Creating a foolproof monthly budget template is critical for achieving financial success. It offers a clear path to managing expenses, saving effectively, and ensuring you stay on top of your financial commitments. In this blueprint, we’ll delve into the essential components for crafting a budget that aligns with your financial goals in 2026.

Top 7 Components of a Winning Monthly Budget Template

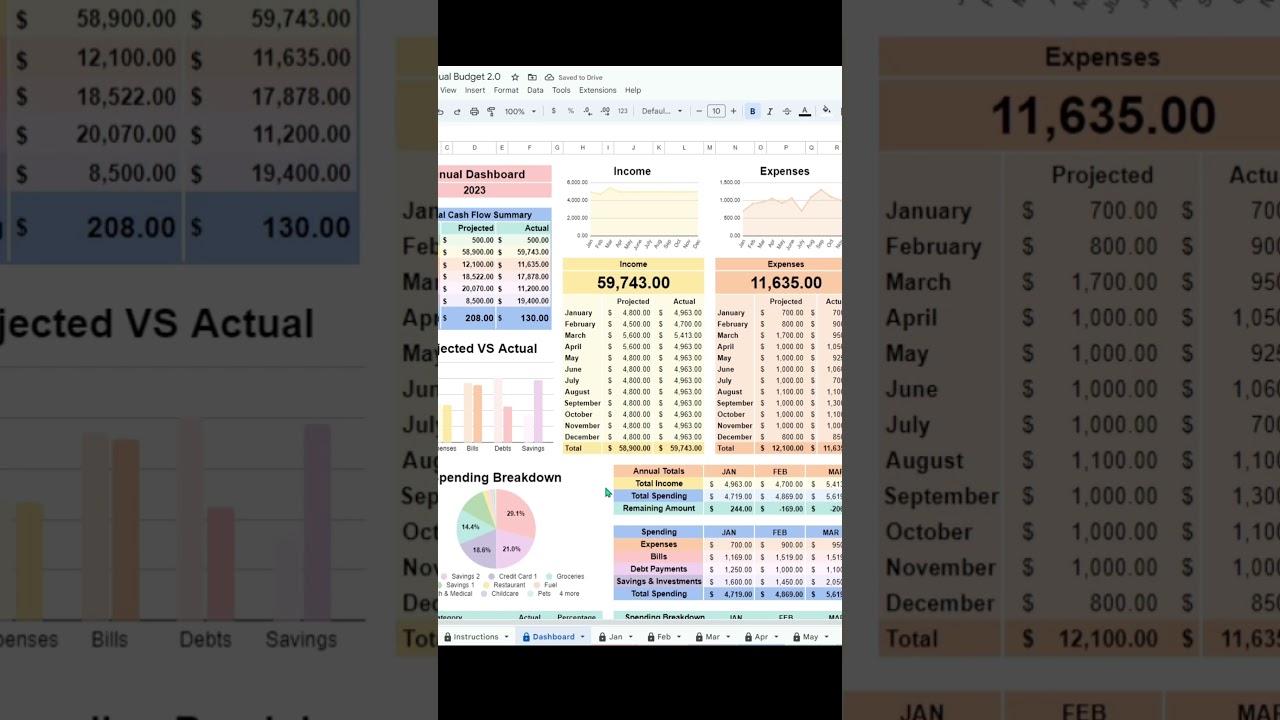

1. Assessing Your Monthly Income: Understanding the One Main Financial Perspective

Getting started with your monthly budget template means first assessing your income. Count every dollar that flows into your account. This includes your salary, bonuses, and any rental income you might have. Also, don’t forget about passive income ideas, like stocks that pay dividends or your side hustle profits.

To help visualize your earnings, using a platform like Mint can be invaluable. You can categorize your income, giving you a bird’s eye view of your financial landscape. Remember, your budget’s backbone lies in understanding precisely how much you have available to work with each month!

