The Realities of the Cost of a Will in 2024: An Indepth Review

The Burgeoning Demand for Wills: Driving Up Costs?

“There’s no place like home,” as the famous line from The Wizard of Oz goes. And, indeed, there’s no place like your very own piece of property. This sentiment leads to a rather sobering reality: estate planning is vital for anyone who values their hard-earned assets. At the heart of estate planning lies the will, a key document that dictates what happens to your property after you shuffle off this mortal coil.

Recent years have ushered in an increased demand for wills. In response to a certain pandemic that shall remain unnamed, plenty of people scampered to get their estate plans in order. This reaction raises the important question: Is this demand spike driving up the cost of a will?

There’s no straight answer here. Granted, increased demand often leads to higher prices, but will-granting services have become more accessible and, in some cases, affordable. However, the “cost of a will” is a complex, multi-faceted topic that goes beyond supply-demand dynamics.

Determining Factors: Understanding the Average Cost of a Simple Will

Factor 1: Nature and Complexity of Assets

Do you remember that crazy “Clima de hoy” when all our investments suddenly seemed risky? The nature of your assets can also whip up a similar storm when you’re trying to navigate through the costs related to creating a will.

Sure, many folks might live in a humble abode or possess a bare-bones bank account. However, others might have a sprawling estate, multiple investment properties, large stock portfolios, or a part-ownership in a thriving Paia fish market. The complexity and nature of these assets can send the cost of a will spiraling upwards.

Comparatively, the average cost of a simple will, where assets are not overly diversified or valued in the multi-millions, can range from around $300 at the lower end. But remember, prices can vary more than the stock market in a tumultuous month. In Texas, for instance, you could wind up paying anywhere between $250 and $2,500+!

Factor 2: Professional Fees

Another cost influencer is attorneys’ fees. As with any professional service, you get what you pay for. More experienced attorneys tend to charge more, but they also provide in-depth knowledge on managing high-value or complex assets. These pros usually charge flat fees for simple wills, with rates often in the ballpark of $300. However, if we’re talking larger, more intricate estates, you’ll need to brace for costs of around $1,000 or more!

Factor 3: Geographic Location

Just as real estate prices swing wildly from one location to the next, so too does the cost of will creation. Factors such as state laws, cost of living, lawyer density, and other region-specific variables can impact the cost. For example, in bustling cities with skyrocketing rent, legal fees are likely to follow suit.

Factor 4: Updates and Maintenance

No, we’re not talking about house repairs here. Maintaining your will is just as important. Changes in your financial circumstances, family composition, or even laws surrounding estates can necessitate updating your will. These updates come with costs, too, often requiring a lawyer’s help.

But before you balk at these expenses, consider the alternative: Your will becomes outdated, leading to potential legal battles among your survivors or misallocation of your assets. So, in this regard, frequent updates can be viewed as an insurance policy against future upsets—and that’s an insurance policy worth having.

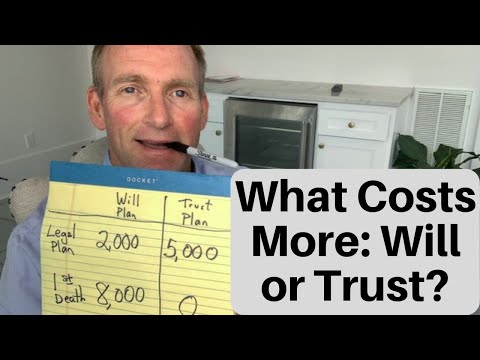

Factor 5: Extra Components

Just when you thought you had it all figured out, another cost lurks around the corner: ancillary services. We’re talking about stuff like setting up trusts or seeking tax advice. A comprehensive will often includes these additional components, which aren’t included in the typical “base fee.”

The cost Of setting up a trust, for instance, can run into hundreds or even thousands. But again, this shouldn’t necessarily deter you. These additional services provide added protection and benefits that a “simple will” might not offer.

| Type of Will | Cost Range | Features | Benefit |

|---|---|---|---|

| Simple Will | $250 – $2,500+ in Texas | Specifies how your estate should be distributed after your death. | Can create a straightforward distribution plan for your estate. |

| Testamentary Trust Will | $300 – $1,000+ | Establishes one or more trusts to be created after your death. | Can provide for minors, adult children, or others who need help managing their funds. |

| Joint Will | Varies with complexity | A single document created by two people, usually spouses, that leave their estate to each other. | Provides simplicity for couples as it’s one document for two people. |

| Living Will | Cost similar to a Simple Will | Allows you to express your wishes for end-of-life medical care. | Gives you control over your medical care if you become incapacitated. |

| DIY Will | Low to no cost | You write out your wishes yourself, could include estate distribution plans. | Risks incompleteness and inaccuracies since it doesn’t involve a legal professional. |

Unpacking Costs: How Much Does It Cost to Make a Will?

The price tags highlighted above should give you a ballpark of what to expect. But remember, the real cost often comes with surprises. Unforeseen complexities might arise, requiring extra legal time and therefore extra legal fees. For instance, if there’s a business to distribute or a need for guardianship provisions, things can get tricky.

Also remember that although your first flat fee might cover the creation of your will, subsequent changes will usually incur extra costs.

Seeking Value in Estate Planning: How much will your peace of mind cost?

Creating a will is about more than just expenses; it’s about value. Substitute your “cost of a will” thinking cap for a “value of a will” one. After all, a well-planned will offers reassurance—knowing that your hard-earned assets will be directed according to your desires.

