As we look toward 2025, understanding the twists and turns of bank rate mortgages becomes crucial for anyone looking to make smart, informed decisions in real estate. With the steady hum of change in the air, we’re rolling up our sleeves and diving into what the landscape looks like now and where it’s headed. Get ready for a spin around the block in our trusty financial vehicle, focusing on the engine that drives homeownership: the ever-dynamic bank rate mortgage.

Understanding the Current Bank Rate Mortgage Landscape

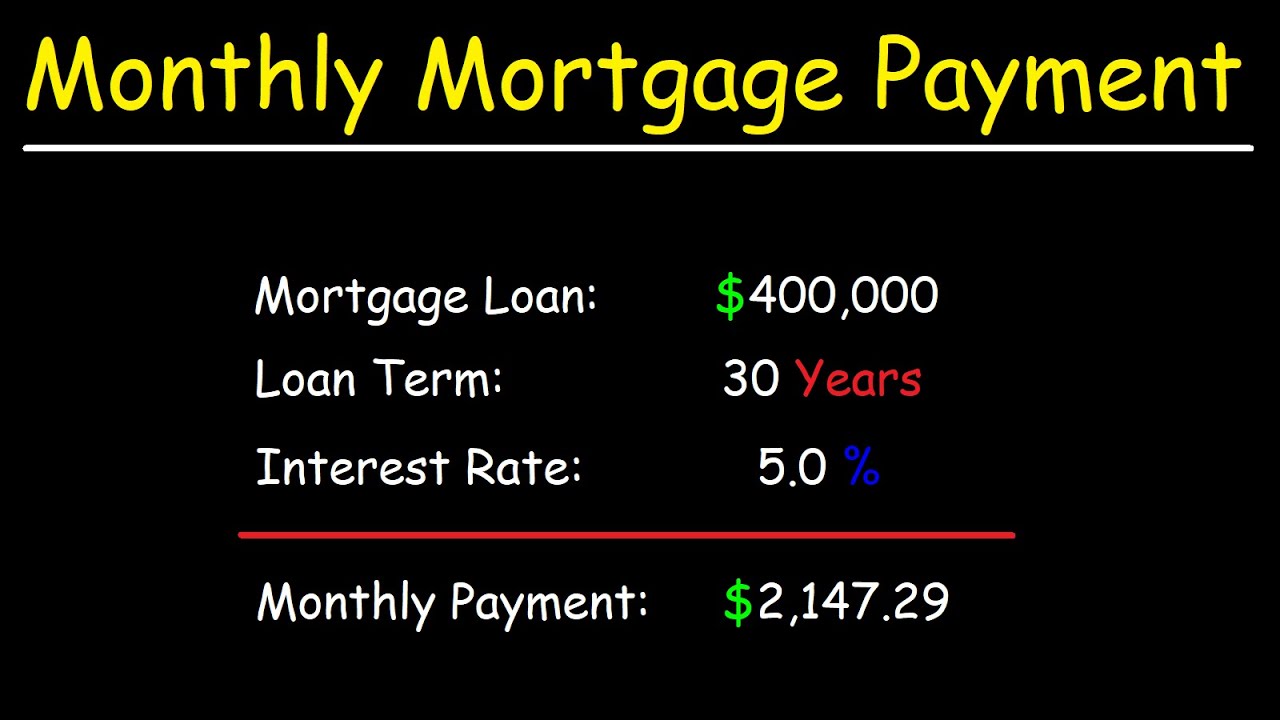

In 2024, we’re riding a wave of dipping mortgage rates. The Bankrate.com national survey shows bank rate mortgages pressing down on the gas pedal, marking a significant cooling period from past years. In fact, the Mortgage Bankers Association is forecasting that by 2025, 30-year mortgage rates could coast all the way down to an inviting 5.6%. It’s a stark contrast to the bumpy road we’ve seen with rising rates shaking the market in the not-so-distant past.

What does this mean for you? It signals a market that’s becoming more accessible to homebuyers who were previously priced out.

