Demystifying the Calculation of Basis Points: A Deep Dive

Let’s face it, folks – in the dizzying world of finance, ‘basis points’ sound like a term that might have you scratching your heads. But worry not, because once you get the hang of it, you’ll find that these tiny titans pack a punch crucial for mortgage moguls and investment wizards alike.

Basis points, or as the cool kids say, bps, are the bread and butter of financial discussions. Think of them as the spice that turns your average financial stew into a gourmet dish; too little, and the taste falls flat, too much, and your portfolio might just blow its top!

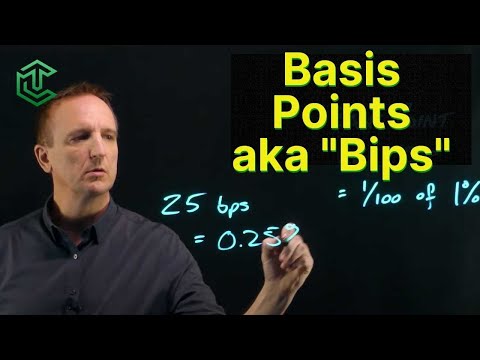

Now, let’s roll up our sleeves and get down to the nitty-gritty of the calculation of basis points. Picture this: you’re knee-deep in an interest rate discussion, and amidst the chatter, someone drops a ’50 basis points’ decrease bomb. Don’t panic! That’s just a fancy-shmancy way of saying a half percent dip.

How is bps calculated? Easy peasy! One basis point equals a minuscule 0.01% or 0.0001 in decimal form. So, my friends, to convert the mysterious bps to something a bit more down-to-earth like a percentage, you take those bps and divide by 100 – presto!

Tip 1: The Magic of Multiplication and Division – Transform Percentages to Bps

You, my friend, are a math magician in the making, and with a swift multiplication and division, you’re about to transform those perplexing percentages to 100 basis points. Here’s the trick: you take the percentage, say 2%, and like pulling a rabbit out of a hat, multiply it by 100 to get 200 bps!

Imagine impressing your clients or colleagues with this quick mental math. You’d be the life of the financial party!

So, let’s break it down with our friend, the calculator:

– 1%? That’s 100 bps.

– 0.3%? Just whip out that multiplication wand, and you’ve got 30 bps!

These conversions are seriously handy when chatting about mortgage rates or investment returns. Keep this tip up your sleeve, and you’ll be dazzling folks with your savvy in no time!

| Subject | Description | Conversion Formula | Example Calculation | Financial Context |

|---|---|---|---|---|

| Basis Point (BPS) | One basis point is 0.01% or 0.0001 in decimal form. | For BPS to %: BPS ÷ 100 | 30 BPS → 30 ÷ 100 = 0.30% | Used to express changes in interest rates, bond yields, and other financial percentages. |

| Percent to BPS | To convert a percentage to basis points. | % to BPS: Percentage × 100 | 0.30% × 100 = 30 BPS | Useful for reporting small percentage changes. |

| Basis Points Change | Determining the change in financial instruments in terms of BPS. | % Change × 100 = Δ BPS | 1% change → 1 × 100 = 100 BPS | Indicates change in yield or return. |

| Treasury Bond Example | Yield change on Treasury bonds described in BPS. | Yield Change (in %) × 100 | 0.2% drop → 0.2 × 100 = 20 BPS | Measures shifts in bond market. |

| Basis Points Value | Relating the basis point change to the monetary value. | (Monetary Value × BPS) / 10,000 | $1,000 bond, 50 BPS → ($1,000 × 50) / 10,000 = $5 | Important for calculating financial impact. |

Tip 2: Bps Meaning Uncovered: Visualizing Minuscule Changes with Big Impacts

Alright, let’s get visual and really wrap our heads around what these bps mean in the real world. Think of it like those tiny grains of sand that can tip the scales; they might look insignificant, but boy, do they add up!

One basis point may not sound like much – just a measly 0.01%, but in the grand scheme of things, especially when we’re talking big bucks, that tiny tweak can make a whale of a difference.

Now, for some visual aid:

– Imagine a dollar split into 10,000 tiny pieces. One single piece? That’s your one basis point right there.

– Let’s look back through the lens of time. Remember when interest rates shifted just enough to cause ripples through the housing market? That’s the bps at work!

