Your credit score, for instance, is a beacon guiding lenders to offer you competitive rates. The down payment you lay down acts as a testament to your commitment—a larger down signals serious business and can snag you a better rate.

Scouring for advice, mortgage brokers and financial pros line the path—they’ve seen the jungle of rates and emerged with insights to share. It’s a move straight out of the smart homebuyer’s playbook.

Navigating the Starter Home Market: How Much Does a Starter Cost with Today’s Rates?

Considering homeownership for the first time can feel like gazing through a telescope at an unfamiliar constellation. In California, the starter home market is as varied as its coastline. The stakes? Understanding how much does a starter cost with the burden—or boon—of today’s rates.

Current 30 year fixed mortgage rates california heavily influence the overall affordability of your home sweet starter. Accounts from first-time buyers reveal a terrain that’s often challenging yet rewarding, illustrating the financial odyssey of climbing that first rung on the property ladder.

Prospects for Homebuyers: What Lies Ahead for 30 Year Fixed Mortgage Rates?

Consulting the oracles of finance, we seek prophecies about the road ahead for california 30 year mortgage rates.

Speculation is rife, with seers predicting the possible ebbing of rates in the coming seasons. Yet, investors and economists alike muse over the regulatory winds that might fan or quench these movements.

One could ponder endlessly: are today’s rates a fleeting dip, a trough from which we’ll ascend, or are we glimpsing at the new plateau of norm? Only time will tell; borrowers need to hover thoughtfully over their crystal balls.

Setting Sail: Preparing for Your California Homeownership Journey

As we survey the landscape of the California housing market and stomach the current state of mortgage rates, remember this—knowledge is the firmest plank in the bridge to homeownership.

Approach the market with the heart of a lion and the diligence of a scholar. Remember, the dream of homeownership, under the glow of the Californian sun, is worth the voyage. And with well-charted plans, may the wind be ever in your sails.

Ready to grasp the helm of your future home? One’s destiny in homeownership beckons beyond the distant shore—and with our insights at your side, may you steer true towards your Californian dream.

What is the interest rate today for a 30 year fixed mortgage in California?

Ah, the golden question: what’s the going rate for a 30-year fixed mortgage in sunny California today? You might wanna sit down for this – it’s a bit of a rollercoaster these days. To get the latest digits, you’ll really need to check with local lenders or finance websites ’cause they change faster than a chameleon on a rainbow!

Will mortgage rates go down 2023?

Will mortgage rates do us a favor and take a nosedive in 2023? Cross your fingers, but don’t hold your breath. Predicting rates is tricky – kinda like trying to catch a greased pig. Most experts can only guess, and with the economy being as wobbly as a newborn calf, it’s best to keep a weather eye on the horizon and check with financial pundits for the latest forecasts.

What is the current percentage rate on a 30 year fixed mortgage?

If you’re on the hunt for the current rate of a 30-year fixed mortgage, you’re not alone. It’s like the daily special – everyone wants to know but it can vary by the day or week. Your best bet is to pop into your lender’s website or give ’em a ring, ’cause they’ll have the freshest rates hot off the press.

What is the conforming 30 year fixed rate today?

Today’s conforming 30-year fixed rate? Now that’s something with more moving parts than a Swiss watch. This little number tends to follow the ebb and flow of the market, so it’s best to get the scoop straight from the horse’s mouth – check with lenders for the most up-to-date info.

Which lender has lowest mortgage rates?

Which lender is the belle of the ball with the lowest mortgage rates? Well, ain’t that the million-dollar question! It’s a neck-and-neck race and changes quicker than a hiccup. Shopping around is your best play – compare a few contenders before you put your money down.

Will home interest rates go down?

Will home interest rates take a breather and head south? If only we had a crystal ball! With economic twists and turns, it’s anyone’s guess. Rates could chill out or stay on the edge of their seat – so stay tuned to financial forecasts for any hints.

Will mortgage rates go back down in 2024?

Forecasting mortgage rates for 2024 is like trying to nail jelly to the wall – it’s darn near impossible! But, rest assured, plenty of sharp folks with calculators are keeping an eagle eye out. Don’t bet the farm on predictions, though – it’s always a bit of a gamble.

How high could mortgage rates go in 2023?

How high could mortgage rates soar in 2023? Get ready for a wild ride! With all the economic shenanigans going on, rates could spike higher than a volleyball at the beach. But hang tight, and keep an eye on financial news for the latest ups and downs.

Are mortgage rates going down in 2024?

Mortgage rates in 2024 – going down, you ask? Well, would you look into the future if you could? Sadly, our crystal balls are a bit cloudy, but don’t throw in the towel just yet. Keep tabs on the market and you might just catch a break!

What is the lowest 30 year mortgage rate ever recorded?

The lowest 30-year mortgage rate ever recorded – now that’s a tale for the grandkids! Believe it or not, there was this one time rates dipped lower than a limbo stick at a beach party. Historical records note rates hitting rock-bottom during 2020’s wild ride, bottoming out in the twos.

What is the best mortgage option right now?

What’s the crème de la crème of mortgage options right now? Ah, it’s like picking the ripest peach; it all depends on your personal financial buffet. Fixed-rate, adjustable-rate, interest-only – they’ve each got their flavors. Sift through the choices and pick the one that best suits your wallet’s appetite.

How to get the lowest mortgage rate?

To snag the lowest mortgage rate, you’ve gotta be smoother than a used car salesman. Polish that credit score until it shines, weigh your options like a pro, and don’t be shy to bargain-hunt. Sometimes, it pays to be as chatty as a parrot with lenders so you can scope out the best deals.

What is the interest rate today in California?

Interest rates today in California? They’re as unpredictable as the weather in San Francisco. Rates can be as local as your neighborhood diner’s specials, so for the most accurate numbers, you’ve gotta check with Cali lenders – they’ve got the skinny.

Can you refinance a 30 year fixed mortgage?

Refinancing a 30-year fixed mortgage – can you do it? Absolutely, and sometimes it’s as smart as bringing an umbrella in a rainstorm. Keep your eyes peeled for when rates dip and hop on the opportunity like a surfer on a gnarly wave.

What is prime rate today?

Prime rate today – what’s the word on the street? The prime rate is like the head honcho when it comes to loans. It’s the benchmark most banks use, and it wiggles more than a dancing noodle. For the latest number, you’re gonna want to check with the big bank websites or finance news. They’ll tell you what’s up, no crystal ball needed!