Flagstar Banking Offers Remarkable Mortgage Solutions

Welcome to the world of Flagstar Banking! If you’re exploring mortgage solutions, you’re in for a treat. Flagstar Bank offers a treasure trove of mortgage options crafted to meet the diverse needs of today’s borrowers. From conventional loans to specialized products like FHA and VA loans, Flagstar Banking shines bright in a crowded marketplace. Let’s […]

Rocket Mortgage Review Is It The Right Choice For You

Navigating the mortgage landscape can feel overwhelming, and that’s where this Rocket Mortgage review steps in to lend a hand. You need to know if Rocket Mortgage is your best option or if you should explore other avenues. With technology leading the way, Rocket Mortgage has modernized the way we approach home loans, making it […]

Ally Bank Review: Discover Amazing Features And Benefits

Are you looking for an online bank that truly delivers on its promises? In this Ally Bank review, we’ll dive into the amazing features and benefits that make Ally Bank a top choice for both savers and borrowers. With a wide range of products and exceptional customer service, this bank is worth your consideration. Let’s […]

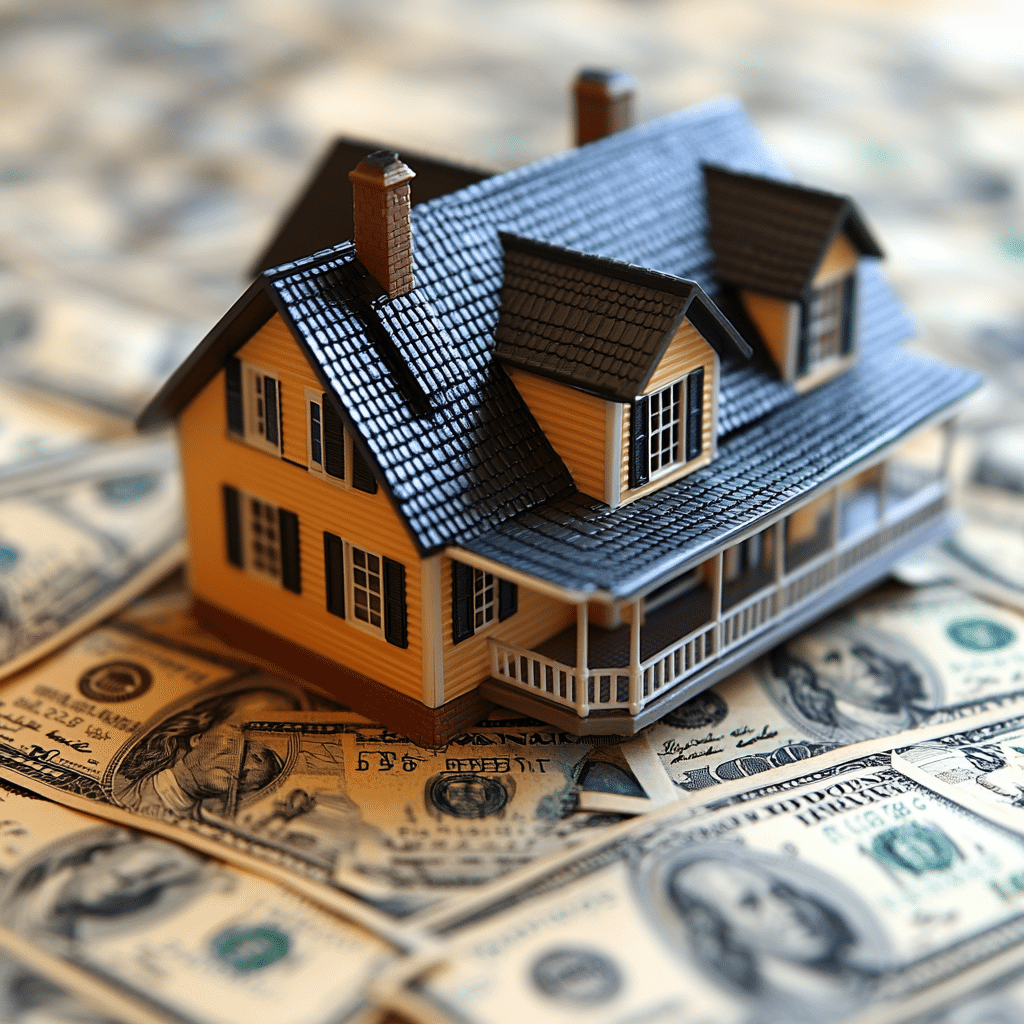

Heloc Mortgage Secrets For Home Equity Access And Savings

Homeowners today have a fantastic opportunity to tap into their home equity using a Home Equity Line of Credit (HELOC) mortgage. This flexible financial tool enables you to borrow against the value of your home, often with better terms than personal loans. Understanding the ins and outs of a HELOC mortgage can open doors to […]

Fixed Rate 30 Year Loans That Provide Secure Stability

In today’s fluctuating economic climate, fixed rate 30 year loans have emerged as a beacon of stability for many homebuyers. They’re not just a popular option; they’re often the go-to choice for individuals seeking a long-term, predictable mortgage plan. With the housing market adjusting in 2024, it’s essential to dive into the nitty-gritty of what […]

Fixed 30 Year Mortgage Benefits To Secure Your Future

When it comes to choosing a home financing option, the fixed 30 year mortgage stands out as a smart choice for many buyers. This long-term loan structure offers stability, predictability, and a wealth of benefits that can help you secure your financial future. From predictable monthly payments to building equity, we’ll explore how this mortgage […]

30 Yr Fixed Rate The Ultimate Choice For Homeowners

When it comes to making one of the most significant financial decisions of your life, choosing the right mortgage can feel overwhelming. Among the various options available, the 30 yr fixed rate mortgage truly shines. This type of loan has gained immense popularity among homeowners, and it’s clear why. The benefits of a 30 yr […]

Zillow Loan Secrets That Could Save You Thousands

The home-buying process can feel overwhelming, but with the right tools and information, you can take charge of your financial journey. Enter the Zillow loan – a fresh approach to home financing that promises to simplify the scene. By delving into the details of a Zillow home loan, you can unlock benefits that may save […]

Jumbo Mortgages That Unlock Your Dream Home Today

Finding the home of your dreams is a journey many embark on, but it can often feel like you’re running into a wall—especially when it comes to financing. Enter jumbo mortgages. These loans can make seemingly impossible dreams come true, enabling access to coveted properties in upscale neighborhoods and high-cost areas. So, let’s delve into […]

Heloc Home Equity Loan Your Key To Financial Freedom

Understanding HELOC Home Equity Loans: A Comprehensive Guide A HELOC (Home Equity Line of Credit) home equity loan allows homeowners to borrow against the equity they’ve built in their property. Unlike a traditional home equity loan, which lends a lump sum, a HELOC offers a credit line that you can draw from as needed. This […]

Bridging Loan Finance A Smart Move In Property Buying

Bridging loan finance has become an innovative tool for those navigating the property market. Whether you’re a first-time buyer or a seasoned investor, this financial option allows you to act swiftly when opportunity knocks. This article will explore everything you should know about bridging loan finance, highlighting its unique benefits, appropriate scenarios for usage, and […]

Local Mortgage Lenders Who Can Save You Money Fast

Local Mortgage Lenders Who Can Save You Money Fast Navigating the path of homeownership can feel like a wild ride. In a landscape crowded with options, local mortgage lenders are your best allies in saving money fast. They provide personalized service, competitive rates, and a profound understanding of regional housing markets. By choosing local lenders, […]