Tip 3: Leveraging Technology in the Calculation of Basis Points

In this digital age, it’s about working smarter, not harder. Why tire out your brain with all that manual labor when you’ve got mighty software tools ready to tackle those bps calculations? These nifty gadgets are the superheroes of the financial toolkit.

Going face-to-face, manual vs tech calculations, it’s like David and Goliath. Sure, using your brain keeps you sharp, but these automated calculators are your ace in the hole for error-free, speedy computations.

Zap those errors and race against the clock with calculators specifically designed for armchair analysts and Wall Street warriors alike. Time is money, after all!

Tip 4: Whats Bps Best Kept Secret? Intuitive Mnemonics and Bps Calculators

Now, let’s talk secret weapons in the fight against bps befuddlement – mnemonics! Develop your own personal cheat code to remember those conversion ratios. Like “Big Percentage Shifts” to recall that each percent change equals a 100 bps jump.

And I haven’t even touched on the sheer genius of bps calculators – those customizable, interactive tools that can handle any curveball financial scenario. Dive into user testimonials, and you’ll find tales of enlightenment, where once-confused folks sing the praises of mnemonic magic and digital prowess!

Tip 5: Reverse Engineering – When to Work Backwards from 100 Basis Points

Occasionally in life, we have to backtrack to find our answers, and the same goes for the world of bps. Reverse engineering is your guiding star when you’ve got the basis points but need to decode the initial percent.

Picture this: You’re staring at a 150 bps change and scratching your head, wondering what that percentage shift is. By working backward (divide those bps by 100), you’ll soon see you’re dealing with a 1.5% change.

By flipping the script, you’ll unveil hidden narratives in financial tales, making you the Sherlock Holmes of mortgage rates and investment yields.

Conclusion: The Basis of Basis Points Mastery

Look at you, all jazzed up with these five “crazy tips” for the calculation of basis points. Embrace them, and soon you’ll be revolutionizing the way bps are cracked, making the world of finance just a tad less daunting.

I urge you, dear reader, to wield these unconventional tools – let them be your compass in the vast sea of numbers. Remember, the journey to bps mastery is lined with curiosity and paved with the stones of innovation. So stay curious, stay bold, and watch as your financial savvy reaches dizzying new heights.

And who knows? Your newfound prowess in mastering basis points might just have you pondering life’s other big riddles—like The enduring mystery Of The Aristocrats joke or Where You can catch The latest on heartthrob Kyle bary. In this ever-spinning globe of ours, today’s calculation could be as changing as tomorrow’s headlines about Canadian Wildfires.

So, keep learning, keep growing, and remember – it’s not about the destination; it’s all about the journey. Let’s take these complex concepts and turn them on their head, making sense of the financial world one bps at a time.

Mastering the Calculation of Basis Points

Buckle up, finance aficionados! We’re about to add a dash of fun to the serious world of finance with a trivia and facts section that will make the seemingly daunting task of the calculation of basis points as breezy as a summer novel. So, let’s dive into the nitty-gritty, shall we?

Condemned to Confusion? Not Anymore!

First things first, have you ever felt condemned to confusion when topics like basis points come up in conversation? Fear not! Calculating basis points is like piecing together a jigsaw puzzle—it seems complicated until you find the corners. To demystify the concept, just remember each basis point is simply a hundredth of a percent, and when it comes to finance, that can mean a lot. So before you sigh and let confusion take hold, check out this link for a deeper dive into the Condemned meaning of financial terms and come back a wiser person.

From Points to Percentages: A Breezy Conversion

Ever wondered how to convert those pesky points to percent without breaking a sweat? Say you’re chilling on the couch watching your favorite show, pondering about how much juicier it’d be if the characters thought about finance like you do. While you’re figuring out Where can I watch The summer I turned pretty, why not make it a double feature and learn to flip points to percentages like flipping channels. Just remember, 100 basis points equals 1 percent—it’s as simple as that! From now on, every time you hear “basis points, you’ll know exactly what percentage they’re talking about, and you can use our handy Points To percent guide to prove it.

The Average Joe’s Guide to Basis Points

If you’ve ever scratched your head thinking, What Is an average day in the life of basis points, and why should I care?, you’re not alone. But let me tell you, knowing the ins and outs of calculating basis points can make you the financial whiz you never thought you could be. Don’t get bogged down in complexities; simply understand that basis points are a standard measure used to describe the percentage change in value or rate of a financial instrument. Grasp this, and you’re on your way to not being just an average Joe but a financial hero! The next time someone asks you about averages, nudge them towards learning what is an average( in the world of finance—it’s thrilling stuff!

