Navigating the journey of securing a mortgage can often feel like sailing through uncharted financial waters. As you chart your course towards homeownership, understanding the significance of the closing date is akin to having a reliable compass onboard. It’s not just any average entry in your planner – the closing date is a crucial marker that defines the horizon of your property-purchasing voyage.

![Curren$y - Closing Date [OFFICIAL VIDEO]](https://www.mortgagerater.com/wp-content/cache/flying-press/r4dVB74_5dk-hqdefault.jpg)

Understanding the Role of the Closing Date in Your Mortgage Journey

On this journey, our closing date is the beacon towards which all our efforts are aimed. Simply put, the closing date represents the day when the drama of offers and counteroffers finally comes to an end – you finalize the transaction, and if all has been navigated properly, ownership transfers from the seller to you, the buyer.

Now, let’s set sail through the timeline typically accompanying this process. From finding the right life jacket – that is, pre-approval – to disembarking at your new property, the process can span anywhere from a month to several, each stage ticking towards that all-important date. Think of it as a meticulous reel of Daniel Day-Lewis movies; each scene (or step in the mortgage process) carries immense weight and gravitas, culminating in a dramatic finale.

Legally binding and more binding than an old family recipe, failing to honor the closing date can mean more than just ruffled feathers – it can have serious implications. In worst-case scenarios, it might even make you nostalgic for the type of drama you’d find in “The Addams family values“.

How the Closing Date Affects Each Stage of the Mortgage Process

When we kick off the mortgage marathon, we’re in the pre-approval and loan shopping stage, akin to stretching before a run. Then comes the moment of offer and acceptance: like claiming a curling wand from a coveted list, you establish a closing date in the purchase agreement.

Next, we sprint to the loan application – precise deadlines and time constraints play a lead role here, much like Kevin Doyle in his prime.

The closing date is the pace-setter, influencing not just the heartbeat of the underwriting process but even the billing cycle of your new home. Under its pressure, the appraisal and inspection windows tighten, and traversing through the mortgage underwriting process feels like a race against time. Only when we’re fast approaching the finish line, do we receive the illustrious ‘clearance to close’.

| Factor | Description |

|---|---|

| Definition | The closing date is the day the sale of a property or business is finalized, where transfer of ownership occurs from seller to buyer. |

| Importance in Real Estate | Crucial as it signifies the transfer of property ownership and the fulfillment of contractual obligations by both parties. |

| Importance in Mergers and Acquisitions | Marks the completion of the transaction, where buyers may take control of a company potentially with retroactive effect to a previously agreed upon date. |

| Financing Impact | Sales can fall through if buyers fail to secure financing or sell current property in time to fund the purchase. |

| Process | Buyers typically secure a mortgage or arrange cash payment, sellers prepare to transfer ownership, and both parties fulfill contractual obligations. |

| Setting a Closing Date (Real Estate) | A closing date is set after interest is shown in a property, offering a timeframe for all written offers to be submitted to the seller’s solicitor. |

| Timeline after Purchase Agreement | Usually spans several weeks post-agreement execution, allowing time for financing and preparation for ownership transfer. |

| Economic Transfer Date | In company acquisitions, ownership transfer can occur on the actual closing date or with retroactive effect to a past date. |

Timing the Market: The Closing Date’s Impact on Interest Rates

Ah, interest rates – the capricious tides of the mortgage sea. Those rates ebb and flow and can shape your financial future like the coast. The chase? To lock them down at their lowest during a lock-in period, harmonized with the closing date rhythm.

Imagine trying to catch a Soho House miami lounge during high season – you strategize when to book to score the best rates. Similarly, you maneuver to anchor your closing date at a time when the rates are fair and the financial skies are clear.

Negotiating the Closing Date: Flexibility and Constraints

From a buyer’s peaceful bungalow to a seller’s stately mansion, perspectives on setting the closing date vary as widely as real estate properties. The flexibility of this date is like a dance, taking two: buyer and seller. Potential complications can turn the dance into a duel, wherein external rhythms – market conditions, demand – set the tune.

You need to tango through a choreography that might include buyers unable to secure a loan in time or sellers nostalgic for one last sunset from the porch – both can tug the closing date in opposite directions.

Costs Associated with the Closing Date

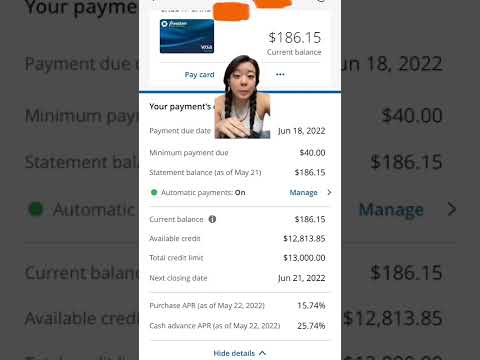

Let’s lay out the coins on the table. Closing costs include several fees, and your chosen closing date can sway the costs like a pendulum. Closing earlier or later in the month can reflect significantly on daily interest charges and prorated taxes.