Grasping the relationship between costs and benefits gained through creating a will is key; it’s not about price tags, but about securing a well-organized future for your loved ones.

Expanding Horizons: Emerging Alternatives to Traditional Will Creation that Could Affect Your Pocket

As with many sectors in today’s digital world, will creation isn’t immune to technology’s touch. DIY will kits and online services are progressively becoming more popular. These alternatives are often more affordable than traditional attorney-drafted wills.

But these nifty, cost-effective alternatives aren’t foolproof. DIY estate planning can be fraught with risk. Ensure you understand the potential saving opportunities and risks associated with them. It’s advised to consult with an attorney to avoid any legal requirements oversights, which could jeopardize your will’s validity.

Personalizing Your Approach: Factors to Consider when Assessing the Cost of your Own Will

Your lifestyle, assets, location, family situation, and many other variables come into play. Weighing these factors and how they apply to you specifically will give you a more accurate estimation of what the cost of your will could be.

Investing in Certainty: The Impact of Will Costs on Your Legacy

Look at the cost of a will as an investment—an investment in your legacy’s certainty. It’s about ensuring the fruits of your life’s labor go to the right hands and securing your family’s future. In other words, consider the cost of a will as having a share in your family’s peace of mind pie.

Decoding the Will-creation Paradox: Balancing Costs and Benefits

By now, you should see how essential careful cost consideration is, where various factors influence the overall price tag of a will. Always remember, a will is not just about cost but also about value. As Robert Kiyosaki wisely said, “It’s not how much money you make, but how much you keep, how hard it works for you, and how many generations you keep it for.” As such, your final takeaway should be to strike a balance between costs and the benefits of will creation.

So, rather than jumping headfirst into drafting your will, take time to understand how much your peace of mind is worth. Considering the cost of a will, then, becomes not just a financial choice, but an investment in your legacy.

What is the cost of the average will?

Wowza! The cost of an average will can certainly vary. Typically, it’s about $200 to $1,000 if drafted by an attorney, while DIY kits are cheaper, around $30 to $70. The golden rule? You get what you pay for!

What does a simple will in Texas cost?

Giddy up, Texans! For a simple will in the Lone Star State, you’re looking at between $300 and $1,000. It’s a tad pricier than a DIY option, but hiring a pro keeps things above board and hassle-free.

Do you need a lawyer to make a will in Texas?

Do you need an attorney to make a will in Texas? Nope, not necessarily. But remember, DIY can be a dicey route without any legal guidance. Weigh your options carefully.

What are the four basic types of wills?

Let’s break it down. The four basic types of wills are: simple, testamentary trust, joint wills, and living wills. Each serves a unique purpose, so it’s worth getting your head around what’s what to pick the best one.

How much do most lawyers charge for a will?

The majority of attorneys will charge between $200 to $600 for a basic will. It’s quite a range, but keep in mind the complex juggling act that is estate law. Pricey, yes, but peace of mind is priceless!

What is the difference between a will and a trust?

A will and a trust — same deal, right? Eh, not so fast. A will outlines your wishes regarding your assets after you kick the bucket, while a trust ensures your assets are managed by a designated person if you’re unable to do so. Apples and oranges, my friend.

How much does an attorney charge for a will in Texas?

In Texas, an attorney typically charges between $300 and $1,000 for a will. Yeah, it’s an investment, but well worth avoiding any unwelcome surprises down the line.

What is the difference between a will and a simple will?

A will and a simple will — easy to mix ’em up! Both outline asset distribution after death, but a simple will is just that — simple, with fewer assets and beneficiaries involved.

What is the difference between a simple will and a regular will?

What’s the diff between a simple will and a regular will? The simple version is ideal for smaller estates and less complicated situations, while a regular will suits larger, more complex estates.

What happens to bank account when someone dies without a will in Texas?

In Texas, if someone passes without a will, bank accounts and other assets are divided under Texas’ “intestacy” laws. In other words, things might get tricky without clear instructions left behind.

Who inherits without a will in Texas?

Without a will in Texas, children and spouses usually inherit the deceased person’s property. However, without these immediate family members, assets could go to more distant relatives.

Do wills have to be filed with the court in Texas?

In the Lone Star State, wills don’t need to be filed with the court until after death. However, safekeeping is vital — the last thing anyone wants is a missing will in a time of sorrow.

What is the golden rule when making a will?

The golden rule when making a will? Be clear and specific. You don’t want any confusion left in the wake of your passing. Additionally, updating it regularly can be a smart move due to life’s many twists and turns.

What is more powerful than a will?

What’s more powerful than a will? A living trust. A trust takes effect the moment it’s created and can cover a wider scope of scenarios. Pretty powerful, huh?

What type of lawyer is best for wills?

The type of lawyer best for wills? An estate planning or probate lawyer. They know the ins and outs of this tricky terrain — let’s leave it to the experts, shall we?

How do I make a will in Florida for free?

To create a will for free in Florida, consider online resources. Plenty of legal websites offer free templates, but proceed with caution. It’s a crucial document and deserves careful attention.

What is the average cost of a trust in Florida?

Sunshine State residents, listen up! The average cost of a trust in Florida ranges from $1,000 to $3,000. A steep price, but it’s a small price to pay for the peace of mind it can provide.

How much does a will cost in NY?

In New York, drafting a will can cost anywhere from $500 to $2,000. A pretty penny, but hey, estate planning in the Big Apple is serious business!

How much does it cost to make a will in Florida?

Making a will in the Sunshine State? It might set you back between $200 and $1,000, depending on its complexity. It’s an investment in your peace of mind — and that’s worth its weight in gold!