Pursuing Perfection in Percentage Points

And of course, no one’s going to come and arrest you if you get it a bit wrong. But in the world of finance, accuracy is key, a bit like how Meghan Hall the cop handles her business—with precision and a sharp eye. So, while it may not be as adrenaline-pumping as a day in the life of Meghan Hall cop, perfection in the world of basis points calculation can definitely give you that thrill of chasing down the details and getting everything just right.

Wrapping Up with a Twist!

Now, didn’t we say learning about the calculation of basis points could be as fun as your favorite summer read or binge-worthy TV show? With these crazy tips and trivia, you’ve got the knowledge to turn basis point calculations from a dreaded task into the highlight of your day. Just remember, when it comes to the financial world, every little point counts, and so does your understanding of it! Keep these fun facts in your back pocket, and you’ll be impressing your peers with your basis point bravado in no time.

How do you calculate basis points?

Oh boy, when you’re knee-deep in mortgage talk, calculating basis points is a piece of cake! Imagine slicing a percentage into a hundred pieces; each slice is one basis point. To figure ’em out, just take your percent, multiply it by 100, and there you have it—your basis points. Simple, huh?

How much is 50 basis points?

Alright, let’s break it down — 50 basis points are like half a percent. Trust me, when it comes to mortgage rates, that tiny-sounding number can pack a punch on your payments.

How much is 20 basis points?

Think of 20 basis points as a wee 0.20%—not a giant leap, but hey, every drop counts in a mortgage ocean!

Is 100 basis points the same as 1?

Hold your horses, yes indeed! The big 100 basis points are the same as 1%. It’s like swapping your shoes for sneakers; different look, same feet.

Why do we use basis points instead of percentage?

We use basis points ’cause they’re clear as a bell. They avoid the confusion of percentage changes, especially when we’re talking teeny-tiny numbers. It’s like saying “I’ll meet you in five” instead of “in a small fraction of an hour.” Gets the point across, right?

Is 10 basis points 1%?

Nuh-uh, 10 basis points aren’t even close to 1%—they’re a mere 0.10%. It’s like saying your cup’s full when it’s just a sip above empty.

How do you calculate basis points between two percentages?

Calculating basis points between two percentages is like finding how far you’ve hiked between two mountain peaks. Just subtract one percentage from another, and then, boom, multiply that number by a cool 100.

Is 500 basis points 5 percent?

You betcha, 500 basis points are the same as 5 percent. It’s like saying 5 bucks is 500 pennies—different ways to say the same thing.

How do you calculate basis points from percentage?

To calculate basis points from a percentage, just grab that percent and give it a 100-times boost. So, 1% turns into—voila!—100 basis points.

How do you calculate basis points to dollars?

Switching basis points to dollars is like converting your grandma’s secret recipe to feed a crowd. Multiply your loan amount by the basis point (keep it as a decimal!), and there’s your dollar amount. Ta-da!

Is 100 basis points a lot?

“Is 100 basis points a lot?” Well, in the world of mortgages, a full 1% can turn the tide on your interest payments. It’s not chump change, that’s for sure!

Is 30 basis points 3 percent?

Hold up, nope! Thirty basis points is more like a tiny 0.30%—not the big 3%, so keep your socks on!

Why do they say basis points?

They say “basis points” to steer clear of mix-ups with percentages. It’s like having nicknames for your pals; it keeps things straight when you’re juggling lots of names.

Is 300 basis points 3 percent?

You’ve got it! Three hundred basis points is exactly 3%. Like hitting 3 bullseyes in a game of darts—bang on!

What percent is 1000 basis points?

Rev up your calculators, folks, ’cause 1000 basis points is a whopping 10 percent. That’s not just a hill; it’s a mountain in the finance landscape!

How much is 100 basis points?

basis points might sound like a space mission, but it’s really just finance lingo for a humble 1%.

How much is 70 basis points?

Seventy basis points might seem skimpy, but that’s still 0.70% of your loan, mortgage fans. Every nibble adds up!

How much is 500 basis points?

Half a thousand—500 basis points—is like 5% in your piggy bank. It’s not pocket change when you’re talking big-ticket items like houses.

Is 300 basis points 3?

And for the grand finale, nope, 300 basis points isn’t three simple points. It’s 3%, and in the kingdom of cost, that could be a royal pain or a fabulous fortune.