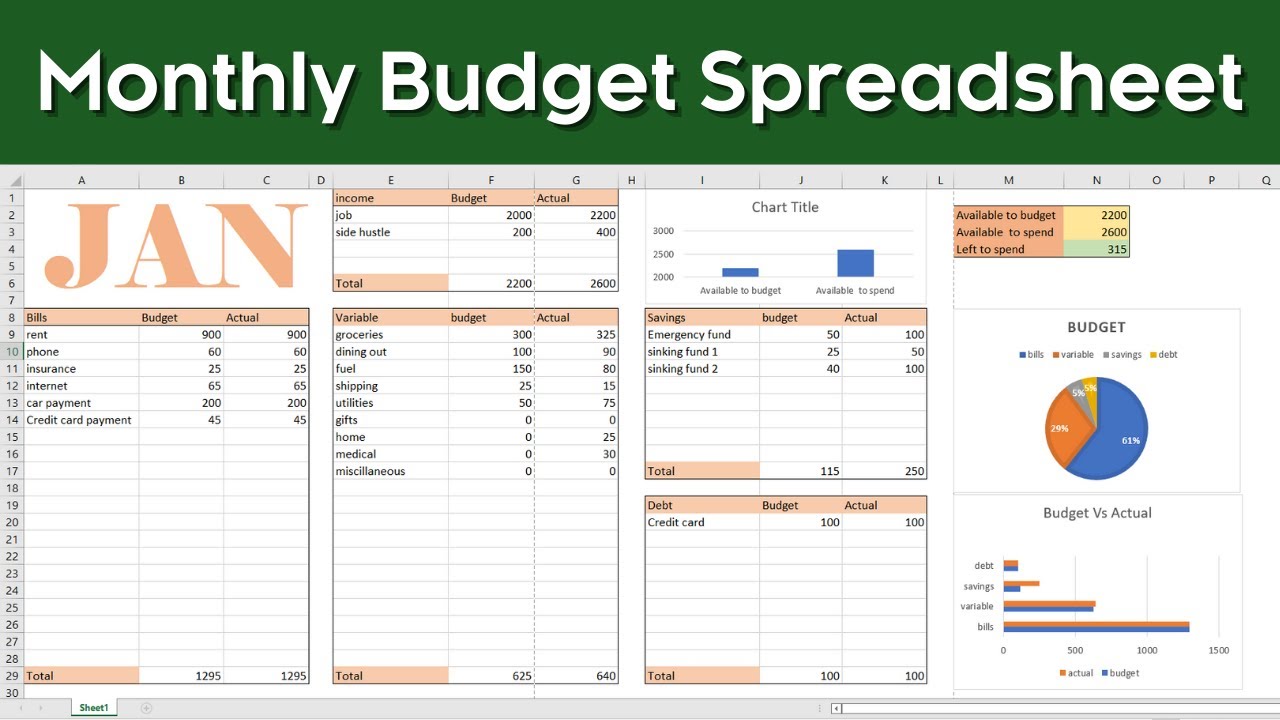

2. Fixed vs. Variable Expenses: Target Bill Pay Breakdown

After pinpointing your income, it’s time to dive into expenses. Split them into two distinct categories: fixed and variable. Fixed expenses include your essential bills, like your mortgage or rent, insurance premiums, and a predictable gas bill amount. These are non-negotiable.

On the flip side, variable expenses cover things like groceries, entertainment, and your outing budget. For instance, if you’re planning a movie night or dinner, these costs can fluctuate wildly. Consider tools like Rentometer to see if your rent aligns with local rates. You might even spark a conversation with your landlord if you’re paying above the market average!

3. Prioritizing Your Bills: The Cricket Bill Pay Strategy

Once your expenses are categorized, you need a strategy for paying them. Welcome to the Cricket Bill Pay strategy! This approach organizes your bills by due dates, ensuring you never miss a payment.

First, prioritize essential payments: mortgage, utilities, insurance, and groceries. Next, allocate your income to cover discretionary spending. By simply putting your bills in order of importance, you set yourself up for peace of mind. It’s a clear, actionable way to maintain your financial health without any last-minute surprises.

4. Anticipating the Tax Deadline: Incorporate Tax-Related Expenses

Don’t let the tax deadline sneak up on you! Include potential tax liabilities in your budget. Throughout the year, keep an eye on your income to avoid unexpected tax bills. Consider using personal finance software like TurboTax to help estimate your upcoming obligations.