But buckle up; this isn’t a solo ride. A myriad of economic indicators are in the driver’s seat, steering bank rate mortgages. Inflation, employment rates, and federal policies are just some of the passengers tagging along for the ride, conspiring to tweak those mortgage interest rates.

Novice and experienced mortgage investors alike are all ears when it comes to the 2025 projections of financial gurus. We’ve gathered the intel, crunched the numbers, and now we’re ready to map out the direction bank rate mortgages are headed. Spoiler alert: there’s a fair share of twists and turns ahead!

Predicted Shifts in Bank Rate Mortgage Trends by 2025

Analysts have their binoculars out, peering into the future to predict how the economy’s evolution will rev up changes in bank rate mortgages. When it comes to federal policies, tweaks to interest rates and housing programs could juggle the numbers on your mortgage rates. And don’t forget global economic shifts—they can toss a curveball into the mix faster than you can say “bank rate mortgage.”

So, what’s the forecast for the housing market as we veer into 2025? Well, let’s just say if it were a weather report, we’d be expecting partly sunny skies with occasional clouds. Home prices are predicted to stabilize as supply catches up with demand, creating a more balanced market for buyers and sellers.

| Category | Details |

| Source of Data | Bankrate.com national survey |

| Survey Methodology | Consistent data collection for over 30 years with an accurate national comparison |

| Current Trends (as of 2024) | Mortgage rates are on a downward trend |

| Future Projections | 30-year mortgage rates expected to fall to 5.6% by 2025 (Mortgage Bankers Association) |

| 30-Year Mortgage Rate | 5.6% (projected for 2025) |

| Benchmark for Comparison | Consistent national apples-to-apples comparison |

| Survey Frequency | Regular (specific frequency not provided) |

| Data Collected on | Banking deposits, loans, and mortgages |

| Usage of Survey | For consumers and industry professionals to compare and analyze financial products |

How Consumers Should Navigate Bank Rate Mortgage Changes in 2025

Let’s lay it out straight: being smart about bank rate mortgage changes can save you a boatload of cash. By staying on top of the fluctuations and knowing when to make your move—like a hawk eyeing its prey—you can nab yourself a deal that could make your wallet sing.

For future borrowers—don’t just sit in the passenger seat; take the wheel by bolstering your credit score, saving for a substantial down payment, and understanding your loan terms like the back of your hand. This preparation is your GPS to navigating changing bank rate mortgages.

Now, if you’ve already got a mortgage and are feeling the itch to refinance, tune into the rhythm of those bank rate changes. Striking when the rates are dipping can shave significant dollars off your monthly payments. It’s like finding an unexpected shortcut on your daily commute.

Bank Rate Mortgage Strategies for First-Time Homebuyers in 2025

Hey, first-time homebuyers! We’ve got your back with some top-notch strategies tailored just for you in the 2025 bank rate mortgage scenery. Deciding between a fixed-rate or an adjustable-rate mortgage? That’s like choosing between a trusty old sedan or a zippy convertible. Each has its perks, depending on the road conditions (aka the economy).

Want a slice of insider info? Check out MortgageRater.com’s latest on current interest rates—seeing how they’ve danced around lately can give you insight into what could happen next.

And here’s a golden nugget: lock in a favorable bank rate mortgage by applying when the rates hit a sweet spot. It’s all about timing, folks!

The Impact of Tech Innovations on Bank Rate Mortgage Approvals and Processes

Technology is shifting gears in the bank rate mortgage world faster than a hot rod at a drag race. Expect cutting-edge tech to streamline mortgage applications and approvals, making it a breeze to slide into your dream home’s driveway.

Fintech companies are revving up, redefining accessibility and remodeling terms on bank rate mortgages. They’re like the flashy new electric cars on the block: efficient, accessible, and oh-so-innovative.

Keep an eye on how these tech trends might affect you by exploring how addition home technologies are changing the ways we think about property and investment.