Here’s where you haggle like you’re bargaining for a prized antique. By selecting a closing date with foresight, you can pinch pennies, turning closing costs from monstrous to moreish.

The Closing Date and Your Moving Timeline

Imagine you’re conducting an orchestra, the closing date is the grand finale, and your move is the symphony leading up to it. Logistics and coordination are your instruments, and your goal is to ensure every section – from the string section of packing to the timpani of transportation – plays in harmony leading up to the closing date credit card swipe that seals the deal.

As you plan, juggle the considerations so that your move-in schedule doesn’t hit a false note. A smoother transition relies on the precision of your planning, much like the planning behind the perfect cup of Ka’Chava for your breakfast on the move-in day.

Unexpected Delays and Extending the Closing Date

But what if there’s a squall on the horizon? Delays can happen: an unexpected repair, a flickering credit issue, perhaps a gust of legal queries. Like seeking safe harbor, extending the closing date might be the wise choice, although it can bring about potential penalties – think of it as paying for extra docking time.

An extended closing can act like an uncertainty vortex – sucking in buyer, seller, and lenders alike into a realm of renegotiations and readjustments.

Leveraging the Closing Date to Your Advantage

With the right maneuvering, the closing date can be your golden compass. It can guide you into harbors of better terms and give you that psychological ease of a clear target. Play it right, and it’s not just a date—it’s a powerful tool in your mortgage arsenal.

Crafting a Winning Strategy Around Your Closing Date

To steer clear of treacherous waters and map out the most strategic course, employ the tools at your disposal – calculators, expert advice, and yes, even those mariner’s old tales that are case studies and real-life scenarios.

Remember, like any seasoned sailor, it’s not just about the destination; it’s also about planning the voyage so that when the closing date comes into view, you’re ready to dock triumphantly.

A Future-Ready Approach to Closing Dates in the Mortgage Industry

Let’s glimpse over the horizon. The mortgage industry, much like every ship at sea, is being outfitted with the latest tech. The significance and orchestration around closing dates are set for change, streamlined by digital advancements.

Predicting the weather isn’t just for sailors anymore. We foresee closing date considerations undergoing a transformation in the coming years, evolving into simpler, more efficient affairs.

With the finishing line in view and keys almost in hand, understanding how the closing date impacts the mortgage process is essential. As we’ve navigated through its significance and the strategies to handle it effectively, it becomes clear that a well-chosen closing date is not just a day on the calendar—it’s a culmination of careful planning, negotiation, and foresight. By masterfully coordinating your mortgage journey around this pivotal moment, you unlock the door to not just a new home but a financial decision that is timed to perfection. Here’s to closing the deal with confidence and the wisdom to know that while dates may come and go, your savvy choices echo throughout the life of your loan.

Closing Date: The Final Countdown in Your Mortgage Journey

You know how every epic tale has that grand finale? Well, in the saga of home-buying, the closing date is the showstopper, the drumroll moment where everything comes together, or as unexpected as the plot twists in a daniel day lewis Movies marathon! It’s the culmination of all the nail-biting, edge-of-your-seat action that is the mortgage process.

A Date with Destiny

Think of your closing date as the ultimate ‘save the date’ — it’s a big deal! This is the day you’ll finally get the keys to your new castle, but timing is everything, amigos. Imagine being all geared up for the grand finale, only to find out that you’ve got to hold your horses because the paperwork isn’t ready. Talk about an anticlimax!

The Early Bird Catches the Worm

Alright, let’s say you’ve got your eye on closing early in the month. You’re thinking, “Hey, I’ll get ahead of the game!” But hold on a sec. While you might feel like you’re on cloud nine for being so proactive, the truth is, your wallet might not share the excitement. Early month closing can mean more upfront cash needed at settlement. It’s like ordering a Kachava smoothie only to realize you’ve got to pay for all those healthy extra toppings now, rather than later.

The Tortoise and the Hare: Late Month Closing

Here’s a fun fact: a lot of folks gravitate toward the end of the month to close on their home. “Why?” you ask. Well, it’s simple, or at least it seems so. Closing later could save you a bit of dough on the prepaid interest before your first mortgage payment is due. However, remember everyone has the same clever idea, which can make title companies busier than a one-legged man in a kickboxing contest. If the tortoise tried to close late, he’d be in a real pickle with potential delays!

Timing is Not Just a Tick on the Clock

Here’s where it gets juicy. Your closing date isn’t just a day on the calendar; it’s a strategic move. Some folks suggest aiming for a mid-month closing, to balance out the upfront cash with a reasonable due date for your first payment. It’s like finding the sweet spot in a game of horseshoes – close enough to count, but not so close that you smudge your shoes.

And Now for the Grand Finale…

Locking down your closing date is like the final scene in an award-winning blockbuster. So make sure it’s a day that suits your schedule, budget, and peace of mind. After all, when the credits roll, and you step over the threshold, you’ll want to feel like the star of your own movie, not like someone scrambling for popcorn as the lights go dim.

Closing dates might be complex, but with a bit of strategy and a sprinkle of luck, you could be signing those papers faster than you can say “Mortgage Approved!” Now, break a leg—the show’s about to start!