Every bit you save throughout the year will help ease the burden during tax season. Adjust your monthly budget template as needed; for example, if you change jobs or receive a bonus, tweak your budget to ensure you account for potential taxation. That way, your finances stay in tip-top shape, even when tax season rolls around!

5. Tracking Your Savings Goals: The Role of I Bond Rates

Let’s be real: saving money can feel like climbing a mountain. But it doesn’t have to be a daunting task! Incorporate savings into your monthly budget template to pave the way for financial empowerment.

As i bond rates fluctuate, take the time to monitor these rates and adjust your savings strategy. Aim to put aside a percentage of your earnings every month. A good starting point is the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings. Using high-yield savings accounts can make your money work a bit harder for you.

6. Preparing for Emergencies: Vet Salary and Unexpected Expenses

Life can throw curveballs, so it’s vital to create a safety net. Consider the average vet salary, which in 2026 is roughly $100,000. Just as vets prepare for unexpected pet emergencies, so should you prepare for life’s little surprises.

Set aside three to six months’ worth of living expenses in an emergency fund. Unexpected medical bills or home repairs can crop up at any time! Don’t let those surprises knock you off your budget. Being prepared can mean the difference between financial stress and stability.

7. Evaluating Investments: Insights on Bullion Exchanges

Investing should be part and parcel of your monthly budget template. Allocate funds to investment opportunities like stocks or precious metals. Staying informed via sources on bullion exchanges can give you insights into gold and silver prices.

Allocate a small portion of your budget each month towards these investments, and reassess their performance. This way, you can adjust your budget, potentially boosting your financial returns. Smart investing today helps create a more secure tomorrow.

Innovative Wrap-Up: Mastering the Art of Your Monthly Budget Template

Crafting a monthly budget template requires careful thought about various financial elements. By understanding your income, diligently tracking your expenses, and planning for the unexpected, you pave a clear path toward financial success.

Embrace tools that fit your lifestyle and financial objectives. Adapt your budget as your needs evolve—for instance, if you move to a town like Lihue or switch jobs in Los angles. With this structured approach, achieving sustained financial success in 2026 isn’t just a distant dream; it’s a reality within reach!

By perfecting your budget, you take one crucial step in mastering your financial life. After all, a strong budget lays the foundation for a secure future—with room to spare for those happy moments along the way!

In short, your monthly budget template is not just a piece of paper; it’s your ticket to a brighter financial future. Now get started, and let’s set that path to success!

Monthly Budget Template: Fun Trivia and Interesting Facts

The Origins of Budgeting

Believe it or not, the concept of budgeting isn’t a modern invention. It dates back to 4,000 years ago when the ancient Mesopotamians kept track of their barley harvests. Just imagine them using a primitive “monthly budget template”! Fast forward to today, and budgeting’s evolved into a fundamental financial tool. Interestingly, keeping a solid budget could be compared to managing a five-year treasury, which can safeguard your investments for the long haul. You could say budgeting is the closest Starbucks to financial stability, providing a familiar spot where you can keep your expenses in check and enjoy that comforting cup of coffee while you plan.

A Creative Approach to Budgeting

Have you heard of Swedish death cleaning? It’s a fascinating concept where you declutter your life—be it your physical space or financial documentation. When crafting your monthly budget template, think about paring down unnecessary expenses, much like decluttering your home. Incorporating creative methods can improve your budgeting journey and keep you focused on your financial goals. Just like in the show Zatima Season 3, where the characters balance relationships and personal finance, you can make your financial journey engaging and relatable. Finding balance can not only help you stay in control but also motivate you to reach your desired financial milestones.

The Impact of a Monthly Budget Template

Creating a monthly budget template isn’t just about staring at numbers; it can be a game changer for your financial health. Studies show that people who budget are more likely to save money and achieve their financial goals, and yes, their financial success rate shoots up like a rocket! Meanwhile, the buzz around public figures like Naomi Ross shows that having a grasp on finances can even boost one’s career. Plus, who knows? Following the latest in financial news, like updates on Terry Bradshaw, might provide useful ideas for optimizing your budget. Remember, every little bit helps when it comes to ensuring a secure financial future!