Top Financial Institutions Leading the Bank Rate Mortgage Change in 2025

Like a pack of racecar leaders, financial institutions including JPMorgan Chase & Co., Wells Fargo, and Bank of America are speeding ahead with competitive 2025 bank rate mortgage trends. They’re the ones laying down the rubber, constantly adapting to keep pace with the market’s demands.

Yet, we can’t ignore the smaller lenders and credit unions. These contenders are nipping at the heels of the big dogs, often providing more personalized customer service and sometimes, better rates.

And what about online lenders? They’re like the satellite navigators of the industry—guiding you through the bank rate mortgage process with precision and ease. Check out some of their anticipated rates and terms with a click on MortgageRater.com’s bank rates today.

The Global Perspective on Bank Rate Mortgage Trends

Okay, time to zoom out for a global view. The US isn’t driving solo on this highway. Countries like Canada, the United Kingdom, and Australia are all part of the traffic flow, dealing with their own bank rate mortgage trends.

Bond markets abroad can impact your home’s bank rate mortgage, just like a traffic jam can slow down your commute. And let’s just tip our hats to foreign investment—they can fuel the market or trigger a need for a pit stop.

Looking at how these trends are handled overseas might just offer some smart strategies you can apply back home on American soil—like learning from the sleek foreign sports car to enhance your own ride.

Innovative Wrap-up: Charting Your Path in the Evolving World of Bank Rate Mortgages

Alright, let’s park this car and sum up our journey. The 2025 bank rate mortgage landscape is shaping up to be an exciting ride, with lower interest rates and tech innovations leading the way.

Remember to ride the waves of change with savvy expertise—keep an eye on your credit, down payment, and the kind of loan that fits your lifestyle. Whether you’re a first-time buyer or a seasoned homeowner, there are opportunities and pitfalls to handle with equal finesse.

Above all, the key to success in the world of bank rate mortgages is to stay informed, stay flexible, and keep both hands on the wheel. Your dream home could be just around the bend.

So, hit the gas, and don’t look back—except, of course, to see how far you’ve come. With the right moves, the bank rate mortgage of 2025 might just take you exactly where you want to go.

Uncovering Bank Rate Mortgage Trends for 2025

Well, butter my biscuit! It seems like just yesterday we were flipping the calendar to ’23, yet here we are, chatting about bank rate mortgage trends for 2025. Hold onto your hats—it’s going to be a wild ride, packed with numbers that move quicker than a sale at the local mall.

So, did you know that the term “mortgage” comes from old French words meaning “death pledge”? Now, don’t get all gloomy on me; it’s not as sinister as slicing through tension with Trigun Knives. It simply meant that the pledge ended (died) when either the obligation was fulfilled or the property was repossessed. Speaking of life’s unpredictable twists and turns, it’s much like receiving a care package For someone who lost a baby which, though immensely compassionate, is an unexpected twist of life’s journey. Just as one would offer support during tough times, current interest rate trends can act as a beacon, guiding us in our decisions to buy, sell, or hold tight in the housing market.

Jumping jackrabbits, haven’t we all heard the saying, “what goes up must come down?” But when it comes to bank rate mortgages, we’ve seen that rates have been more roller coaster than a serene Ferris wheel ride. If you’re curious about the particular ebb and flow, scoot on over to check out the current interest rate; you’ll get a more clear picture than through a streak-free window. And while we’re on the topic of delivery, have you ever considered how the concept of immediate service, like getting that Panda Express delivery straight to your door, has influenced our expectations—yes, even in mortgage rate decision timing?

But hang on a second, did you know that the average home size in the U.S. has doubled since the 1950s? That’s right, we’ve gone from cozy bungalows to sprawling mansions faster than Soleil Moon frye went from Punky Brewster to a full-fledged director. Our homes aren’t just buildings; they’re our personal castles and the stage upon which life’s dramas unfurl. And speaking of transformations, just as Soleil Moon Frye tackled an array of roles over the years, so too does the housing market adapt to shifts in bank rate mortgages—truly, a performance worth a standing ovation.