What is the real closing date?

What is the real closing date?

Ah, the real closing date—that’s the day when the fat lady sings for your home purchase! It’s when all the paperwork is signed, sealed, and delivered, and ownership officially changes hands. Keep in mind, the date can change if both buyer and seller agree to a little calendar shuffle.

What happens with a closing date?

What happens with a closing date?

On the closing date, it’s go time! This is when you’ll cross your T’s, dot your I’s, and sign a stack of papers like you’re an autograph-hungry celebrity. The keys are handed over, the seller gets their payday, and you step into the world of homeownership. It’s the grand finale of the home buying process.

Is closing date same as purchase date?

Is closing date same as purchase date?

Nope, they’re as different as apples and oranges. The purchase date is when you both agree on a deal and sign the contract—think of it as the “we’re doing this” moment. The closing date? That’s later down the line, the “it’s all official” day.

Is the closing date the effective date?

Is the closing date the effective date?

Well, not exactly. The closing date is when you seal the deal, but the effective date is often another beast—it’s the day the contract comes to life and both parties are on the hook to fulfill their promises.

Can you move on the day of closing?

Can you move on the day of closing?

Sure can—if everything goes off without a hitch! Once papers are signed and funds change hands, the place is yours to call home. But, heads up, it could be late in the day, so maybe don’t book the moving van for breakfast time.

What happens when seller does not meet closing date?

What happens when seller does not meet closing date?

Oh boy, missed closing dates are a real spanner in the works. If the seller can’t stick to the schedule, you might be fuming, but there are usually contract contingencies to sort things out. Extensions, financial penalties, or even waving goodbye to the deal—if it gets really sticky.

Do I have to pay before closing date?

Do I have to pay before closing date?

Hold your horses! You don’t have to pay the full amount before the closing date. You do whip out your checkbook for things like the earnest money and inspections beforehand, but the big bucks don’t flow until closing day.

How long after a closing date do you hear?

How long after a closing date do you hear?

Well, aren’t we anxious? If you’re a seller waiting for bids, you should hear back from your realtor once the deadline gets as close as a nosy neighbor. Buyers usually hear on or shortly after the closing date if their offer gets the stamp of approval.

Why is closing date important?

Why is closing date important?

Let’s cut to the chase—the closing date is when the curtain rises on your homeownership dreams. It’s a big milestone that starts your mortgage clock and sets the tone for your moving schedule. Missing this date? That can be as frustrating as a screen door on a submarine.

Can a buyer back out if closing date is not met?

Can a buyer back out if closing date is not met?

You betcha. If the seller drags their feet past the closing date, a buyer might have a get-out-of-jail-free card, thanks to contract contingencies. But let’s not shake the table too much without a chat with a lawyer first, huh?

Can I make a purchase on my closing date?

Can I make a purchase on my closing date?

Technically, you could, but let’s not put the cart before the horse. Your wallet’s about to take a heavyweight hit, so maybe cool your jets on any big purchases until after the ink’s dry on that mountain of closing paperwork.

How long after closing is the first payment due?

How long after closing is the first payment due?

Typically, your bank will give you a breather! Expect your first mortgage payment to be due about a month and a half after you do the closing day victory dance. This helps you catch your breath and your bank balance to recover.

Why does the seller keep delaying closing?

Why does the seller keep delaying closing?

Why indeed? It’s quite the pickle when a seller plays the delaying game—could be they’re dragging their feet on repairs, wrestling with paperwork, or juggling their own move. Keep your ears to the ground and your realtor on speed dial to stay on top of things.

What is the best closing date?

What is the best closing date?

The best closing date is like choosing a ripe avocado—it depends on your taste. You might want the end of the month to save on interim interest, or mid-month to avoid the rush. It’s all about what gives your wallet and schedule the warm fuzzies.

What does loan closing date mean?

What does loan closing date mean?

When the term loan closing date pops up, it’s the lenders’ version of showtime! It’s when you wave goodbye to application forms and hello to your mortgage, officially locking in your loan and responsibilities. Your John Hancock on this date breathes life into the loan.

Is the closing date the date of sale?

Is the closing date the date of sale?

They’re practically kissing cousins! The closing date wraps up the home sale, making it the date of sale for all the world records. It’s the day you can say, “This home’s got my name on it—literally.”

How far can you push back closing date?

How far can you push back closing date?

Pushing back the closing date can be like herding cats—possible, but it takes some doing. You’ll need a nod from the other party and an adjustment to the contract. There’s room to maneuver, but don’t bank on a marathon postponement.

Is closing date the same as close of escrow?

Is closing date the same as close of escrow?

Right on the money! Closing date and close of escrow are as similar as two peas in a pod. It’s the grand finale when all the conditions are met, the paperwork is complete, and the home sale is set in stone.

What to do when buyer wants to extend closing date?

What to do when buyer wants to extend closing date?

Take a deep breath and try not to blow your top. If the buyer needs more time, weigh your options. A bird in the hand is worth two in the bush, so consider negotiating terms that won’t leave you high and dry.